CIHEX Team Looks for the Opportunities in This Irregular Market Up/Volatility Up Environment

These are irregular, volatile times for investors in the options market—which nonetheless provide windows of opportunity and market dislocations for actively managed Calamos Hedged Equity Fund (CIHEX).

Thursday’s call with Calamos Co-CIO Eli Pars, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager, and Jason Hill, Senior Vice President, Co-Portfolio Manager, featured an overview of the environment less than one month away from the start of third quarter earnings reports in October and two months from the Nov. 3 national elections. (Listen to the call replay here.)

Beyond the calendar events, the market has been dealing with plenty of anomalies. Hill commented on three market dynamics:

-

“Off-the-charts” retail option activity has been concentrated mostly in very short-term options (less than two weeks), the majority of which are on technology/momentum names.

-

Softbank, a Japanese conglomerate that had been accumulating options in technology stocks, gained notoriety for having driven the largest ever volumes in contracts linked to individual companies prior to the September pullback.

The team believes the story was “a bit overblown” and that Softbank didn’t have such a large role in the tech moves, Hill said.

“Some of their trades were actually option spreads and were essentially delta neutral—meaning not leaning long or short—so not quite as impactful as originally thought but still relevant from an option activity standpoint. Still,” Hill continued, “Softbank was most likely a contributor to market moves and, more importantly, a provider of upward pressure on option pricing and volatility that we’ve seen.”

-

Significant political and virus-related uncertainty, prompting investors to continue to bid for downside risk mitigation even while markets continue to climb.

Hill confirmed that the team is seeing option prices being bid up as tensions grow. “There is even an upward kink in the S&P option pricing term structure at the end of September, which is around the date of the first debate,” he said.

What’s even more interesting, he said, is that “implied volatility term structure really ramps up near the election date of November 3, but doesn’t stop there as forward vol continues to rise past that date. This is telling us right now that option markets are currently pricing in or implying that we won’t know the results for days or weeks past Election Day.”

All of the above adds up to a more challenging environment for the CIHEX team.

“The more typical market up/volatility down environment is theoretically easier to add hedge and navigate because, simply put, you have option prices cheapening as the market rises. Adding hedge is a lot easier,” Hill said.

“The inverse of that, what we’re seeing right now, has been definitely more challenging and more problematic for us to create the risk/reward that we’re accustomed to, especially on the way up.”

Current Positioning

The team likes the trade CIHEX has on today. The fund is managed within a range of 40 to 60 beta to the S&P. Currently, Pars said, it’s at 40—at the lower end of its sensitivity and at the higher end of the hedge.

“The position is partially a function of the straight-up stock market well bid on the volatility side. It’s a little trickier to be opportunistic when you have a straight-up trending market,” he said.

“Normally, with the run we’ve had in the equity market, you’d expect the VIX to be high teens instead of mid-20s like it is.”

What the team likes, Pars said, is that “we do get paid to wait. Options prices are higher, which generates additional return over and above our net exposure so we are appreciative of that.”

Picking Spots

With the flexibility to remain opportunistic, the team is on alert to take advantage of dislocations that present themselves—what Hill described as “picking spots to chip away and add layers of hedge in order to have as much of an asymmetric payoff as possible in the current environment.”

One example: recent put spread trades, some near the election and others out past the election.

“These trades are attractive right now,” Hill explained, “because we’re able to mitigate some of the cost of buying a long put by pairing it with a further out-of-the-money put sell, the put sell being executed at what we believe to be elevated levels. Essentially selling an expensive put to finance buying closer to the money puts.”

“Some of the payouts in these recent trades are around 20 to 1, which is very attractive relative to past history,” he added.

While such trades are incremental and not necessarily “big bets,” they help reduce risk and provide incremental downside risk mitigation on the way down.

Most of the hedge runs out to the end of the year. While it’s possible that the events of the next few months could prompt some shifts, Pars said it’s conceivable that the positioning will continue through December and roll forward into 2021.

“An important takeaway about our current environment,” Hill said, “is that it’s temporary—and because of our flexibility and the opportunistic nature of managing this fund—we’ll be there to take advantage of it when it reverses.”

In fact, a reversal has already started, according to Hill.

“One way to gauge the relative level/value of implied volatility or option pricing is to look at the dispersion between actual realized volatility and option implied volatility. At the beginning of September, with the market at all-time highs, we saw 10-day realized historical S&P volatility in the single digits with one-two month implieds in the high teens.

“This has since crossed back over with historic realized vol around 30 and implieds in the mid 20s. So, the landscape has already started to normalize a bit after the recent pullback off our September 2 highs,” Hill noted.

Investment professionals, for more information about CIHEX and the opportunities ahead, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

The S&P 500 Index is generally considered representative of the U.S. stock market.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

A put spread is an option spread strategy that is created when equal number of put options are bought and sold simultaneously.

Out of the money means that an option has no intrinsic value, only extrinsic value.

The VIX Index, created by the Chicago Board Options Exchange, is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPXSM) call and put options. It is one of the most recognized measures of volatility.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Morningstar Options-Based Category funds may use a variety of strategies, including but not limited to: put writing, covered call writing, option spread, options-based hedged equity, and collar strategies. In addition, options-based funds may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies.

Morningstar RatingsTM are based on Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2020 Morningstar, Inc. All rights reserved.

802151 0920

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

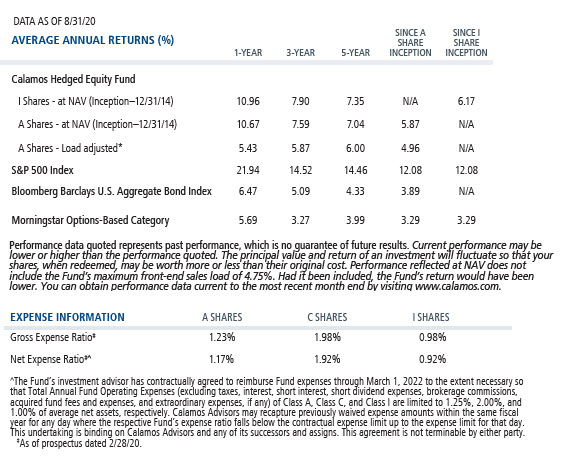

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

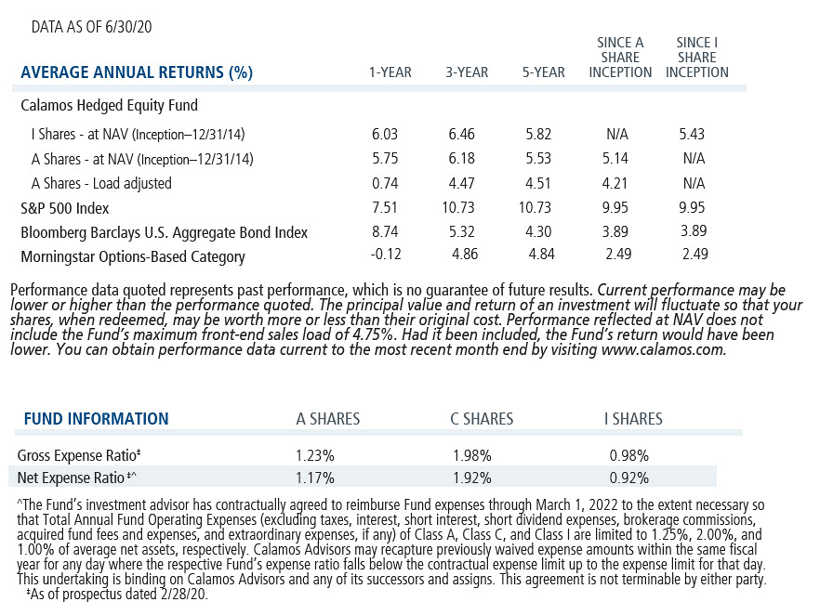

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on September 18, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.