Investment Team Voices Home Page

Investment Team Voices Home Page

The Easy Part of 2023 Is Behind Us

- By late summer, the easy part of “fixing inflation” gives way to the harder part. This may be the key driver of markets into autumn and determine whether we see a hard or soft landing in 2024.

- Disinflation momentum has been the key narrative, but the entry point for this trade was last October. We see a wide dispersion of possible outcomes for what comes next.

- Beyond summer, rising volatility seems inevitable as investors await the resolutions of key debates, including the one over Fed policy.

As we discussed in “A Very Different Decade Ahead,” there is a further mild upside for equities, but equities are not in a new bull market. The end of “free money” implies the investment landscape is being reconstituted. We anticipate a new set of winners and losers in coming years versus those that characterized the long era of excessive monetary accommodation.

Growth stocks can lead as interest rates stabilize but selectively for two reasons. First, the removal of excess liquidity by central banks will be extended. Second, corporate profitability for many has peaked structurally (with the reversal of globalization and quantitative easing). Across industries, Calamos Phineus Long/Short Fund’s positioning emphasizes quality and profitability within sensible valuation parameters. This style “wins” as long as investors believe a recession is only a matter of time.

- In Technology, we emphasize GARP quality, while avoiding names without valuation support. We have tactical positions in the semiconductor industry as investors wrestle to identify the winners and losers of an AI future. (See our post, “The AI Foreshock—Evaluating Potential Winners and Losers.”)

- Financials are an “Up Cycle” group, but investors are fixated on the inevitability of recession. We have reduced exposure materially in the past year. The profitability of banks is more in question today than in past decades due to normalized interest rates and, thus, higher funding costs and more competition for deposits.

- The US Consumer is in pole position globally, though the bigger story is the shift from goods to services. The latter is a long way from normalization. We favor a range of businesses that benefit from structural undersupply in air travel and sustained strength in consumer leisure.

- In Energy, structural underinvestment has been overshadowed by slower global growth and war-related inventory excesses. The key swing factor may now be Chinese economic growth—a dominant source of incremental demand. For China, the pandemic years have likely camouflaged the dawn of numerous structural headwinds.

- Consumer Staples are vulnerable to normalized rates and challenged to pass through cost inflation. We see capital rotating into other stable businesses with stronger pricing power like railroads, industrial gases and defense contractors.

- Valuations in Healthcare have been reset as the pandemic distortions are largely worked through. We look for opportunities to add.

Chair Powell has been tightening the screws of monetary policy and so far winning the battle to return markets to the promised land of Goldilocks. Equally important has been the story of economic resilience. Investors and the Fed alike no longer anticipate a US recession in the second half of 2023—contrary to consensus thinking in late 2022.

But we see the easy part of 2023 giving way to a murkier horizon this autumn. All of these key debates—the path of inflation, rising recession risk and Fed policy—will become less friendly for risk assets, reinforcing our view that investors should embrace a more tactical and cyclical approach to equity allocation, and to style and security selection.

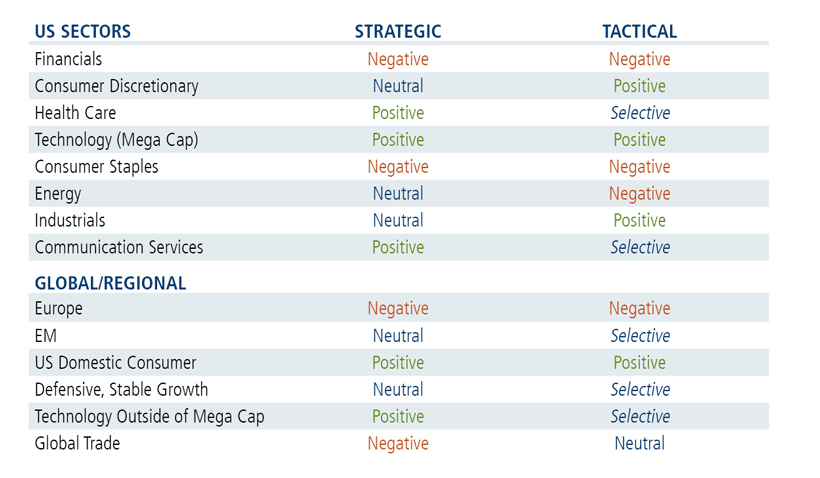

CPLIX Positioning Outlook

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

Growth at a reasonable price (GARP) describes firms with superior top-line growth that are not excessively valued on earnings.

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.