Investment Team Voices Home Page

Investment Team Voices Home Page

When Stocks Have Rallied off Bear Market Lows, Small Caps Have Stood to Gain

Brandon Nelson, CFA

- We expect markets to broaden, and small caps are likely to participate.

- History provides many examples of small caps outperforming large caps after the S&P 500 Index has rallied off bear market bottoms.

- We’re encouraged small caps outpaced large caps in June, with the Russell 2000 Index returning 8.1%, versus the S&P 500 Index, up 6.6%.

- We’re also encouraged that the market is rekindling its appreciation for stocks with above-average growth prospects and visible fundamental strength.

The second quarter’s market performance can best be explained by examining it as two halves. During the first half, concerns about US and global economic activity dominated everyone’s attention, with many investors particularly worried about the US regional banking system. During the second half, investors focused on the momentum of artificial intelligence (AI).

Although each half had unique catalysts, both led investors to buy the same types of stocks: mega-cap growth. In the first half, investors bought them for defense as a safe haven in a murky macro environment. In the second half, investors bought mega caps for offense because AI will likely be a revenue and profit driver for most mega-cap growth names.

While large-cap growth stocks were the star of the show during the quarter, many investors have commented on their discomfort with the concentration of the recent Nasdaq-led mega-cap growth rally, expressing concerns that the narrowness may be a sign of a flimsy, unsustainable rally. However, history shows that extreme Nasdaq leadership is often a leading indicator for broadening market strength.

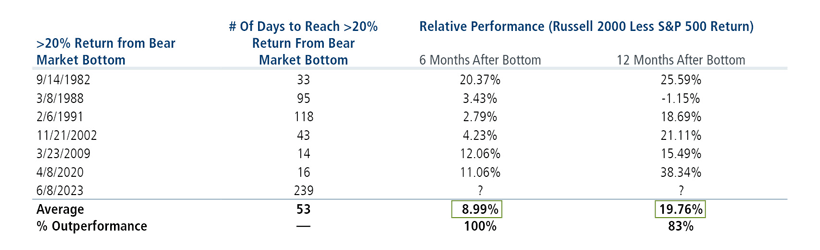

We believe the second half of the year is setting up advantageously for small caps, and we expect the narrow market leadership of 1H 2023 will broaden out to include small caps. Not only are small caps relatively inexpensive versus large caps currently, but they historically outperformed in the months after the S&P 500 Index has risen 20% above a bear market low. We believe the bear market low was in October 2022, and the index reached that 20% threshold gain on June 8, 2023. After past 20%+ rallies, small caps (as represented by the Russell 2000 Index) have historically outperformed large caps (as measured by the S&P 500 Index) by about 9% over the following six months and by about 20% over the following 12 months (Figure 1).

Figure 1. Small-cap performance after bear market bottoms and confirmation of new bull markets

Past performance is no guarantee of future results. Source: Piper Sandler Technical Research and Bloomberg.

We believe Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX) are well positioned. Our funds are tilted toward stocks that we believe offer above-average growth prospects and very visible fundamental strength. Stocks with those characteristics were out of favor for most of 2022, but since early February 2023, many of those stocks are back on track with the market. The funds have an especially strong representation in technology, where we have found several stocks poised to benefit from the emergence of AI. For more on the small and mid-cap opportunities in the AI ecosystem, see our post, “Active and Nimble: Finding Small- and Mid-Cap Opportunities in a Dynamic AI World.”

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund and Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Past performance is no guarantee of future results. The S&P 500 Index is a measure of large-cap US stocks and the Russell 2000 Index is a measure of small cap US stocks. Indexes are unmanaged, do not include fees or expenses and are not available for direct investment.

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.