On the Job Every Day the Market Is Open: CIHEX Is Actively Managed to Optimize Volatility

There’s plenty of work left to do for the actively managed hedged equity fund this year—both to position for what may be more upside and to build in strategies designed to blunt potential downside risk. While other strategies’ set-it-and-forget-it approach may be on autopilot through year-end, the Calamos Hedged Equity Fund (CIHEX) is being managed to make the most of multiple possible scenarios, as recently detailed by Calamos Vice President and Portfolio Specialist Joseph Cusick.

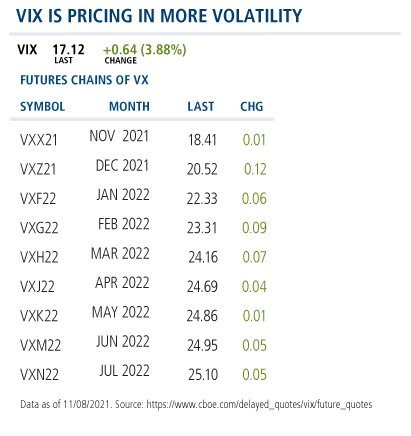

Investors appear to be complacent with the VIX right around 16—compared to a median of 18.5 over the last 20 years. “Hitting all-time highs isn’t that difficult. It takes just a quarter of a percent move in most of these markets, and all of a sudden, we have all-time highs,” he said.

The CIHEX team is looking for where risk is being priced going into the end of the year and Q1 2022, where volatility in the mid-20s is anticipated. “While the team believes that realized or actual volatility should stay in the more normalized range, we’re seeing that the VIX complex is pricing out the ability to have more volatility into the first quarter,” said Cusick.

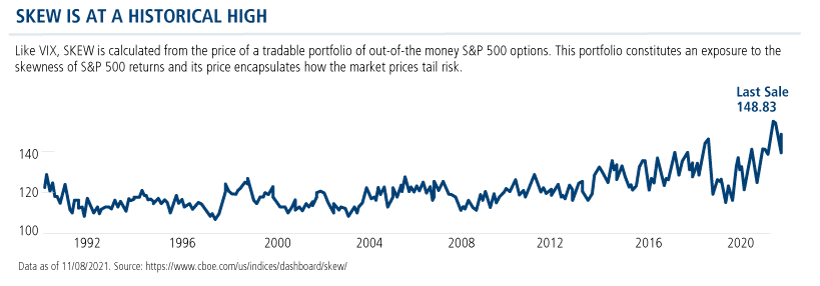

He also touched on the SKEW Index. “The SKEW Index is where you look at the front month, out-of-the-money puts. These are the puts that are commonly referred to as tail risk puts. These are two, three, four standard deviations out of the money, and the SKEW Index tells us if those are relatively cheaply priced or if they’re getting more expensive. And we can see right now, with a 148 SKEW as shown below, the index is up in the highest part of the range that we’ve seen since the inception of the index.”

The environment, according to Cusick, presents an opportunity to use different strategies to optimize downside risk. “Where out-of-the-money puts are expensive, we’re using put spreads. We’re buying puts that are closer to where the market’s trading, and we’re trying to take advantage of that increased implied volatility in the left tail and selling those out-of-the-money puts, which helps with deferring the cost of the long puts.”

Cusick cites the strategy as an example of using volatility to optimize and be opportunistic by putting on what the team believes are more favorable hedges. This also provides the fund the ability to participate more on the upside. The S&P 500 has surprised many by climbing to 4700, and there may be more to come this year. By contrast, a strategy capped at a lower level is shut out from further participation.

The team is managing CIHEX to be long-leaning, seeking its 60% capture guardrail. At the same time, they're actively building in controls that seek to limit the downside to 40%.

This is a crucial difference between CIHEX and other strategies. “Why would you accept a capped upside with a defined downside? Why wouldn’t you want to capitalize on opportunities when the market moves up or down?” Cusick asks.

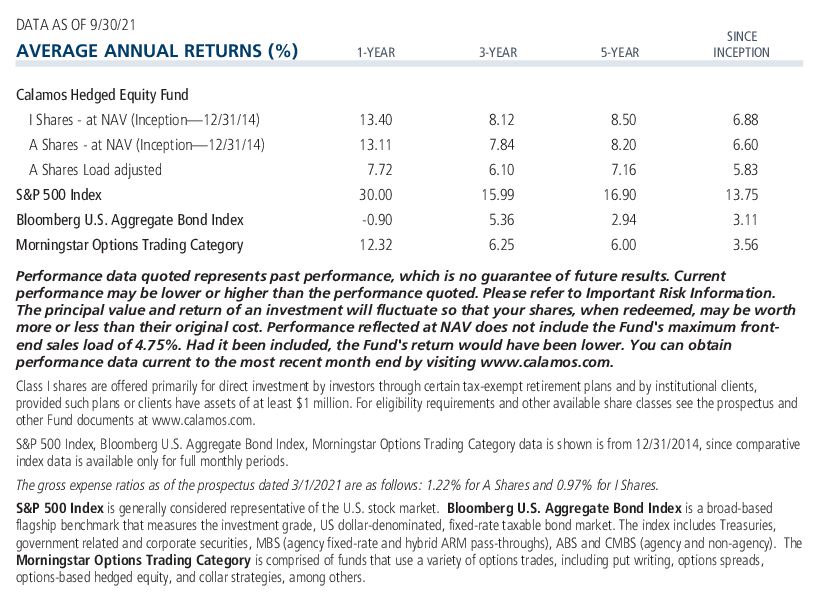

His point: The CIHEX team continues to manage in pursuit of a positive outcome every day the market is open—and in fact, it’s times like these when the fund has outperformed passive strategies. Investment professionals particularly value this for clients getting into the fund in the last few months of the year.

For an update on the volatility markets, contact your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com to schedule a 10-minute briefing with Cusick. Cusick joined Calamos after serving as the Director of Institutional Education and Business Development for The Options Industry Council (OIC) and is available to meet with small groups of investment professionals.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks. As of March 1, Calamos Hedged Equity Income Fund’s name has been changed to Calamos Hedged Equity Fund.

Morningstar RatingsTM are based on risk-adjusted returns and are through 10/31/21 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc.

808575 1121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on November 16, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.