With the Market Signaling Heightened Volatility Ahead, CIHEX Is Poised for a Breakout in Either Direction

This first month of the year, following the famously unprecedented 2020, continues to be unusual in the market.

“To have a period where you’re continuously setting new highs but to have the VIX north of 20 is unique,” Calamos Co-Portfolio Manager David O’Donohue said on Wednesday’s call (listen to the call here).

Such a divergence signals uncertainty—and leads the Calamos Hedged Equity Fund (CIHEX) team to believe that the future will not be as quiet as the recent past. Whether related to the vaccine rollout, federal stimulus or the new president’s agenda, “people are expecting higher volatility especially as we get into the middle part or later part of this year,” O’Donohue said.

What’s also different: “Normally, when we think about volatility,” O’Donohue said, “we think about puts but a lot of this is being driven by calls. There’s still a large demand for upside calls, which could be the retail/Robinhood [trading platform] effect. It could be people thinking about pent-up demand once we get past COVID and that demand combining with the effect of stimulus fueling the market higher. It could be people not wanting to miss out on a rally.”

The discrepancy between implied and realized volatility is not sustainable, said Eli Pars, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager. “Usually one or the other will give. Either realized vol will pick up in the market or implied vol prices will start coming in.”

The fact that heavy call buying is driving some of the options pricing may alter that behavior some or make it slower to correct. But, if the equity market stays firmly bid, and as the vaccination process starts gaining traction, “it won’t take much to get people thinking that this nasty chapter is behind us,” Pars said.

CIHEX Positioning

With a beta range of 40 to 60, the fund’s beta at the end of last week was at 43—the high end of the hedge and the low end of equity market risk.

“In general, we’d like to see a breakout, really in either direction,” O’Donohue said. “A lot of the value we create with our active approach comes in periods after larger market moves. It’s that flexibility we have to be able to adjust and react as the landscape changes. It’s the ability to create that extra edge, to capture a higher percentage of up moves than down moves.”

“We’re waiting for that bigger move,” he continued, “and that’s when we’ll be able to adjust and adapt the hedge and layer in extra layers of upside or downside participation opportunistically.”

The team’s North Star or model trade (writing 80% calls and buying 40% puts) is attractive currently, although to a lesser extent than when volatility was even more elevated last year.

Currently, short-dated calls are being bought opportunistically to provide more market participation.

The team also is looking for opportunities to add skew to the downside, Pars said. On up days, buying put spreads to layer in some ability to mitigate against the downside is one way to do it. If vol comes in to the upside, there will be ways to add upside skew as well.

Not surprisingly, O’Donohue said, “On the put side, the skew is still steep. There’s still a pretty good bid for disaster puts. That makes put spreads more attractive for us, we’re able to buy closer to the money puts and sell a further out of the money put that still has a good bid to it.”

“When you look at a distribution, or graph, of our returns, people love to see that really flat left tail,” he added. “Adding in put spreads enables us to flatten it out for certain parts of the distribution.”

Until that bigger move, though, the PMs said they’re playing a waiting game.

CIHEX’s active approach has three components, as described by O’Donohue:

- Try to understand the environment and to handicap what the potential outcomes are.

- Structure the hedge to take advantage of as many possible outcomes.

- React and be opportunistic as the market moves—“and that’s what we’re still waiting for, to some degree,” O’Donohue said.

Related: Navigating Option Skew: When the Smile Turns Into a Smirk

Multiple Moves, Multiple Times Add Up

Asked to comment on their actively managed, dynamic approach to hedging equities, the team referred to its ability to be opportunistic within the guardrails that are in place.

“The S&P is fairly efficient, but there are pockets of value and our ability to take advantage of them over time has enabled us to add alpha consistently,” Pars said.

“We have the ability to adjust as the market moves,” said O’Donohue. “The proper hedged strategy is different when volatility is really low than when volatility is really high.”

There are funds that can do well in down markets and funds that outperform in up markets, O’Donohue said. “We have the ability to adjust and shift and capture more of the upside and less of the downside in each move regardless of the level of volatility or direction of the market. Our ability to do that multiple times over time drives our performance and is what should give us the ability to capture more return over longer periods.”

Investment professionals, for more information about CIHEX and the opportunities ahead, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The CBOE Volatility Index (VIX) is a leading measure of market expectations of near-term volatility conveyed by S&P 500 Index (SPX) option prices.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Skew is the difference in implied volatility between out-of-the-money options, at-the-money options, and in-the-money options.

In the money. A call option’s strike price is below the market price of the underlying asset or that the strike price of a put option is above the market price of the underlying asset. Being in the money does not mean you will profit, it just means the option is worth exercising. This is because the option costs money to buy

Out of the money. A term used to describe a call option with a strike price that is higher than the market price of the underlying asset, or a put option with a strike price that is lower than the market price of the underlying asset. An out of the money option has no intrinsic value, but only possesses extrinsic or time value.

Call and put spreads. Options strategies when a manager buys a call/put option, while simultaneously selling a less expensive call or put/option. Because the call/put options share similar characteristics, this trade is typically less costly than an outright purchase, but still provides similar protection.

Implied volatility is a metric that captures the market's view of the likelihood of changes in a given security's price. Investors can use it to project future moves and supply and demand, and often employ it to price options contracts.

Realized volatility is the magnitude of daily price movements, regardless of direction, of some underlying, over a specific period.

Morningstar Options-Based Category funds may use a variety of strategies, including but not limited to: put writing, covered call writing, option spread, options-based hedged equity, and collar strategies. In addition, options-based funds may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies.

Morningstar RatingsTM are based on Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc. All rights reserved.

802270 0121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

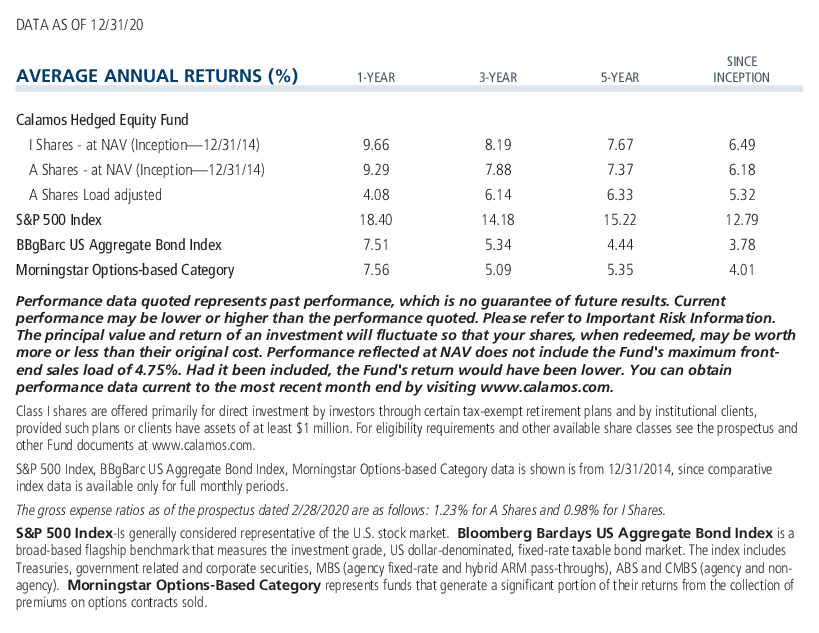

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 21, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.