CPLIX’s Grant: Optimistic About ‘Remarkable’ Earnings Improvement, Resilient Economy—and Potential for Risk Assets

To Co-CIO Michael Grant, the only surprise is that the market has experienced so few episodic sell-offs since March. “Investors are acutely aware of political uncertainty, sensitive to virus developments, fearful of elevated volatility and the potential for leadership rotation,” the Senior Co-Portfolio Manager and Head of Long/Short Strategies said on Wednesday’s CIO call. Investment professionals, listen to a replay here.

But, he said, a “September chop should not be confused with a market top.” To the contrary, the CPLIX team expects the bull market in risk assets to extend into 2021.

“Equity recovery has been rational in the context of fundamentals, economic and corporate,” according to Grant. Going forward, the economy’s continued reopening and “some eventual” fiscal package will support demand while cost cuts will drive operating leverage. He describes these two as “a powerful combination to support earnings growth into 2021.”

“We are standing in 2021, we imagine the fruition of this record stimulus gaining traction across the major economies. We have witnessed the end of COVID and vaccines have proliferated. Is it that hard to imagine this as driving a much better economic backdrop than is currently embedded in risk asset prices?”

The market’s rally to date has been discriminate, with investors rewarding companies that have adapted most quickly to the economy’s challenges while overlooking opportunities with the potential to lead as the economic cycle evolves. While Grant concedes that some stocks are trading at excessive valuations, he considers many priced attractively given their medium and long-term potential.

“The global economy continues to heal, probably more than generally appreciated. Global short rates made new lows in August; the number of global easing announcements has been unprecedented. We all know that monetary policy typically works with a lag,” Grant said.

He anticipates a positive new year: “We are standing in 2021, we imagine the fruition of this record stimulus gaining traction across the major economies. We have witnessed the end of COVID and vaccines have proliferated. Is it that hard to imagine this as driving a much better economic backdrop than is currently embedded in risk asset prices?”

Grant framed his remarks in the context of “three nuances of the investment landscape” that have surfaced this year and he expects to be decisive for returns.

- The dysfunctional politics of the virus

- The “perfect storm” for duration

- Growth versus value: “Someday this war’s gonna end”

The Virus

In July, Grant wrote that the pandemic in the U.S. was climaxing and would largely burn itself out by autumn. In fact, he said Wednesday, the outlook for COVID-19, treatments and vaccines is promising. U.S. hospitalizations and deaths peaked in April, while daily cases peaked in July.

CPLIX Positioning Timeline

Start of 2020

CPLIX net equity exposures were close to neutral at year-end 2019. Grant argued that clients were not adequately paid for late cycle equity risk as corporate earnings expectations for 2020 were declining.

March 2020

At the time of the outbreak of COVID-19, market valuations were already vulnerable, and the pandemic was an overwhelming catalyst that caused markets to plummet. The team believed it was time to lean into equities, increasing the net equity exposure to the net +50-60% range, where it has remained.

For Grant’s views at the time, see this March 23 post The Road Back to 3000. At the end of April, he predicted the market would recover by July (see this post).

June 2020

CPLIX recovered its first quarter drawdown by early June—half the time needed by the S&P 500 and most of its peers in the Morningstar Long/Short category. By June 15, the fund had recovered from the sell-off over the past three months, up 21.7% over the period. This improvement propelled the fund to up 3.49% YTD, eclipsing both the S&P 500 (-4.18%) and the Morningstar Long/Short Equity category average (-6.10%) for the same period. (And see this post.)

In June, the renewed spread of the virus throughout the southern and western U.S. was a surprise. While market behavior was bullish into the summer, there has been considerable style and sector rotation.

Looking Ahead

The CPLIX team expects a historically fast return to pre-COVID-19 levels of output, with global and developed market economies recovering to their prior peaks between the fourth quarter of this year and the third quarter of next. The U.S. economy will have returned to pre-COVID levels by late spring 2021.

Revenue growth for the S&P 500 declined 8% year over year in the second quarter, will likely beat the consensus expectation of down 4% in the second half of 2020, and will grow double digits in 2021. The bottom line: Grant expects the breadth of earnings improvement in coming quarters to be “remarkable.”

What matters now is no longer the virus itself but what Grant called the “politics of the virus.” He said, “Across much of the Western world, public debate is dominated by competition to demonstrate empathy and a precautionary bias…Governments are struggling to reconcile the pressure to appear precautionary with the need to restore economic life.”

Insufficient attention has been paid to the “multiple long-term costs of restricting social and economic activity,” according to Grant. “When the history of 2020 is written it will say that incomplete understanding led the developed world to adopt disproportionate and unsophisticated responses to a virus that, while capriciously contagious, is not especially fatal.”

The good news, he said, is that the virus crisis may have an end date: the morning after U.S. elections, November 4.

“Many view this election as more consequential than most. But the nuance is that the policy implications may not matter for equities until much later in 2021 or 2022. What may matter immediately is the end of the dysfunctional politics of the virus,” Grant said.

Assuming his analysis is correct, he looks for markets to begin to favor the “return to normal” parts of the market through October. Corporate fundamentals continue to matter, he said, expecting the October results season to be decisive for factor and sector rotation. “Watch the reaction of stocks closely as we progress through October.”

The Perfect Storm for Duration

To date, this year has been the “perfect storm” for duration and for long duration within the equity market. Quality, defensive, growth styles have been historic winners.

It’s the outcome of the swiftest economic downturn on record—driven, Grant said, “by a virus that removed all moral doubts that might have discouraged policy actions. The barometer of duration is interest rates. And interest rates are not just low, they are at the lowest levels in centuries.”

But Grant questioned whether long duration assets will ever again enjoy as favorable a setting as 2020.

“Now is normally the moment in the cycle—the classic recession to recovery stage of cycle—when valuations peak and begin a gradual compression as corporate profits recover.”

Instead, he said, the virus marks the start of a new regime: “the revitalized power of the Big State” and one that marks the end of a long disinflationary regime and “the beginning of the end for the supremacy of duration.”

“Democracies cannot tolerate prolonged deflation and thus, governments are finally responding with force: debt monetization, debt rescheduling and forgiveness. One doesn’t have to look far to see a perfect storm for reflation,” Grant said.

Grant identified a few implications for investment professionals. “Reflation, fiscal activism and more volatility of financial prices will bust up the portfolio construction strategies that worked so well in the past.”

- Stocks that have been largely valuation winners should be avoided. The first “losers” of this shift will be utilities and REITs and many parts of the defensive consumer staple industries.

- The 60/40 model. “The stunning success of this model is partly the outcome of the negative short term correlations between bonds and equities—but equally the consequence of the extraordinary fixed income gains over four decades. Those gains were ultimately the result of a political victory by those who control capital. Our industry has enjoyed 40 years of disinflation because of the shift in power in our economy from labor to capital.”

The end of duration is a high conviction view of Grant’s, as he said, “If I am wrong—if the 60/40 strategy works as well in the next decade as it has in the past, then democracy may have failed.”

Equity multiples are peaking now, Grant said. If the major benchmarks have further upside into 2021, it must be powered by earnings growth.

The CPLIX team is emphasizing stocks that they believe are poised for material earnings recovery in the coming year as part of the global recovery. This is a contrary bet to what has been working since early June, he noted.

Growth Versus Value

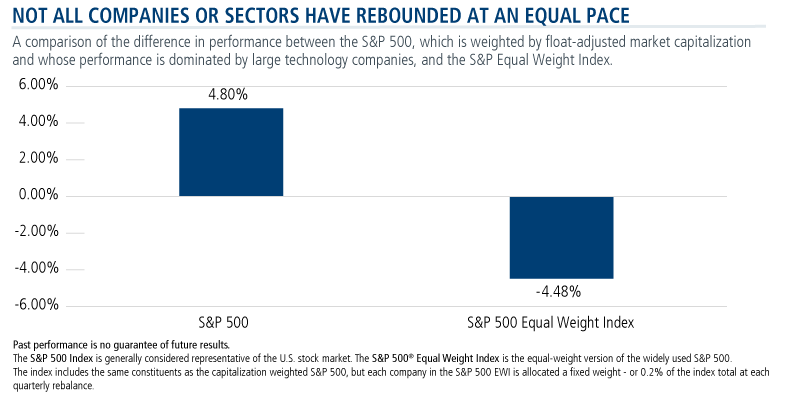

Because the recent outperformance of U.S. equities is attributable to a small group of tech leaders, the leading benchmarks are no longer the measure of “the stock market,” said Grant.

“Without their contribution it becomes clear that all developed equity markets have remained in a phase of consolidation since early June—neither participating in the July and August upside, nor the pullback in September,” he said.

Grant thinks that this is about to change or even is in the process of shifting now: “The nuance is that this may not be a debate between growth versus value, but recovery and normality on the one hand versus quarantine and COVID on the other hand.”

“Cyclicals rather than value are the real beneficiaries of negative interest rates,” said Grant.

Consumers are not happy with the decline in their quality of life since the pandemic. Grant and team expect considerable pent-up demand to drive renewed spending when normalization occurs. “The combination of negative interest rates and eventual normalization is a recipe for substantial style and sector rotation,” he said, adding that CPLIX is positioned accordingly.

Specifically, the CPLIX team is looking for 20%-30% upside in the composition of its long book, based on the expectation of broadening cyclical earnings recovery. Their preference is for cyclicals over defensives, less mega-cap exposure, and companies that can exhibit strong operating leverage to an ongoing recovery. The goal: to own stocks whose earnings per share over the coming year can rise more than the potential valuation compression in the major benchmarks.

Investment professionals, for more information about Grant’s perspective or CPLIX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Click here to view CPLIX's standardized performance.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Equity Securities Risk. Equity investments are subject to greater fluctuations in market value than other asset classes as a result of such factors as the issuer's business performance, investor perceptions, stock market trends and general economic conditions. Equity securities are subordinated to bonds and other debt instruments in a company's capital structure in terms of priority to corporate income and liquidation payments. The Fund may invest in preferred stocks and convertible securities of any rating, including below investment grade.

Short Selling Risk. The Fund will engage in short sales for investment and risk management purposes, including when the Adviser believes an investment will underperform due to a greater sensitivity to earnings growth of the issuer, default risk or interest rates. In times of unusual or adverse market, economic, regulatory or political conditions, the Fund may not be able, fully or partially, to implement its short selling strategy. Periods of unusual or adverse market, economic, regulatory or political conditions may exist for extended periods of time. Short sales are transactions in which the Fund sells a security or other instrument that it does not own but can borrow in the market. Short selling allows the Fund to profit from a decline in market price to the extent such decline exceeds the transaction costs and the costs of borrowing the securities and to obtain a low cost means of financing long investments that the Adviser believes are attractive. If a security sold short increases in price, the Fund may have to cover its short position at a higher price than the short sale price, resulting in a loss. The Fund will have substantial short positions and must borrow those securities to make delivery to the buyer under the short sale transaction. The Fund may not be able to borrow a security that it needs to deliver or it may not be able to close out a short position at an acceptable price and may have to sell related long positions earlier than it had expected. Thus, the Fund may not be able to successfully implement its short sale strategy due to limited availability of desired securities or for other reasons.

Each fund has specific risks, which are outlined in the respective funds' prospectuses. The general risks involved in investing in a closed end fund include market volatility risk, dividend and income risk, and loss of investment risk. Please refer to each fund's prospectus, annual and semi-annual reports at www.calamos.com for complete information on the fund's performance, investments and risks.

The S&P 500 Index is generally considered representative of the U.S. stock market.

Morningstar Long/Short Equity Category funds take a net long stock position, meaning the total market risk from the long positions is not completely offset by the market risk of the short positions. Total return, therefore, is a combination of the return from market exposure (beta) plus any value-added from stock-picking or market-timing (alpha).

802150 920

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on September 18, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.