Investment Team Voices Home Page

Investment Team Voices Home Page

The Pendulum Swings Back Our Way

Brandon Nelson, CFA

Summary Points:

- We’re encouraged to see the market focus less on the macro and more on the micro (i.e., company-specific fundamentals).

- We see an excellent set up for small caps, supported by our expectations of Fed rate cuts, investor buying power and M&A activity.

- Stocks with strong fundamental momentum—the bread and butter of our funds— are positioned to outperform, in our view.

Continuing the momentum from the fourth quarter of 2023, stocks advanced during the first quarter. Large caps rose by 10% while small caps ticked higher by 5% as measured by the Russell 1000 Index and Russell 2000 Index, respectively. Interestingly, this advance occurred despite a rise in 10-year US Treasury bond yields.

This breaks a pattern and is an encouraging sign that the markets are getting more comfortable with the current interest rate environment. While the Federal Reserve is still important and will be watched closely, the market has become less obsessed with it, perceiving the interest rate tightening cycle to be largely complete. The bigger question now seems to relate to the timing of when the Fed will begin cutting interest rates.

This more benign interest rate backdrop has enabled the market to focus less on the macro and more on the micro, company-specific traits of each security. For several months prior to the March quarter, many stocks with strong company-specific fundamentals had been left in the dust. The first quarter proved to be a bit of a catch-up period during which some of those stocks were disproportionately rewarded for continued strong fundamental execution.

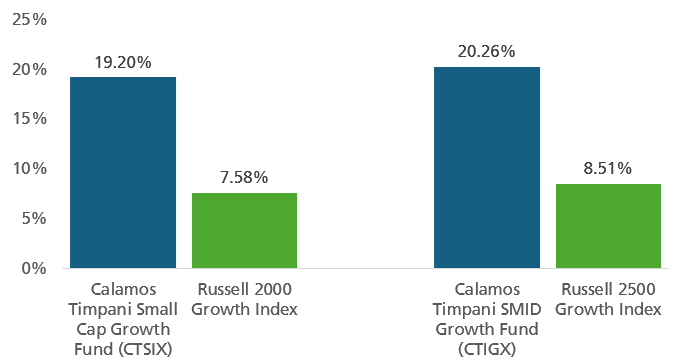

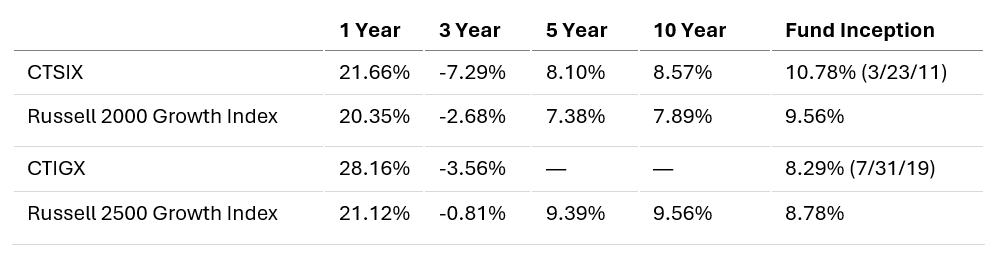

Calamos Timpani Funds: Positioned for the return of fundamental momentum

Source: Morningstar.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Funds’ maximum front-end sales load of 4.75%. Had it been included, the Funds’ return would have been lower. All performance shown assumes reinvestment of dividends and capital gains distributions. As of the prospectus dated 3/1/2024, CTSIX’s gross expense ratio is 1.12% and CTIGX’s gross expense ratio is 1.73%.

For instance, positive company-specific data points relating to generative AI (Gen-AI) drove excitement for many technology stocks. There is a tidal wave of Gen-AI related spending coming, especially tied to the build-out of data center infrastructure, something we’ve been highlighting for several months. But it wasn’t just Gen-AI related names that rallied during the quarter. Several industrial, health care, and consumer discretionary stocks with fundamental momentum also saw sharp increases in stock prices.

What does all of this mean for small and SMID cap stocks? We believe the set-up is excellent and that unlike large caps, the small cap bull market is just beginning. While the past cannot predict the future, we do believe it can provide valuable insights, and historically, a typical small cap bull market has lasted 34 months and has generated returns of 131%.1 We are only five months into this one, and valuations versus large caps continue to look extremely low (10th percentile).2 We expect the Fed will cut interest rates later in 2024, which typically has provided a disproportionate tailwind to small caps. Finally, heavy cash on the sidelines (buying power), a robust M&A environment (where takeover premiums are likely), and presidential cycle tailwinds (the fourth year of a presidential term usually has been relatively strong) add to the optimism.

With the small and SMID cap asset classes teed-up and the market focused more on companies with fundamental momentum (i.e., fast growth and underestimated growth), we believe the outlook for Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX) is exceptional. Both funds are loaded with exposure to companies with fundamental momentum. It’s been a sloppy couple of years as the markets were disproportionately fixated on macro issues. But now, the pendulum has swung back our way and a new upcycle has begun. We were ready for it and are beginning to reap the rewards.

Related post: CTSIX: Capitalizing on Fundamentally Driven Markets and Small Cap Catalysts, by John P. Calamos, Sr., Founder and Global CIO, and Scott Becker, CFA, SVP and Head of Portfolio Specialists

1 Source: 22V Research, “Who’s Next?” February 11, 2024. Data from 1980.

2 Source: Jefferies, as of March 31, 2024, valuations of small caps versus large caps, lower percentiles indicate more favorable relative valuations for small caps.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. Returns of more than one year are annualized

The Russell 1000® Index measures the performance of the large-cap segment of the US equity universe. The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the US equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. The Russell 2500® Growth Index measures the performance of the small to midcap growth segment of the US equity universe. It includes those Russell 2500 companies with higher growth earning potential. Unmanaged index returns, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund and Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of the potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

024014b 0424

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.