Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, April 2024

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

During the first quarter, markets reflected upbeat sentiment about a resilient US economy and a more supportive Federal Reserve, even as expectations for interest rate cuts were pushed out. Corporate earnings announcements came in strong. Against this backdrop, the S&P 500 Index reached new highs.

With ups and downs over the past year, the S&P 500 reached new highs by the end of 1Q

Past performance is no guarantee of future results. Source: Bloomberg.

Although a small group of tech-oriented names still drove much of the market’s gains, we were encouraged to see a broadening in the markets, with greater attention given to company-specific growth fundamentals. Within the S&P 500, strong-performing sectors for the quarter included not only information technology and communication services but also energy and financials. Gains within non-US stock markets were more modest overall, although there was a good degree of variation among individual markets, with Japan and India among the brightest spots. Meanwhile, in a market led by mega caps, we were not surprised that broad convertible benchmarks gained but at a more modest pace. Within fixed-income markets, high yield debt outpaced investment grade bonds.

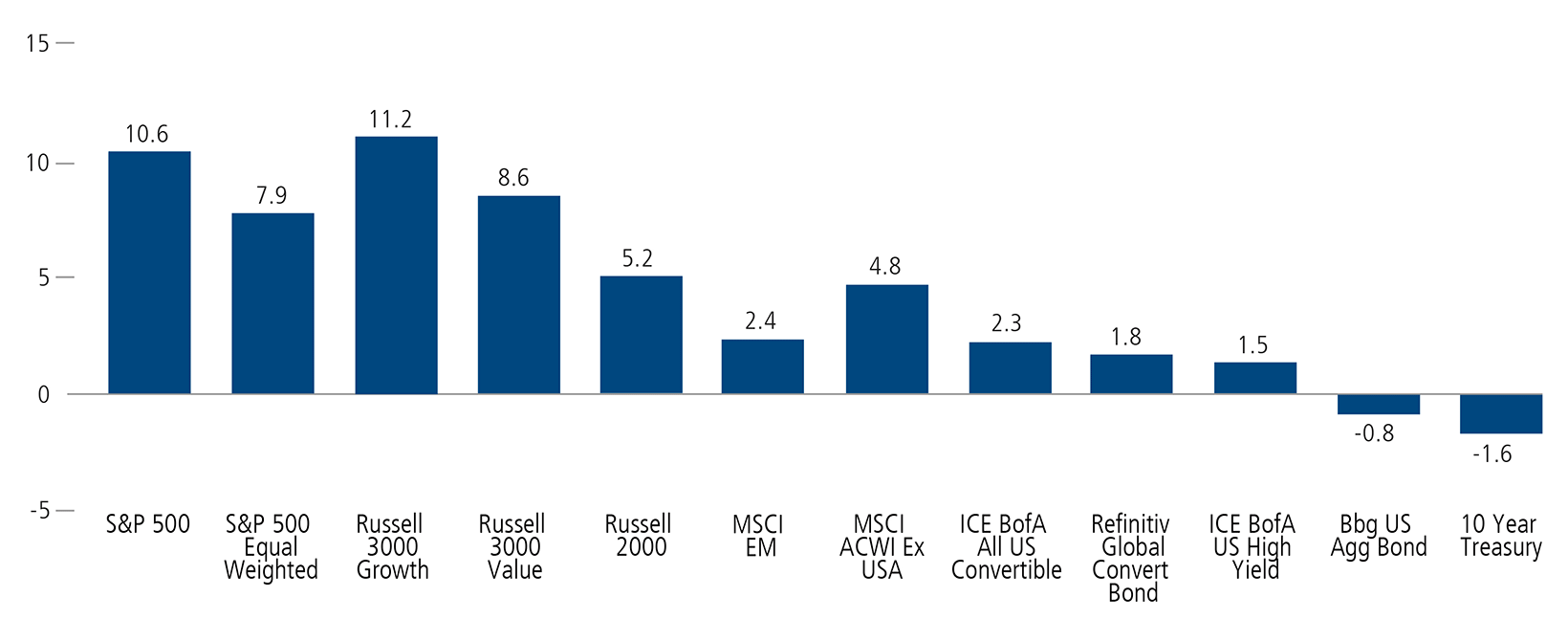

In 1Q, US stocks set the pace with growth-oriented companies leading the way

Past performance is no guarantee of future results. Source: Morningstar. Data as of March 31, 2024.

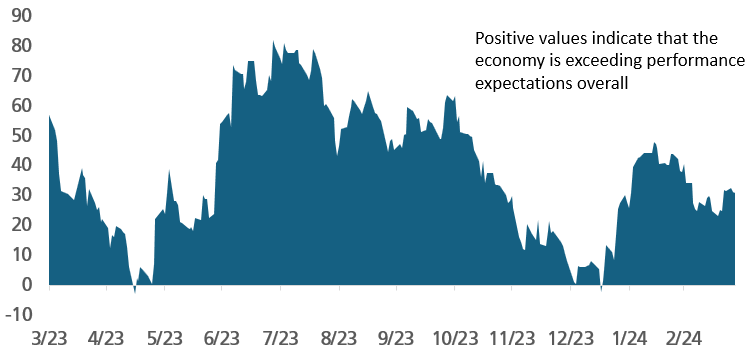

As we look forward, our teams see many opportunities, but are also vigilant to the potential risks on the horizon. On the one hand, key pieces of the US economy continued to surprise on the upside, including healthy consumer spending and employment data, improving financial conditions, and rebounding productivity. On the other hand, business confidence, industrial production, an inverted yield curve, and rising consumer debt delinquencies suggest caution. Slowing but sticky inflation adds to the uncertainty about when the Fed will move to cut rates.

Surprise! US economic data continues to exceed expectations

Past performance is no guarantee of future results. Source: Bloomberg.

Then, of course, we have elections in November. The importance of fiscal policy to the health of the economy and markets cannot be overstated, and this upcoming election is unlike any other. We expect volatility to rise in the run-up to the US presidential election, and our teams are also closely watching the outcomes of other elections around the world.

What’s next for the markets?

Investors are likely wondering how long the good times in the US equity market will last, how long the economy will continue to grow, when the Federal Reserve will actually cut interest rates, and what the impact of the presidential election will be on fiscal policy. There’s no way—for anyone—to answer these questions with certainty, and it’s always important to remember markets do move down as well as up. Cooling-off periods are normal and to be expected. If volatility kicks up over the summer and into fall—as we expect it will—we encourage investors not to lose sight of the long-term.

The good news is that history shows that for long-term investors there has been opportunity in all environments and that although markets can be volatile in the short term, they’ve been resilient in the long term.

As I noted earlier, we’re seeing investors give greater attention to company-specifics, and we believe our teams are well-equipped to perform in an environment that favors individual security selection, discipline, and the insights to identify the themes that are transforming the world. As you will read in the commentaries below, our investment teams are pursuing these opportunities with a wide range of risk-managed, research-driven approaches.

Earlier this year, I listed out my “7 Principles for 2024 … and Beyond”—and one key theme that ran through these tenets was the importance of asset allocation. I’d encourage investors to not chase market performance or focus on benchmarks. Instead, look to enhance your asset allocation—depending on your personal circumstances, which could mean rounding out your portfolio to include more small cap growth stocks and global exposure or adding alternatives to your equity and fixed-income allocations. As you will read in the commentaries below, our teams are finding many opportunities across asset classes. They are following disciplined, and research driven approaches to turn volatility into long-term opportunity.

2024: Recession Comes Later

Calamos Phineus Long/Short Fund (CPLIX)

Michael Grant

Marching on as Bonds Stumble

Calamos Market Neutral Income Fund (CMNIX)

Eli Pars, CFA

Déjà Vu … All Over Again

Calamos Hedged Equity Fund (CIHEX)

Eli Pars, CFA

Macro Tailwinds Provide a Catalyst for Merger Arbitrage

Calamos Merger Arbitrage Fund (CMRGX)

Jason Hill

Finding Attractive Convertible Opportunities … and Likely More on the Way

Calamos Convertible Fund (CICVX)

Jon Vacko, CFA and Joe Wysocki, CFA

Global Convertibles for a Surprising World

Calamos Global Convertible Fund (CXGCX)

Eli Pars, CFA

Productivity Improvement Provides Upside Opportunities

Calamos Growth and Income Fund (CGIIX)

John Hillenbrand, CPA

Welcoming in a More Discerning Market

Calamos Growth Fund (CGRIX)

Matt Freund, CFA, and Michael Kassab, CFA

The Pendulum Swings Back Our Way

Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX)

Brandon Nelson, CFA

The Sweet Spot of Disinflationary Growth

Calamos Global and International Suite (CNWIX, CGCIX, CIGEX, CIGIX, CSGIX)

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA and Kyle Ruge, CFA

Risk in the Rally?

Calamos Antetokounmpo Sustainable Equities Fund (SROIX)

Jim Madden, CFA, Tony Tursich, CFA and Beth Williamson

Sorting Through a Mixed Bag

Fixed Income Suite (CIHYX, CTRIX, CSTIX)

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The S&P 500 Equal Weighted Index includes these same companies but is not market cap weighted. The MSCI All Country World ex USA Index represents the performance of global equities, excluding the US. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA US High Yield Index is an unmanaged index of US high yield debt securities. The ICE BofA All US Convertible Index (VXA0) is a measure of the US convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible. The Bloomberg US Aggregate Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of US small cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Merger Arbitrage Fund include: in the case of an investment in a potential acquisition target, if the proposed merger, exchange offer or cash tender offer appears likely not to be consummated, in fact is not consummated, or is delayed, the market price of the security to be tendered or exchanged will usually decline sharply resulting in a loss to the fund, the fund invests a substantial portion of its assets in securities related to a particular industry, sector, market segment, or geographic area, its investments will be sensitive to developments in that industry, sector, market segment, or geographic area, the Fund is classified as “non-diversified” under the Investment Company Act of 1940, American Depository Receipts risk, call risk, convertible hedging risk, convertible securities risk, covered call writing risk, currency risk, debt securities risk, derivatives risk, equity securities risk, foreign securities risk, hedging transaction risk, high yield risk, lack of correlation risk, liquidity risk, MLP risk, options risk, other investment companies (including ETFs) risk, portfolio selection risk, portfolio turnover risk, REITs risk, Rule 144A securities risk, sector risk, short sale risk, small and mid-sized company risk, Special Purpose Acquisition Companies risk, special situations or event-driven risk, synthetic convertible instruments risk, tax risk, total return swap risk, U.S. Government security risk, and warrants risk.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid-capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund nclude: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

The principal risks of investing in the Calamos Antetokounmpo Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, large-capitalization stocks as a group could fall out of favor with the market, small and mid-sized company risk, sector risk, portfolio turnover risk, and portfolio selection risk.

The Fund’s ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund’s exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC (“CGAM”), an investment adviser registered with the SEC under the Investment Advisers Act of 1940, serves as the Fund’s adviser (“Adviser”). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo.

Mr. Antetokounmpo serves on the Adviser’s Board of Directors and has indirect control of half of the Adviser’s Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund’s investments, and neither Original C nor Mr. Antetokounmpo shall provide any “investment advice” to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then “Antetokounmpo” will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

024014a 0424

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.