Investment Team Voices Home Page

Investment Team Voices Home Page

The AI Foreshock—Evaluating Potential Winners and Losers

Like most people, we have been trying to wrap our minds around AI and what it means for different industries and companies.

With the launch of ChatGPT this past autumn and Microsoft’s investment in OpenAI earlier this year, it feels a bit like the iPhone moment in 2012 or the Netscape IPO in 1996, when something goes from hype to a harbinger of broader change. If AI really is a major new wave in technology along the lines of the internet, mobile and the cloud, expect a lot of market cap to be built and destroyed.

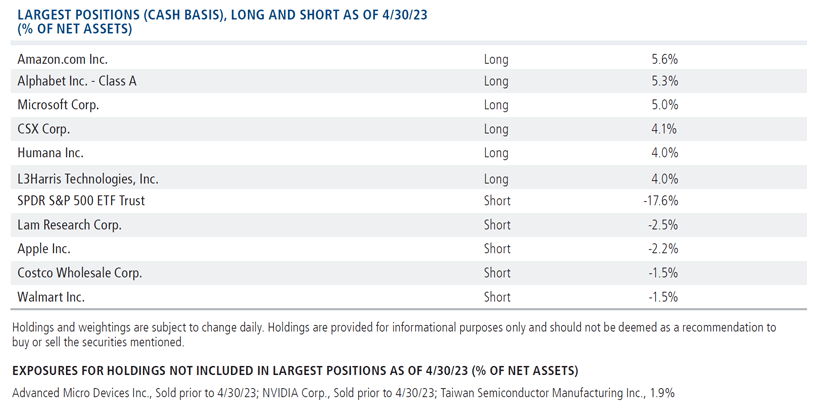

The Calamos Phineus Long/Short Fund’s top three long holdings—megacaps Microsoft, Alphabet and Amazon*—are currently viewed as early winners. The fund has made tactical trades in NVIDIA* and Advanced Micro Devices,* and maintains positions in other leading semiconductor names like Taiwan Semiconductor* that are likewise potential beneficiaries.

Understanding the opportunities is a work in progress, and one where our proprietary depth of research will serve us well. Our team has been working to identify areas that stand to gain or lose the most from AI as well as which companies are ahead of—or behind—the curve.

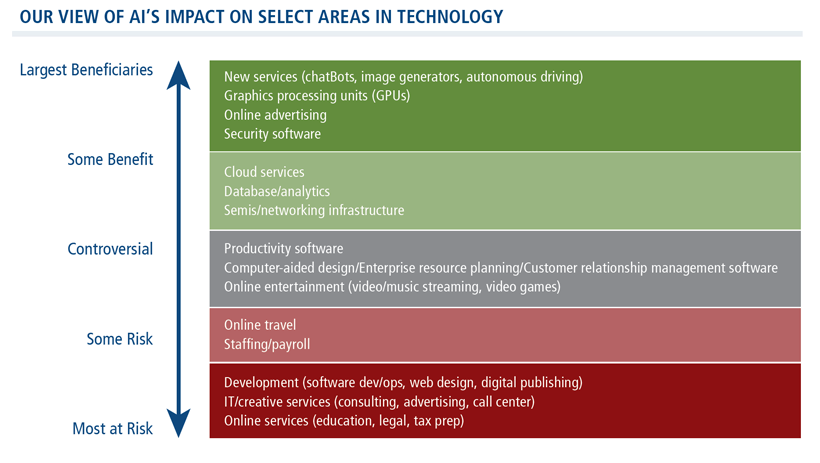

A host of investment banks have assembled baskets of AI winners and losers, but there is little agreement. Some companies that sit in the AI winner baskets at some sell-side shops are in the AI loser baskets at others. For example, semiconductor companies that some see as AI winners may lose in other parts of their business if AI sucks much of the oxygen out of the room and IT budget dollars get diverted away from things like PC upgrades or enterprise application deployments. There’s growing concern that online services that can be enhanced by AI engines—in areas such as education, legal and tax preparation—are most at risk.

At baseline, AI promises to improve productivity, especially in areas that involve creating large amounts text, video and software. This has led to a debate over what AI means for industries like publishing, advertising, software development, and IT consulting if one person with the help of AI can potentially do the work of two or many more.

How much markets grow or shrink will depend on whether productivity enhancements lead companies to find new uses and create more demand for their products and services or, alternatively, lower costs and reduce headcount. How much of their incremental margin companies can keep rather than cede to tech vendors will also affect the economics of many different industries.

AI potentially creates winners and losers in markets based on who’s ahead or behind the curve in adopting it—and who has the scale and capacity to spend on it.

Key Dynamics in AI

Software harnessing AI will become more powerful, allowing vendors to charge more and customers to do more with fewer users. This is the latest extension of the basic technology ROI case: spending capex to save opex. For example, can Microsoft charge twice as much for Office with CoPilot if it allows one user to do the work of three? For many software companies and their customers, they will need to strike a new balance based on this improved productivity, weighing positive implications for pricing against negative implications for headcount and license seats. Investors are wrestling with whether this balance tilts positively or negatively for key product segments. Who has the pricing power, and which franchises are defensible from the threat of upstarts if barriers to competition are lowered?

Across digital content areas like gaming, advertising, and video/audio streaming, AI tools make it dramatically easier to create better content. Video games get better and cheaper to create, a positive for video game publishers, but do new independents emerge or are there new competing demands on gamers’ time? With streaming, there is a key distinction between licensed and unlicensed content. Streaming services own and rent rights, and that model isn’t going away. AI potentially helps them acquire and create more popular content and target ads better. But the risk is that user engagement and subscriber numbers fall if alternatives like YouTube become more compelling.

Online advertising businesses will benefit from more content and pageviews and better ad targeting, with the largest companies advantaged over smaller peers given the scale requirements to deploy AI. Brand advertising firms are at risk of disintermediation but could conceivably benefit from the ability to produce more and better content with fewer creative staff. Digital publishing and website design can be done by fewer people with much less training. The high end of the market could see seat count attrition, and the low end potentially could see growth in consumers, hobbyists, and influencers creating content. Can the latter opportunity more than offset the former risk?

Some online services seem highly at risk, but new ones are set to emerge. Online education, online legal advice, online tax prep (Intuit) could be replaced by AI versions or at least face competition from new entrants if barriers are lowered. Online travel agencies that potentially face more acute competition from Google and other platforms could be less relevant if not obsolete. AI potentially enables other services that were previously unimaginable, the most notable being chatbots, image generators, and autonomous vehicles.

Labor-intensive segments of IT are at risk. Consulting, outsourcing, contact centers, temporary staffing all appear vulnerable. Within consulting there’s debate over how much strategic advisory firms will benefit from helping clients adopt and incorporate AI versus feeling the pinch as more basic corporate projects are done internally rather than outsourced.

Select areas of semiconductors will benefit. Graphics processing units and server connectivity appear to be the clearest winners. Areas like memory, hard disk drives, and broader networking will potentially see incremental demand from AI initiatives but a portion of this likely represents a shift in demand away from traditional computer infrastructure. Benefits to other areas of the semiconductor space like analog and semiconductor capital equipment appear limited.

Much of the rest of tech is a big question mark. A lot of AI development likely happens on the major cloud providers with Microsoft and Alphabet seemingly ahead of Amazon for now. Enterprise systems, hardware, and applications appear challenged by reduced headcounts, although some vendors may be able to benefit from the broader growth in data. Security should benefit from more bots, traffic, and content expanding the general threat environment. Apple*, much like Amazon, has been notably quiet so far on AI.

In this Brave New World of AI, Experienced Active Management Will Be Vital to Success

There is a lot to be learned about which areas pose the ripest opportunities for AI development and where the largest potential monetization or best new business models lie. Beyond OpenAI, we expect a quickening flow of small companies making splashy announcements and big promises in the coming years. Much of our discussion here has focused on the views of large public companies (and their bankers) but we may find that a lot of innovation and the ultimate direction of where things head originates from small companies with a group of talented developers and a vision.

It is early and remains to be seen what kind of return-on-investment companies get on their AI spend. Of course, no one knows at this point exactly how these developments play out. When it comes to revolutionary technology, investors usually get the direction right, but they tend to overestimate the rate of change and the number of winners. We have navigated major inflections before and are confident that our decades of experience position us well to manage the inherent imprecision and capitalize on the changes that AI portends.

For additional information about the potential long-term benefits of including Calamos Phineus Long/Short Fund (CPLIX) in an asset allocation, please contact your Calamos Investment Consultant at 888-571-2567.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

*HOLDINGS INFORMATION: CALAMOS PHINEUS LONG/SHORT FUND

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund is subject to risks, and you could lose money on your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The Fund also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of the potential for unlimited losses, leverage risk, and foreign securities risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less-developed countries.

Alternative investments may not be suitable for all investors. The Fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The Fund may lose money should the securities the Fund is long decline in value or if the securities the Fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

The portfolio is actively managed. Holdings, sector weightings, net exposures and geographic weightings subject to change daily.

821083 0623Q IO

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.