Investment Team Voices Home Page

Investment Team Voices Home Page

Déjà Vu … All Over Again

Eli Pars, CFA

Summary Points:

- Calamos Hedged Equity Fund benefited from the strong equity market move in the first quarter of 2024.

- The fund’s performance in the first quarter aligned with our goal of capturing S&P 500 upside with less exposure to downside.

- The 65/35 option trade we put into place earlier this year remains attractive, in our view.

Learn more about the three pillars of CIHEX.

- Seasoned options expertise

- Track record of downside risk mitigation

- Seeks to avoid sacrificing upside participation

As an equity alternative, Calamos Hedged Equity Fund employs an active options-based strategy to seek upside participation in the equity market while limiting downside exposure. Given the uncertainties in the market and the potential for the unexpected, we are dedicated to being favorably positioned for as many market outcomes as possible.

In 2023, the fund benefited from a rise in interest rates and a benign equity volatility environment, conditions which proved advantageous during the first quarter, as well.

The fund continues to be well served by our 65/35 trade. As we discussed in our previous commentaries (e.g., see “Focused on Capitalizing on—not Capping—Equity Upside”), market conditions gave us the opportunity to set up an especially attractive option trade, structured to pursue 65% of the market’s upside and 35% of the market’s downside at its expiration in December 2024.

This trade existed in part because a higher interest rate environment provided an attractive environment for us to sell calls, and these opportunities continue to be available to us, despite the rally we’ve seen in the equity markets. (For a deeper dive into why this trade represents an unusually compelling opportunity, see “CIHEX Set to Capitalize on What We’re Calling a Cicada Trade.”)

While the appreciation in the market moved the goalpost for our original trade, putting the trade on today would result in a similar risk/reward tradeoff. To balance the potential outcomes for longer standing and newer investors, we increased the fund’s downside risk mitigation a bit in March by selling calls and increasing our put hedge.

Conclusion

Markets can move quickly and strategies that are locked into static, rules-based approaches can expose investors to risks and limit upside opportunities. In contrast, we believe our active approach—combined with decades of options experience—provides us with an important edge. As we have noted, although our 65/35 trade could be considered a rules-based strategy on its face, our ability to adjust it as market conditions warrant is what makes the difference.

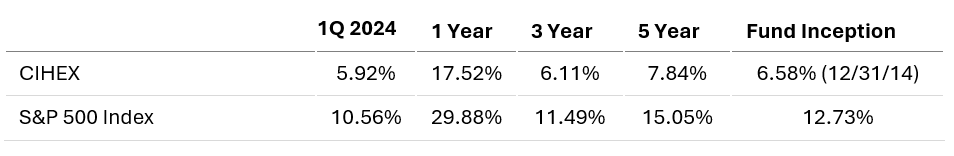

CIHEX: A History of Capturing Equity Upside, Managing Downside Volatility

Source: Morningstar. Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The fund’s gross expense ratio as of the prospectus dated 3/1/2024 is 0.92% for Class I shares.

Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P 500 Index is considered a measure of the US equity market. The Bloomberg US Aggregate Index measures the performance of investment grade bonds. The Bloomberg US Government/Credit Bond Index includes Treasuries and agencies that represent the government portion of the index, and includes publicly issued US corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements to represent credit interests.

The Morningstar Options Trading Category is comprised of funds that use a variety of options trades, including put writing, options spreads, options-based hedged equity, and collar strategies, among others.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

024014k 0424

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.