CTSIX: Powering Through the Small Cap Bear Market, Expecting Strong Fundamentals to Ultimately Prevail

“A valuation re-rating lower without a lot of teeth behind it”—that’s how Calamos Senior Portfolio Manager Brandon Nelson describes what’s been happening with small caps.

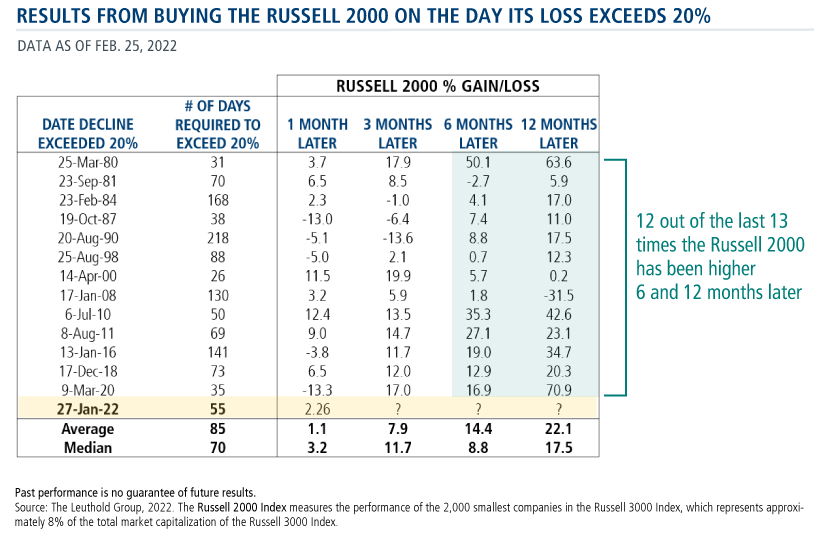

As tracked by the Russell 2000 Index, small caps started their decline near Thanksgiving and entered bear market territory on January 27. They seesawed back and forth since, finishing February with a -8.66% year-to-date return. Nelson provided his analysis of the volatility within the asset class and its impact on Calamos Timpani Small Cap Growth Fund (CTSIX) on last week’s CIO Conference Call (listen to the call in its entirety here).

Small cap growth stocks, in particular, have taken “a pounding” approaching the magnitude of their drawdown during the dot com bubble in 2000. In the one-year period between March 15, 2000 and March 15, 2001, Nelson recalled, the Russell 2000 Growth Index underperformed the Russell 3000 Index by about 44 percentage points.

But here’s the difference, he said: While small caps today have lost about 70% of the ground lost 20 years ago, investors at that time were reacting to severe negative earnings revisions. By contrast, today’s small company fundamentals are fairly strong, according to Nelson.

On earnings calls, companies are “talking about a really strong 2022, but it’s going to be more second half-weighted than people were originally modeling. They’re expecting some softness in the March quarter, they’re guiding to that. [Covid variant] Omicron sort of bled over into January and that disrupted some operations to some extent,” he said.

Recent earnings updates have revealed a few companies with issues related to Covid, supply chain and/or labor constraints. “There are problems here and there. There always are, but for the most part, business is fine, and in a lot of cases, much better than fine, but stocks are getting hit anyway,” Nelson said.

“Down is down and it’s just as painful either way,” he acknowledged, “but to me, it’s more believable that you could see a recovery, because [the downturn] is not being led by negative estimate revisions.”

“There are a lot of things to worry about,” Nelson continued, “the Fed tightening cycle and the trajectory. Of course, we’ve got geopolitical concerns now front and center. Covid is still lingering. People are worried about inflation. It’s murky right now but a lot of damage has already been done.”

Referring to the below chart, he said, “Historically, this [when small caps are down 20%] is typically a good entry point. It doesn’t feel like it in your gut, probably, but that’s what the history books tell you.”

Adjustment on the Edges

CTSIX focuses on small companies with two characteristics:

- They’re growing fast—revenue is expected to grow at least 10%, earnings per share is expected to grow at least 15%, both for multiple quarters in a row.

- Their growth is underestimated, whereby they’re poised to exceed market expectations for the next several quarters.

“We’re going through a period where the market is almost solely focused on low valuations and it’s more or less yawning at the fundamental momentum components that we tend to succeed in finding,” said Nelson. “We’ve seen these periods before where the market puts less emphasis on the things we care the most about, but we power through.”

“I’ve never seen an environment where we didn’t get it back, in terms of relative performance and in terms of absolute performance,” he said. “To me, and to our team, this is an air pocket, but it’s nothing we haven’t seen before.”

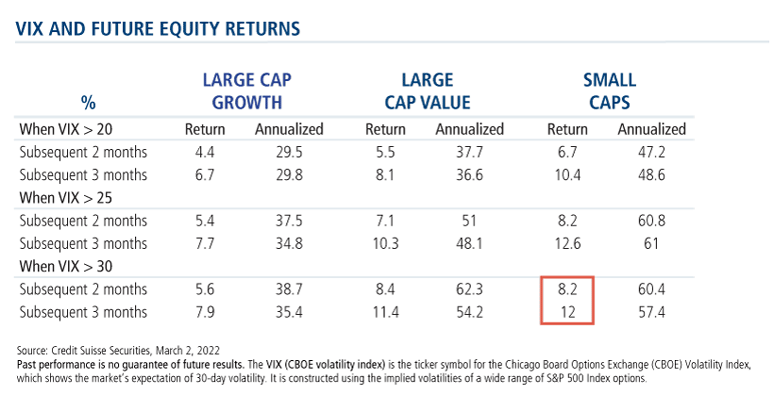

When the VIX Has Been at Its Highest, Small Caps Have Led the Rebound

It’s been said that the more volatile the asset class, the worse the investor behavior. On their own, investors struggle to remain invested through the volatility. This table below illustrates why it’s in your clients’ best interests to stay put or, better yet, add: As the VIX climbs, so do future equity returns—for small caps, in particular.

Mindful of the market’s focus on valuations, some adjustments are being made. “In a good chunk of 2020 and most of 2021, it was telling us we didn’t have to care as much about valuation and we responded to that. Now it’s telling us it cares a lot about valuation and we’re tweaking what we do to cater to that without actually changing our stripes.”

CTSIX is known for its high growth style (see its style map), and there’s no wavering there, according to Nelson. “We’re staying in our small cap growth box, but we’re listening to what the market is telling us and we’re making some adjustments around the edges. At the margin, we’re caring a bit more about valuation as well.”

Examples include cutting back on exposure to fast growing companies that were earlier in their maturity. Nelson cited software companies as an example of companies that have been “slammed.”

“If you were trading at, let’s say, a P/E ratio of 28 times around Thanksgiving, you’re probably trading at about 20 times or maybe 21 times earnings right now, and that’s if your business has been on track. If you had problems and you’ve missed expectations, you’re trading at a much lower valuation, but just the re-rating has been severe. It’s been something to the tune of 30%.

“If your price-to-sales ratio was eight or nine times going into Thanksgiving,” he continued, “you’re probably five or six times right now. It’s nothing you did wrong as a company. It’s just the market with all the macro concerns that it has. It has decided to take everything down across the board, especially if you’re small cap, especially if you’re growth.”

The team continues to manage a portfolio with diversified sector exposures including healthcare, technology, consumer discretionary and several more. Some new themes within the portfolio have emerged in recent weeks where valuations are low but the companies still offer fundamental momentum. For example, the portfolio now includes some oil services stocks, along with more exposure to commercial construction, casino equipment suppliers, and health care companies with exposure to rising elective procedures—all are areas that are seeing an incremental uptick in business.

“We’re active managers. We read the tea leaves. We look at what the market gives us, and what it cares the most about, and we make adjustments,” Nelson said.

Large vs. Small

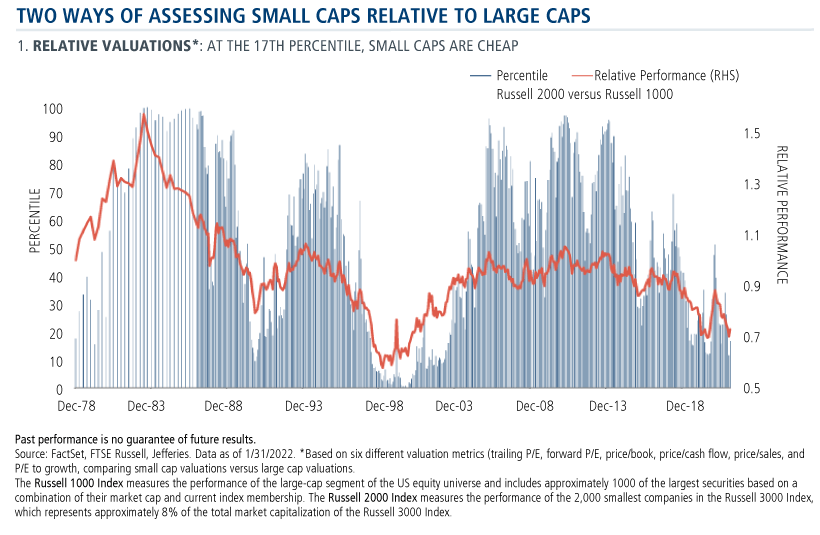

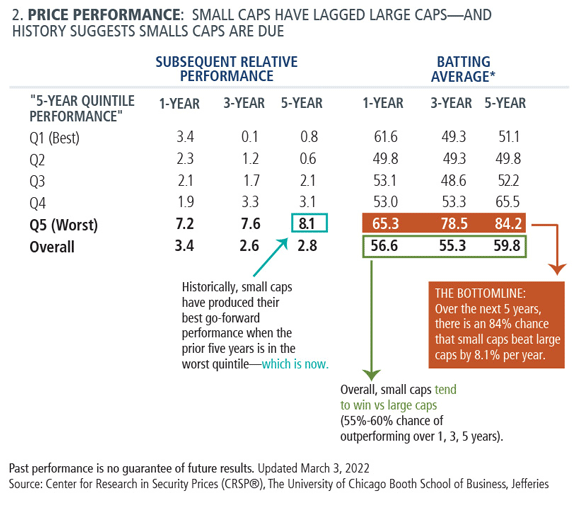

Nelson also commented on small caps’ underperformance relative to large caps, a trend that has persisted for years.

“We’re currently in about the 17th percentile of where that relationship typically stands of small cap versus large cap valuations. Things are stretched to the downside and why that matters is that it can be a strong predictor of future performance. What tends to happen is when things are stretched this far, they do tend to mean revert,” Nelson said.

In price performance, too, he cited 100 years of data that suggested “the punch line is there’s an 84% chance that over the next five years small caps are going to outperform large caps by a magnitude of 8.1 percentage points per year. That’s a stunning statistic.”

Growth ‘On Sale’

Further—and what Nelson described as a valuation anomaly—the CTSIX portfolio may be at an attractive entry point in particular.

“I say all that [about the strong fundamentals of the portfolio holdings] and here we are 33% off the NAV high in the mutual fund. But,” he said, “that’s part of what’s got me excited. The portfolio is on sale.”

“Valuations have just pulled back meaningfully for the asset class, for our portfolio. Our valuation, relative to the Russell 2000 Growth Index is almost the same, and that’s unusual,” according to Nelson.

“Because we’re a bit less sensitive to valuations, we tend to be more expensive than the Russell 2000 Growth Index, but tend to have much higher growth rates in the portfolio. We still have that today, but the valuation premium in our portfolio relative to the Russell 2000 Growth Index is much smaller than normal and you’re getting—for a modest valuation premium—a much higher growth portfolio. The P/E-to-growth ratio, in other words, looks very attractive on our fund versus the Russell 2000 Growth.”

Investment professionals, for more information about opportunities with CTSIX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

808676 322

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 03, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.