Diversifying Credit Risk within Fixed Income

August 24, 2017

As always, the tension in investment decision-making is between risk and return. Our perspective is that in the reach for yield, the opportunities for missteps are plentiful.

As long-term rates are unlikely to soar, there are ongoing opportunities within the fixed income market. But lately, the Calamos Product Management & Analytics team is being asked to consult on fixed income allocations that are heavily tilted toward credit risk.

“Many products generate meaningful yield but they must reach for it in lower quality credit, often overlapping with allocations specific to high yield and bank loans. There is also a heavy dose of securitized overlap,” says Shawn Park, Calamos Vice President and team head. “While securitized products provide a yield advantage over investment grade quality, overdiversifying in one asset class is not recommended.”

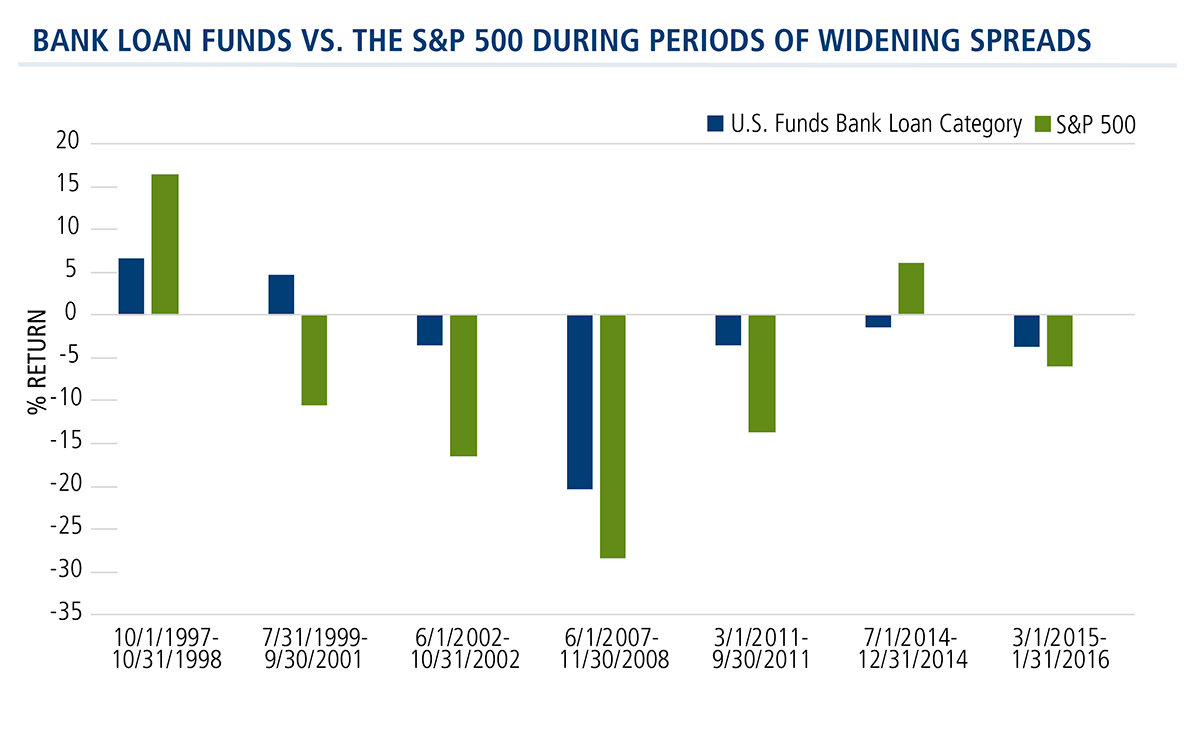

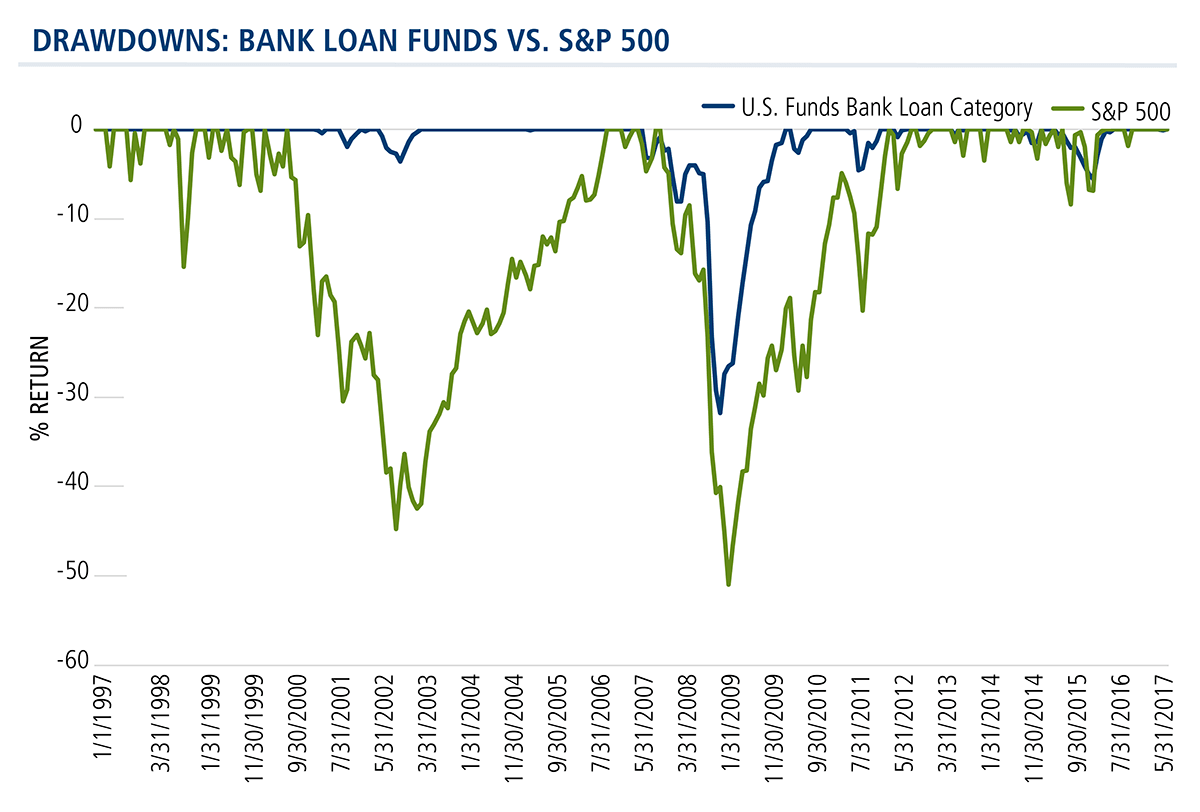

Bank loan funds, also known as floating rate funds, have appeal now due to the rising LIBOR. Park reminds advisors that with these types of funds come volatility and the potential for larger drawdowns because bank loans are highly correlated to the credit spread cycle. Credit risk is the primary risk to bank loans.

Here’s a look at bank loan fund performance during the last seven periods of widening credit spreads in the last 20 years.

And the drawdowns that resulted.

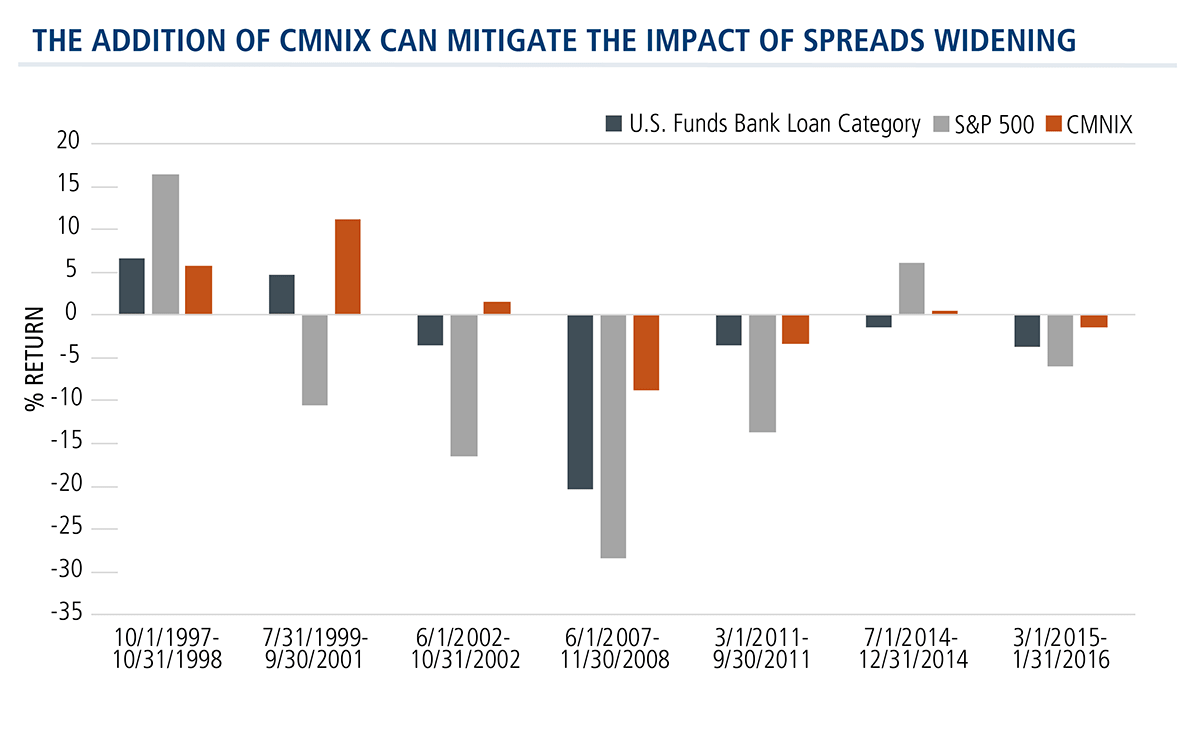

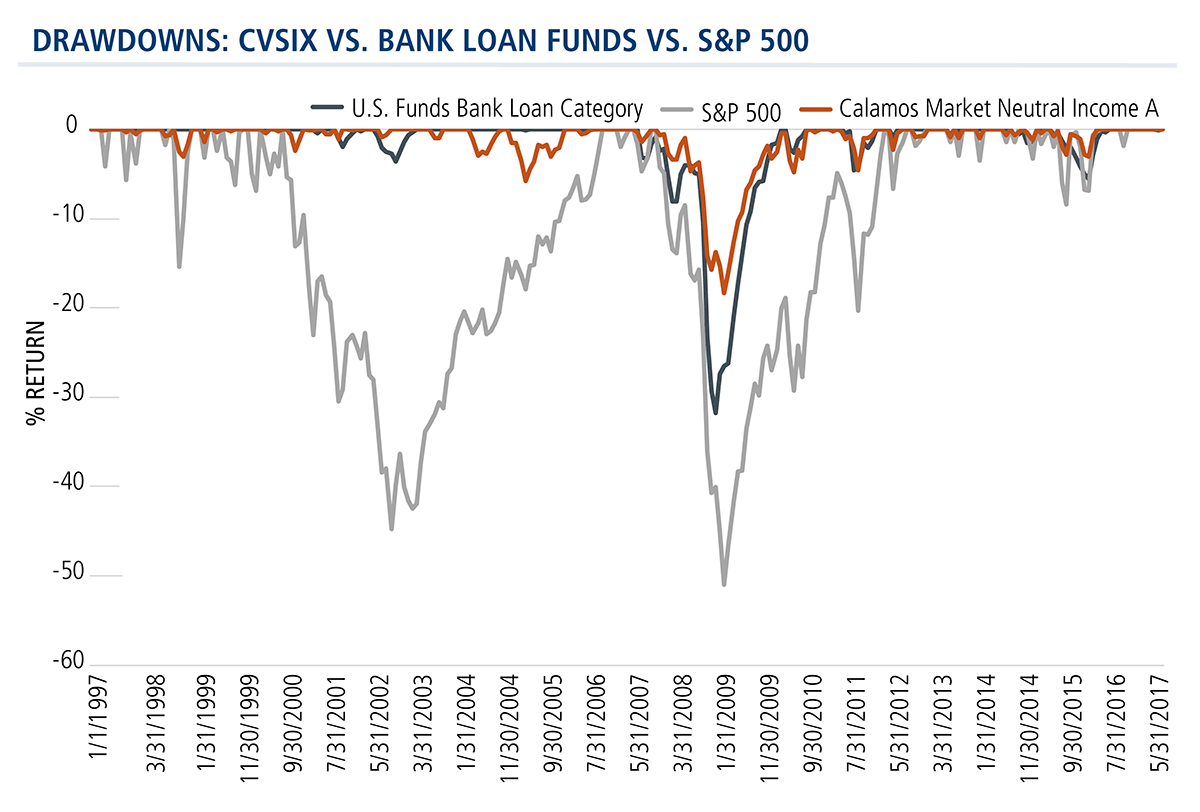

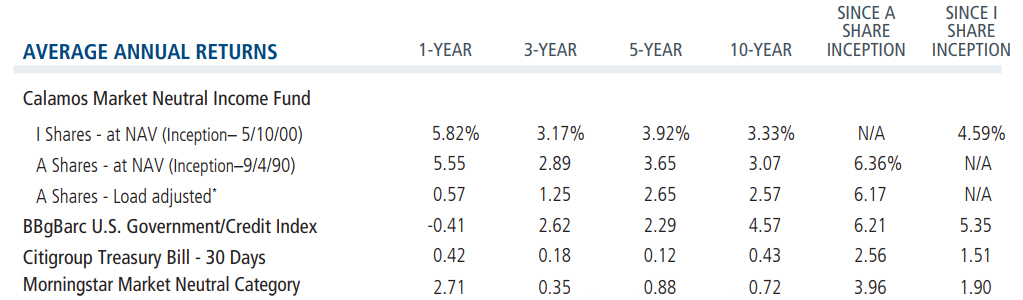

Diversification—the inclusion of Calamos Market Neutral Income Fund (CMNIX) in a portfolio, for example—can help mitigate the impact of spreads widening when the time comes.

Use CMNIX to strengthen the ballast of a fixed income allocation that may or may not include bank loans. It can 1) provide a return stream similar to that of a traditional intermediate term bond fund 2) without lowering the credit quality of the portfolio 3) while still providing a hedge against fixed income risk exposures that include credit risk or liquidity risk (also a concern with bank loans).

Advisors, for more information about CMNIX, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

As of 6/30/17

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

Morningstar Bank Loan Category represents funds that invest primarily in floating-rate bank loans instead of bonds. In exchange for their credit risk, they offer high interest payments that typically float above a common short-term benchmark.

The S&P 500 Index is considered generally representative of the U.S. equity market.

The Citigroup 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments. Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

The Bloomberg Barclays U.S. Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

800424 0817