The Fed Will Slow If Not Pause, Inflation Will Reverse—and the Climate Will Turn Positive for Equities: CPLIX’s Grant

In just-published commentary, Calamos Co-Chief Investment Officer Michael Grant shares his high-conviction view that:

- The Fed will slow or pause its rate-hiking before the year’s end, cheering the financial markets.

- Market volatility will continue at a heightened pace, thanks to the dissonance created in 2022 by the gap between projected vs. actual monetary policy.

- Equities will bottom through late autumn, with the setting becoming more constructive as disinflation takes hold in 2023.

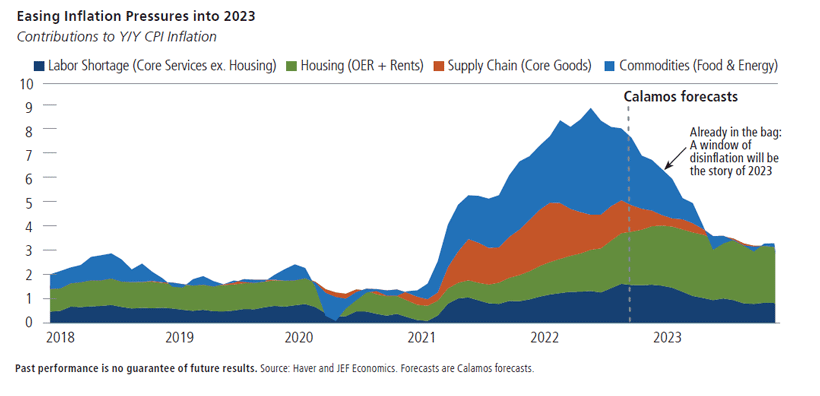

- The inflation surge “will reverse symmetrically” over the next four to five quarters.

- A material weakening of the profit cycle, leading to the next leg down in equities, should not be expected until late 2023 at the earliest.

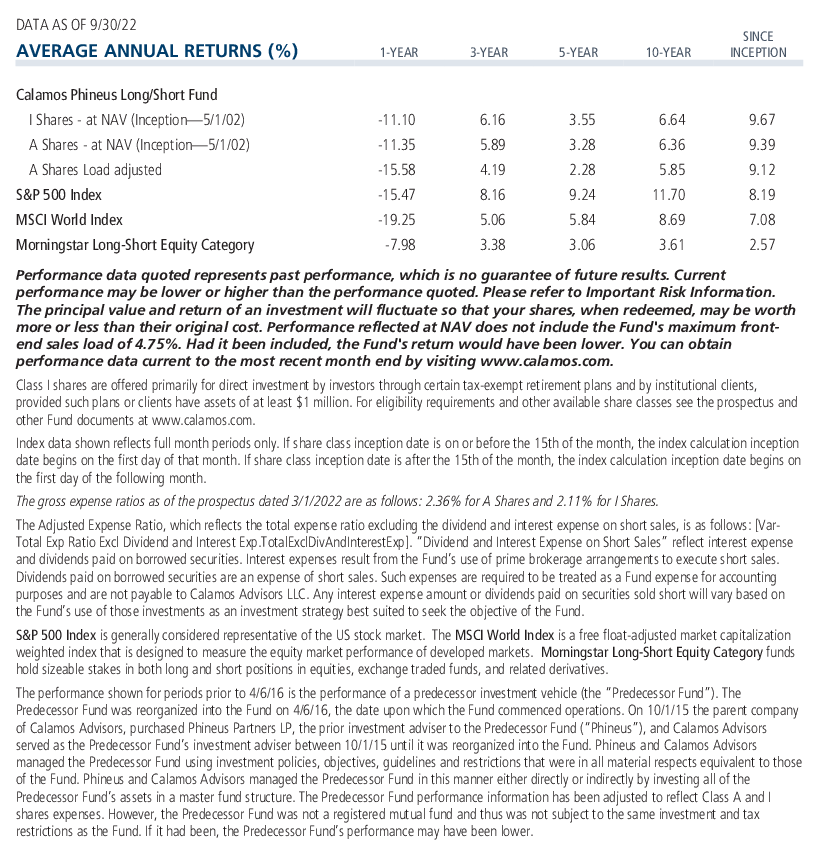

Grant is Senior Co-Portfolio Manager of Calamos Phineus Long/Short Fund (CPLIX), which closed the first 10 months of the year with a -2.24% return versus the S&P 500 Index’s decline of -17.70%. This result reflected the fund’s positive beta to equities, given its average net equity exposure of 58.73% in Q3.

“Fears around an imminent fundamental downturn are misplaced,” writes Grant, “because the problem today is inflation, not deflation. Inflation implies healthy levels of nominal activity that feed directly into consumer and corporate income.” By the middle of next year, “fears of runaway inflation will appear absurd,” he comments.

Acknowledging that risks of recession have become heightened, “we believe an actual downturn is neither imminent nor likely to be severe.” The balance sheets of households and the corporate sector are “strikingly healthy based on key metrics like debt-to-income ratios and liquidity levels. The seeds of the end of any expansion are normally behaviors that lead to excessive spending and borrowing, which has not happened in the current cycle,” he says.

Grant believes he’s more optimistic than most about the spending potential of the US consumer. “The market is viewing consumer strength as a sign that the Fed will ‘keep at it.’ Our view is that the US consumer will hold together long enough for inflation to cool. With $2.3 trillion in excess savings, the rate sensitivity of the consumer may be less than generally assumed.”

Third quarter earnings reports to date have been generally positive, supported by continuing strong consumer demand. CPLIX's weightings in cyclicals, such as airlines, transportation and hotels, as well as financials, have been well suited for pent-up post-COVID consumer demand.

While positive on the medium term outlook for equities, Grant notes that the bull market in equities ended in December 2021. He expects “the major indices to move in a broad rangebound pattern between today’s levels and the former highs for much of the current decade.”

Consequently, he says, an investment landscape characterized as a long era of price stability is being replaced by a new experience of quasi-price instability (read more here).

For more information about Grant’s perspective or about CPLIX, reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The S&P 500 Index is generally considered representative of the US stock market.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

820311 1122

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on November 04, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.