Investment Team Voices Home Page

Investment Team Voices Home Page

Active and Nimble: Finding Small- and Mid-Cap Opportunities in a Dynamic AI World

As recently as late last year, AI to many seemed like science fiction, and most people had little concept of how AI could affect our lives in countless, complex ways. All that changed with OpenAI’s rollout of ChatGPT late last year. Suddenly, AI was the new tech juggernaut crashing upon the scene in both exciting and unsettling ways.

Many investors are now grappling with what AI means for businesses across the economy, especially after one tech company that produces the gold standard of GPUs for powering AI posted an upside earnings revision that was earth-shattering. Meanwhile, certain companies providing online educational tools, IT services, and business-process outsourcing are being perceived as potential losers.

What If This Is Just Another Dot.com Bubble?

At this point, we don’t see AI as a bubble—revisions are just beginning to move higher for companies. Even though AI has been talked about for years, dedicated investment dollars are just starting to flow. A spending inflection seems to have started with the recent ramp in the popularity of ChatGPT. Companies are well aware of AI and don’t want to be caught flat-footed. In order to stay relevant and also improve efficiency, corporate management teams feel urgency to invest in AI. It’s early in the spending ramp, and there is still plenty of skepticism among analysts/investors—it seems too soon to call it a bubble.

How We Are Participating in AI Opportunities

A lot of attention has been given to what the mega caps are doing with AI, but there are many opportunities for small- and mid-cap companies in a rapidly evolving AI ecosystem.

Even before the previously mentioned GPU manufacturer’s earnings announcement, we had been adding exposure to the AI theme within Calamos Timpani Small Cap Growth Fund and Calamos Timpani SMID Growth Fund. Most of our recent investments relate to carefully increasing exposure to high-powered computing within data centers. This includes selective small- and mid-cap investments in semiconductors, servers, server cooling technology, data center buildouts, connecting cables used within data centers, etc.—really anything in the food chain of where AI dollars are being spent by the household-name hyperscalers in online retail, search, and software.

For many small companies, this spend represents revenue growth and profit margin expansion that’s being underestimated by the analyst community. We seek companies with fast and underestimated growth, thus this set-up is right in our wheelhouse. And because these are smaller companies with lower revenue bases, small amounts of incremental revenue can significantly move the needle.

The Importance of Active Management in the Age of Machine Learning

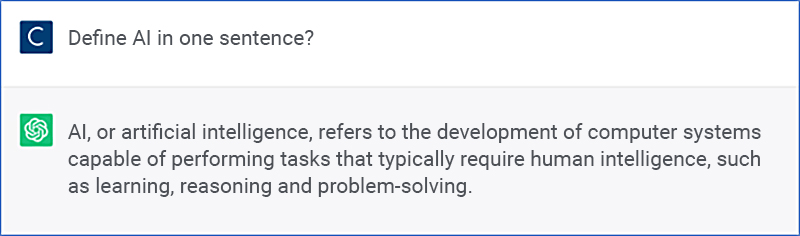

If you ask ChatGPT about AI, this is what you get:

Source: ChatGPT.

Of course, there’s a lot more to AI than this—especially for investment managers. We’re not only looking at fundamentals, but also the emotion in the markets. We believe our funds’ shift toward AI highlights the advantage of being an active manager with minimal decision-making bureaucracy. We can respond quickly to changes in the market like the recent ramp in generative AI spend, whereas a passive index fund couldn’t pivot like that.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund is subject to risks, and you could lose money on your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The Fund also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

821086 0623

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.