As of March 1, Calamos Hedged Equity Income Fund’s name has been changed to Calamos Hedged Equity Fund.

August 22 marks the longest equity market expansion since the end of World War II. Congratulations to all who remained invested throughout. Those who did experienced a cumulative 367% return from March 1, 2009 to July 31, 2018.

But the 3,453-day period posed multiple—and some unprecedented—tests of investors’ resolve. Remember QE1, QE2, Operation Twist, the Taper tantrum, the Arab Spring, the depreciation of the Chinese yuan, ebola, the Greek debt crisis, U.S. debt downgrade, the Flash Crash, etc.?

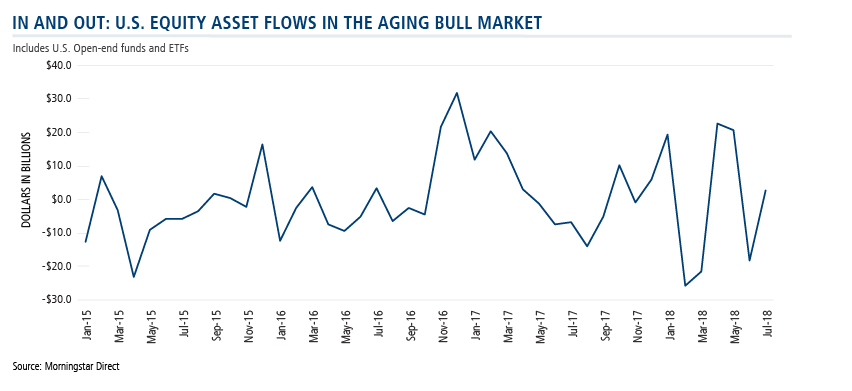

As the bull market aged, as interest rates began to reverse course, as valuations continued to climb, equity investing became increasingly perilous for some. The end was near, many concluded. In the last three-and-a-half years, $1.14 billion left the Morningstar U.S. Equity fund categories.

And yet U.S. stocks continued to be the place to be—the S&P 500 returned a cumulative 47% since the start of 2015.

The financial advisor positioning his or her client in the last few years might have considered one of three scenarios:

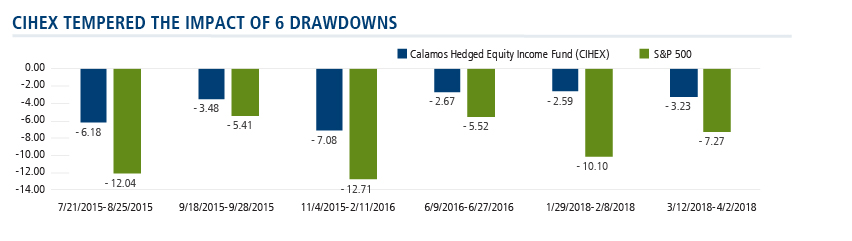

- Full tilt to equities—remain 100% invested through six drawdowns of more than 5%, including a 12.71% decline at its deepest.

- Capitulation—withdraw from equities in favor of fixed income, to protect gains.

- Hedge equity—assure exposure to advancing equity markets while tempering the effect of drawdowns that are known to send investors to the sidelines.

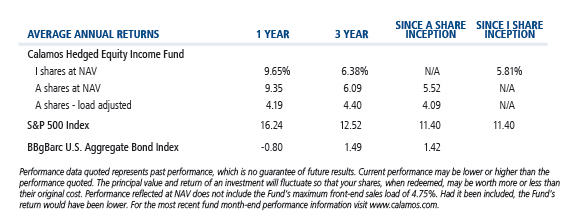

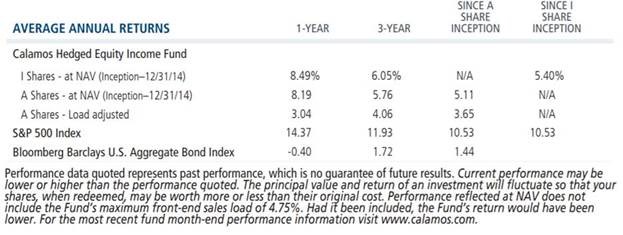

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 4.75%. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Today’s markets are what Calamos Hedged Equity Income Fund (CIHEX) is designed to address. CIHEX pursues equity market returns with lower volatility. Its covered call strategy invests in a diversified portfolio of equities while using options to generate income and manage risk.

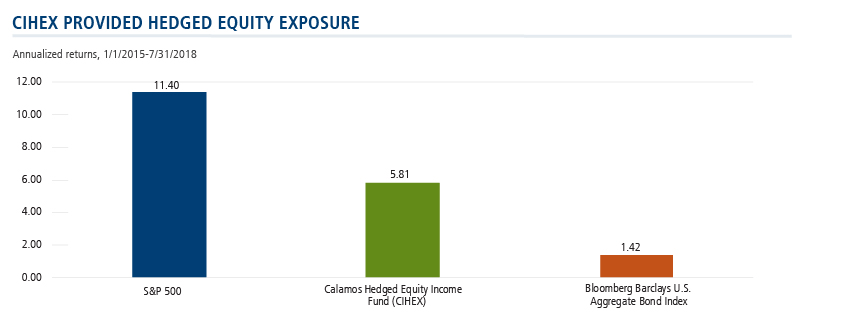

Here’s how CIHEX provided hedged equity exposure since its inception on 12/31/2014. It’s been a less volatile ride than the S&P, with half the standard deviation (5.60 vs. 10.17 for the period from 1/1/15 to 7/31/18), and offered more growth than the Bloomberg Barclays U.S. Aggregate Bond Index. Also see CIHEX Played Defense in the First Half—and Finished Ahead of the S&P 500.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 4.75%. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Financial advisors, if now is not the time for your clients to be all in, learn more about CIHEX by talking to a Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com. Calamos ranks fifth on the list of alternative fund managers by assets under management in the Morningstar Alternatives Category as of 6/30/18.