Positive about 2020? Even More Reason to Hedge Equity Risk with Calamos Convertible Fund

We’re starting the new year, a new decade, on a high note in the markets. Across the world, central banks are accommodative. The U.S. appears to have avoided a recession, thanks to the continuing strength of the consumer. Trade sentiment has turned positive, and U.S. stocks have continually set all-time highs even as tensions rise in the Mideast.

In such a resiliently positive environment, why wouldn’t financial advisors just get their clients in equities and wait for more of the good times to roll?

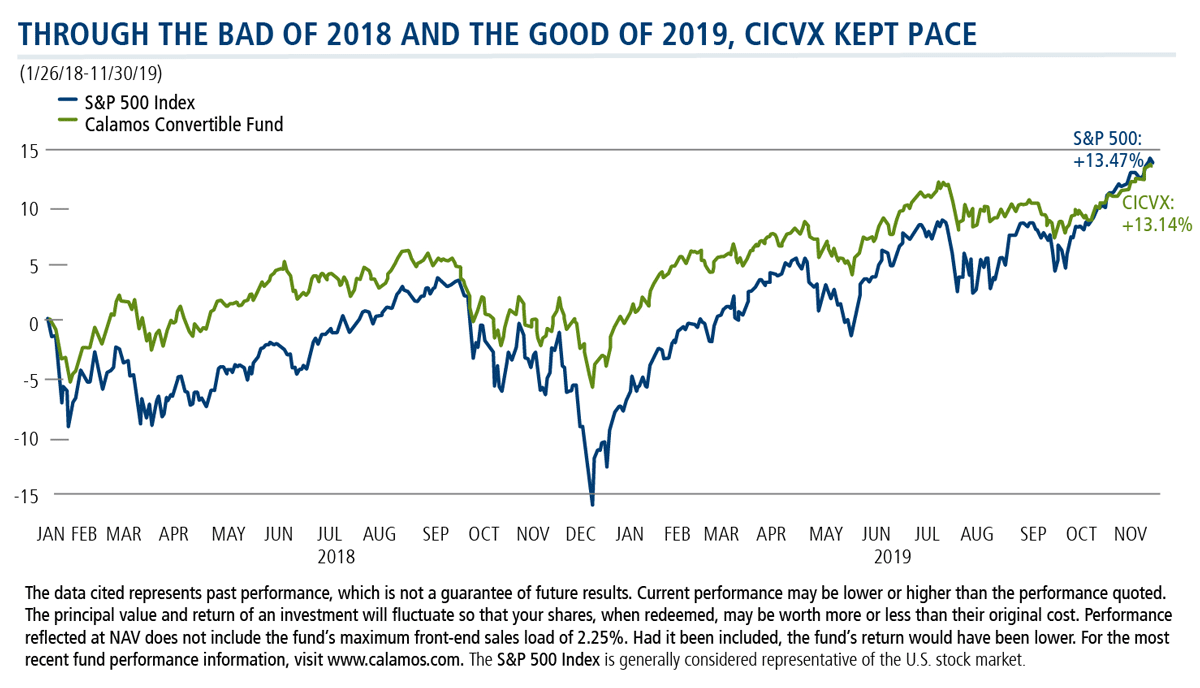

Because, according to this timely reminder from the portfolio management of the Calamos Convertible Fund (CICVX), no one really knows what’s going to happen in the stock market. As Jon Vacko, CFA, Senior Vice President, Co-Portfolio Manager, puts it: “It’s really tough to time market corrections...our objective is to maintain a balanced risk/reward to give you the best upside and provide downside risk mitigation.”

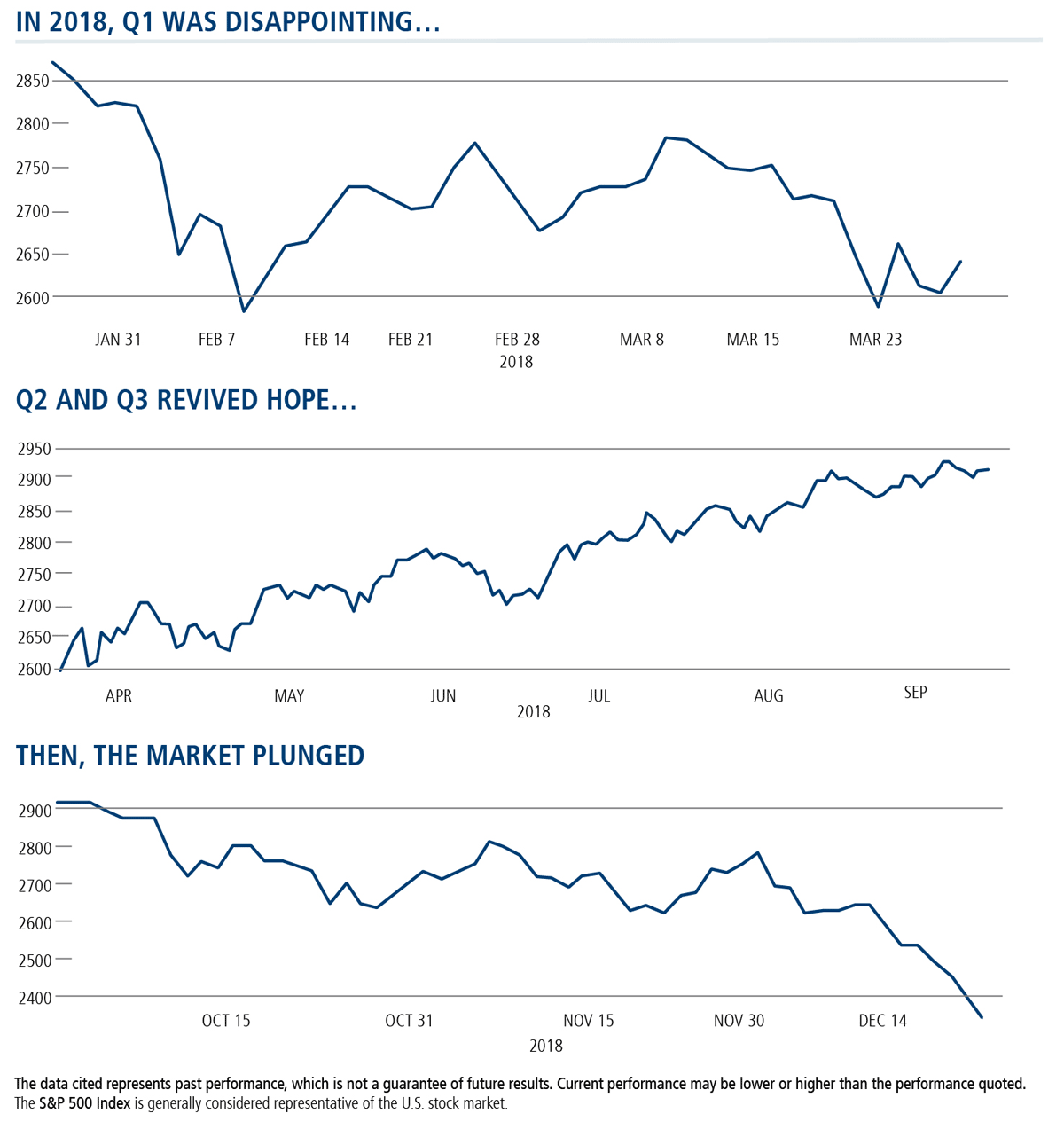

Let’s revisit some of the market’s head fakes of just the last two years:

2018 Started with a Promising Outlook

- S&P 500 had hit all-time highs in 2017.

- Tax cuts were just passed.

- Unemployment was at a 45-year low.

- Merger volume was surging.

- North Korea talks were underway.

- Global growth appeared to be synchronized.

But 2018 did not proceed as envisioned at the start of the year.

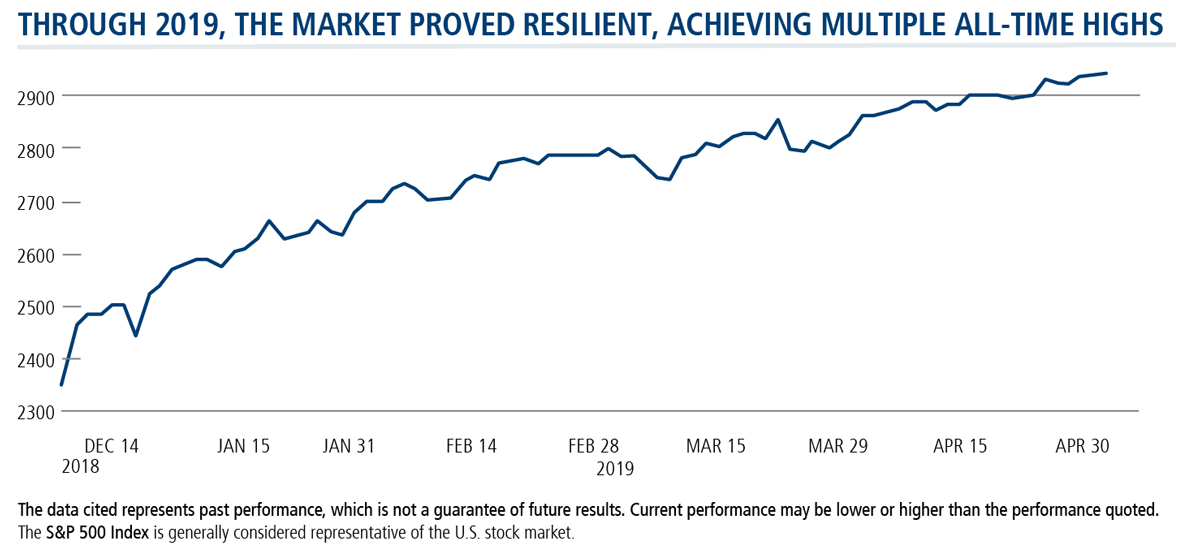

Investors Began 2019 with Many Reasons to Be Concerned

- 20% correction in S&P 500 in December 2018.

- The global economy slowed down.

- The probability of recession was rising.

- Trade threats loomed.

- Tariffs were increasing.

- Rates were rising.

- VIX was spiking.

- Spreads were widening.

- The yield curve was on its way to an inversion.

And yet look how 2019 surprised!

Equity risks are ever-present and unpredictable. This two-year review underscores why financial advisors have turned to Calamos Convertible Fund for the last 35 years: CICVX’s actively managed portfolio of convertible securities has proven its ability to seek upside equity market participation with reduced exposure to the downside.

Advisors, to learn more about CICVX, please call 888-571-2567 or email caminfo@calamos.com to talk with your Calamos Investment Consultant.

Click here to view CICVX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 2.25%. Had it been included, the Fund's return would have been lower.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The CBOE Volatility Index (VIX) is a leading measure of market expectations of near-term volatility conveyed by S&P 500 Index (SPX) option prices.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

801843 0120

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 05, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.