Interest Rates Just One Component of the Resilient Bond Portfolio

November 27, 2017

This post was written by Christian Brobst, Calamos Vice President, Portfolio Specialist.

The variety of fixed income asset classes that make up the market of bonds can be likened to the variety of market capitalizations and economic sectors in the stock market. And, it’s possible, for example, for mid-cap basic industry to be down while large cap consumer cyclical stocks might be up.

Similarly, the bond markets can have very different reactions to rising rates. We entered the year with general concerns about higher interest rates but at this point, two Fed hikes later, many fixed income markets have provided opportunities for positive returns.

That’s because interest rates are just one input in how an individual bond will perform. A bond’s yield is made up of many components that include a risk-free rate, as well as credit spread premium and liquidity premium, among others.

These yield components often move in conflicting directions. If one input (e.g., risk-free interest rates) moves up, sending bond prices lower, it is very possible other inputs could more than offset that move to deliver positive performance. In addition, time is on a bond investor’s side as a result of the income collected over time.

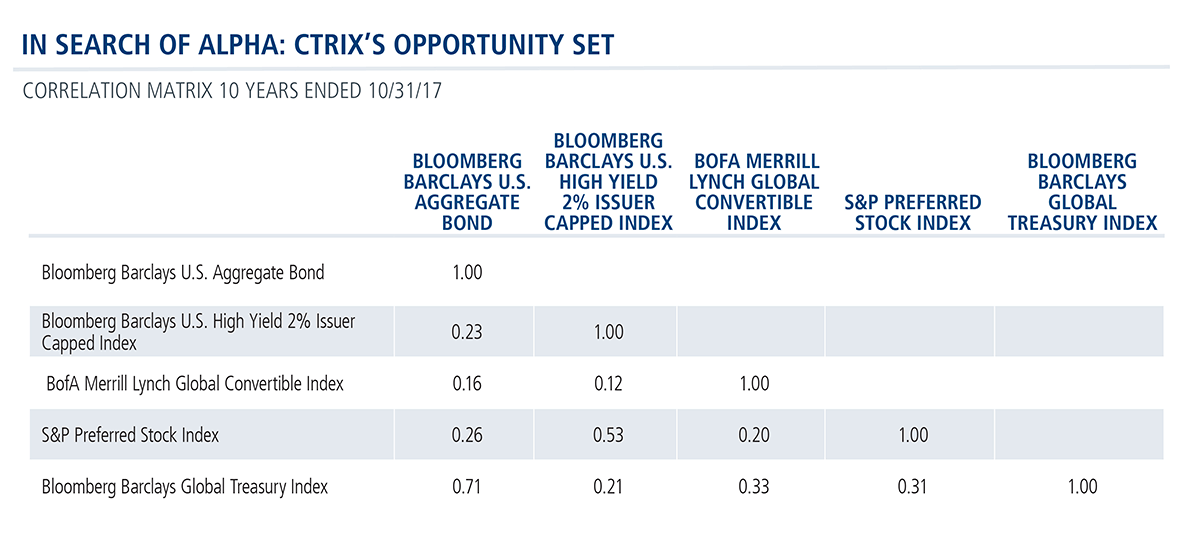

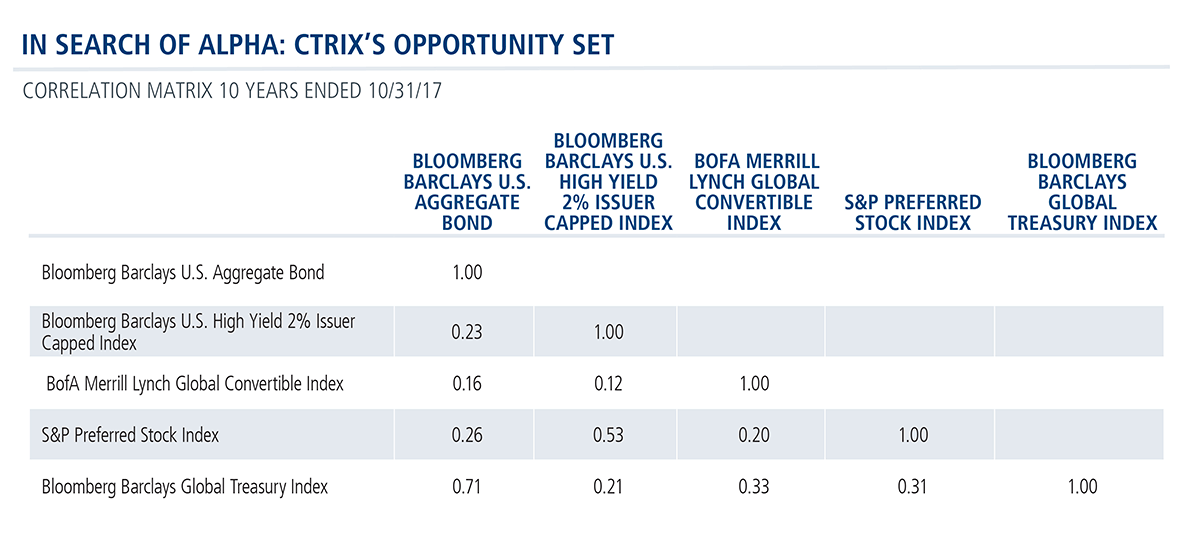

Also remember that bonds from different fixed income asset classes and issuers do not have perfect positive correlations.

The Skill Required

All things considered—the components of yield and the individual correlation characteristics of an array of bonds—and you can begin to understand the skill required to build a resilient bond portfolio.

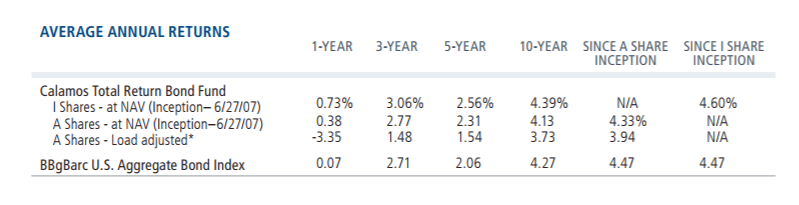

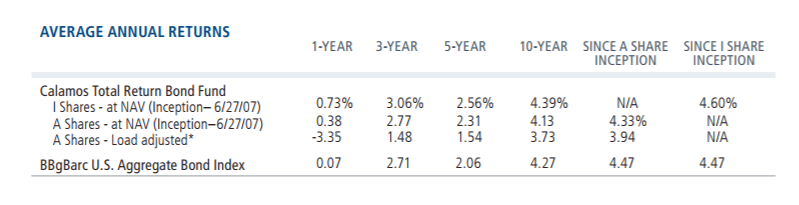

In fact, this is how the Calamos Total Return Bond Fund (CTRIX) delivered positive performance (net of fees) of 3.16% year-to-date (through October 31), performing in line with the Bloomberg Barclays US Aggregate Index (which returned 3.20%).

Our team takes a different approach than its peers. The portfolio is built from the bottom up, with selection based on fundamentals and a focus on being well compensated for the risks taken.

We pursue the best investment opportunities across the globe to generate alpha, which includes augmenting the core allocation to domestic, investment grade bonds with opportunistic allocations to markets such as high yield, convertibles, preferred stock and foreign bonds. The table below shows correlations among several of the markets in our investment opportunity set.

The fixed income markets have changed over recent years. Persistent low interest rates and limited dispersion of performance have lowered return expectations. And yet, we recognize that advisors’ need to generate alpha from core fixed income allocation is as important as it ever has been.

Advisors, to learn more about CTRIX’s disciplined and repeatable process, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Related Resources

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Data as of 9/30/17

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index covering the USD-denominated, investment-grade, fixed-rate, taxable-bond market of SEC-registered securities. The index includes bonds from the Treasury, Government-Related, Corporate, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS sectors.

The Bloomberg Barclays U.S. High Yield 2% Issuer Capped Index measures the performance of high yield corporate bonds with a maximum allocation of 2% to any one issuer.

The BofA ML Global 300 Convertible Index is a global convertible index composed of companies representative of the market structure of countries in North America, Europe and the Asia/Pacific region.

The S&P Preferred Stock Index is designed to measure the performance of the U.S. preferred stock market.

The Bloomberg Barclays Global Treasury Index tracks fixed-rate, local currency government debt of investment grade countries, including both developed and emerging markets. The index represents the treasury sector of the Global Aggregate Index and contains issues from 37 countries denominated in 24 currencies.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

800897 1117