CTSIX’s Brandon Nelson: Pursuing the Disproportionate Reward of Small Cap Growth Stocks

Meet Brandon M. Nelson, founder of Timpani Capital Management, the investment management firm focused on small cap growth investing that was acquired by Calamos in May 2019. Nelson is Senior Portfolio Manager of the Calamos Timpani Small Cap Growth Fund (CTSIX).

ABOUT BRANDON M. NELSON, CFA

Prior to joining Calamos in May 2019, Senior Portfolio Manager Brandon Nelson was a co-founder of Milwaukee-based Timpani Capital Management. He was the firm’s Chief Investment Officer and Portfolio Manager since its inception in April 2008.

Prior to joining Calamos in May 2019, Senior Portfolio Manager Brandon Nelson was a co-founder of Milwaukee-based Timpani Capital Management. He was the firm’s Chief Investment Officer and Portfolio Manager since its inception in April 2008.

From 2005 to 2008, he was a Managing Director and Senior Portfolio Manager at Wells Capital Management. Earlier he was a Portfolio Manager and Research Analyst for Strong Capital Management.

Brandon received his master’s degree in Finance from the University of Wisconsin-Madison and was selected to participate in the prestigious Applied Security Analysis Program. He also received his B.B.A. in Finance from the University of Wisconsin-Madison and has earned the right to use the CFA designation.Q. Brandon, small cap stocks have developed the reputation of being a difficult to get to know space—how were you able to break into small caps and become a specialist?

A. I started my career in the mid-1990s as an all-cap research analyst, but I always enjoyed small caps. I liked meeting the teams, it’s easier to get your arms around the fundamentals and I liked the potential to get disproportionately rewarded with small cap stocks. I get excited about the possibility of discovering the next big thing. I like sniffing out trends and finding companies that are levered to take advantage of them or maybe innovating themselves.

There’s the opportunity to get disproportionately punished too, of course.

My direction was set in 2000 when my mentor at Strong Funds assigned lieutenants within the team ahead of his planned retirement. He assigned me to head small caps because of my passion for them, and I had a reasonably good batting average. I was named co-portfolio manager of the strategy with him in 2000.

Q. It sounds as if you just naturally gravitated to small caps.

A. You could say that. Not everyone is comfortable with how things can get exaggerated with small caps. People focus on the cost of being wrong, and some don’t like the pressure. I like pressure situations. I like being the guy shooting the game-winning free throw.

Q. Over the years, what have you found to be the least understood aspect of small cap investing?

A. You can’t just buy and hold individual securities. You can’t buy, leave the scene for five years, return and expect everything to be on track. That’s not going to be true. Things can go south fast, stories change, fundamentals change, and investors can get blindsided.

Small caps can be squirrelly and you need someone bird-dogging at all times to make sure the companies are executing.

Q. Hmm, what does that mean for investors using an index-based fund for small cap exposure?

A. Using an index-based fund or ETF can get you exposure to the small cap asset class, but inevitably, one will get exposure to dead weight—underperforming stocks of companies that often have poor fundamentals. Skillful active managers should be able to navigate to find winning stocks and avoid more of the dead weight than the index holds. We think the many inefficiencies within small cap create tremendous opportunities for adept small cap active managers to outperform the passive approaches over time.

Q. What’s your understanding of what financial advisors need from small caps?

A. I think advisors want three things: capital appreciation, alpha generation, and a return profile that is minimally correlated with other asset classes in the portfolio.

Q. Since its founding in 1977 Calamos’ focus has been on risk-managed investment returns. Why are Timpani and Calamos a good fit?

A. It’s a good question because small cap stocks are inherently more volatile. That’s why we are ultra-sensitive to risk at the individual stock and sector level.

Our biggest competitive differentiator, our greatest value-add, is our unemotional sell discipline, which is a risk management tool. We have a no-nonsense approach. We sell quickly when we sense the fundamental momentum is diminishing at a company.

Beyond our attention to risk controls, there are other benefits of the acquisition. By joining Calamos, my team and I will be relieved of many non-investment related duties, assuring that we will maintain the ability to focus our time and energy on our key value proposition as portfolio managers. We’ll have access to the significant resources of an established enterprise while enjoying research, trading and risk management/quantitative synergies that will specifically support our investment efforts.

WHERE FUNDAMENTAL INVESTING COMBINES WITH BEHAVIORAL FINANCE

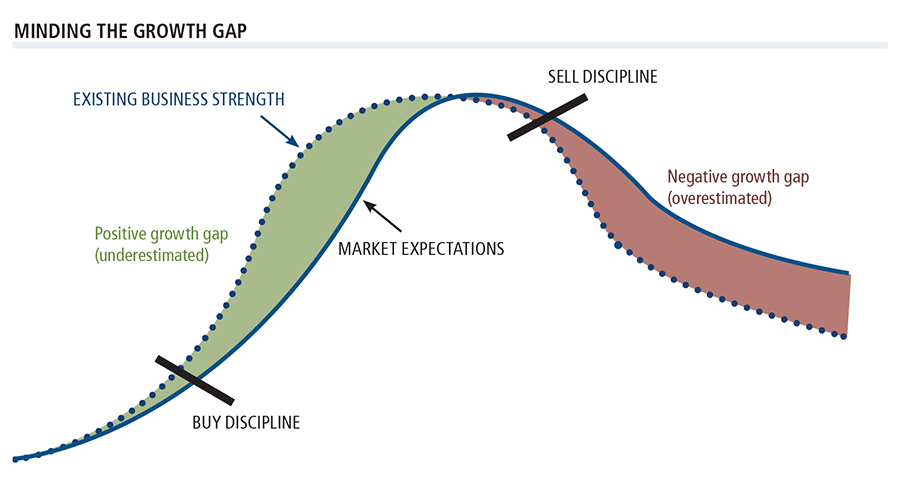

CTSIX’s objective is to identify and exploit the gap that exists between a company’s business strength and the market’s expectation of that strength. A key piece of the team’s approach is its avoidance of the emotion and behavior biases that can trip up other small company investors.

Here’s Nelson’s explanation:

”We try to get in front of positive earnings revisions. Let’s say analysts are raising their estimates from $1.00 a share to $1.10 to $1.20 to $1.50 throughout the course of the year. That stock might be expected to rise by the same percentage as those positive revisions, and then what often happens in typical markets is the valuation expands. Maybe the stock was trading at 20 times earnings when it was $1.00 per share in the estimate and by the time it’s $1.50 a share, the market is rewarding that company with a 30 times multiple.

There are two ways to win: with the positive trajectory of the revision and valuation expansion.

Every growth stock goes through this life cycle where eventually the world catches up to reality—and that’s at the top of the curve, where the business strength and market expectation lines converge. On the left-hand side of the curve, investors chase reality to the upside and raise their estimates to try to keep up with reality. On the right side, they can’t cut their estimates fast enough. By then, we’re long gone.

Our objective is to buy at the bottom dash and sell at that top dash or as close to it as we can possibly get.”

Buying and selling stocks based on where they are on this curve helps the team minimize exposure to the disposition effect, which is the tendency for investors to sell their winners too soon and to keep their losers too long. Investors subject to anchoring bias can be slow to react to incremental, relevant changes. The prevalence of such a bias helps explain why growth gaps exist, according to Nelson.

Q. What have you learned about small cap investing over the length of your career?

A. We focus on finding companies with fundamental momentum and our track record demonstrates that we’ve identified growth opportunities.

What I’ve learned over the years is that the market doesn’t embrace fundamental momentum at all times. However, during those times when fundamental momentum isn’t rewarded in the short term, it will be rewarded over the intermediate- and long term. We can wait. Our track record shows how we’ve benefited when the mean reverted back to favoring what we do.

Whether fundamental momentum is in vogue or not, we’re not going to deviate from our strategy and our philosophy. And, that’s what our clients have told us that they appreciate most—they know what they’re getting. They know that we’re not going to drift stylistically.

Q. Lastly, what is it about the timpani that led you to name your business after it?

I wanted to name the firm something that I had a personal connection with. I’ve been playing drums since I was in the fifth grade, drum set is probably my favorite but “timpani” seemed a bit more subtle.

Advisors, to learn more about CTSIX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. The opinions and views of third parties do not represent the opinions or views of Calamos Investments LLC. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Fund Information

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, foreign securities risk, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, liquidity risk, portfolio selection risk, portfolio turnover risk, sector risk, and small-sized company risk.

Alpha is a historical measure of risk-adjusted performance. Alpha measures how much of a portfolio’s performance is attributable to investment-specific factors versus broad market trends. A positive alpha suggests that the performance of a portfolio was higher than expected given the level of risk in the portfolio. A negative alpha suggests that the performance was less than expected given the risk.

© 2019 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

801582 0519

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end performance information, please CLICK HERE. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on June 02, 2020Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.