Financial advisors, what were your balanced funds doing during the wild ride that was the first quarter?

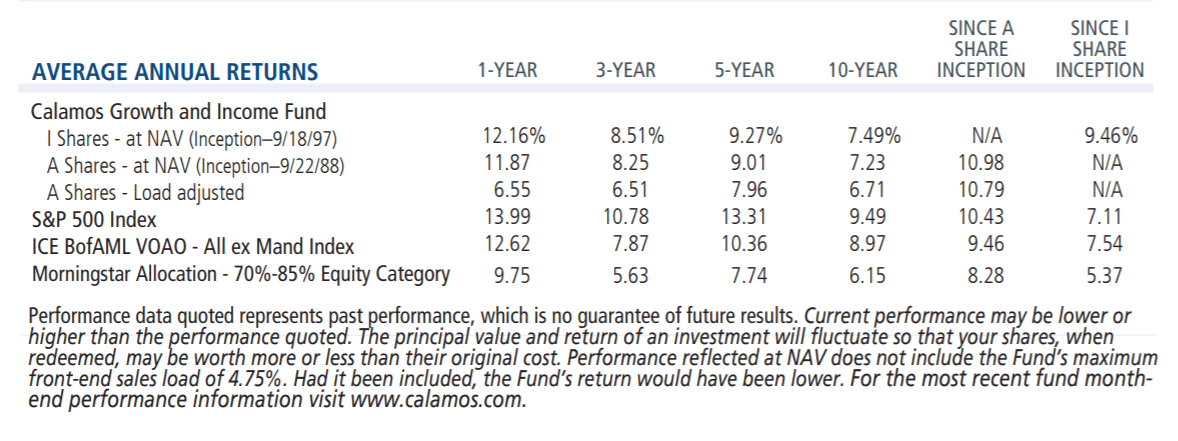

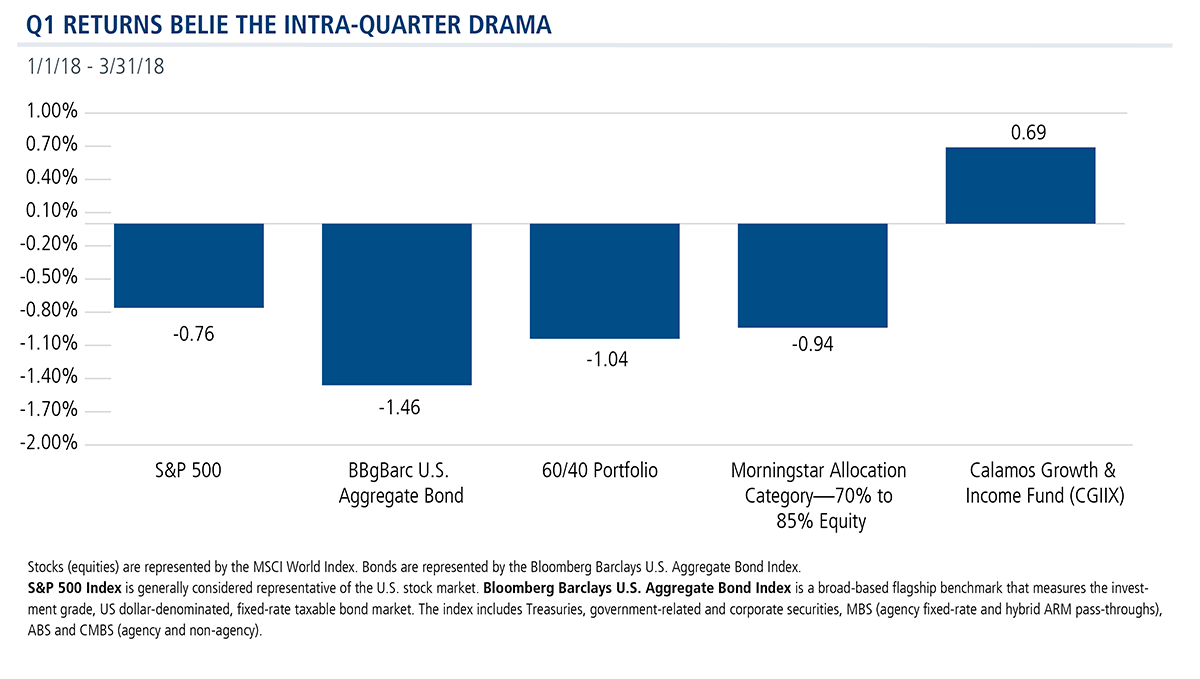

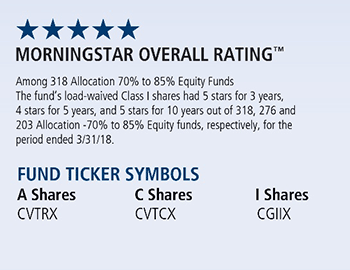

A typical balanced fund with stock and bond exposure would have struggled along with the S&P 500, which finished the quarter 0.76% down, and the Bloomberg Barclays U.S. Aggregate Bond Index with a -1.46% return. A portfolio of 60% stocks (with stocks represented by the S&P) and 40% bonds (with bonds represented by the Bloomberg Barclays U.S. Aggregate Bond Index) would have lost -1.04%. The Morningstar Allocation Category which includes balanced funds with 70% to 85% equity slipped -0.94%.

Those modestly negative returns belie the dramatic swings that took place in the quarter. Here’s the story of how Calamos Growth & Income Fund (CGIIX)—which distinguishes itself from balanced funds by its use of convertible securities—stepped through a volatile Q1 2018.

“The first quarter was a microcosm of what we’re trying to accomplish throughout market cycles,” explains Scott Becker, Calamos Senior Vice President, Head of Portfolio Specialists. “Where pricing and opportunity present itself, we utilize a range of securities to manage the fund’s risk reward. Long term, we want to provide equity-like returns with less risk. That’s how we can help client portfolios weather choppy markets and build long-term wealth.”

Up, Down, Down and Almost Back to Even

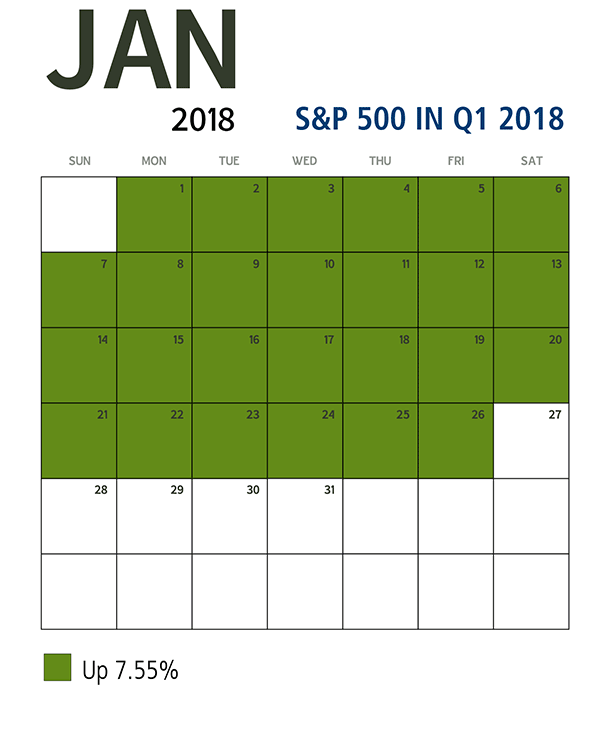

January 1-26, 2018: The year started out with equities on a tear, with the S&P 500 climbing to 7.55% by January 26. CGIIX was right alongside it, with a 7.53% return.

The portfolio management team used cheap short-term volatility in 2017 to buy calls as well as puts with the goal of enhancing the risk/reward dynamics of the convertible securities that we blend with the equities in the portfolio. The CBOE Volatility Index (VIX) was regularly 10 or below in the second half of 2017, which was low even by the standards of recent years.

This enabled our risk-conscious fund to participate almost fully in the rising equity market.

Compare this to high quality bonds, which are the traditional offset to equity in a balanced approach. During this same period, the Bloomberg Barclays U.S. Aggregate Bond Index declined -0.95%.

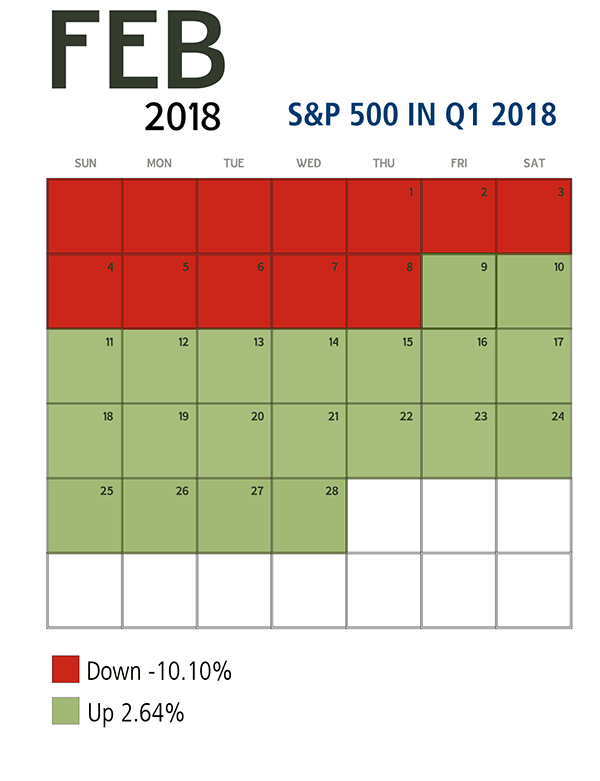

January 27-February 8, 2018: When the equity market corrected, dropping 10.10% in 11 days, CGIIX fell -8.33% (or 82.5% of the S&P decline). The put side of the earlier trade demonstrated its value. Once again, the fund’s use of market opportunities to manage the portfolio’s overall market sensitivity enabled a better path for investors.

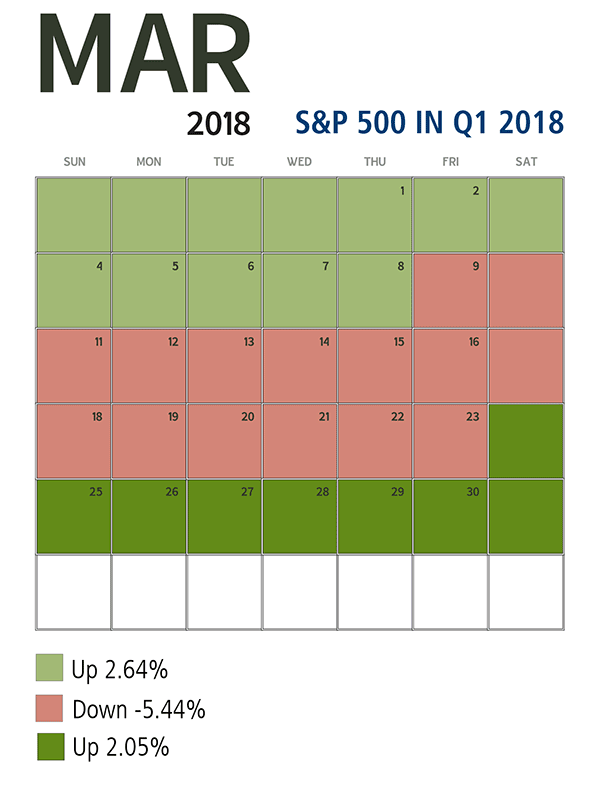

February 9-March 31, 2018: The market continued up and down for the rest of the quarter including a nerve-racking 5% dip in March. The fund’s upside/downside participation in the choppy market was typical of its long-term track record.

As you can see, the use of cheap short-term volatility was an effective way for the team to actively manage risk/reward of the convertibles and the overall portfolio. Vol has now “spiked” back to more normal levels.

Today longer-term vol (what convertibles have in their pricing) is more attractively priced than it was previously, and CGIIX’s equity and convertible mix offers what the team believes to be the right entry to equity markets, Becker says.

And There’s More

In addition to CGIIX’s management of volatility, its sector allocations and issue selection contributed to outperformance against both the S&P and a traditional 60/40 portfolio in the first quarter.

At the close of the quarter, the fund favored high growth (mainly technology) as well as cyclical growth (financials, industrials and some consumer areas) and was less enthusiastic about more defensive sectors (staples, utilities, REITS). For more information, see our commentary (PDF).

Advisors, how confident are you that the bond portion of your balanced funds will contribute as fixed income has in the past? What are your expectations about volatility—are your clients prepared for the return of normal volatility such as what’s occurred to date this year?

When you’re ready to learn more about CGIIX, the alternative to balanced funds, your Calamos Investment Consultant is ready when you are—call 888-571-2567 or email caminfo@calamos.com.