Investment Team Voices Home Page

Investment Team Voices Home Page

Global Convertibles for a Surprising World

Eli Pars, CFA

Summary Points:

- We believe investors should be prepared for choppier markets and that convertible securities offer many advantages for pursuing upside amid turbulence.

- The first quarter saw strong new issuance, which we expect to continue.

- We are finding many global convertible securities that offer exposure to growth opportunities, with attractive structural downside risk mitigation.

We have been surprised at the resiliency of the US economy and the equity market. We’ve also been surprised that raising overnight rates 500 basis points hasn’t yet created more disruptions for businesses. And, then of course, we have the US presidential election. Regardless of who ultimately wins, we believe that investors should not be surprised if there are some twists and turns along the way.

We certainly can’t complain about this supportive environment, but we’re also mindful that some investors and areas of the capital market may be getting ahead of themselves. Our job is not only to understand and capture the opportunities of the current landscape, but also to position the fund ahead of future turns.

All in all, there seem to be plenty of reasons why some might want to hedge. Global convertible securities are up to the task, in our view. They offer the opportunity for upside participation because of an embedded option that benefits from upside volatility and downside risk mitigation through their fixed income characteristics.

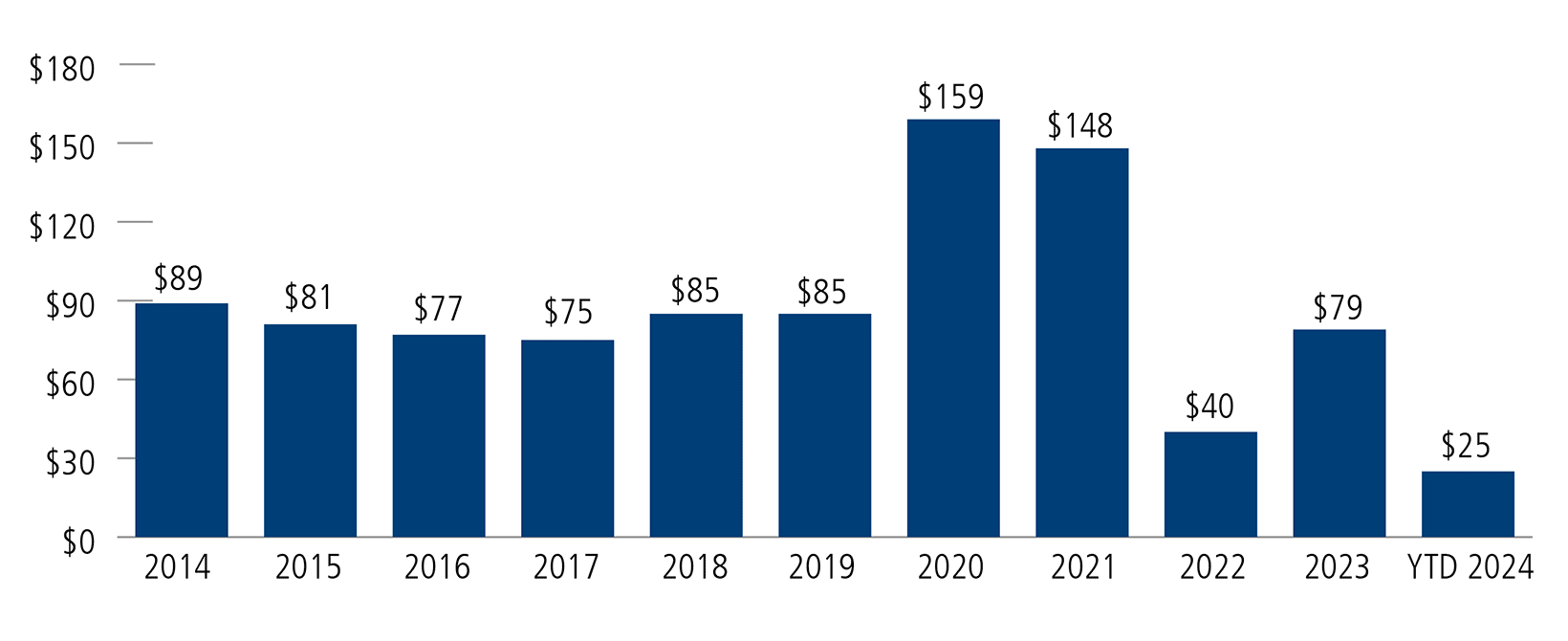

Moreover, we’re seeing many encouraging trends in the global convertible market as companies issue securities with favorable terms, such as higher coupons and lower conversion premiums. Levels of issuance are also robust. During the first quarter, global convertible issuance totaled $25 billion, well ahead of last year’s pace. We expect that new issuance will continue to energize the convertible market for at least the next year or two, given the large maturity walls approaching in the investment-grade bond, high-yield debt, and convertible markets. With interest rates at current levels, we believe that many issuers seeking to refinance will decide that convertibles are the most attractive choice. We also anticipate increased breadth in the convertible market, with more investment-grade companies issuing convertibles.

Global convertible issuance set a brisk pace in 1Q 2024

Source: BofA Global Research

Reflecting our focus on participating in equity opportunity while remaining mindful of risk, Calamos Global Convertible Fund currently emphasizes convertibles that offer balanced levels of equity-sensitivity and fixed-income sensitivity. The fund’s largest allocations include information technology, consumer discretionary, and heath care. From a regional standpoint, US companies represent the largest weighting, followed by emerging Asia and Europe. The portfolio includes companies positioned at the forefront of many global secular growth trends, ranging from AI innovators to businesses capitalizing on global demographic trends, such as growing household wealth in India.

We continue to find many opportunities in the new issuance market. We’ve been taking advantage of refinancing trends and have been able to invest in companies we already liked and now can like even more with higher coupons and lower conversion premiums. We’ve also initiated exposure to companies, including higher-octane companies in fast-growing areas, while taking on less exposure to downside than equity investors do.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

Foreign security risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The Refinitiv Global Convertible Bond Index is designed to broadly represent the global convertible bond market. Morningstar Convertibles Category funds are designed to offer some of the capital-appreciation potential of stock portfolios while also supplying some of the safety and yield of bond portfolios. To do so, they focus on convertible bonds and convertible preferred stocks. Convertible bonds allow investors to convert the bonds into shares of stock, usually at a preset price. These securities thus act a bit like stocks and a bit like bonds.

024014m 0424

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.