This post was written by Christian Brobst, Calamos Vice President, Portfolio Specialist.

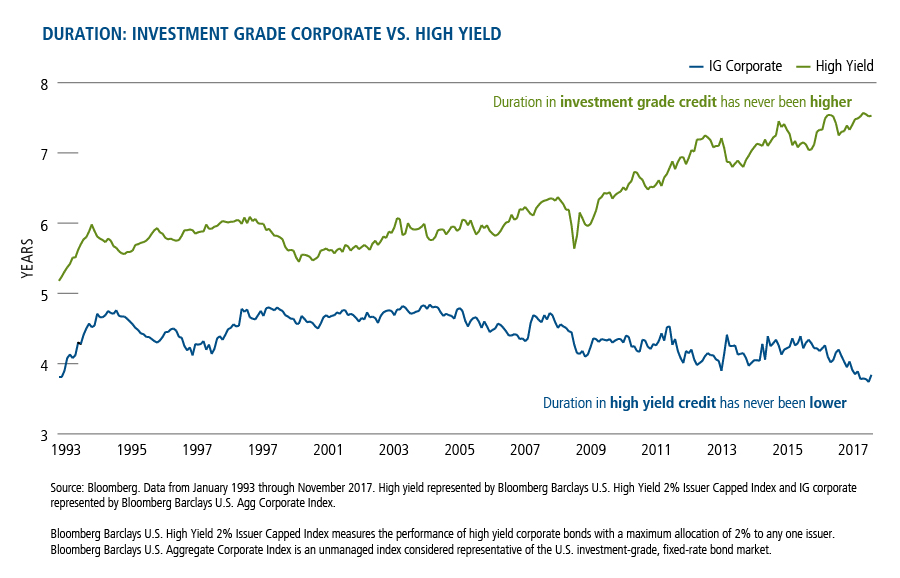

As the year draws to a close, we’ll call your attention to two extremes in the duration of high yield and investment grade corporate bonds that you may want to consider as you position your clients’ fixed income allocations for 2018.

Duration in investment grade credit has never been higher since 1993, and duration in high yield credit has never been lower.

What could cause such divergent trends? The answer is largely supply-driven.

High Yield Market Has Been Contracting

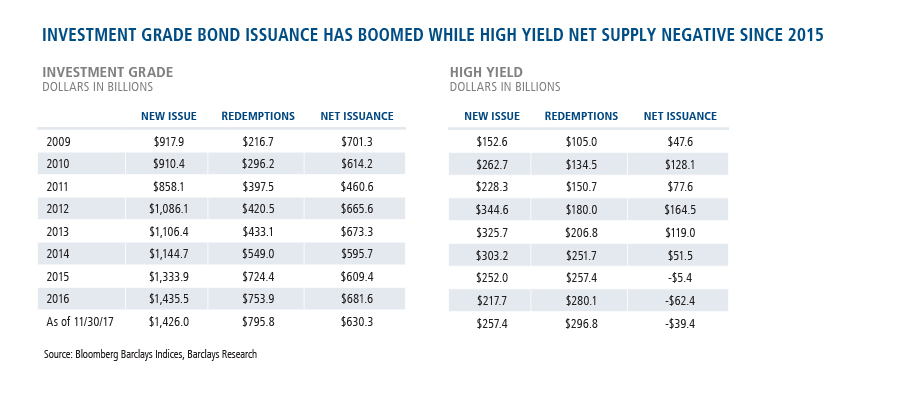

While anecdotes abound of irresponsible corporate borrowing and debt-fueled shareholder friendly activity, the reality is that net supply in the high yield market has been negative since 2015. This implies that redemptions of outstanding debt by companies is outpacing the issuance of new bonds. At -$39.4B YTD through November 30, net issuance was on pace to finish the year at -$43.0B. While this represents an uptick from the -$62.4B in 2016, it is only the fourth annual contraction in the size of the high yield market since 1998.

The lower level of supply has the effect of shortening the duration of the overall high yield market as outstanding issuance ages and new issues do not contain enough duration to replenish the aging debt.

The Boom in Investment Grade Corporates

Meanwhile, investment grade corporate debt issuance has been robust with an average annual net issuance total of $626.1B since 2009. The 2017 total through November 30 stood at $630.3B, on pace to finish the year at $687.6B. That would be the second highest total since 1993.

Moreover, as the term premium has been declining in the form of a flattening curve, companies have continued to “term-out” debt in the form of longer maturity fixed-rate issuance. As this issuer behavior has continued, the duration of the investment grade corporate bond market has continued to extend.

What Does the Divergence Mean?

Duration is a measure of risk for fixed income portfolios, it is an estimate of how much the value of a bond portfolio will change for a given change in yield. Spread duration is an estimate of how much the value of a bond portfolio will change for a given change in spreads. A lower overall duration implies a lower spread duration.

As such, this data indicates that there is less spread duration risk in the high yield market, and more spread duration risk in the investment grade market than there has been since 1993.

Credit markets have had a strong 2017 across ratings categories, and we continue to be constructive on both investment grade and high yield credit for 2018 while recognizing that there will be limited opportunity for broad-based spread tightening from current levels. We continue our focus on uncovering value in out-of-favor sectors through bond-by-bond fundamental research.

Duration management is a piece of the argument to be made in favor of active management of fixed income portfolios.

Advisors, for more information, please talk to your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.