Back At It Again: How Calamos Convertible Funds Protected Against February’s Downside

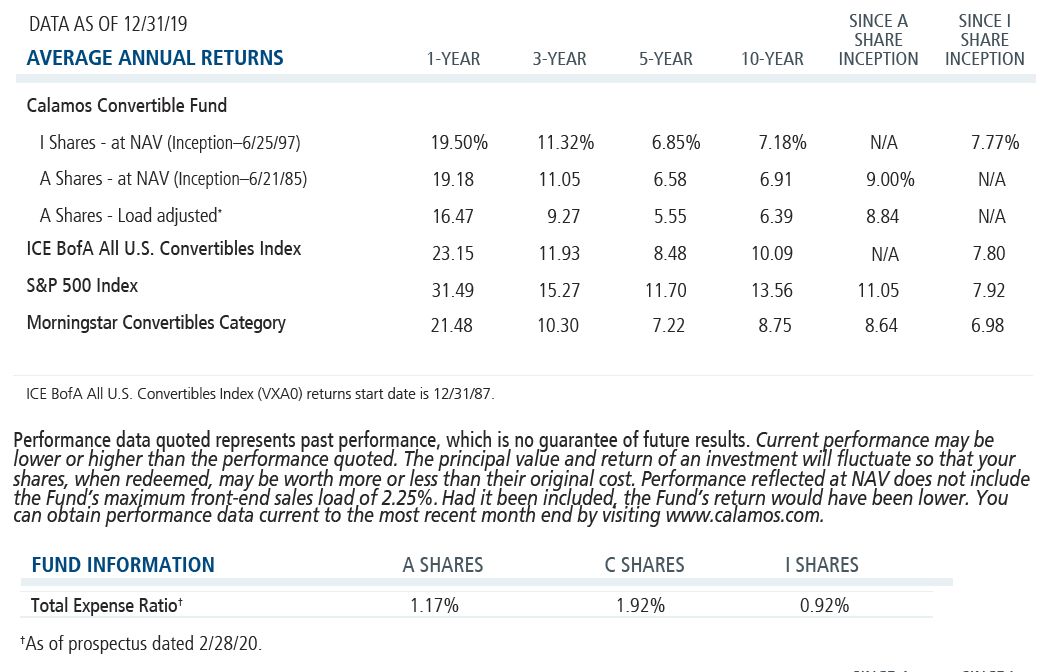

The benefit of actively managed convertible securities in a portfolio has been demonstrated yet again in the performance of Calamos Convertible Fund (CICVX) through the first two months of this year (-1.18%), defying the stock market’s -8.27% decline through 2/29/20—and capturing just under 43% of the market’s downside in the month of February alone.

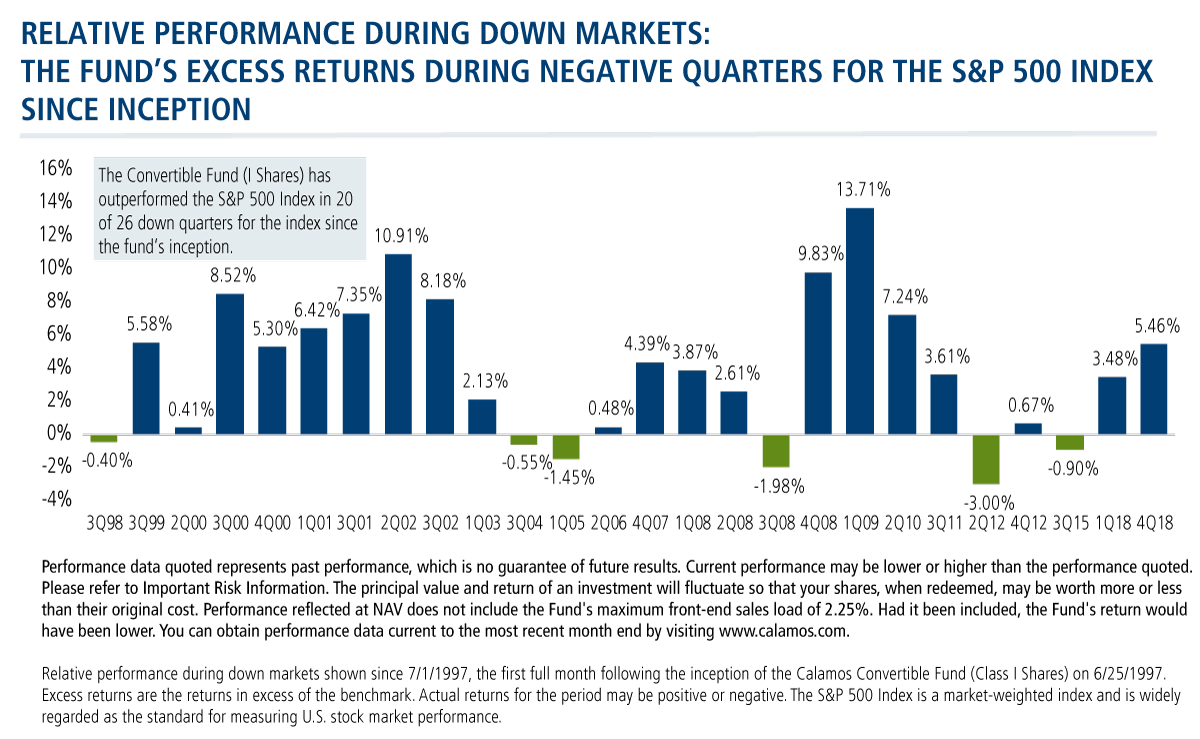

It’s the latest in a long line of outperformance during market drawdowns. As shown below, CICVX has outperformed the S&P 500 in 20 of 26 down quarters since the fund’s inception in 1997.

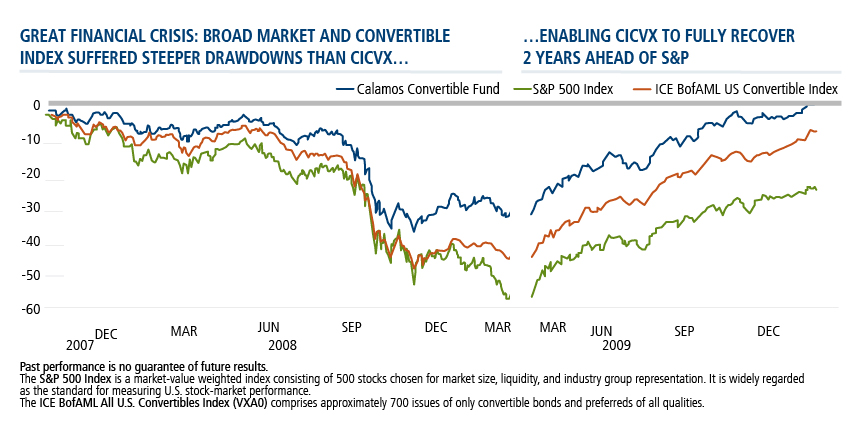

And during the most challenging market in recent history, CICVX held up significantly better than the equity market. Its shallower drawdown in the Great Financial Crisis resulted in a much quicker recovery than the S&P or its benchmark.

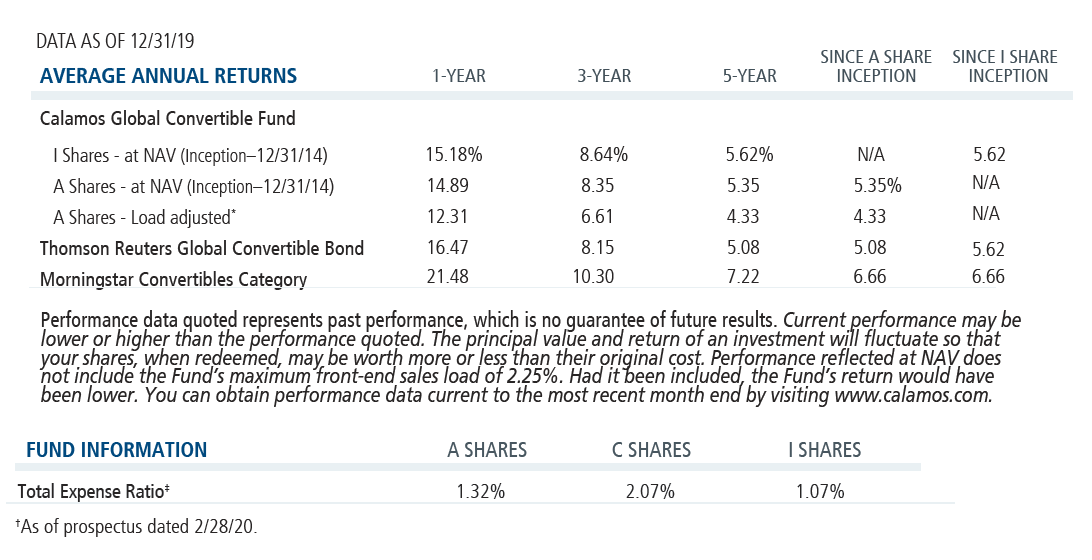

Calamos Global Convertible Fund (CXGCX), too, protected shareholders, by remaining in the black with a 0.89% year-to-date. CXGCX dropped 1.47% in February versus the S&P’s 8.23% decline.

The Difference That Active Management Makes

For financial advisors looking for a resource (or refresher) on how convertibles offer potential equity participation while mitigating downside risk, we refer you to our just-updated 32-page Convertible Securities: Structures, Valuation, Market Environment and Asset Allocation guide.

The guide is written by Calamos Founder, Chairman and Global Chief Investment Officer John P. Calamos, Sr., with contributions from Eli Pars, CFA, Calamos Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies. John Calamos is widely acknowledged as a pioneer in convertibles, and Eli is Senior Co-Portfolio Manager of Calamos Market Neutral Income Fund (CMNIX), the industry’s largest alternative fund (Morningstar data, 12/31/19).

While the guide covers all things convertibles, below we’ve highlighted the discussion on the importance of active management (excerpted from Convertible Securities: Structures, Valuation, Market Environment and Asset Allocation):

Why do convertibles require active management? Because of their structural complexities, convertible securities demand active management within asset allocations. It is not simply the convertibles that make a strategy work, but how convertibles are managed to achieve a particular investment objective. Convertibles have varying degrees of equity and fixed income sensitivity, and these characteristics may change for a given convertible over time.

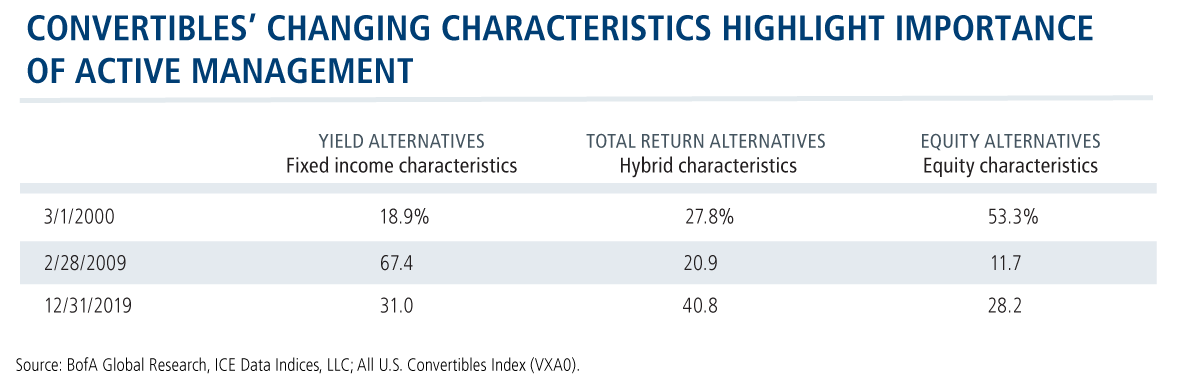

As of February 29, 2020, the market mix was 35% yield alternatives, 36% total return and 29% equity.

“The convertible market was very healthy entering 2020 as recent new issuance helped maintain a well balanced opportunity set despite years of strong equity market returns. With the recent market pullback, however, we are again seeing a shift toward more credit-sensitive names, which may continue if equity markets decline further,” says Joe Wysocki, CFA, Senior Vice President, Co-Portfolio Manager.

“A key to longer term success is a disciplined approach to actively manage these risk/reward tradeoffs in order to participate in the upside potential of equities but also to protect on the downside.”

As the table above shows, the convertible market demonstrated a much higher degree of equity sensitivity in March of 2000, against the backdrop of a peaking equity market and technology bubble. An investor who had favored a passive or index-like strategy in this environment would have been over-exposed to equity downside. By February of 2009, the pendulum had swung to the other extreme. As the markets troughed in the liquidity crisis, more than two-thirds of convertibles were trading as “credit-sensitive.” An investor who chose to mimic the broad market would have been positioned for limited participation in the equity market’s subsequent upside. Finally, you can see the total return tilt of the convertible market as of 12/31/19.

These statistics illustrate why convertible strategies must be actively managed to maximize their potential benefits. The most equity-sensitive convertibles may not provide adequate downside protection, while the most bond-like convertibles may not offer sufficient equity upside participation. Passive strategies cannot adjust to changes in either an individual convertible’s characteristics or to the characteristics of the convertible universe as a whole. Therefore, they cannot provide investors with the benefits that an actively managed convertible portfolio may offer.

Download the guide to read more about convertibles. Here’s what you’ll find:

-

Introduction to Convertible Securities

What is a convertible bond?

What is a convertible preferred stock?

What is a mandatory convertible?

What are exchangeable convertible bonds and exchangeable convertible preferred stocks?

Where do convertible securities fit within the capital structure?

What is a synthetic convertible?

-

Factors Driving Convertible Issuance

Why do companies issue convertibles?

What macro factors drive convertible issuance?

-

A History of the Convertible Market

When did companies first issue convertible bonds?

What were some of the key trends in the convertible market in the twentieth century?

How has the convertible market evolved in the twenty-first century?

-

Valuing a Convertible Bond

What is the investment value?

What is the investment premium?

What is the conversion price?

What is the conversion ratio?

What is the conversion value?

What is the conversion premium?

What is the relationship between conversion value and investment value?

What are the different types of convertible call provisions?

What antidilution protections do convertible bonds carry?

-

Performance of Convertibles in Various Environments

How have convertibles historically performed versus equities and corporate bonds?

How have convertibles performed in up and down markets?

How has the performance of investment-grade and speculative-grade convertibles differed over time?

-

Characteristics of the Global Convertible Market

How large is the global convertible market?

What is the regional composition of the global convertible market?

What are the credit characteristics of the convertible market?

How frequently have there been defaults in the U.S. convertible bond market?

-

Convertibles and Asset Allocation

In what ways can convertibles be used within asset allocations?

Why do convertibles require active management?

How should convertibles be managed within a core/strategic allocation?

How can convertibles be incorporated as tactical allocations?

What are the potential limitations of a convertible allocation invested exclusively in investment-grade credits?

Financial advisors, for more information on CICVX or any of the Calamos funds that use convertible securities, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee against a loss. This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned, and while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The S&P 500 Index is a market weighted index and is widely regarded as the standard for measuring U.S. stock market performance.

The ICE BofA All U.S. Convertibles Index (VXA0) comprises approximately 700 issues of only convertible bonds and preferreds of all qualities.

Convertible securities entail interest rate risk and default risk.

Fixed-income securities are subject to interest rate risk. If rates increase, the value of fixed-income investments generally declines.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, mid-size company risk, small company risk, portfolio turnover risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

©2020 Calamos Investments LLC. All Rights Reserved. Calamos®, Calamos Investments® and Investment strategies for your serious money® are registered trademarks of Calamos Investments LLC.

801915 0320

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 11, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.