What’s Behind CIHEX’s Appeal in This Frothy and Volatile Market

At all times, investment professionals are interested in what their peers are up to. Remote working and social distancing have only heightened this curiosity—and sincere desire to learn from others’ thinking.

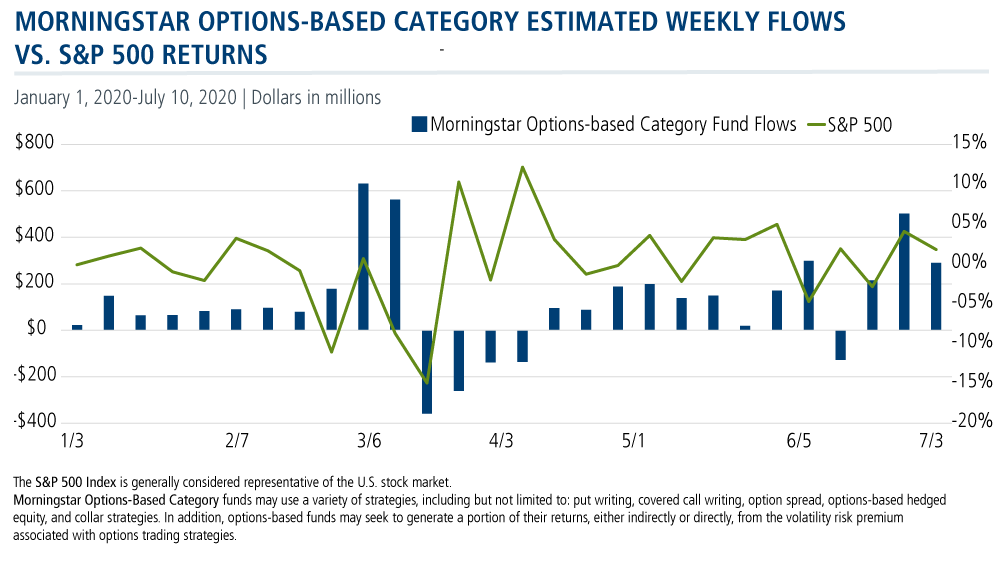

In that spirit, we’ll call your attention to the flows this year into Morningstar’s Options-based category—a category that includes Calamos Hedged Equity Fund (CIHEX).

Specifically, we’re tracking $790 million flowing into the category in the first two weeks of July, as reported by the Calamos Weekly Alternatives Snapshot.

Such a surge is reminiscent of what was seen in the first and second week of March, when almost $1.2 billion flowed into the category. That was followed by rare outflows the next four weeks.

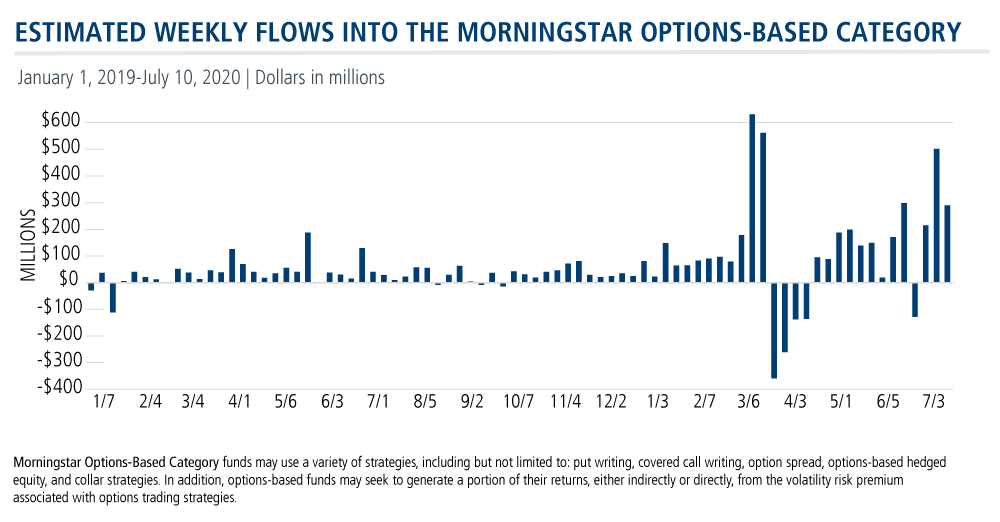

In 2020 overall, interest in options-based funds has been higher than last year—a year when the category was the fastest growing liquid alts category (see Liquid Alternatives: 2019 Year in Review). Through July 10, the category has attracted $3.4 billion in net flows versus $1.8 billion in all of 2019.

The difference between the calm of 2019 and the froth and volatility of 2020 may very well explain the spike in appeal of hedging strategies. It seems clear that investment professionals are re-evaluating equity risk and turning to options strategies for help.

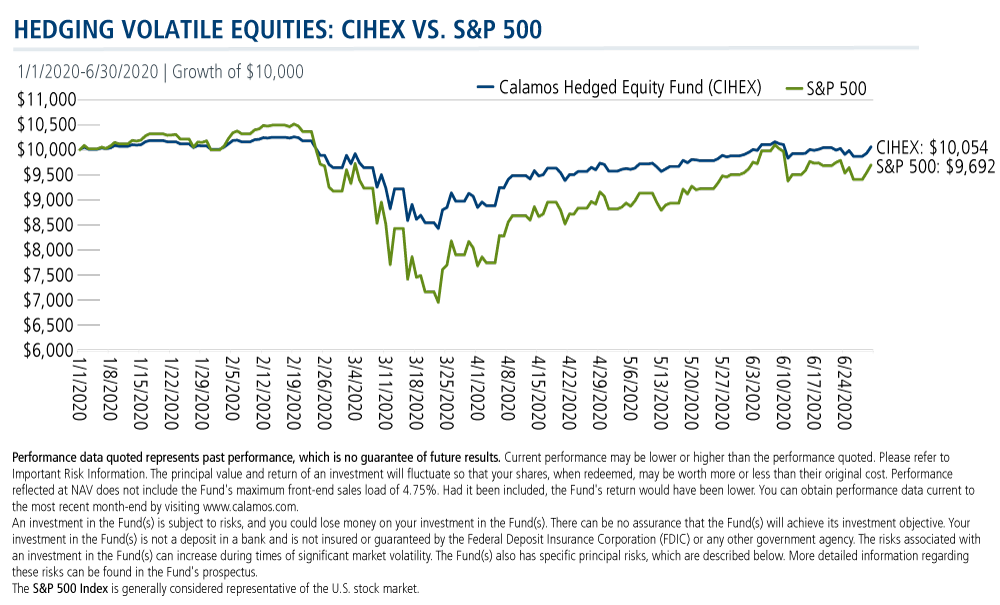

CIHEX outperformed not just the S&P 500 during the last six months but a traditional 60/40 portfolio as well.

Option Strategies Vary Significantly

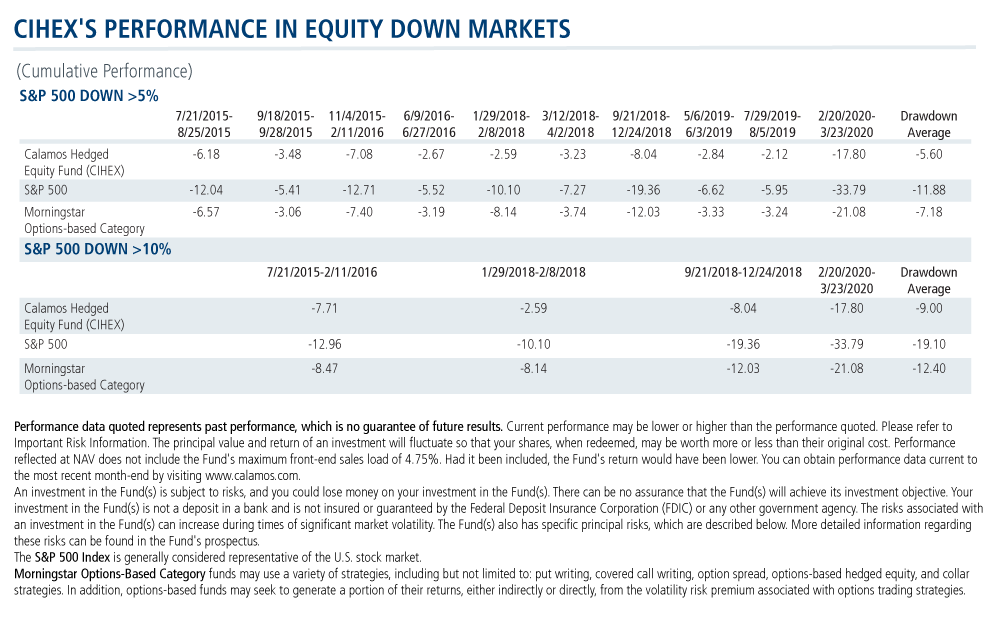

In evaluating options-based funds, it can be helpful to review historic performance during the kinds of high stress market periods you’re hoping to help your clients navigate through.

Significant differences in options strategies—both their advantages and their limitations—can be revealed during market drawdowns. Variations in performance results during 5% and 10% equity market pullbacks can be attributed to several factors, including:

- Use of puts and percentage of portfolio hedged.

- The frequency of when the managers reset their hedges, including whether it’s as needed (active) or periodically (passive).

- Underlying equity positions, whether active or index-based.

- Guidelines for calls written.

Below we show CIHEX’s track record in managing pullbacks. For CIHEX, the advantage has been the ability to manage a “living, breathing hedge,” as the team described in a conference call in May (see blog post).

“As markets move,” according to David O’Donohue, Senior Vice President, Co-Portfolio Manager, “we want to use that to add in pieces. What piece can I add in today that I couldn’t yesterday or last week or last month? If we wake up tomorrow and the market is up 3%, how can I use that to add a piece? Can I sell a call higher, can I add a put or a put spread for 30% less than it cost yesterday?”

This flexibility, he noted, isn’t available to other options-based funds, many of which preordain the amount of calls they’ll sell and puts they’ll buy in a period. Getting the timing right is key to passive options-based funds’ success.

Investment professionals, if you’re considering the array of options available to you in hedging strategies, see our Options-based category explainer. For custom support in understanding specific directions, reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Click here to view CIHEX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 4.75%. Had it been included, the Fund's return would have been lower. You can obtain performance data current to the most recent month-end by visiting www.calamos.com.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

The S&P 500 Index is generally considered representative of the U.S. stock market.

Morningstar Options-Based Category funds may use a variety of strategies, including but not limited to: put writing, covered call writing, option spread, options-based hedged equity, and collar strategies. In addition, options-based funds may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies.

Morningstar Ratings™ are based on risk-adjusted returns and are through [As Of_6/31/20] for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2020 Morningstar, Inc.

802077 0720

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on July 16, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.