Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Hedged Equity Fund: A Dynamic Approach for Navigating Market Volatility

Fund Overview

- CIHEX is a liquid alternative for equity allocations that leverages Calamos Investments’ pioneering expertise in alternative investing.

- The Fund is managed by the same team as Calamos Market Neutral Income Fund, a fixed income liquid alternative which has employed a hedged equity strategy for more than a decade.

Calamos Hedged Equity Fund (CIHEX) has demonstrated resilience consistently during market drawdowns, including the February selloff. We interviewed the Fund’s investment team to learn more about how they’ve historically mitigated risk and pursued upside through a highly responsive, dynamic approach that contrasts with “set-it-and-forget-it” option-based funds.

Give us an overview of Calamos Hedged Equity Fund.

Jason Hill: Calamos Hedged Equity Fund is managed to mitigate risk and provide equity upside participation. Few traditional or alternative strategies respond positively to rising equity market volatility, but CIHEX is dynamically managed to monetize volatility. For this reason, the Fund can add a lot in terms of overall diversification.

How do you see CIHEX fitting into a strategic asset allocation?

David O’Donohue: It’s an equity alternative strategy that can help investors manage equity market risk without worrying about timing moves out of stocks into cash or bonds and then timing re-entry. It’s designed to serve as a volatility dampener for an equity allocation—while still providing the opportunity to participate in equity gains.

Historically, the Fund has outperformed in volatile markets, while also capturing equity upside. This focus on risk-adjusted returns makes it an attractive choice for a strategic, all-weather allocation.

Why CIHEX?

- Highly responsive to dynamic market conditions—unlike “set-it-and-forget-it” option-based strategies.

- Dynamic management creates opportunity to add alpha from option market dynamics and equity market volatility.

- “Guard rails” seek to address unexpected market conditions.

- Demonstrated history of downside resilience.

- Managed by a seasoned team from Calamos Investments, the largest provider of liquid alternative strategies*

How do you invest the portfolio to align with your goal of mitigating downside risk and maximizing upside participation?

Jason Hill: Calamos Hedged Equity Fund has two actively managed components: an equity component and an actively managed option overlay. We start with a basket of long S&P 500 stocks, typically 250 to 275 names. Here, our goal is to replicate—and ideally beat—the S&P 500. We aren’t taking large sector or factor bets. While adding alpha in our equity books is a priority, our primary focus is on maintaining a minimal tracking error to the S&P 500.

Low tracking error is important because we overlay the Fund’s equity basket with options against the S&P 500 Index. In normal market conditions, we’re targeting to preserve 60% of the S&P 500’s upside, while limiting downside to 40%. This is what we consider our “north star.”

What sets your approach apart from other funds in your category?

Eli Pars: One key difference between our approach and many other option-based strategies is that our approach is active and dynamic. Some funds employ “static rebalancing.” These “set-it-and-forget-it” strategies adjust hedges only periodically, sometimes even only quarterly. Also, there are a lot of option-based strategies that are mechanistic—by that, I mean they are constrained by pre-set ranges and resets, like upside capture capped at a certain level.

Calamos Hedged Equity Fund is not a “set-it-and-forget-it” strategy. We believe we best serve clients by being responsive to changing market opportunities and risk. That can’t be achieved by setting a hedge and checking back in a month or even a quarter later. In this Fund, we continuously search for a hedge that gives us as much risk mitigation as possible and maximizes our participation in a market rally. For example, our baseline “north star” hedge that Jason mentioned earlier is something that we will adjust, depending on the market environment.

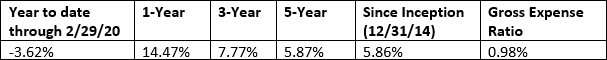

(since inception to 12/31/19)

- Beta: 0.49 vs S&P 500

- Sortino Ratio: 1.25

- Sharpe Ratio: 0.79

- I Shares: CIHEX

- A Shares: CAHEX

What do you believe has been the key to CIHEX’s historical success?

Eli Pars: We’re always preparing for a variety of outcomes, including the ones that investors are betting against. While we can’t predict the outcomes of market events—like the impact of the upcoming U.S. elections—we do know there will be an event that could produce any number of market dislocations.

David O’Donohue: There’s a lot of different options strategies that we can employ. We have a lot of experience—the average industry experience of our portfolio managers is more than 20 years, with combined experience of over 85 years. In our view, this gives us an advantage in understanding which strategies work best in a particular environment.

As Eli mentioned, we can’t predict the outcome of an event on the horizon. What we can be sure of is that the market changes over time. Today’s market environment is not going to look the same as tomorrow’s. Instead of forcing the Fund into a predetermined hedge that may or may not be appropriate, we want to step back and understand what’s unique about the current environment. Then, our team decides how we can take advantage of that to construct a better hedge.

One idea that’s key to our philosophy is to take advantage of what the market is giving. For example, a low volatility environment gives us the opportunity to pick up inexpensively priced puts and calls. By buying variety of options at attractive prices, we can position the Fund for both upside and downside volatility. We’re getting ahead of a potential dislocation that may be weeks or even months down the road. It’s like buying a snowblower in the middle of summer when demand is low—you won’t pay as much as if you wait till a blizzard is coming.

After an extended period of low volatility, we saw more normal conditions return in 2018. How has the fund performed?

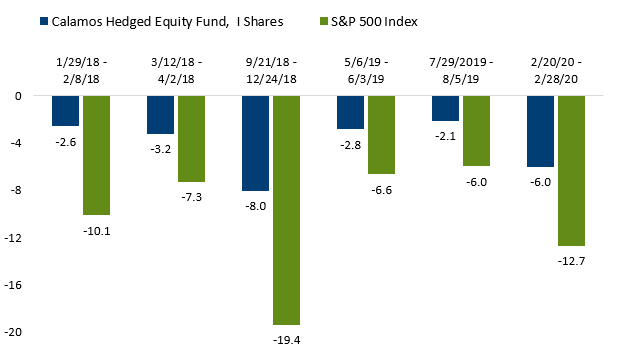

Jimmy Young: We look for ways to capitalize on volatility while also focusing on managing drawdowns. Since its inception, the Calamos Hedged Equity Fund has outperformed the S&P 500 during each drawdown of 5% or more, including six drawdowns since the start of 2018 through the February selloff.

% Returns During Down Equity Markets (S&P 500 down 5% or more)

Past performance is no guarantee of future results. Data from 1/1/2018 to 2/29/2020.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com. There is no assurance the Fund will achieve or maintain its investment objective. Source: Morningstar. In calculating net investment income, all applicable fees and expenses are deducted from the returns. All performance shown assumes reinvestment of dividends and capital gains distributions. The Fund offers multiple classes of shares; performance for other share classes will vary.

Key Tenets of our Philosophy

- Markets change over time, so a dynamic, flexible approach serves investors better than a static approach.

- Take advantage of the opportunities that the market presents.

- Focus on being positioned for as many outcomes as possible.

- Buy what is cheap and sell what is expensive to set the Fund up for better risk-adjusted returns.

- Seek the hedge that gives as much risk mitigation as possible while maximizing potential participation in a market rally.

How did the dynamic management of hedges benefit performance during the February correction?

Eli Pars: Our dynamic adjustment of hedges contributed to CIHEX’s outperformance when the S&P 500 Index plummeted in February. In January, the S&P 500 surged to new highs. We opportunistically sold out of shorter dated long calls. We used some of the proceeds to purchase puts and put spreads, at a low cost. Included in these were put spreads expiring in early March to take advantage of any volatility arising from Super Tuesday. So, against the backdrop of positive market sentiment, we took steps that prepared CIHEX for a potential increase in volatility. As a result of these adjustments, CIHEX began February with additional puts over and above our typical “north star” positioning. This served the Fund well as anxiety about the coronavirus outbreak created havoc in the markets.

You’ve mentioned that you have a lot of flexibility to structure hedges and to be opportunistic. Where does risk management fit in?

Jimmy Young: Because we recognize that markets may go above or below our expectations, we’re very conscious about having guard rails in our positioning.

We won’t let the portfolio be net short to the upside—by that I mean, we have no negative exposure to equity upside. To do this, we never go above 100% notional calls written and we always have net long puts, typically 40% or more of the portfolio.

Also, we’re never without a downside hedge. We always have at least a 40% delta hedge to the downside, which means that no matter how far the market falls, the Fund will still have a hedge in place.

Your team also manages Calamos Market Neutral Income Fund. How do the two funds differ?

Eli Pars: Compared to Calamos Market Neutral Income Fund, Calamos Hedged Equity Fund is a higher octane approach, albeit a risk-managed one. The funds fulfill different roles in an asset allocation, so investors and advisors can include both. Hedged Equity Fund is an equity substitute, designed for the equity side of an asset allocation. Calamos Market Neutral Income Fund is a more conservative approach—it’s an alternative for the fixed income side of an allocation.

In closing, can you summarize how CIHEX can help investors address the risks in the market?

Eli Pars: Calamos Hedged Equity Fund provides a solution for investors who recognize that volatility will always be part of the equity markets. By monetizing that volatility with an active and flexible approach, the Fund offers an innovative way to enhance diversification. Ongoing adjustment of hedges—and a focus on being prepared for multiple outcomes—differentiates our approach from option-based funds that follow a static approach.

Turn Equity Volatility into Opportunity with Calamos

CIHEX has demonstrated its ability to dampen the impact of equity market volatility. For more information about how CIHEX may help address your asset allocation needs, please contact your financial advisor, visit www.calamos.com, or call us at 800.582.6959 (Monday through Friday, 8:00 a.m. – 6:00 p.m., CT).

Financial Advisors: Please talk to your Calamos Investment Consultant about how CIHEX can work within your clients’ portfolios. Contact us at 888-571-2567 or caminfo@calamos.com.

Investment Team

ELI PARS, CFA, CO-CHIEF INVESTMENT OFFICER, SENIOR CO-PORTFOLIO MANAGER

Eli Pars leads the portfolio management team of Calamos Hedged Equity Fund and Calamos Market Neutral Income Fund. He is also a member of the Calamos Investment Committee. Eli has 32 years of industry experience, including 13 at Calamos. He has served as Portfolio Manager at Chicago Fundamental Investment Partners, where he comanaged a convertible arbitrage portfolio. He also held senior roles at Mulligan Partners LLC, Ritchie Capital and SAM Investments/The Hampshire Company. He received a B.A. in English Literature from the University of Illinois and an M.B.A. with a specialization in Finance from the University of Chicago Graduate School of Business. Eli is frequently quoted in industry publications, including Barron’s and The Wall Street Journal.

JASON HILL, SENIOR VICE PRESIDENT, CO-PORTFOLIO MANAGER

Jason Hill is responsible for portfolio management and investment research, focusing on hedged equity and market neutral strategies. He joined Calamos in 2004 and contributes 18 years of industry experience. Prior to joining Calamos, he worked at HFR Asset Management, LLC, with responsibilities in risk and portfolio management. Jason received a B.A. in Finance from North Central College and a M.S. in Finance from DePaul University.

DAVID O’DONOHUE, SENIOR VICE PRESIDENT, CO-PORTFOLIO MANAGER

David O’Donohue is responsible for portfolio management and investment research, focusing on hedged equity and market neutral strategies. He joined the firm in 2014. His investment industry experience of 20 years includes co-manager responsibilities at Hard Eight Futures, Forty4 Asset Management, Chicago Fundamental Investment Partners, Mulligan Partners LLC and Ritchie Capital. He began his career as a trader at SAM Investments. David graduated from the University of Illinois with a B.S. in Finance.

JIMMY YOUNG, CFA, VICE PRESIDENT, CO-PORTFOLIO MANAGER

Jimmy Young is responsible for portfolio management and investment research, focusing on hedged equity and market neutral strategies. He joined the firm in 2003 and has 17 years of industry experience. Jimmy holds a B.S. in Finance from Northern Illinois University.

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The opinions referenced are as of the date of the publication, are subject to change due to changes in the market or economic conditions, and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

There can be no assurance that the Fund will achieve its investment objective. Asset allocation and diversification does not guarantee profit or eliminate the risk of loss.

Important Fund Risk Information. An investment in the Fund is subject to risks, and you could lose money on your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks. The risks associated with an investment in the Fund can increase during times of significant market volatility. The writer of a covered call may be forced to sell the stock to the buyer of the covered call and be precluded from benefiting from potential gains above the strike price.

Options Risk: The Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment adviser to predict pertinent market movements, which cannot be assured.

Convertible Arbitrage Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

Gross Expense Ratios are as of the prospectus dated 2/28/20. the Fund's investment advisor has contractually agreed to reimburse Fund expenses through March 1, 2022 to the extent necessary so that Total Annual Fund Operating Expenses (excluding taxes, interest, short interest, short dividend expenses, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) of Class A, Class C, and Class I are limited to 1.25%, 2.00%, and 1.00% of average net assets, respectively. For the period of January 22, 2020 through February 28, 2021, the Fund's investment advisor has contractually agreed to reimburse Fund expenses to the extent necessary so that Total Annual Fund Operating Expenses (excluding taxes, interest, short interest, short dividend expenses, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, if any) of Class A, Class C, and Class I are limited to 1.15%, 1.90%, and 0.90% of average net assets, respectively. Calamos Advisors may recapture previously waived expense amounts within the same fiscal year for any day where the respective Fund's expense ratio falls below the contractual expense limit up to the expense limit for that day. This undertaking is binding on Calamos Advisors and any of its successors and assigns. This agreement is not terminable by either party.

About Class I shares: Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

Morningstar Data: Morningstar RatingsTM are based on risk-adjusted returns and are through 2/29/20 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

The Morningstar Options-Based Category represents funds that generate a significant portion of their returns from the collection of premiums on options contracts sold.

Beta is a historic measure of a fund’s relative volatility, which is one of the measures of risk; a beta of 0.5 reflects ½ the market’s volatility as represented by the fund’s primary benchmark, while a beta of 2.0 reflects twice the volatility.

Sharpe ratio is a calculation that reflects the reward per each unit of risk in a portfolio. The higher the ratio, the better the portfolio’s risk-adjusted return is. The Sortino ratio, a variation of the Sharpe ratio, differentiates harmful volatility from volatility in general by using a value for downside deviation.

The S&P 500 Index is a measure of the performance of the U.S. stock market. Indexes are unmanaged, do not include fees and expenses and are not available for direct investment.

18767 0320

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.