How The Closed-end Fund Optimizes Convertible Holdings for the Income-oriented Client

Investing in convertible securities via a closed-end fund is the focus of a recent Closed-End Fund Association (CEFA) podcast featuring Eli Pars, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies and Bob Bush, Senior Vice President and Director of Closed-End Fund Products.

While Calamos believes convertibles should be a core allocation, Pars commented on the argument today for being tactical with convertibles. Investment professionals may be looking for a way to get their clients equity exposure with less risk, in light of the market’s recent pullback.

“Convertibles, first and foremost, are a bond,” explained Pars. “They're typically issued at par with a five-year term and redeemable at par, but they also have embedded in them the option to convert into the company's stock—and it's your option, so it really only comes into play when the stock moves up.

“The combination of the two, the option and the bond, gives you the ability to get equity exposure when things are going well for the company. However, the bond component offers downside risk mitigation in a more defensive environment. The end result you get when you actually manage these bond and stock aspects in a portfolio is equity-like returns over a full market cycle with less volatility.”

Convertibles are a way to help clients “sleep at night,” making them less inclined to sell during market declines because they are less susceptible to steep market sell-offs than general equities, he noted.

Pars further commented on the income-producing advantage of using closed-end funds that invest in convertibles, including the six convertible-using Calamos closed-end funds. “In a levered vehicle like a closed-end fund,” he said, “the convert's ability to manage volatility protects you a little bit and takes a little of the edge off the leverage. And the leverage in the portfolio, while it's pretty modest—20%-30%—does allow you to get a little bit of extra return in the portfolio and produce some income that's attractive to certain investors in the market.

“The spread between our cost of leverage vs. our reinvestment rate,” he continued, “has been favorable over time, resulting in leverage being generally accretive to the operations of the portfolio.”

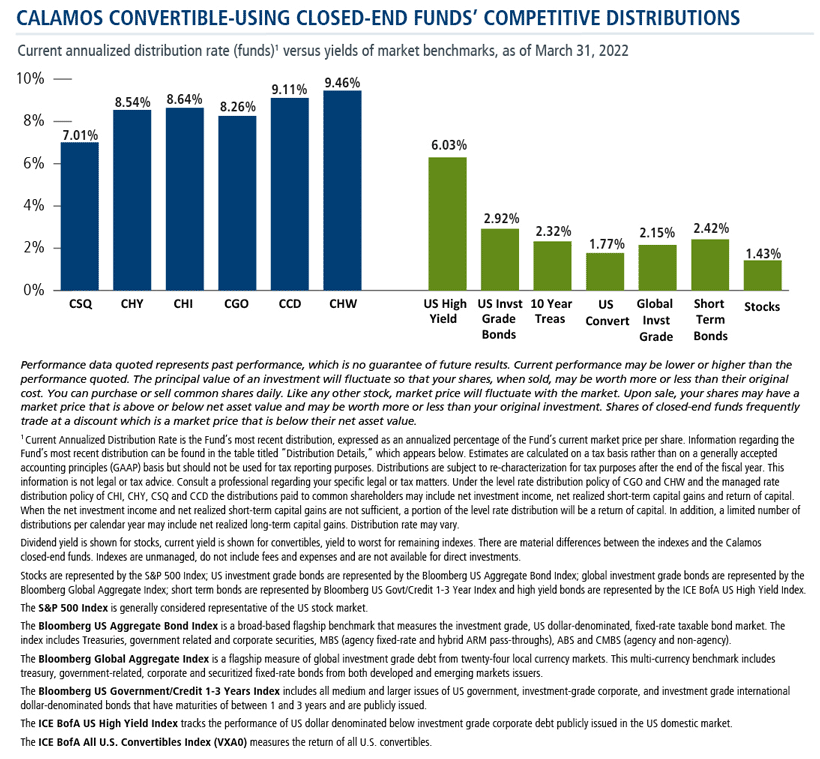

As reported in the most recent month-end Calamos Closed-End Fund Snapshot, current distribution rates on the funds have provided more income than stock and bond alternatives.

Also on the podcast, Pars provides his update on the US and global convertible market (and also see this recent market update). For regular market updates including performance, issuance, credit quality and more, subscribe to the Calamos US Convertible Market Snapshot or Calamos Global Convertible Market Snapshot.

Investment professionals, to discuss convertibles or closed-end funds, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Past performance is no guarantee of future results.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

809978A 422

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on April 08, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.