Investment Team Voices Home Page

Investment Team Voices Home Page

Global Convertible Market Update: Portfolio Manager Q&A

Diverse opportunities and structural features provide tailwinds to counter rising rates and equity volatility

Since its founding more than 40 years ago, Calamos Investments has used convertible securities to help investors pursue a range of asset allocation goals, including lower-volatility equity market participation and to hedge against rising interest rates and inflation. To find out more about convertible securities and some of the exciting trends in the market, we spoke with Eli Pars, CFA, and Joe Wysocki, CFA, both senior co-portfolio managers at Calamos. Eli also serves as Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies.

How did Calamos come to be recognized as a premier manager of convertible securities?

Joe Wysocki: Our founder, Global Chief Investment Officer John P. Calamos, Sr., first began using convertible securities in the 1970s. Back then, the asset class wasn’t well known, but he saw an opportunity to use convertibles as a way to provide his clients with the “best of both worlds” that stocks and bonds offer.

Since then, convertibles have been a cornerstone of Calamos. John launched one of the first convertible funds in 1985 and established himself as a recognized authority on the asset class. Now, Calamos manages nearly $14 billion in convertible assets, including US and global funds. Since 2002, we’ve also used convertibles as cornerstones in our closed-end funds, which are multi-asset portfolios that seek to provide competitive distributions, as part of either an enhanced fixed income or total return approach.

Joe, what is a convertible bond?

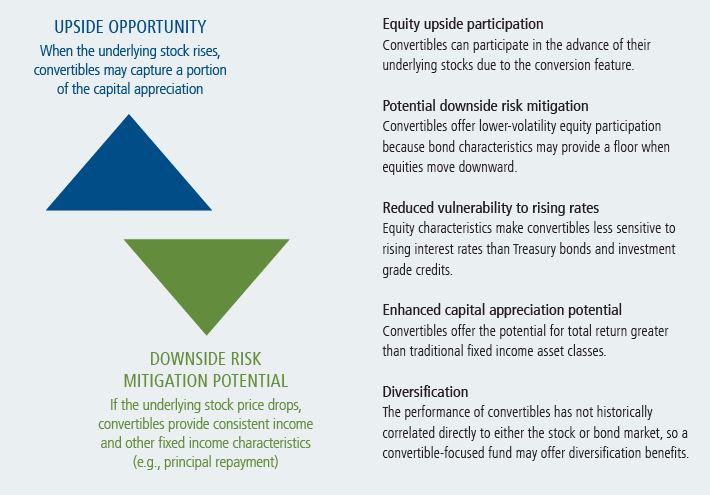

JW: A convertible bond combines features of stocks and traditional fixed income securities. A convertible bond is technically a debt instrument because it pays interest and has a maturity date. Convertibles are most often issued as senior unsecured debt and are senior to equities in the capital structure.

But here’s where things get interesting: A convertible bond can be exchanged—or converted—into a specific number of shares of the issuer’s common stock. That means that a convertible’s performance is also linked to the performance of its underlying equity which can have meaningful upside potential. This is what differentiates convertibles from every other form of traditional fixed income.

The stock market has been turbulent this year, but inflation and rising rates are making investors wary about adding to bonds to dampen volatility. How does this environment set up for convertibles?

Eli Pars: Convertibles offer an interesting way to get equity exposure with potentially less risk. So, let’s take a closer look at the structure of a convertible. As Joe said, convertibles are bonds, first and foremost. They're typically issued at par with a five-year term and redeemable at par, but they also have an embedded option for the holder to convert into the company's stock. The combination of the option and the bond give the convertible investor the opportunity for equity exposure when things are going well for the company. But, if things are going less well—and the stock is trading down or sideways—the convertible investor is a bond holder, who still receives the coupons and par at maturity. In other words, the convertible’s bond attributes—coupon income and the bond floor—can potentially mitigate exposure to equity market downside.

The interplay of the fixed income and the option side is what allows you to potentially have an asymmetric return profile with more upside participation than downside.

Convertibles can provide a good way to access parts of the equity market that have tended to be more volatile. A lot of these companies also offer fundamentals we like. We've seen a lot of software as service (SaaS) names issue convertibles. These line up really well with the convertible structure because the underlying stocks have aggressive valuations, and the companies are growing fast, but the credit side is actually pretty conservative. Most of these companies have hardly any debt when they come into the convertible market. When they're only borrowing in the convert market, it's hard for them to get into too much trouble from a credit standpoint.

Rising rates and inflation are top of mind with investors. How have convertibles tended to perform in these types of environments?

EP: In rising rate environments, convertibles have historically done quite well relative to longer-duration traditional fixed income investments. I mentioned that convertibles are typically issued as five-year paper, but because they have an embedded equity option, many have the duration of a three-year bond. A seasoned convertible portfolio could easily have a duration of two years, which is much shorter than most fixed income ETFs or indexes you might use as points of comparison. So, you'd expect converts to outperform in a rising rate environment, just by that duration math alone.

But there’s more than the duration math. Typically, when you are in a rising rate environment, it’s a mid-cycle-type environment where the equity market does fairly well. In this type of market, the convertible’s embedded equity option can provide an added tailwind.

Is the process for selecting a convertible the same as for a stock or bond?

JW: Convertibles are complex, and that’s why we believe Calamos has a real advantage. Eli and I have been using convertibles for decades—and that’s true for many of our teammates. And of course, the firm’s proprietary research dates back to the 1970s, when John Calamos founded the firm.

The Calamos approach focuses on comprehensive capital structure research—we’re blending equity analysis, debt analysis and convertible analysis. We’re looking at top-down factors, as well as bottom-up fundamentals.

What’s tricky about convertibles is that they vary in their levels of equity and fixed income sensitivity—and this changes over time, for individual convertibles and the convertible universe as a whole. So, at times a convertible may be more stock-like or bond-like. That’s why active management is so important. Passive strategies can easily become too exposed to equity downside, or they may not have enough equity exposure. We’re always seeking out opportunities to rebalance our portfolios—to continually enhance the risk/reward as market opportunities evolve.

EP: Joe’s right, that rebalancing is really important. Convertibles are great securities that can give good upside participation and good downside risk mitigation when they're around par. But if they work out and the stock's up 50% or 100%, then they can look a lot like equity. At that point, we want to rotate out of the more equity sensitive convert into something closer to par with better convexity.

How big is the convertible market?

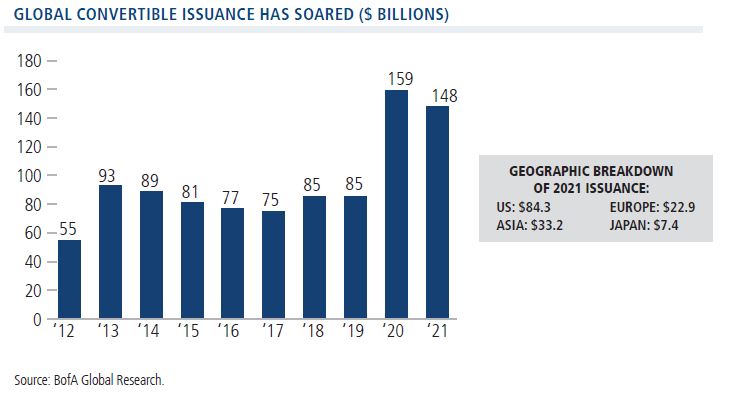

EP: The global convertible market is valued at more than $456 billion, which gives us a lot of choices. Also, the market is going through an exciting period in terms of issuance, with soaring issuance in 2020 and 2021. In 2020, $159 billion of convertible paper came to market globally. In 2021, issuance totalled $148 billion. Historically, the convertible market has been one of the first to open up after periods of market stress. And that certainly was the case when the markets sold off in March of 2020. Issuers flocked to the convertible market to shore up their balance sheets.

JW: The Covid downturn was definitely a catalyst for the convertible market—and we’re really pleased to see that it has been sustained. This surge of new paper has given us lots of opportunities to rebalance and diversify. We’re also excited that issuers are focused on growth capital—for mergers, acquisitions, capital spending and research and development.

Tell us more about the types of companies that issue convertibles. Is it mainly a US market or a global one?

JW: There are all kinds of companies in the convertible market. Geographically, US issuers represent about 60% of the market, but there are also big convertible markets in Europe and Asia. There's a meaningful convertible market in Japan.

There’s diversity by market cap and sector, too. Historically, small- and mid-cap growth-oriented companies in areas like technology and health care have been especially well represented in the convertible market. One reason for this is that convertible investors are willing to accept modestly lower coupons, in exchange for the opportunity to participate in equity upside. So, the convertible issuer can monetize the potential upside of its equity and have lower debt payments than if it issued a straight, non-convertible bond. That can be especially attractive for companies that are focused on growth. But, there’s definitely a mix—there are also larger-cap companies issuing convertibles.

Although we tend to see more of these larger-cap names in non-US markets, there are also US examples. Last year, Ford Motor issued $2 billion in convertible securities. So, the convertible market definitely runs the gamut—from tomorrow’s leaders to today’s bellwethers.

In addition to the overall amount of issuance, are there other trends you’re excited about?

EP: We've had a lot of other interesting companies come to the market—including in newer spaces like cryptocurrency. In the past couple of years, we’ve also seen a nice expansion of the names in the convertible market, including new entrants and companies with relatively short histories as publicly traded companies.

Repeat companies have also come back. When Covid started taking down the equity market in March and April of 2020, we saw companies that hadn’t issued convertibles for years come back with attractively structured deals to quickly tap the market. These included cruise companies and airline names—so again, we’re seeing a lot of breadth in the asset class.

After two years of such high issuance, what do you see on the horizon for 2022?

EP: In 2020, there was a big chunk of Covid recovery trades—cruise lines, airlines, retailers, and so forth. As we went into 2021, many investors thought that we wouldn't see that trade again, but 2021 ended up being pretty close to 2020. We saw a diversity of newer companies coming to the market. Coming into 2022, expectations were that we would have another good year in issuance, although maybe not getting to heights we saw in the past two years. This quarter has been pretty quiet with all the volatility in the markets. Convertibles, like other asset classes, haven’t seen a lot of new issuance. Still, we think there's a fair amount of pent-up demand on both the issuer side and the investor side that should create a healthy market going forward for the rest of the year.

As things settle down and people get their arms around what the Fed's doing and get some clarity about what's evolving in Ukraine, our team expects the convert market to open up and open up quickly. In the past, we’ve seen things change overnight, and suddenly we're getting a ton of paper.

JW: I’d also add a final point on issuance. Although the high issuance we’ve seen has been great for the asset class, the case for convertibles doesn’t hinge on issuance levels alone. It’s about the companies in the market and their fundamentals, and of course, the structural benefits of convertibles to address the challenges of equity volatility and rising interest rates. The dynamics of every asset class ebb and flow, and we’ve been doing this for a long time. Even if issuance were to taper, we’re confident we could take that in stride.

How are you positioning portfolios in response to this volatility?

JW: At Calamos, we believe the flipside of volatility is opportunity. We’ve been through many market cycles over the years and while the cause of the volatility can be different, we use periods like this to add to favorite names and to establish new positions. We’re always focused on enhancing the risk/reward skew of the portfolios we manage.

Do you have any closing thoughts about the opportunity of convertibles?

EP: We view convertibles as strategic allocations to be held over full market, economic and interest rate cycles. But right now, with the pullback and volatility in the market and rising rates, there are also tactical opportunities in addition to the strategic ones. For a lot of investors, it’s tough to buy equities when you've had this kind of volatility, and converts are a way to increase equity exposure in your portfolio and sleep at night. We believe convertibles are a great way for an investor to take some risk off the table and stay in the equity market. Convertibles can also be a compelling choice for an investor who has missed some of the equity market and now is trying to decide, should I dip my toe back in? So, convertibles can be a great way to add a little bit of equity risk without getting too far over your skis.

To learn more about convertible securities and asset allocation, please visit our convertible resources page, which includes videos, commentary and blog posts. You can also subscribe to the US Convertible Market Snapshot or Global Convertible Market Snapshot for regular updates on market developments, including performance, issuance, credit quality and more.

As of March 31, 2022, Calamos convertible assets under management totaled $13.8 billion. Overall convertible market asset data as of March 31, 2022, source: BofA Global Research.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Convertible securities entail interest rate risk and default risk.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The views and opinions expressed are those of Calamos Investments and are not necessarily those of any other entity including other broker/dealers or their affiliates.

Duration is a measure of interest rate risk, with longer durations associated with increased sensitivity to interest rates.

18948 CVQACOM 0422

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.