A Hedged Equity Strategy Needs the Flexibility to Position for Big Moves—Up or Down

Much of the commentary on market volatility has to do with shielding investors from the downside. But, gains in down markets can significantly contribute to overall investment returns. Don't overlook the potential for volatility to provide an upside opportunity.

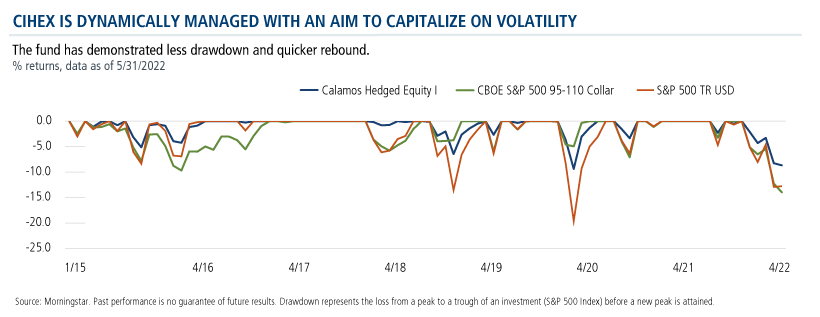

Here is where Calamos Hedged Equity Fund (CIHEX) differs from others in Morningstar's Options Trading category: Its active management has the flexibility to position the fund opportunistically. CIHEX is managed to pursue equity returns in all environments—and as windows of opportunities open and close. There are no caps to limit participation when stocks run.

One window could be opening next week, says Joseph Cusick, Calamos Vice President, Portfolio Specialist. Many of you know Cusick from attending options updates hosted by our Calamos Investment Consultants or our Options 101 Continuing Education course. Cusick came to Calamos after managing and educating about derivatives since 1994 at firms such as Stafford Trading, optionsXpress, and Charles Schwab.

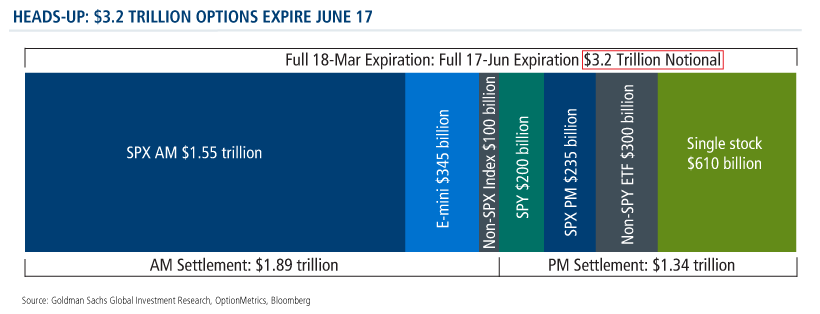

Next Friday, June 17, is a “quad witching day"—so-called by traders to refer to the quarterly expiration of cash index options (SPX), index futures (e-mini), futures options (e-mini), and single stock options.

"Such a large expiration could spark a historic gamma release by dealers, i.e., liquidity providers who will have to cover their hedges against the options they transacted. This hedge covering could, in turn, potentially see the market trade more volatile, especially if strategically combined with a burst in buybacks and a potential short squeeze," according to Cusick.

What happens on the 17th remains to be seen, of course. Nevertheless, it provides a timely example of why a hedged equity strategy needs that flexibility to position for expected big moves, whether up or down.

In this case, says Cusick, CIHEX is back to having significant skew in the hedge. CIHEX has more outright long puts vs. put spreads as a hedge than the fund has used in the last 18 months. But, Cusick hastens to add, "we also have a clear runway to the upside. We have the lightest short call exposures in '22. We have a fairly defined bottom, with an extended runway for the next 30 to 60 days."

Beyond commenting on the likelihood of heightened trading activity on June 17, Cusick provided additional perspective on the market. “There is a real lack of harmony between bullish and bearish catalysts,” he said. “This makes it virtually impossible to develop a coherent case for either sustained market upside or another sharp burst of selling.

“However,” he continued, “in our conversations with investment professionals, we hear a general trend of continued risk aversion by clients and expectations that the stock market will remain volatile. The options market’s message is clear: many significant events could change the market’s tempo around hedging, demanding discipline and fortitude.”

Investment professionals, contact Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com to learn more about our dynamic approach to hedged equity.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

The Morningstar Options Trading Category is comprised of funds that use a variety of options trades, including put writing, options spreads, options-based hedged equity, and collar strategies, among others.

Morningstar RatingsTM are based on risk-adjusted returns and are through 5/31/22 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2022 Morningstar, Inc.

810162 622

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

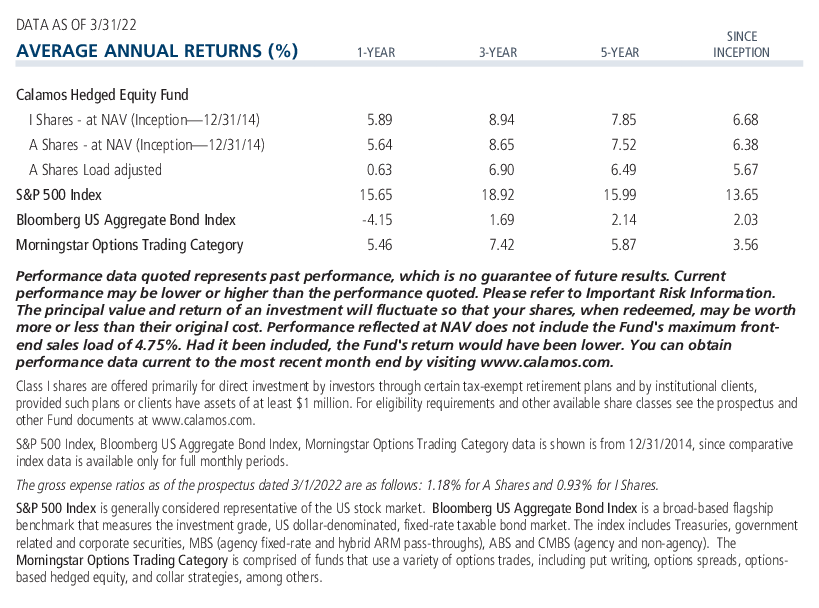

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on June 09, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.