Here’s One Way to Rebalance—Before the Market Does It for You

First published: August 23, 2019

The good news: Financial advisors, if you invested $100,000 into a 60/40 portfolio 10 years ago (December 31, 2009) and let it ride, your portfolio would have appreciated to $271,774 by December 31 of 2019. Most of that growth would have come from appreciation of the equity allocation. Congratulations!

The bad news: Your 60/40 portfolio is now 79% equities and 21% fixed income—and represents substantially more risk to your client.

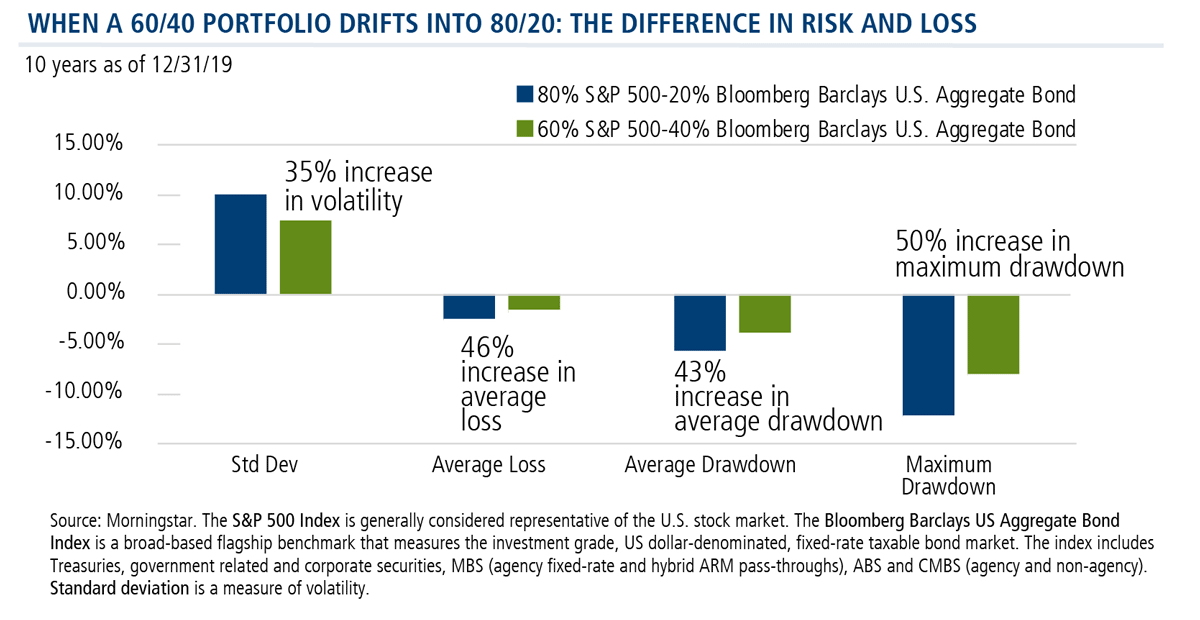

The risk return profile of a 60/40 portfolio is very different than a portfolio approaching 80/20. Below is an example of these differences in an 80/20 equity/fixed income portfolio relative to a 60/40 portfolio over the trailing 10 years (models rebalanced annually).

At this point, your client is subject to a 35% increase in volatility and a 46% increase in potential loss to the portfolio he or she has built over the last 10 years.

While the reflex might be to just reset the portfolio back to 60/40, here’s another idea—an alternative, if you will.

Potentially De-Risk Without Trading Away All of the Upside

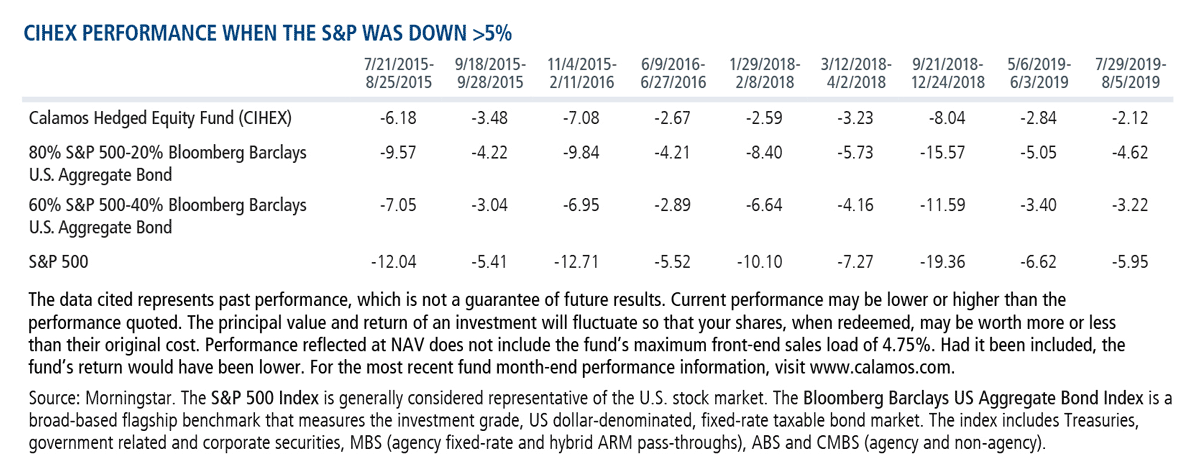

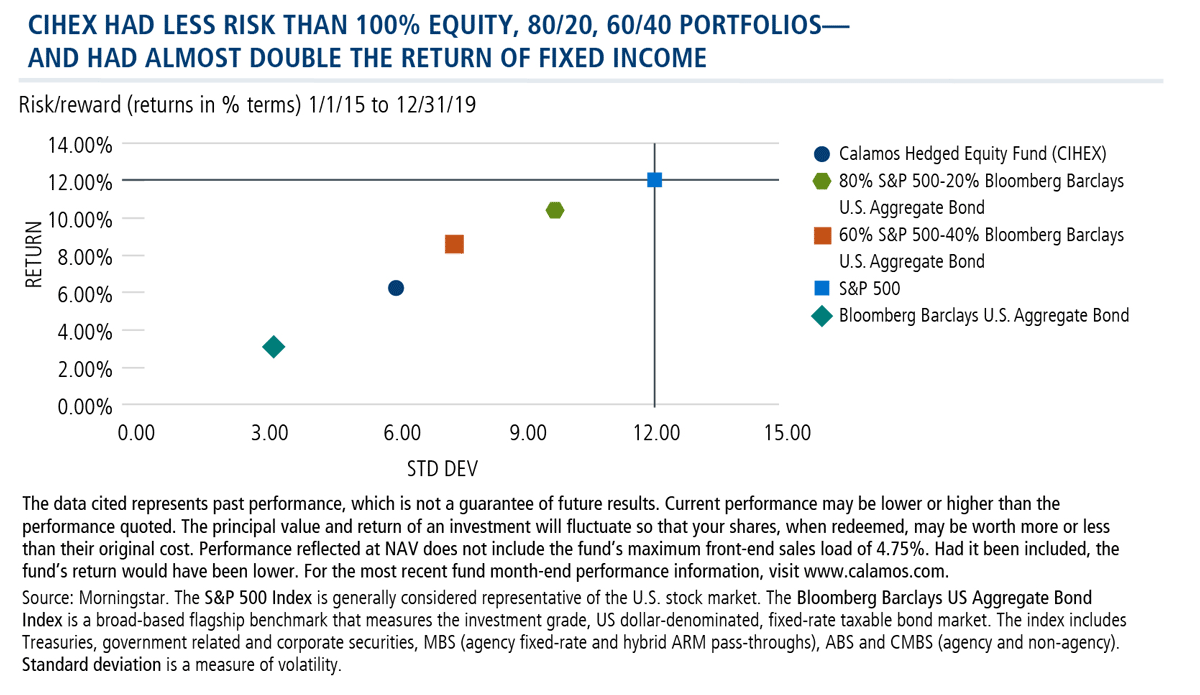

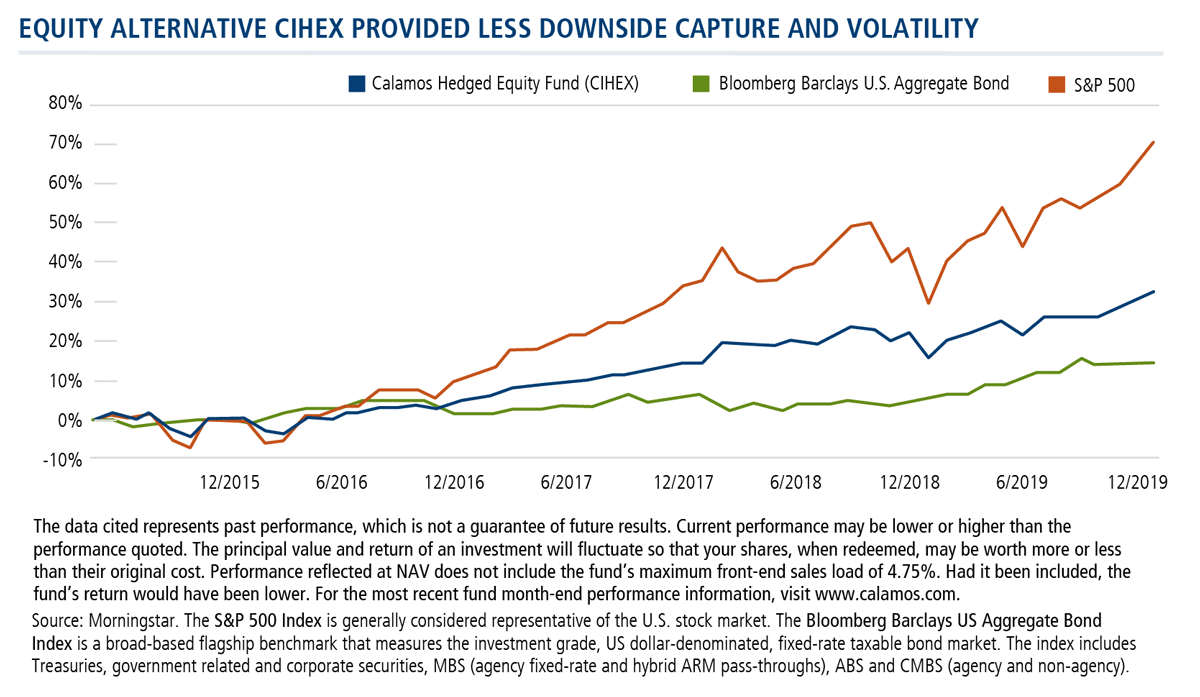

The Calamos Hedged Equity Fund (CIHEX) can provide a way to potentially de-risk the portfolio without trading away all of the equity upside potential. CIHEX is managed to seek 60% of the equity upside participation with only 40% of the potential downside capture and about half of the volatility of equities over time.

Below see how CIHEX has worked over the nine equity down markets (S&P 500) since its inception in December 2014.

Advisors, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com for specific recommendations on how much of CIHEX to rebalance your equity overage into. Financial advisor support and investment performance results that met advisors' expectations throughout 2019 helped Calamos climb to second on the list of the industry’s largest managers of liquid alts assets.

Click here to view CIHEX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put of call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

Alternative investments are not suitable for all investors.

Morningstar Options-based Category funds use options as a significant and consistent part of their overall investment strategy. Trading options may introduce asymmetric return properties to an equity investment portfolio. These investments may use a variety of strategies, including but not limited to: put writing, covered call writing, option spread, options-based hedged equity, and collar strategies. In addition, option writing funds may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Standard deviation is a measure of volatility.

801706 0120

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 16, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.