Financing 4 Years of College? Here’s One Way to Do It

First published: May 16, 2019

Sure, college could be free by the time your baby (or grandbaby) is college-age. That could happen.

But what if it isn’t? In 1997, investors setting aside funds for their child’s education had no way of knowing that college tuition and fees would rise at one of the highest inflation rates—even as inflation overall was tamed. The year at a state college that cost $3,110 in 1997 when they started saving rose to $9,716 by 2018-19, the time their baby was about to graduate from college.

Here’s where financial advisors today can add value: Help your clients focus on the challenge ahead of them. If recent history is any guide, the average cost of college tuition and fees may well continue its relentless climb. Your task is to establish an investment account, subject to fluctuating markets, capable of funding costs that have historically gone in just one direction.

Where to Invest?

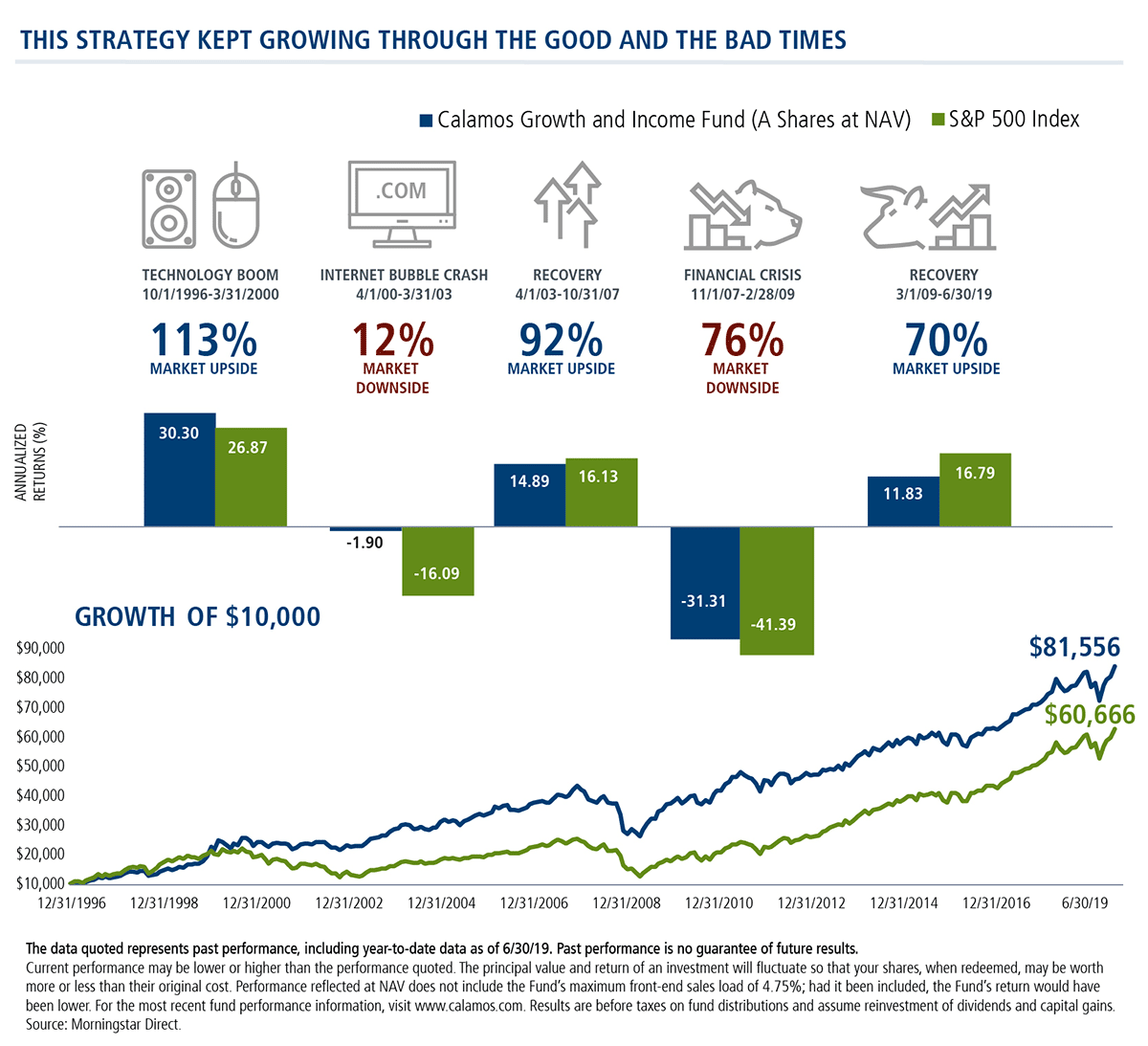

First, there's the selection of the funding source. Parents who used the lower-volatility equity Calamos Growth and Income Fund—A Shares (CVTRX), also available as Class I Shares (CGIIX), captured a significant amount of upside during bull markets and limited losses when markets plunged. By keeping drawdowns to a minimum, the fund preserved opportunities for the invested balance to continue to grow. Most important: the absence of dramatic declines kept parents invested and focused on the end goal.

The hypothetical illustration below demonstrates the path of a $10,000 investment in the fund from 1997 to 2019 compared to the Standard & Poor's 500.

The College Savings Plan

Next was the investment plan, including how much and how often.

Below is a hypothetical illustration that demonstrates how 10 annual contributions of $4,000 into Calamos Growth & Income Fund (A Shares at NAV) from 1997 to 2006 would have been enough to cover college expenses of $30,000 a year from 2015-2018.

By the time the child was 10 years old, his or her college education financing was provided for—thanks both to the 10 consistent investments made and the capital appreciation and income generation of the fund.

After four years of college were paid for, $4,540 remained in the fund as of 6/30/19.

It's been our pleasure to play a role in helping the Class of 2019 parents fund their children's academic dreams, and they (and their financial advisors) have our hearty congratulations.

Advisors, for thoughts on building a lower volatility plan for your clients’ up-and-coming scholars, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Click here to view CGIIX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Growth and Income Fund risk include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, equity securities risk, growth stock risk, small and mid-sized company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk and portfolio selection risk.

S&P 500 Index – Is generally considered representative of the U.S. stock market

Standard Deviation is a statistical measure of the historical volatility of a mutual fund or portfolio. Sharpe ratio is a calculation that reflects the reward per each unit of risk in a portfolio.

Alpha is a measure of performance on a risk-adjusted basis. Alpha, often considered the active return on an investment, gauges the performance of an investment against a market index used as a benchmark, since they are often considered to represent the market’s movement as a whole. The excess returns of a fund relative to the return of a benchmark index is the fund's alpha.

Beta is a historic measure of a fund’s relative volatility, which is one of the measures of risk; a beta of 0.5 reflects 1/2 the market’s volatility as represented by the Fund’s primary benchmark, while a beta of 2.0 reflects twice the volatility. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Important Risk Information:

An investment in the Fund is subject to risks, and you could lose money on your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The Fund also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Hypothetical Report Disclosure Statement

This is an illustration of a simulated investment that assumes the portfolio holding(s) were purchased on the first day of the period indicated. Sales and tax charges, including those required in the event of transfers between assets, are taken into account at the rates shown and may be higher or lower than what an investor would have actually paid had the investments been purchased then or now. The performance data represents past performance and is not indicative of future results. Principal value and investment returns will fluctuate, and an investor's shares/units, when redeemed, may be worth more or less than the original investment.

The underlying holdings of the portfolio are not federally or FDIC-insured and are not deposits or obligations of, or guaranteed by, any financial institution. Investing in securities involves investment risks including possible loss of principal and fluctuation in value.

The investment returns do not reflect active trading and do not necessarily reflect the results that might have been achieved by active management of the account. The investment returns of other clients of the advisor may differ materially from the investment portrayed.

The information contained in this report is from the most recent information available to Morningstar as of the release date, and may or may not be an accurate reflection of the current composition of the securities included in the portfolio. There is no assurance that the weightings, composition and ratios will remain the same.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

801574 0719

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end performance information, please CLICK HERE. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on July 15, 2020Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.