‘We’ve Been Here Before:’ Convertible Market Rotations, Volatility May Set Up Opportunities for CICVX

The portfolio management team of Calamos Convertible Fund (CICVX) opened the Calamos February CIO Conference Call series last week acknowledging that convertibles have recently provided less participation to the S&P 500 than would typically be expected.

Convertible Issuers vs. the S&P 500

Convertible market performance is often compared against the S&P 500 even though convertible issuers “typically are not necessarily the same companies that are in the S&P 500. And, we would argue that that’s a good thing,” said Wysocki. “Typically, convertibles are issued by growth companies for growth capital. That tends to lead them to be more smaller, mid-market cap-type companies with a growth bias.”

By contrast, S&P 500 companies are more mature companies, larger cap. “They generate cash flows internally, and they can fund their growth internally, so they don’t need external financing, certainly not equity, and if they do need that, they can go straight to the debt markets and issue traditional bonds at very low interest rates.”

Smaller and mid-cap growth companies can act differently, as demonstrated by 2021 and the first six weeks of this year. The Russell 2000 is about 20% below its all-time high while the S&P 500 is 7% off its high. “If a convertible issuer index existed, it would probably be the same as the Russell 2000, including many individual stocks that have corrected 30% or 40%.”

“Why do you want to own that type of a company? Higher returns,” Wysocki said. He cited research that showed that the performance of stocks underlying convertibles outperformed the S&P 500 over the longer term. Converts are “a little bit of a higher beta exposure, a little bit more variable, higher volatility, but a much stronger return pool to choose from,” he said.

“Convertibles help investors who can’t stomach the downside risk of pure equity ownership in these types of names, and that’s why we think convertibles make sense. The opportunity is to keep majority upside participation through the call option in the convertibles while mitigating against the downside with that credit exposure and that bond exposure.

“While issuers of convertibles have been down, and yes, it has recently led to a negative total return for convertibles, convertibles themselves have actually protected against some of that decline. By actively managing that risk-reward, and with all the opportunities we see out there, we can reposition a portfolio to capture that eventual upside in a higher return cohort of companies.”

With almost 50 years of experience between them, Senior Co-Portfolio Managers Jon Vacko and Joe Wysocki described today’s market as in a state of flux: Mid- to small cap issuers are struggling more than S&P companies, and the convertible bonds’ historical performance advantage when rates rise has yet to materialize. What’s helpful, they said, is that the record issuance of the last two years has broadened the opportunity set, providing the team with ample room to manage for a favorable risk-reward in this increasingly volatile market. (Listen to the call in its entirety here.)

Today’s macro uncertainty is “making volatility the norm. But the volatility, the rotations we’re seeing, and the diversions from the S&P are not concerning. We’ve been here before,” said Wysocki.

“Convertibles can act differently at different times, whether it’s months or quarters or even longer than typical as we’ve seen this year but,” he said, “through cycles, convertibles have produced broader equity market-like returns with less volatility. We don’t see anything structural that can change that longer-term relationship today.

“If anything [the current environment has] created some good opportunities for us to take advantage of,” he said. Consolidation in some of the issuer base of convertibles due to recent market rotations can set the stage for further returns going forward, he added.

The convertible market is dynamic and that’s especially apparent today, said Vacko. “Deltas are at the lowest level since pre-COVID, and we have more busted bonds than we’ve seen in a long time. You’d have to go back to March of 2020 to see a similar level of busted bonds. Fifty percent of bonds today are at or below par.”

Because any attempt to time rotations is “futile,” according to Vacko, the team believes the key is to focus on maintaining a favorable structural risk-reward. “There are times when we say we roll up deltas and times when we roll down delta,” he said.

He contrasted the value of the fund’s active management—backed by a full team of equity and credit analysts—to what happens with a passive convertible fund. Investors in passive convertible products today will “likely not know if you’re getting exposure to an equity portfolio or a busted portfolio or a balanced portfolio.”

Picking Spots to Play Offense

Having focused on shielding shareholders in the fourth quarter from the downside risk of some growth names, Vacko said the team has since been surprised by the magnitude of the move in some of those names.

“We think they may have overshot, and risks at this point might have shifted to missing on the upside,” according to Vacko. “We’re picking and choosing our spots to play offense right now. We’re evaluating what companies are saying and what they’re doing, and we’re looking at who’s winning…For the most part, we like what we hear so far [in earnings calls]. This very bottom-up, individual company-driven performance focus is exactly the same kind of thing that helped returns in 2020. It’s the same process that we’ve used through all our cycles.”

Vacko provided these specifics:

-

Fundamentals. The fundamental momentum of many issuers is “very strong. We’re looking at accelerations in revenue, in cash flow, improving margins or positive analyst revisions. We’ve seen companies able to overcome some supply chain issues, etc., and those are the types of names we’re looking to add. In general, the companies that we’re looking at are well capitalized, and generally have decent balance sheets.

“Often, in the convertible universe, convertible bonds are the only debt on the issuers’ balance sheets, and they still have a lot of the cash remaining on their balance sheets from convert issuance. So, the overall credit risk is minimal within our universe and within our portfolio.” - M&A target opportunities. “Although M&A is not a sole reason we’d hold a name, there’s a lot of liquidity out there, and capital’s relatively cheap. For a lot of the names that we own, they’re fast-growing, they’re generating and creating innovative products, they’re taking market share, and often, they’re quite attractive to other firms.”

-

Valuations. Some individual names are becoming very attractive from a valuation perspective. “Our process focuses on intrinsic value and growth of that intrinsic value over time. In some instances, we’re seeing that the intrinsic value has grown, if we compare it to pre-COVID levels, but the stock prices are at the same level or down. That can be a great opportunity for us.”

The analysis is on revenue generation and whether improvements are sustainable or just a result of having been brought forward during COVID. The same is happening on the expense side. “Many companies had to cut expenses through the recession, and some will be able to maintain those, and some will have to add those costs back to get back to where they were,” Vacko explained.

The Broader Opportunity Set

Vacko and Wysocki commented on the broader opportunity set available in the convertible market.

Both 2021 and 2020 are in the top five years of convertible issuance—resulting in more than 100 more companies in the market than two years ago. “That’s not an insignificant number,” Wysocki noted, “because our market has about 400 companies on the US side that issue convertibles.”

What’s more, many of the companies have multiple convertibles within their capital structures, providing more bonds to choose from.

“No two bonds are the same,” Wysocki said. “Even if the same company issues a convertible, the terms can be different, and the actual price points at which they were issued could be different, and as we know, convertibles are hybrid securities that can act like debt or equity, depending on where the market’s moved since issuance.”

The team regularly swaps positions within a company’s individual convertible offering in pursuit of what they believe is the best risk-reward.

Rising Interest Rates and Convertibles

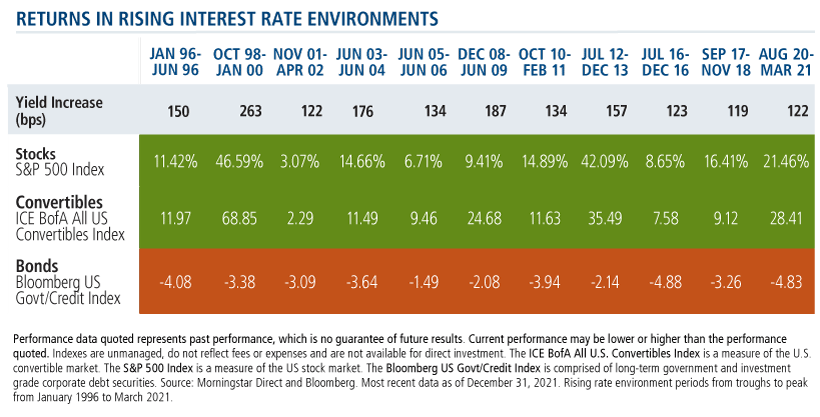

Some of today’s volatility can be attributed to investor uncertainty about rising rates. Wysocki took time on the call to review why convertibles have historically outperformed fixed income when interest rates rise.

When rates rise, a traditional bond portfolio tends to have negative total returns. It’s a mathematical relationship, Wysocki explained, where when rates are up, bond prices are down, the income you receive from that bond does not offset the capital loss, and that results in a negative total return.

Here’s the advantage that convertibles have historically provided: When the 10-year Treasury has risen by 100 basis points or more, traditional bond allocations have had negative returns while convertibles have produced positive returns, beating the equity markets in some cases.

“The driver of those returns with convertibles is not a mathematical relationship like it is with traditional bonds,” Wysocki explained, “but you can understand how that works when you look at the hybrid nature of convertibles.

“Convertibles have a bond portion and an equity option. That bond portion faces the same headwinds that traditional bonds do. When interest rates rise, that bond portion is worth less. But they are shorter duration bonds—five years when issued—so typically you have a convertible duration that is much lower than any of the other fixed income markets (see this post). That can help mitigate the risk of the downside.

“On the flipside," he continued, "the equity option can benefit from rising equity prices, and typically, when rates are rising, it’s because of a stronger economy or rising inflation. Stocks can benefit from that as well, from rising revenues, rising profits, rising cash flows. Companies can have pricing power to take advantage of some of that.”

The equity participation embedded within the convertible more than offsets the downside from the bond portion of it, resulting in equity-like returns with less equity risk. (For more on convertibles, see our guide.)

“Each rate cycle is different, so it’s important to understand what drives a rising rates cycle. But," Wysocki said, "that volatility can be a bit different as it starts. While there’s uncertainty as to why rates are rising, convertibles may have more volatility and variability at the beginning of a rates cycle, but as it progresses, convertibles have been able to do quite well.”

Investment professionals, for more information about CICVX or convertibles, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%. Had it been included, the Fund’s return would have been lower. You can obtain performance data current to the most recent month end by visiting www.calamos.com.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The S&P 500 Index is generally considered representative of the US stock market.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

Delta expresses the convertible's sensitivity to changes in the stock price. It compares the amount of change in the price of a convertible with the change in the underlying stock price.

808660 222

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on February 15, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.