CIHEX’s Pars, Hill Make the Case for a ‘Living, Breathing’ Hedge in a Persistently Volatile Environment

Two months into the year, 2022 is showing all the signs of providing the kind of persistent volatility that Calamos Hedged Equity Fund (CIHEX) thrives on, and missed last year.

“More back and forth volatility gives us more opportunity to add alpha and historically has produced the best relative years, both to the market and to peers, for us,” explained Co-CIO, Head of Alternative Strategies, Co-Head of Convertible Strategies and Senior Co-Portfolio Manager Eli Pars on last week’s call with Co-Portfolio Manager Jason Hill. The discussion highlighted the advantages of the dynamic management of the fund as opposed to the systematic management of the leading fund in the Morningstar Options Trading category—of particular relevance today. Listen to the call in its entirety here.

How to Use CIHEX

- To take some risk off. A client may have been equal weight or overweight equities and done well. An investment professional may not want to go to cash or bonds but want to de-risk.

- Conversely, as a means of wading back into equities for a client who has been underweight or out of equities but is nervous about getting back in at a higher level.

- “The other way that we’ve had people point out is that this is an S&P 500-centric strategy. The fund is linked to the S&P and will always be highly correlated, moving directionally similar to the S&P. So, it doesn’t have the basis risk that some fundamental strategies have, relative to the S&P,” Pars said.

“This year’s drawdown,” Pars continued, “has allowed us to rotate our trade into a trade with more skew—enabling us to participate more to the upside as the market goes up. As the market has risen, our participation has risen and, thanks to our positioning designed to mitigate the risk of the downside, as the market has dropped, our participation has dropped.”

Hill added, “We’re not into predicting where volatility is going to be, necessarily.” He named the many sources of vol—including geopolitical risks such as what’s happening in Ukraine, rising rates, inflation, supply chain issues, lingering COVID effects and even the mid-term elections—that point to the potential for larger swings in volatility.

“These types of moves, increases in volatility of volatility, allow us to do what we do best,” he said. “As markets move, we want to use that to add and layer in pieces of hedge. Or, often we can just take off pieces to create the best payoff available. Typically, there’s always something we can do to improve our current payoff, especially in these types of markets.”

The Vulnerability of a Systematic Strategy Today

The team emphasized the advantage of such a dynamic approach, especially at a time of persistent volatility. Last year was characterized by low-level volatility but, too, it’s been years since the S&P has experienced consecutive negative quarters. Pars explained that investment professionals using funds that rely on a systematic approach need to be aware of the nuances and even risks involved that may lead to unexpected outcomes in today’s changed environment.

The leading fund in the Options Trading category is transparent about its strategy, which enabled Pars to elaborate on his point.

The fund buys a 5/20 put spread and funds it with a call sell. “What that means is they buy a put 5% below where the S&P is on the last day of the quarter—and they’re buying options three months out. On December 31, they’re rolling their hedge to March 31. They’re buying that 5% put and they’re selling it down a 20% put. So, the investor is protected between 5% and 20%. And, they fund that by selling a call that is anywhere from 2% to 5% out of the money, depending on where the volatility is in the market because they just want to pay for that put spread.”

“That’s fine,” according to Pars, “but there are meaningful holes in that kind of strategy at different spots.”

“For example, if you’re down 5% in the quarter—so, on the last day of March in that example, the S&P’s down 5% for the quarter, you will be down 5% in that strategy. You get no protection at all.

“Among the worst outcomes you could have would be a series of down 3% to 5% quarters. We haven’t seen that in a while. In the last nine years there’s been only one quarter that was down between 0% and 5%. In other words, the market was down but not down at least 5%. As you start getting past down 5%, down 10% or down 15% that protection is meaningful and you’re still losing only on that first 5%. But if you see a couple quarters where it’s down 3% or down 4%, it will be painful.”

Further, Pars continued, “Now that [the manager] has moved to a monthly series—essentially one fund has options expiring at the end of each month and just rolling forward for three months from that—bad outcomes are statistically a lot more likely to occur. You’re also likely to see more dispersion between funds that are supposedly identical.”

He struck a contrast between those funds’ management and CIHEX. “It doesn’t matter when you invest in the quarter with us,” Pars said. “You don’t have to worry about trying to time that. While the others are not traded during the quarter, “we’re trading it so that we try to give an optimal hedge at all times.”

Pars concluded by saying, “We’re not saying there’s anything really wrong with the systematic approach. It’s just different and you’re going to get some different outcomes at different points in time. It’s important to understand that when you’re investing in that fund for your clients.”

CIHEX Positioning

For Hill, the recent volatility brings to mind 2018, the most volatile calendar year for the S&P in the fund’s eight-year history and the S&P’s only down year since the fund’s inception. The year closed with the S&P down 4.5% and the fund up 1%.

More About CIHEX

CIHEX is designed to closely mimic the S&P 500 but it seeks to deliver roughly 60% of the S&P’s upside while limiting downside to around 40% by using an S&P 500 option overlay.

“When we talk about wanting to capture 60% of the market’s upside and 40% of the downside, it isn’t about capturing every up day or every up period and 40% of every down day or every down period,” Hill explained. “It’s really about capturing a little bit more up and a little less down over multiple periods.”

The team’s goal is to “take advantage of opportunities that the market presents and we focus on being positioned for as many outcomes as possible.

“What’s unique about today? How can we use this flexibility we have to take advantage of it? We’re opportunistic as the market moves. In focusing on being positioned for as many outcomes as possible, we’re not necessarily trying to predict any outcome specifically, but we’re using our strategy’s freedom to be ready for whatever the outcome is.”

The portfolio is made up of a mixture of S&P 500 options, long and short as well as option spreads, when it’s appropriate.

With as much “flexibility and freedom” as the team enjoys, Hill noted these guardrails:

- "We’ll never be net short put options. When you’re net short a put option, you’re actually introducing risk into a portfolio instead of mitigating it. We’ll never be net short put options.

- 'We’ll never be over 100% call overwritten. If you’re 100% call overwritten and the market goes up forever, you won’t participate at all. If you’re over 100% call overwritten and the market rises, you’re actually losing money.

These two guardrails “have gotten funds in our category in trouble,” resulting in their demise, Hill said.

- 'We have a self-imposed 40% minimum put protection limit. This is just to let shareholders know that we will not take the hedge off if it gets expensive or if it gets harder to hedge. We will have 40% on, minimum, at all times. We usually have a lot more than that.”

On the equity side, the CIHEX portfolio owns approximately 250 S&P names. “We optimize those to deliver S&P returns with minimal factor sector bets,” explained Hill. “For example, we don’t want a big value versus growth tilt. That can cause basis risk versus the index. The goal there is high correlation, low tracking error to the S&P, since we’re using S&P options as our hedge. We want to try to beat the S&P, which we’ve been able to do historically. But we don’t think our edge is beating the S&P with tight tracking error. Our edge is on the option side.”

He provided an update on the team’s recent moves. “One of the things we’ve been able to do recently is monetize the downside risk mitigation that we’ve added in the past. Selling some of our closer-to-the-money short-dated long puts while rolling them out and down—meaning out in time and down in strike—has in some cases given us the ability to sell one and buy two. That helps extract value from the downside risk mitigation while still adding hedge or at least keeping a similar hedge on while still monetizing those puts.

“In other cases, we’re able to just sell closer-dated near the money puts and not roll into anything because we have that adequate additional risk mitigation that we purchased months previous,” according to Hill.

Further, he said the team continues to close short calls as the market declines. “For example,” he explained, “we had some soon-to-expire out-of-the-money short calls that we sold at the end of October last year for $40. Recently, we’ve been able to close those, buying them back for single digits. We call this ‘clearing the runway,’ as it uncaps your upside as the market is going down. It helps create that asymmetric payoff that we’re looking for.”

One attendee asked how far out the team looks when positioning options.

In response, Hill said, “Just to clarify, we have multiple expirations, multiple strikes, different quantities of each option to make up the entire hedge overlay. We like to say that it’s a living, breathing hedge that we’re monitoring. It’s changing all the time.

“So, when we talk about how far out we look in option maturity, it varies. We typically will have anywhere from three to eight different expirations on at any given time. Most of the time it averages in that 30-to-60-day range, even when we have some longer dated pieces on. Also, in laddering our expirations, it helps to not have an entire hedge expiring on the same day. But this will largely depend on the environment and what we’re seeing in the options market, where we think the most attractive spots in the term structure are for what we’re trying to do.”

In this environment of heightened volatility, the fund’s puts tend to be shorter dated. “It’s a bit harder to go out in time, even though we are seeing a recent inverted term structure in the S&P option land. This is something we may look at in the coming weeks, if this inverted structure persists we may go out further in our puts.”

This contrasts with the fund’s call hedge, which is longer dated.

Hill offered an example: “In the first week of January, the market was down a bit. Volatility didn’t move a whole lot. We were able to do a calendar-type trade where we shorted year-end out of the money calls to fund buying four to six times the amount of the same strike calls out to February and March. That shows you how upward sloping volatility was at the time and how we take advantage of it, and in this case gained upside exposure. It also shows you how quickly things change. The market is down 12% now since the first week in January and vol is now inverted. That trade is long gone.”

Investment professionals, for more information about CIHEX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Covered Call Writing Risk—As the writer of a covered call option on a security, the Fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Options Risk—The Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment adviser to predict pertinent market movements, which cannot be assured. The Fund may also purchase or write over-the-counter put or call options, which involves risks different from, and possibly greater than, the risks associated with exchange-listed put or call options. In some instances, over-the-counter put or call options may expose the Fund to the risk that a counterparty may be unable or unwilling to perform according to a contract, and that any deterioration in a counterparty’s creditworthiness could adversely affect the instrument. In addition, the Fund may be exposed to a risk that losses may exceed the amount originally invested.

The Morningstar Options Trading Category is comprised of funds that use a variety of options trades, including put writing, options spreads, options-based hedged equity, and collar strategies, among others.

Morningstar RatingsTM are based on Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2022 Morningstar, Inc. All rights reserved.

808673 322

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

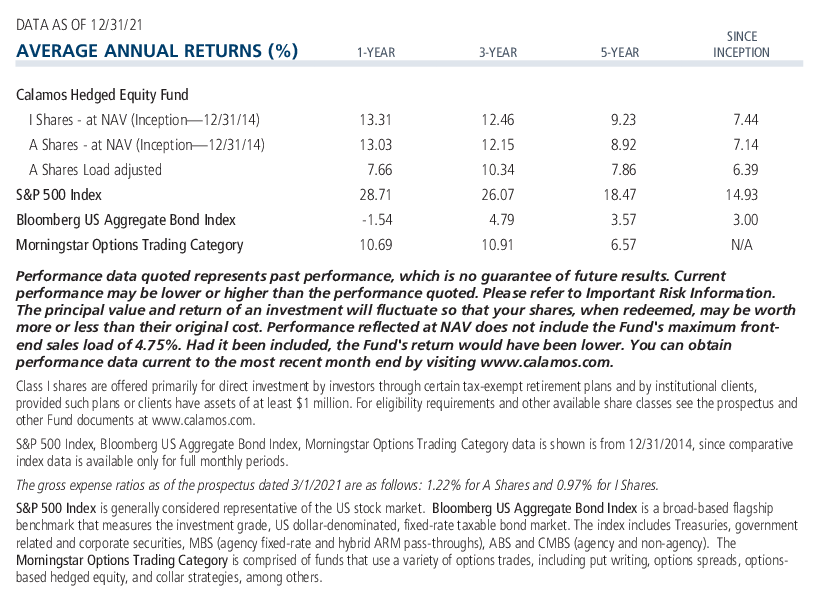

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 01, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.