Investment Team Voices Home Page

Investment Team Voices Home Page

Marching on as Bonds Stumble

Eli Pars, CFA

About Calamos Market Neutral Income Fund

CMNIX is designed to enhance a traditional fixed income allocation.

The fund combines two complementary strategies—arbitrage and hedged equity—to pursue absolute returns and income that is not dependent on the level of interest rates.

Our approach has proven effective over the long term but also through periods of extreme change in the markets (For more, see our post “Consistency Through Uncharted Waters.”)Summary Points:

- As the bond market declined in the first quarter, CMNIX advanced.

- The fund has outperformed bonds over the long-term, demonstrating its merits through interest rate cycles and different policy regimes.

- Because the fund relies on alternative strategies (arbitrage and hedged equity), it is not exposed to the level of interest rate risks that bonds carry.

- The hedged equity sleeve continued to capture equity market upside during the first quarter.

- We continued to find attractive choices for our convertible arbitrage sleeve in a robust new issue market.

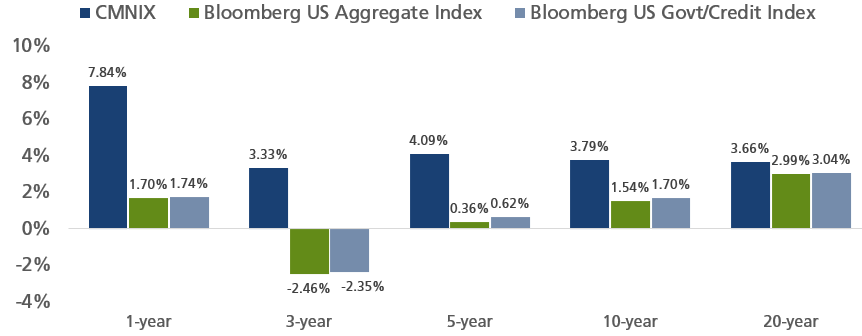

Traditional bonds came under considerable pressure during the first quarter, as investors cheered the continued growth in the economy and anticipated interest rate cuts even as they moderated their expectations for how many cuts would come. The Bloomberg US Aggregate Index slipped into negative territory, returning -0.78%. Calamos Market Neutral Income Fund continued to demonstrate the benefits of an approach with little interest rate opportunity or risk, posting a gain of 1.88%.

CMNIX: A history of outperforming bonds through interest rate and market cycles

Source: Morningstar. Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. All performance shown assumes reinvestment of dividends and capital gains distributions. The fund’s gross expense ratio as of the prospectus dated 3/1/2024 is 0.97% for Class I shares.

We are finding plenty of opportunities in arbitrage and hedged equity

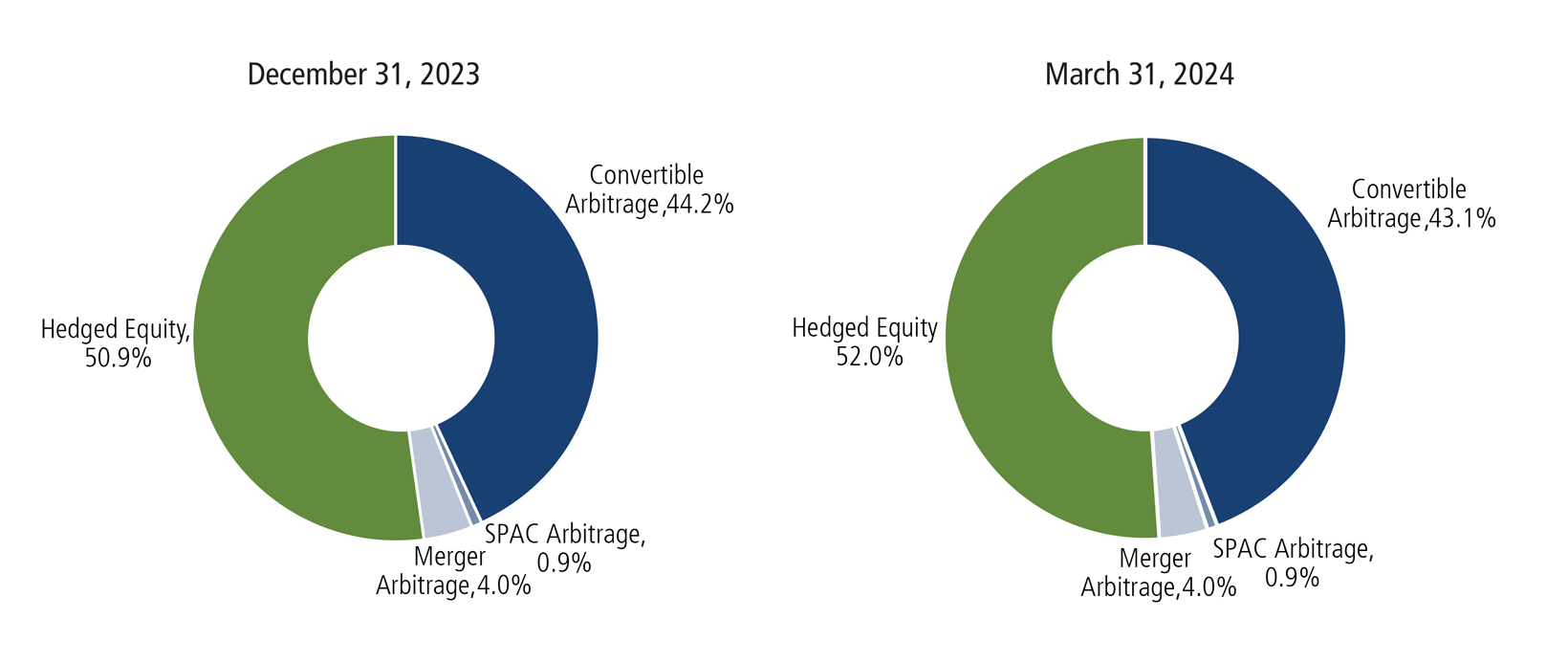

We actively manage the fund’s allocation between arbitrage and hedged equity. Reflecting our view of strong relative opportunities in both, we have maintained a roughly equal balance through recent months, with hedged equity currently representing a slightly larger allocation.

Over the past several quarters, we have increased our allocation to convertible arbitrage and merger arbitrage, while paring the fund’s book in special purpose acquisition company (SPAC) arbitrage. We entered the year with the lion’s share of assets in hedged equity and convertible arbitrage and left it largely unchanged over the quarter.

CMNIX allocation: Hedged equity and convertible arbitrage offer abundant opportunities

Arbitrage strategies. Our arbitrage strategies performed well overall in the first quarter. As we have discussed in our past commentaries, the returns of these strategies are traditionally linked to overnight money, with higher rates providing a boost. For example, convertible arbitrage is linked to overnight rates. The most direct link is the rebate we get on our short positions, which is typically at the fed funds rate, less a fee for borrowing the stock (generally around 50 basis points). Slower to come through, but just as important, is the rise in coupons that we’ve seen as new issues come to the convertible market and old, lower-coupon bonds mature or are refinanced.

Convertible arbitrage is the cornerstone of the arbitrage sleeve. Robust new convertible issuance with favorable terms (lower conversion premiums and higher coupons) is a key factor that underpins the appeal of convertible arbitrage today. The new issuance flow has given opportunities to participate in higher-octane names, but with a attractive risk/reward skew provided by the combination of the risk mitigation of the convertible structure and our hedge.

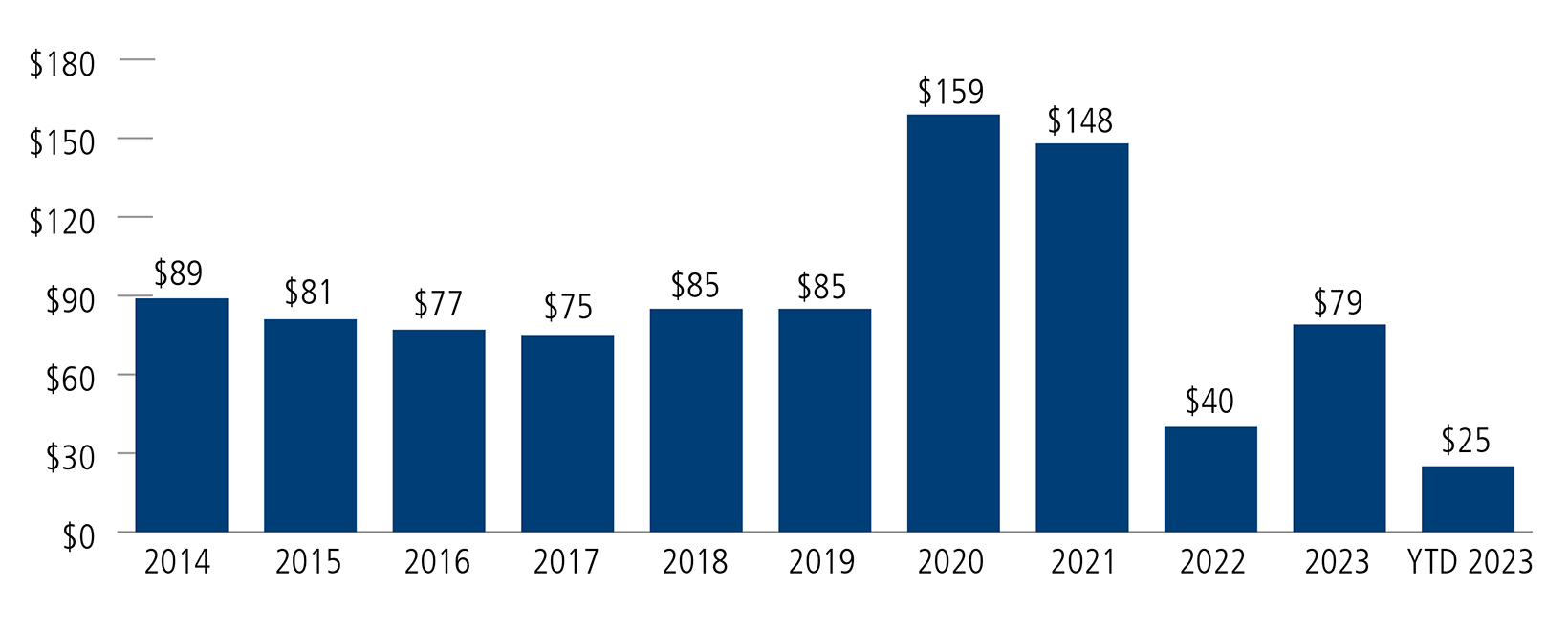

During the first quarter, global convertible issuance totaled $25 billion, well ahead of last year’s pace. US companies led, bringing nearly $21 billion in issuance. We expect that new issuance will continue to energize the convertible market, for at least the next year or two, given the large maturity walls approaching in the investment-grade bond, high-yield debt and convertible markets. With interest rates at current levels, we believe that many issuers seeking to refinance will decide that convertibles are the most attractive choice. We also anticipate increased breadth in the convertible market, with more investment-grade companies issuing convertibles.

Off to a brisk start

Source: BofA Global Research

Merger arbitrage. Merger arbitrage provides another way to pursue absolute returns with little correlation to the equity and fixed income markets. We expect to see more opportunities, supported by continued economic growth and stabilizing interest rates. The merger arbitrage space experienced some outlier events in 2024 but we believe that the current regulatory environment is likely to give way to a less harsh climate. For more on our outlook on merger arbitrage, see Co-Portfolio Manager Jason Hill’s commentary, “Macro tailwinds provide a catalyst for merger arbitrage.”

Hedged Equity. The fund’s hedged equity strategy continues to be positioned with minimal exposure to the S&P 500 Index’s downside. Our hedged equity sleeve has the lowest beta to the S&P 500 Index in the history of the sleeve, a reflection of the favorable dynamics in the option market. More specifically, we’re getting more money to sell calls, while put prices are reasonable.

Even so, we captured a respectable amount of the S&P 500’s gains during the quarter. This favorable asymmetrical capture was supported in part by the positive standstill yield that our hedge can generate in an environment of higher short-term interest rates. The recent rise in the fed funds rate flows through to the option market in higher call and lower put prices. (Co-Portfolio Manager Dave O’Donohue’s video blog “Higher Rates are an Opportunity for Hedged Equity Strategies” offers a good primer on how higher rates impact option pricing.) We intend to retain our higher delta hedge through 2024, as long it is still the most attractive one available to us in the option market.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P 500 Index is considered a measure of the US equity market. The Bloomberg US Aggregate Index measures the performance of investment grade bonds. The Bloomberg US Government/Credit Bond Index includes Treasuries and agencies that represent the government portion of the index, and includes publicly issued US corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements to represent credit interests.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Foreign security risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

024001b 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.