Macro, Inflation, Even Covid Won’t Keep Small Caps From Pursuing Their Destinies: CTSIX’s Nelson

Last week’s Small Cap Market Update covered a range of topics of obvious interest to the hundreds of investment professionals who joined the call live and posed dozens of questions for Calamos Timpani Small Cap Growth Fund Senior Portfolio Manager Brandon M. Nelson.

Below you’ll read excerpts of Nelson’s comments on today’s environment for small caps, including inflation’s impact, the growth vs. value debate, the difference that microcaps can make, and the overall argument for active management. (Listen to the full replay of the call.)

The Deck Is Stacked in Favor of Small Caps

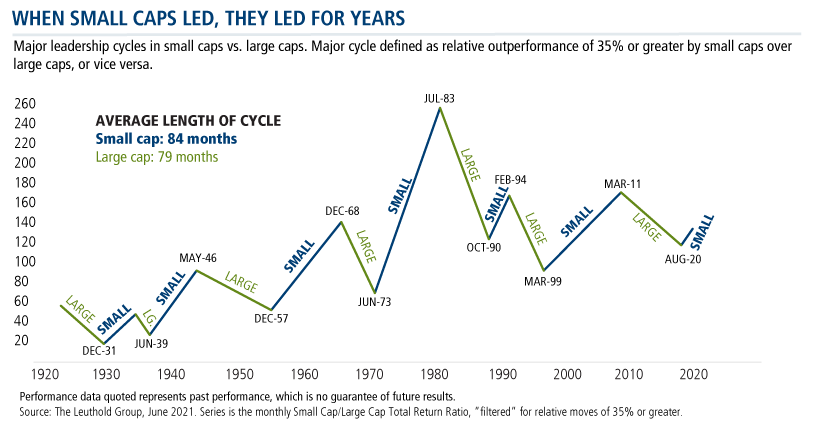

“Large caps have significantly outperformed small for the last decade or so. We believe last September started a new regime where small cap took over leadership. This has happened over the last 100 years or so, they take turns. Small caps lead for a decade or so, and then large will beat small for a decade or so, and they keep passing the baton back and forth.

We think the deck is stacked in small caps’ favor on a go-forward basis. Valuations are really inexpensive for smalls relative to large. And it’s not because the fundamentals stink. I think it has more to do with neglect than anything.

The fundamentals in the small caps space are excellent. From a high level you’re seeing strong growth, you’re seeing positive revisions—sales revisions and earnings revisions. But small caps have just been neglected. They’re trading at a severe discount relative to large, relative to history. We’re in the bottom quarter of where that relationship typically is. By the time the baton gets passed back to large, which likely will be multiple years from now, small caps will look expensive versus large caps.

We have multiple years potentially in front of us where small caps could be really well positioned, which could just turbocharge what we do. We’re going to stay in our [style]box and make sure we’re staying true to the small growth mandate that we’ve been hired for. But [small cap leadership] could be just the cherry on top of our outlook.”

Small Growth vs. Small Value

“Small value’s done extremely well thus far in 2021 versus small growth. For the prior decade or so, we did see small growth outperform small value. Going forward, on the one hand small value looks cheaper than small growth. And so, you could argue that’s a better place to be but, on the other hand, the visibility for small growth is substantially better than it is for small value. I’m biased toward small growth. It’s easier to have a better handle on the future with small growth.

With small value you’re very dependent on the macro. We’ve seen just in the last couple of weeks there have been macro curveballs and that can change the outlook for small value much more. Small growth stocks are more in charge of their own destiny, and a lot of time the company specifics can carry the weight there.

If you look back at 40, 45 years of data, in the first 20, 25 years of that period, small value did extremely well versus small growth. As I said earlier, small growth has done well in the last decade or so. Who’s to say that small growth can’t do well for another decade? Maybe we’re only halfway through a 20-year period of small cap growth outperformance versus small value.

I think both small value and small growth could perform well over the next few years. I think they’ll both feel some tailwinds if I’m right about small caps outperforming large caps.”

Inflation as a Tailwind

“Inflation tends to be a tailwind for small caps overall. A lot of companies can ride that wave or are able to pass pricing along and are able to see their earnings grow at a nice clip. Rising inflation goes hand in hand with an expanding economy. And, generally speaking, small caps are more sensitive to the overall economy. Typically, they’re more cyclical by nature.

But you do have to watch more at a company-specific level. Is it an above-average risk from a bottom-up standpoint for company XYZ that we’re looking at? That becomes a bigger risk for companies that have high financial leverage. That can be problematic as their cost of capital is rising in a rising inflation environment. You want to have your antennae up to that. You want to be aware of that risk and make sure that company is not overly leveraged.

So, what you’ll see in our portfolios very consistently over the years is that our exposure to financial leverage tends to be below average in the companies that we choose to invest in. And so, that rising inflation risk is somewhat muted by the bottom-up stock selection because we’ve got less financial leverage in stocks that we’re investing in.

A lot of companies are really humming right now and generating a lot of excess cash flow. They’re able to prioritize that in such a way that they’re continuing to grow their business organically, but they are also prioritizing to reduce debt. We like to hear that and see that. It can be accretive to earnings. It also takes the risk profile down during an environment in which inflation is a bit elevated, like we’re in now.”

Small Caps and the News

“We look at every macro piece of incremental information. We think about every stock within the portfolio and how the news impacts their business. Around the edges we definitely have names that are impacted by the macro. Some healthcare names, for instance, have exposure to elective surgeries and if COVID is ramping up again, that might influence the amount of volume they’re going to see. But that’s only a very short-term component way of measuring that stock.

At the end of the day, we want to find stocks of companies that are not dependent on the macro going one way or the other. What we are pretty good at finding are situations where companies are more or less in charge of their own destinies. They’ve got some really unique product or service. It’s proprietary. It’s patent-protected. It’s really just about them growing that, going to market and getting the distribution they need to see the revenues and earnings grow. What happens at the macro level may impact them around the edges, might influence by a couple of growth points here and there. But for the most part, that stock and that company will have highly visible growth in front of it, in almost any macro scenario.

That’s what we’re looking for. That’s typically what we find. We don’t spend as much time trying to predict the macro. There’s just so much margin for error in getting that right. So, let’s spend our time finding situations where we really can have an edge. Where we’re discovering a new technology, or discovering a company that’s discovering a new technology or has some fantastic new product or service, and we watch it blossom. That’s where we can really add the value.”

Active Management

“I’m a big believer of active management, especially in the small cap space. There’s just a lot of dead weight in the indexes, and probably in the large cap indexes as well. But to the extent you go down in market cap, everything is exaggerated. The winners win by more, and the losers lose by more typically.

So, that dead weight can really be costly. Active management is all about adding value to the portfolio by what you own and what you don’t own.

Our process has worked. It can add a lot of value if you find a manager that has a proven process that can avoid the problems and be disproportionately exposed to the winners. When you can do that successfully, you tend to see outperformance and that’s where the rubber hits the road. I think we’re good at that and I think the category [Morningstar Small Growth] tends to get above average marks in that regard as well.”

Microcaps

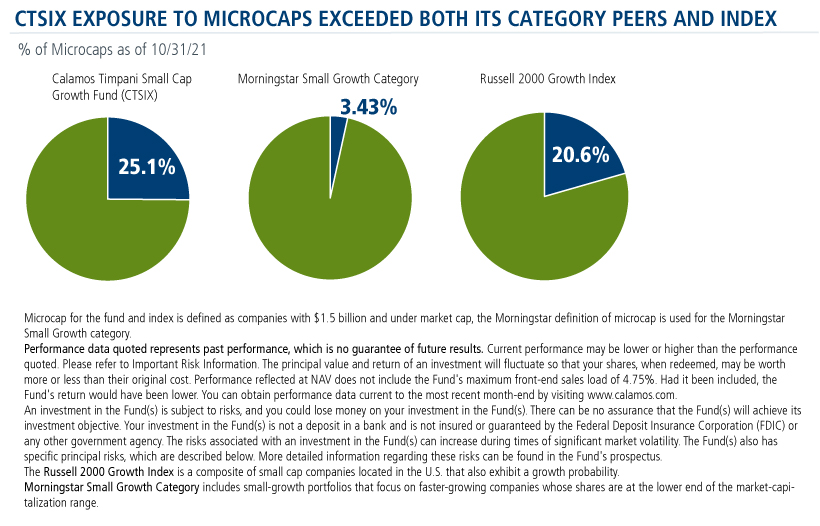

“We traffic in true small caps stocks, we don’t drift. We’ll go as low as $150 million in market cap and up to about $5 billion in market cap for new ideas. The sweet spot is probably $500 million to $2 billion. That’s where we spend most of our time for new idea generation. But we have the ability and we’ve got our processes designed to navigate the smallest of the small caps.

This is a huge competitive advantage. We’ve got quite a bit of excess capacity in terms of our ability to handle more assets. That enables us to look further down the market cap spectrum. You still have to be right. You still have to pick the right stocks, but we’re able to navigate in a part of the market where some of our competitors can’t even look because their asset base is so much higher. The numbers just don’t make sense for some of those folks.

If they were to buy a 1% stake in a $500 million market cap name, they might own 10%-15% of the company, and that’s unacceptable to them. So, they just end up saying, ‘It’s too small for me to even care about.’ But for us, we’re still small enough that we can do that. And it can be a very value-added part of the effort. We can generate, theoretically, a tremendous amount of alpha by navigating in that part of the market. It doesn’t mean we’re always going to be there, but we have the option of going there. (Also see A Good Month for Small Caps, Even Better for CTSIX’s Microcaps.)”

Growth Expectations

“We want to see fast revenue growth (10% plus) and 15%-plus on the earnings per share line. We want to see the margins expanding. That’s where you get that leverage in the model where earnings can grow at a faster clip than actual sales.

Those are just the minimum growth rates we’re talking about. Most of the stocks that are in the portfolio have much higher than those minimums. And, maybe just as importantly, they have not only growth, but underestimated growth. We would rather invest in a company that’s growing 15% and expected to grow 15%, but we think the real growth rate’s is going to be closer to 22%-23%. We would buy that stock and we would probably pass on the stock that’s growing at 40% in reality and is expected to grow at 40%. There you have fast growth, but you don’t have underestimated growth. Fast growth and underestimated growth is more appealing to us because you have a better chance of having that stock get rerated higher.”

The Sell Discipline

“We’ve been really good at two things: 1) finding big winners and staying with them as long as they continue to show fundamental momentum. 2) Cutting losses quickly. We stumble upon losing situations, we don’t bat a thousand, but the way we handle those problematic situations may be different from the way others do.

It might have been the wrong idea at the wrong time and that’s OK. You cut your losses and you don’t let that stock ruin the whole year. It’ll be a bruise. It’ll be a scratch. But it’s not going to wipe you out where you need to come up with 10 big winners to make up for that one loser. Some of these small cap names are inherently volatile. In order to traffic in those responsibly, you’d better have a short leash on all. Things can change quickly. Don’t fall in love with these stocks. It was one of the first lessons my mentor taught me back in the mid-1990s. I never forgot it.

It’s critical to have a strict sell discipline. It keeps you out of trouble. It doesn’t prevent problems, but it minimizes problems and that’s the big takeaway. This actually shows up in the attribution. I just ran attribution year to date through the end of November. I looked at outliers—the big winners, stocks that have added at least 50 basis points of relative performance—and the number of stocks that have cost us at least 50 basis points of relative performance.

That ratio year to date through the end of November is 15 to 2. We have 15 stocks that added at least 50 basis points. Nine of those 15 added at least 100 basis points. And then the two that cost us that were over 50—were 54 and 57 basis points. They left a mark, but it wasn’t that damaging in the grand scheme of things. It’s very typical to have that sort of lopsidedness to the good. In different years it will vary, the magnitude will vary. But looking back at many years of attribution, that’s definitely the theme.”

Investment professionals, for more on Nelson’s outlook or CTSIX, please reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Morningstar Small Growth Category funds focus on faster-growing companies whose shares are at the lower end of the market-capitalization range. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Morningstar RatingsTM are based on risk-adjusted returns and are through 10/31/21 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc.

808598 1221

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

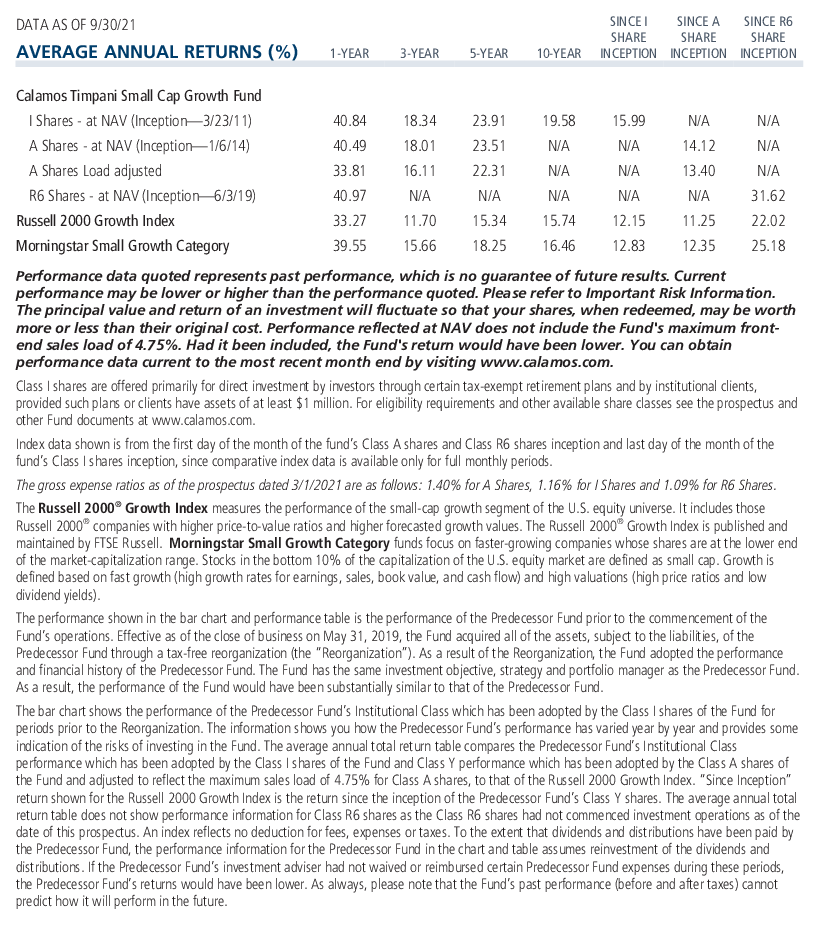

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on December 14, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.