Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, January 2024

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

Investment Outlook and Strategies for Asset Allocation in 2024

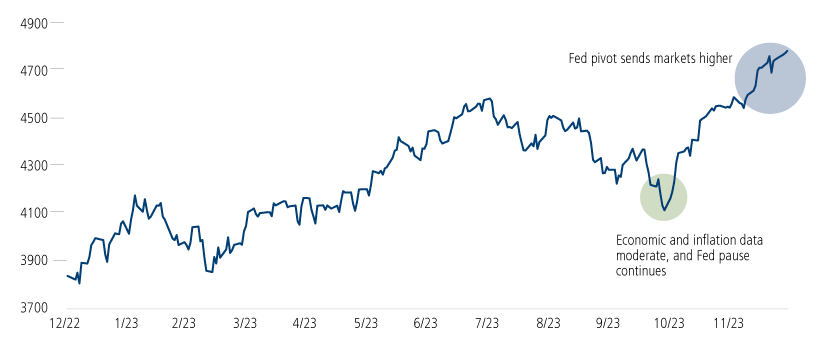

Investors will likely remember 2023 for its many ups and downs, which included several leadership rotations, along with double-digit total return selloffs and rallies. The roller-coaster ride reflected investors’ shifting views on Federal Reserve policy, inflation, and the health of the US economy. Investors also responded to a variety of events, including the failures of Silicon Valley Bank and Signature Bank in the US as well as Credit Suisse overseas, an autoworkers strike, and contentious debt ceiling negotiations in a polarized US Congress. Emerging secular themes—most notably advances in artificial intelligence and weight loss drugs—disrupted the markets as investors considered which companies and industries were positioned to win or lose.

As autumn approached, the mood in the market was turning gloomy as investors grappled with the prospect of higher-for-longer interest rates and inflation that was still elevated despite some declines. Although the Federal Reserve paused its rate tightening in September, the central bank dashed hopes of imminent rate cuts by reinforcing prior guidance that rates would be higher for longer. The yield of the US 10-Year Treasury Bond reached multi-decade highs, while the onset of the Israel-Hamas war intensified geopolitical uncertainty.

The tide turned dramatically in the final months of the year. In late October, moderating economic and inflation data and a continued Fed pause set stocks on an upward trajectory. The markets cheered even more loudly in December when the Fed indicated that it would not be unreasonable to expect multiple rate cuts in 2024—a stark departure from its previous stance.

Moderating Economic and Inflation Data Drives Strong Equity Rally

Past performance is no guarantee of future results. Source: Bloomberg.

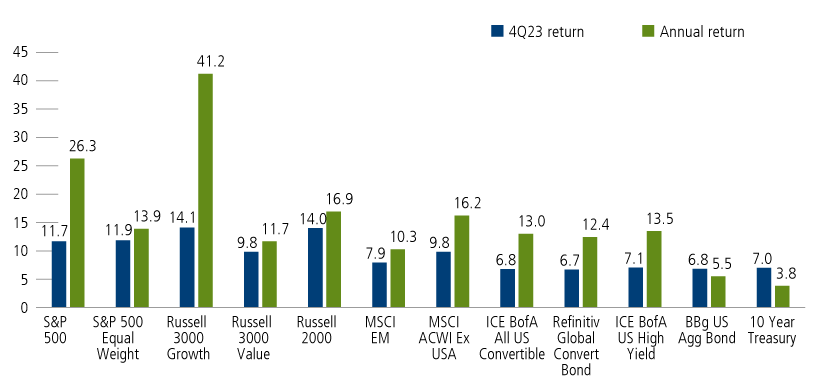

Fueled by this broad rally, stocks, bonds and convertibles all posted healthy gains for the year. Growth stocks posted the most impressive gains within the stock market, led in large measure by a group of large cap stocks referred to as the Magnificent Seven, while high yield bonds led the bond market.

An Upbeat End to a Turbulent Year

Past performance is no guarantee of future results. Source: Morningstar. Data as of 12/31/2023.

What’s Next in 2024?

Last year may have ended on an especially upbeat note, but we caution investors to remain mindful of risk. After a year of robust gains in the markets, it would be quite normal to see more measured performance in 2024.

- We expect saw-toothed and volatile markets to continue. Markets hate uncertainty, and there’s plenty on the horizon.

- Although a good amount of data points to a soft landing for the US economy, the fiscal policy landscape is extremely uncertain with the US presidential election looming large.

- The Fed will continue to be a focal point for investors. Although the markets are increasingly pricing in rate cuts, there are no guarantees, and we’ve seen market sentiment—and asset prices—shift dramatically.

- I believe we are in a stock-pickers’ and a bond-pickers’ market. Not all companies will find the environment equally hospitable. Individual security selection, fundamental research, and the identification of growth themes will be extremely important.

- Market leadership is likely to broaden out. Although we still see attractive potential for the narrow group of mega-cap tech companies that dominated the market for much of 2023, it’s unlikely they will drive the market as they did in 2023. We expect different and more diverse leadership in 2024.

- With new and exciting innovations and disruptions always underway and as further interest rate hikes are likely no longer to be the market’s great concern, we see tailwinds for growth companies, as our Calamos Growth Fund team explains in their commentary, “We See Continued Upside for Quality-Oriented Growth Stocks in 2024.”

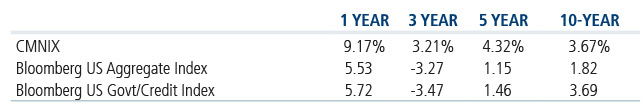

- We believe 2024’s landscape supports the case for alternative approaches. For example, Calamos Market Neutral Income Fund (CMNIX) has served as a compelling alternative to traditional bonds, outpacing the bond market in 2023 as well as for longer periods, as our Co-CIO Eli Pars discusses in his commentary, “Charting a Steadier Path as Bonds Deliver a Wild Ride.”* We also believe private credit offers attractive risk/reward and yield potential beyond what’s available in public markets, given stable company fundamentals we see today. (You can learn more about private credit, our capabilities, and Calamos Aksia Alternative Credit and Income Fund here.)

7 Principles for 2024 … and Beyond

After the fourth quarter rally, many investors may be wondering if the good times can last, especially with the unknowns on the horizon. Some may be wondering if they should adjust their portfolios in the new year. Here’s some key points that I believe investors should keep in mind—and not just for 2024. I believe they’ve stood the test of time.

- Don’t time the market or chase performance. Jumping in and out of the market is a dangerous strategy—investors tend to capture the downturns and miss the upturns. During the fourth quarter, the markets took off suddenly, and investors who were on the sidelines found themselves behind the curve. Instead, put a plan in place and rebalance periodically.

- Your goals—not the markets—should drive your asset allocation. It’s easy to forget about risk when markets are moving up, but your asset allocation should reflect your long-term risk tolerance and goals, not near-term market conditions.

- Benchmark your asset allocation to your own goals. Indexes are useful barometers, but they usually don’t tell the whole story. For example, during much of 2023, the performance of the S&P 500 Index reflected the outsized performance of a small pool of stocks, while most of the index’s constituents were delivering much more measured performance. Also, indexes generally track one type of investment, while an asset allocation will include different types of investments, with different levels of risk and reward.

- There is no perfect time to invest, but there is opportunity in all markets. I’ve been investing for more than 50 years, and there’s always been uncertainty. Between the election cycle, the Federal Reserve, and geopolitics, I’m ready for plenty of short-term volatility in 2024. But uncertainty doesn’t preclude opportunity. Our teams are focused on individual security selection across asset classes, including innovative companies that are disrupting the status quo, and fundamentally strong companies that have fallen out of short-term favor with the market.

- Maintain a long-term perspective. There are up days in down markets and down days in up markets, and your investments aren’t going to move in a straight line every day. Prioritize long-term results over short-term moves.

-

Alternatives provide an edge. A well-diversified asset allocation can provide a potentially steadier ride. As most investors know, stock and fixed income strategies can provide a sound foundation, along with cash for liquidity and short-term needs. From here, many investors may benefit from adding alternative funds, which can employ a wider array of strategies than traditional funds to enhance returns and provide additional ballast.

Convertible securities, which have often been considered alternatives, can provide powerful benefits to investors. As hybrid securities combining features of stocks and bonds, convertibles can offer upside participation in the stock market, with potentially less exposure to downside. Additionally, they have historically been less vulnerable to shifts in interest rates than traditional bonds. With active management, convertibles can be used in a wide array of ways. - Think globally. Although economies are interconnected, there are important differences among countries and regions in terms of fiscal policy, monetary policy, demographic trends, and cyclical and secular growth themes. This creates distinct opportunity sets around the world and supports the case for global diversification, in both emerging and developed markets.

Thank You for Your Trust

Entering a new year, all of us at Calamos Investments would like to thank the investors and investment professionals who have placed their trust in us. As you will read in the commentaries below, our teams are finding many opportunities across asset classes. They are following disciplined, and research driven approaches to turn volatility into long-term opportunity.

Nothing is Obvious

Calamos Phineus Long/Short Fund (CPLIX)

Michael Grant

Charting a Steadier Path as Bonds Deliver a Wild Ride

Calamos Market Neutral Income Fund (CMNIX)

Eli Pars, CFA

Focused on Capitalizing on—Not Capping—Equity Upside

Calamos Hedged Equity Fund (CIHEX)

Eli Pars, CFA

Stabilizing Interest Rates Can Set the Stage for a Merger Surge

Calamos Merger Arbitrage Fund (CMRGX)

Jason Hill

Bright Prospects for Convertibles in 2024

Calamos Convertible Fund (CICVX)

Jon Vacko, CFA and Joe Wysocki, CFA

A Sunny Outlook for Global Convertibles

Calamos Global Convertible Fund (CXGCX)

Eli Pars, CFA

A Normalizing Economic Backdrop Offers Capital Appreciation Opportunities

Calamos Growth and Income Fund (CGIIX)

John Hillenbrand, CPA

We See Continued Upside for Quality-Oriented Growth Stocks in 2024

Calamos Growth Fund (CGRIX)

Matt Freud, CFA, and Michael Kassab, CFA

The Fed’s Dovish Pivot: A Catalyst for Sustained Small Cap Strength

Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX)

Brandon Nelson, CFA

Headwinds to Tailwinds: An Improved Horizon for Overseas Markets

Calamos Global and International Suite (CNWIX, CGCIX, CIGEX, CIGIX, CSGIX)

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA and Kyle Ruge, CFA

Risk Management Will Matter More in 2024

Calamos Antetokounmpo Sustainable Equities Fund (SROIX)

Jim Madden, CFA, Tony Tursich, CFA and Beth Williamson

The Fed’s Pivot: Clear but Not an “All-Clear”

Fixed Income Suite (CIHYX, CTRIX, CSTIX)

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

*Total Returns for Calamos Market Neutral Income Fund, as of 12/31/2023

Source: Morningstar. Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 2.75%. Had it been included, the Fund's return would have been lower. All performance shown assumes reinvestment of dividends and capital gains distributions. The fund’s gross expense ratio as of the prospectus dated 3/1/2023 is 0.88% for Class I shares.

Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The MSCI All Country World ex USA Index represents the performance of global equities, excluding the US. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA US High Yield Index is an unmanaged index of US high yield debt securities. The ICE BofA All US Convertible Index (VXA0) is a measure of the US convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible. The Bloomberg US Government/Credit Bond Index includes Treasuries and agencies that represent the government portion of the index, and includes publicly issued US corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements to represent credit interests. The Bloomberg US Aggregate Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of US small cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Merger Arbitrage Fund include: in the case of an investment in a potential acquisition target, if the proposed merger, exchange offer or cash tender offer appears likely not to be consummated, in fact is not consummated, or is delayed, the market price of the security to be tendered or exchanged will usually decline sharply resulting in a loss to the fund, the fund invests a substantial portion of its assets in securities related to a particular industry, sector, market segment, or geographic area, its investments will be sensitive to developments in that industry, sector, market segment, or geographic area, the Fund is classified as “non-diversified” under the Investment Company Act of 1940, American Depository Receipts risk, call risk, convertible hedging risk, convertible securities risk, covered call writing risk, currency risk, debt securities risk, derivatives risk, equity securities risk, foreign securities risk, hedging transaction risk, high yield risk, lack of correlation risk, liquidity risk, MLP risk, options risk, other investment companies (including ETFs) risk, portfolio selection risk, portfolio turnover risk, REITs risk, Rule 144A securities risk, sector risk, short sale risk, small and mid-sized company risk, Special Purpose Acquisition Companies risk, special situations or event-driven risk, synthetic convertible instruments risk, tax risk, total return swap risk, U.S. Government security risk, and warrants risk.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

The principal risks of investing in the Calamos Antetokounmpo Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, large-capitalization stocks as a group could fall out of favor with the market, small and mid-sized company risk, sector risk, portfolio turnover risk, and portfolio selection risk.

The Fund’s ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund’s exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC (“CGAM”), an investment adviser registered with the SEC under the Investment Advisers Act of 1940, serves as the Fund’s adviser (“Adviser”). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo.

Mr. Antetokounmpo serves on the Adviser’s Board of Directors and has indirect control of half of the Adviser’s Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund’s investments, and neither Original C nor Mr. Antetokounmpo shall provide any “investment advice” to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then “Antetokounmpo” will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

Important Information: Calamos Aksia Alternative Credit and Income Fund

The Fund has been organized as a closed-end management investment company. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) because investors in a closed-end fund do not have the right to redeem their shares on a daily basis. Unlike most closed-end funds, which typically list their shares on a securities exchange, the Fund does not currently intend to list the shares for trading on any securities exchange, and the Fund does not expect any secondary market to develop for the shares in the foreseeable future. Therefore, an investment in the Fund, unlike an investment in a typical closed-end fund, is not a liquid investment.

Risk Factors: General Economic Conditions and Recent Events. Difficult global credit market conditions may adversely affected the market values of equity, fixed-income, hard assets, and other securities and these circumstances may continue or even deteriorate further. Investments made by the Fund are expected to be sensitive to the performance of the overall economy.

Lending. The value of the Fund's assets is volatile and may fluctuate due to a variety of factors that are inherently difficult to predict and are outside the control of the Advisor and Sub-Advisors, including prevailing credit spreads, general economic conditions, financial market conditions, domestic or international economic or political events, developments or trends in any particular industry, changes in interest rates, or the financial condition of the obligors of the Fund's assets.

Direct Origination. A significant portion of the Fund's investments may be originated. The results of the Fund's operations depend on several factors, including the availability of opportunities for the origination or acquisition of target investments, the level and volatility of interest rates, the availability of adequate short and long-term financing, conditions in the financial markets and economic conditions.

Loans. Loan interests generally are subject to restrictions on transfer, and the Fund may be unable to sell loan interests at a time when it may otherwise be desirable to do so or may be able to sell them only at prices that are less than what the Fund regards as their fair market value.

Secured Debt. Secured debt in most circumstances is fully collateralized by assets of the borrower. However, there is a risk that the collateral securing the Fund's loans may decrease in value over time, may be difficult to sell in a timely manner, may be difficult to appraise, and may fluctuate in value based upon the success of the business and market conditions, including as a result of the inability of the borrower to raise additional capital.

High Yield, Low-Rated or Unrated Securities. Debt securities (including bonds) and preferred stock in which the Fund invests may or may not be rated by credit rating agencies. The values of lower-rated securities (including unrated securities of comparable quality) fluctuate more than those of higher-rated securities because investors generally believe that there are greater risks associated with them.

Unsecured Loans. The Fund may make unsecured loans to borrowers, meaning that such loans will not benefit from any interest in collateral of such borrowers. Liens on such a borrower's collateral, if any, will secure the borrower's obligations under its outstanding secured debt and may secure certain future debt that is permitted to be incurred by the borrower under its secured loan agreements. The holders of obligations secured by such liens will generally control the liquidation of, and be entitled to receive proceeds from, any realization of such collateral to repay their obligations in full before the Fund.

024001m 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.