Investment Team Voices Home Page

Investment Team Voices Home Page

Macro Tailwinds Provide a Catalyst for Merger Arbitrage

Summary Points:

- By pursuing absolute returns that are largely uncorrelated to equity and fixed income markets, we believe CMRGX provides attractive long-term diversification benefits.

- The past several months have been an unusual period for merger arbitrage, and we anticipate fewer “broken deals” going forward.

- We believe continued economic growth and stabilizing interest rates will provide a hospitable environment for merger activity.

- We believe the current antitrust regulatory environment is unusually inhospitable, but likely transitory.

Merger Arbitrage at a Glance

When mergers between companies are announced, there’s typically uncertainty around the consummation of the deal and the timeline of the merger’s completion.

As a result, the stock price of the acquisition target is normally lower than the announced acquisition price.

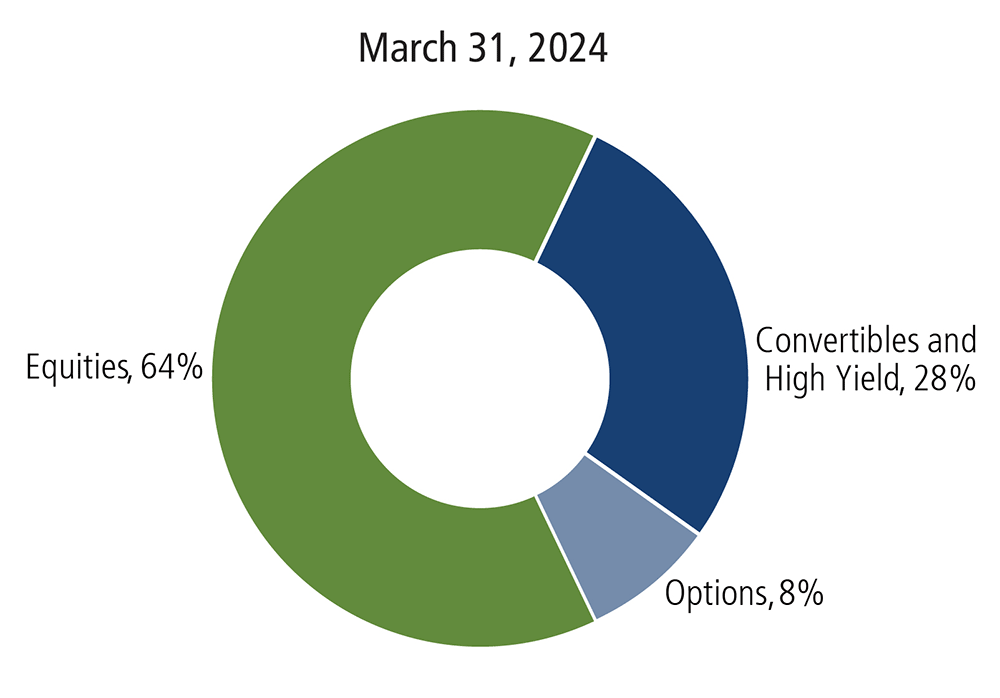

Our team seeks to provide absolute returns that are largely uncorrelated to equity and fixed income markets by taking advantage of dislocations between potential and proposed merger-and-acquisition deal prices and where companies’ stocks are publicly trading before the deals are completed.Throughout the period, we sought to capture arbitrage spreads in a variety of ways—through equities, convertible bonds and other fixed income securities, and liquid options. The choices we make are bottom up, based on the idiosyncratic characteristics of the companies involved, and draw upon Calamos’ legacy in comprehensive capital structure research. We believe the fund’s breadth of investment choices offers many advantages for striking attractive risk/reward. For example, our use of options and fixed income securities provide valuable levers for mitigating downside risks.

As of the close of the reporting period, CMRGX held securities associated with 31 deals or potential deals, in line with 33 at the start of the quarter. Equities made up 64% of the securities in the fund at the end of the quarter, versus 57% at the start. Convertible securities declined from 37% to 28%, and options rose from 6% to 8%.

CMRGX: Finding opportunities across targets’ capital structures

The portfolio is actively managed and subject to change daily without notice.

Navigating regulations and political crosscurrents is often the biggest challenge for companies involved in mergers, given the many entities that may want a say. Certainly, the companies involved in the mergers are the most vested in the outcome and devote considerable effort and expense to anticipate all possible hurdles before they enter a definitive deal. Even so, occasionally the regulatory and political obstacles prove insurmountable, resulting in a broken deal. January proved to be an outlier month, and three deals were broken; in one case, the companies walked away because of concerns raised by European regulators, and in another, a state government’s objections blocked the way. The third was squashed by an individual US district court judge. The overarching theme seemed to be one of “big is bad” or “bigger is worse.” While CMRGX had exposure to all three of these deals, we believe that our trade structures and use of options were key to limiting downside.

Although we were discouraged by these outcomes, we nevertheless believe the outlook for merger arbitrage is attractive from here. We see sustained economic growth and a more stable rate environment providing catalysts for companies to enter mergers. As we noted in our previous commentary (“Stabilizing Interest Rates Can Set the Stage for a Merger Surge”), we believe many companies are simply waiting for rates to stabilize to enter into merger agreements. We look forward to participating as this pent-up demand may produce future opportunities. In our view, these agencies are pursuing new theories of harm, which have less legal and philosophical precedent. We believe this is likely to be temporary, and that just as administrations themselves are transitory, regulation will swing back to focusing more on traditional antitrust theory and case law.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Merger Arbitrage Fund include: in the case of an investment in a potential acquisition target, if the proposed merger, exchange offer or cash tender offer appears likely not to be consummated, in fact is not consummated, or is delayed, the market price of the security to be tendered or exchanged will usually decline sharply resulting in a loss to the fund, the fund invests a substantial portion of its assets in securities related to a particular industry, sector, market segment, or geographic area, its investments will be sensitive to developments in that industry, sector, market segment, or geographic area, the Fund is classified as “non-diversified” under the Investment Company Act of 1940, American Depository Receipts risk, call risk, convertible hedging risk, convertible securities risk, covered call writing risk, currency risk, debt securities risk, derivatives risk, equity securities risk, foreign securities risk, hedging transaction risk, high yield risk, lack of correlation risk, liquidity risk, MLP risk, options risk, other investment companies (including ETFs) risk, portfolio selection risk, portfolio turnover risk, REITs risk, Rule 144A securities risk, sector risk, short sale risk, small and mid-sized company risk, Special Purpose Acquisition Companies risk, special situations or event-driven risk, synthetic convertible instruments risk, tax risk, total return swap risk, US Government security risk, and warrants risk.

024014d 0424

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.