‘Keeping Small Caps on a Short Leash:’ The Sell Discipline Key to CTSIX’s Building a Portfolio of ‘Big Winners’

Small cap growth? It’s an exciting asset class early in what could be a multi-year leadership cycle. Few believe this more strongly than Brandon M. Nelson, CFA, Senior Vice President and Senior Portfolio Manager. (And for more, see this post.)

But, as made clear on Tuesday’s CIO Conference call, Nelson isn’t one to sugarcoat the opportunity: “Small caps can be squirrely, they can test your patience. They can be volatile, and the business models and income statements can surprise you both positively and negatively.” (To listen to the August 10 call, go to www.calamos.com/CIOsmallcap-8-10.)

What small cap investments need, according to Nelson, is to be “kept on a short leash.”

“Inevitably,” he continued, “we're going to have problems, we're going to have some stinkers. And when that happens, you’ve just got to get out of the way, as soon as possible. Recognize that as quickly as possible, and then just take action. Don't fall in love with these companies. They’re stocks, they're not family members.”

'Jaw-dropping' Historical Outperformance

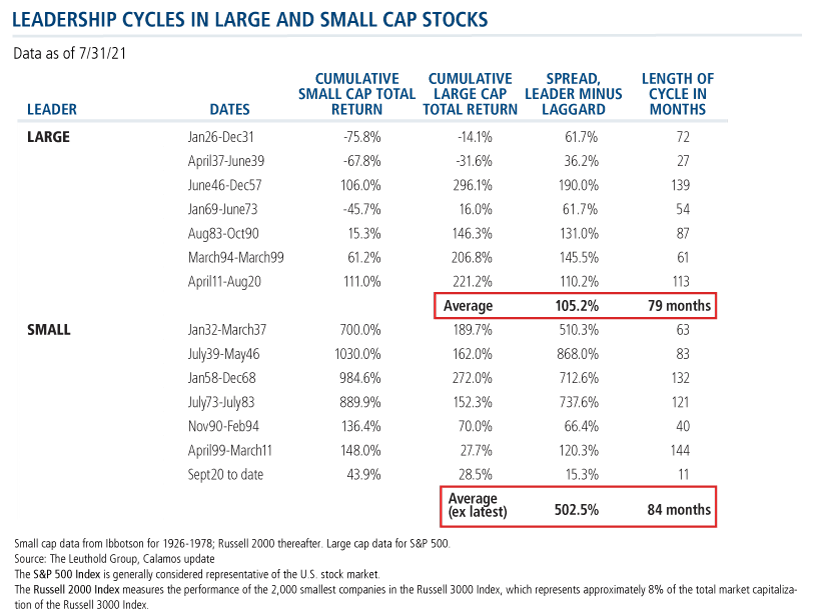

From September 2020 through the end of February—the start of small caps assuming leadership over large caps—smaller companies returned 41.7% (Russell 2000 Index) versus the 11.8% return of larger companies (Russell 1000 Index). Such an outsized difference is to be expected, according to Nelson. “When small caps beat large caps, the magnitude of outperformance is somewhat jaw-dropping. It’s about five to one.”

Since March, small caps have lost ground, which is also typical. Nelson describes it as a “routine, two steps forward, one step back pullback.”

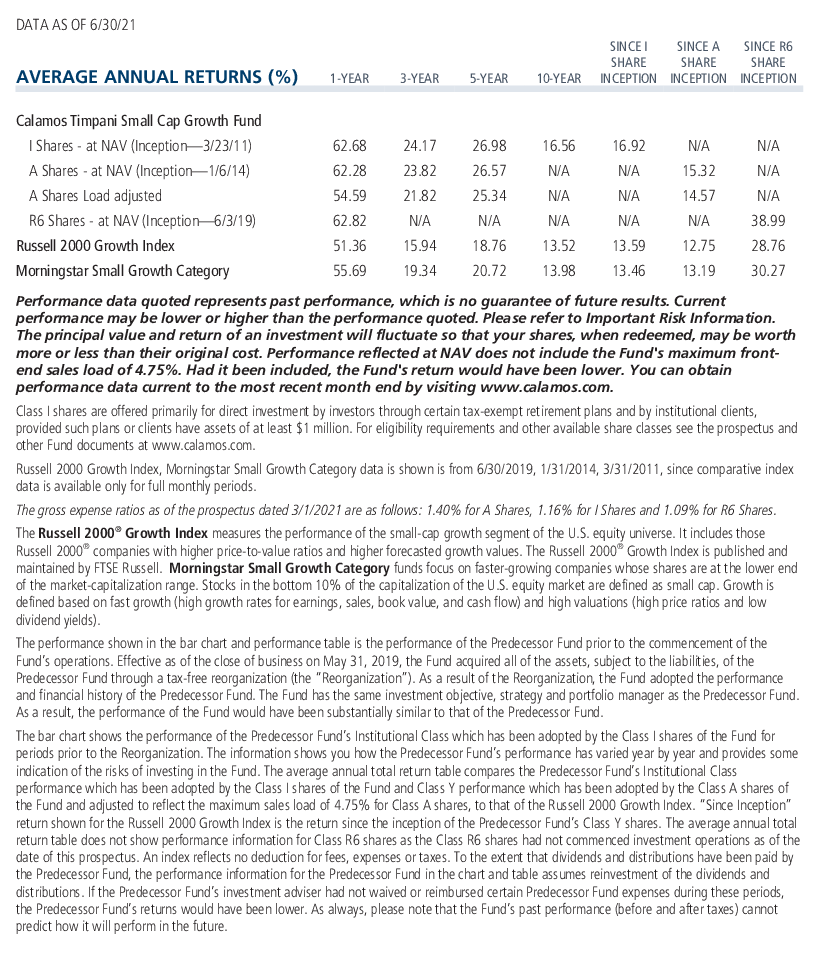

Even so, to date in 2021, CTSIX gained 11.81% through July 31 versus the Russell 2000 Growth Index return of less than half of that, or 5.01%. This follows 2020, when CTSIX gained 63% versus the index’s 35% (see post).

The fund’s strict sell discipline partly explains the performance gap between the fund and its benchmark. Nelson has commented on the fund’s sell discipline multiple times before (see this post and these videos).

On this week’s call, he quantified the value added year to date. The portfolio includes 12 stocks that added at least 50 basis points of relative performance, year to date. Just two stocks cost at least 50 basis points—one stock 51 basis points and the other 50 basis points.

“Our sell discipline provides a lot of damage control to the portfolio. It creates a risk buffer,” said Nelson. “The crux of what we do is all about finding big winners, and then deploying damage control on losing situations so that they leave no more than a scratch on us, as opposed to a much more severe injury. We're not going to let one stock ruin the whole year.”

In fact, 2021 is a year that Nelson said he expects big things from, citing historical data. Since 1989, in years when small caps were up over 10% during the first six months of the year (the broader Russell 2000 Index was up 17.5% at the halfway mark), they continued to rise in the second half of the year, on average by another 12%.

Past performance is no guarantee of future results, Nelson acknowledged. But, he said, “as we sit here today, for the second half of the year since June 30, small caps are down about 3%. So, you've got to make up the 3% plus go up another 12%. If history repeats itself, we could be looking at a 15% return from here until the end of the year,” he said.

Q2 Earnings

Small caps are continuing to report their second quarter earnings, and Nelson described the season as a “mixed bag” so far. “We think we've found some really special situations, where we have been rewarded meaningfully.” But, he continued, “For the most part, I feel like the market is selectively rewarding companies for beating and raising. It's being somewhat picky.”

CTSIX’s Search for Underestimated Growth

The CTSIX team is on the lookout for small companies that meet minimum growth thresholds: 10% revenue growth and 15% earnings per share growth.

“We want to see companies that are growing at a fast clip but, importantly, have upside to that growth,” explained Nelson.

“We would rather buy the stock of a company that's expected to grow 15% in earnings per share, but they're really going to grow 23% in earnings per share. In that case, you have 800 basis points of upside surprise to that growth rate.

“We would buy that stock all day long. We would probably pass on the stock that's expected to grow 40% and is going to grow 40%. There you have higher growth, but the growth is not underestimated.

“We want both: We want to have high enough growth to be above the minimums. But we want to see upside surprise relative to those expectations, because that will be the trigger that expands the valuation.”

The good news: The team continues to find promising opportunities across a variety of sectors, including healthcare, technology, consumer discretionary and industrials.

And the ideas just keep coming. “We're basically out of cash and have been for a long time,” Nelson said. “I've been saying this for months, but our biggest day to day problem continues to be what are we going to sell, to buy that next great new idea?”

CTSIX looks for companies demonstrating fundamental momentum, whose growth is both strong and underestimated (see box at right). Such “winners” are typically re-rated higher as they progress through a beat and raise cycle over consecutive quarters—“rinse and repeat,” as Nelson said.

“A typical CTSIX stock might be trading at two or three times sales when the beat and raise cycle begins, but after several strong quarters of solid execution, that stock might be trading at nine or 10 times sales.

"We want to go along for that valuation expansion ride," Nelson said.

The market’s response is “always a wildcard,” he acknowledged. “Is the market going to actually pay us for the strong fundamental performance? There are certain times when it's very willing to pay you. And there are other times where it doesn't put as much weight on that. That’s usually when the market is obsessed with more macro bigger picture issues.”

Here again he returned to the team’s discipline. “We just keep doing our thing.”

Secular Growth Powers Through

While the discussion and a few questions asked by investment professionals touched on macro considerations including inflation and the impact of the Delta variant of COVID-19, Nelson stressed that the fund is focused on secular growth companies “that are able to power through.”

“There's a lot going on right now in the economy. There’s a lot of pent-up demand, you've got a lot of stimulus still in the system. That's sort of turbocharging some of the macro trends.”

But Nelson said, “We don't want to be dependent on the macro.

“At the end of the day, we're focused on bottom-up, company-specific situations where companies are in charge of their own destiny, and they've got something special, a unique service or a unique product and the market’s embracing it. Whether inflation is 3% or 4.5% isn't really going to matter much to what happens with that company.”

“I look at the whole portfolio,” he continued, “and I see several stocks that have the potential to double, to triple, to quadruple over the next few years. They have open-ended growth in front of them. As long as they execute on their business plan and meet and exceed expectations and sustain growth at a high level, we think they've got the makings for big appreciation.

“That's how we spend our time,” said Nelson, “trying to find those types of companies and sniff out those big winners.”

Investment professionals, for more on Nelson’s perspective and CTSIX, reach out to your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com. For more on the small cap market, subscribe to the Calamos Small Cap Market Snapshot.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

802472 0821

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on August 13, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.