Investment Team Voices Home Page

Investment Team Voices Home Page

Setting Out the Bullish Case for China

Kyle Ruge, CFA

Throughout 2020, we set out our case for why China offered especially attractive investment opportunities—a view that has been validated over recent months by macro data, policy developments, and company-specific results. Looking ahead to the remainder of the year and beyond, we believe China’s growth story provides abundant potential for our active approach. In this post, we’ll highlight some of the reasons why Chinese companies are well represented in our global and international portfolios, and why we see long-term tailwinds for select Chinese companies.

-

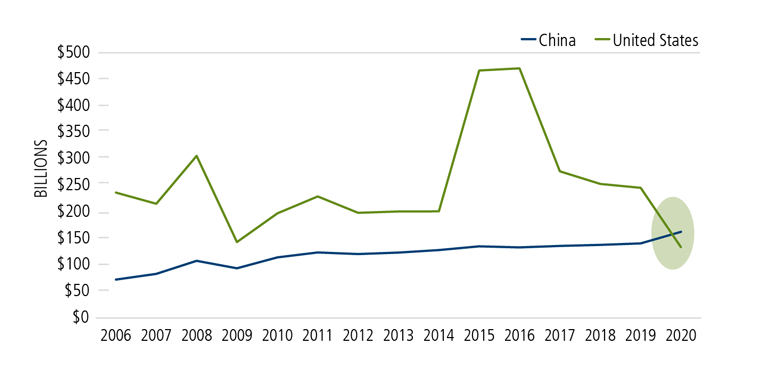

China continues to move forward with its strategic aspirations to be a destination of foreign investment. Over recent years, policymakers have taken gradual but deliberate strides designed to promote increased investor inflows and access into China. These have paid off, and investors are flocking to China. As shown in Figure 1, in 2020, foreign direct investment flows into China exceeded those into the United States for the first time.

Figure 1. In 2021, China garnered more FDI than the U.S.

Source: Macrobond. USD terms, inward flows at current prices.

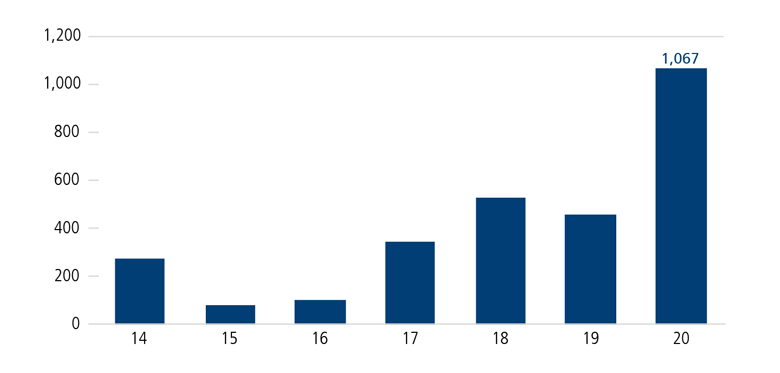

Total inflows into Chinese onshore debt also strengthened throughout 2020, as interest rate normalization created a relatively more attractive interest rate environment for foreign investors. A focus on expanding foreign access to equities has continued in 2021 with China’s announcement that it will make some A-share names listed on its STAR Board available to foreign investors through the Hong Kong Stock Connect program. Launched in 2019, the STAR Board is China’s version of the Nasdaq exchange and includes some more innovative and technologically oriented A-share companies. Our team provided an overview of the market and its significance to China’s long-term growth narrative in our 2019 post, “Wish Upon a STAR: A Q&A About China’s New Stock Exchange.” We are excited as this expanded access increases the opportunity set of interesting growth businesses for investment consideration.

Figure 2. Inflows into Chinese Bonds Soared in 2020

Annual China Bond Inflows, RMB (bil)

Source: Macquarie, “The Other Side of Deglobalization,” January 14, 2021, using PBoC, WIND, Macquarie Macro Strategy, January 2021.

-

Chinese businesses are positioned to enjoy a longer runway for key secular trends, while leading the world in others. For example, the cloud software industry in China is in a more nascent stage versus in the U.S. and Europe, and offers “more room to run” especially given the likelihood of de-globalization. Also, in many industries, Chinese companies are setting the pace to beat, such as in 5G technology where we see strategic policy decisions amplifying opportunity. (See our posts, “China’s Cloud Software Industry: Long Runway Supports Secular Growth Potential” and “Investing in Technology Innovators: The Benefits of a Global Approach” for more.)

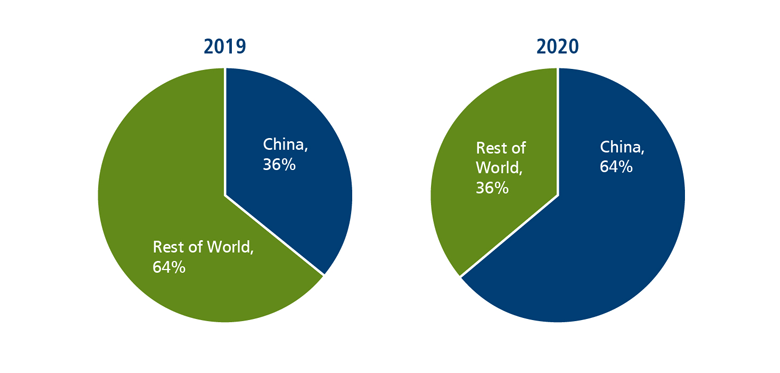

The strength in Chinese companies is reflected in technical as well as fundamental terms, with Chinese stocks making up the largest contingent of the world’s best performing companies last year. In 2020, Chinese companies made up 64% of the top 50 performing companies globally, up from what was an already strong 36% level in 2019.

Figure 3. In 2020, nearly two-thirds of the world’s top-performing companies hailed from China

% of 50 top-performing companies in the MSCI ACWI

Source: Bloomberg. Past performance is no guarantee of future results.

-

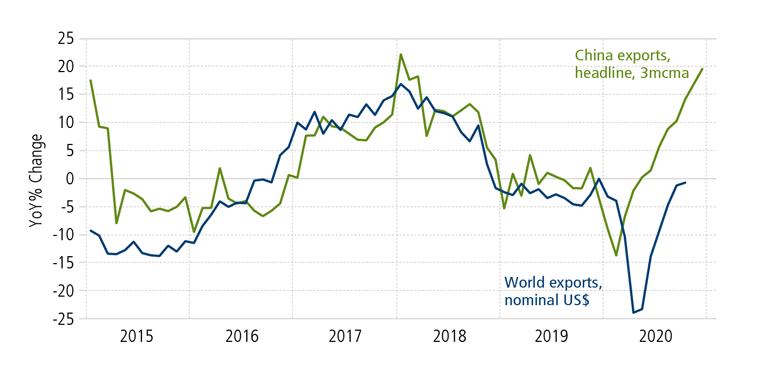

China benefits from being first-in, first-out of the pandemic. Cultural and societal norms enabled quick responses to the pandemic in China. As a result, China became—and remains—well-positioned to be a key source of goods and exports as economies across the rest of the world recover from the pandemic. This has and will continue to provide strength to the overall Chinese economy, helping offset declines in domestic demand that initially occurred as a result of the pandemic.

Figure 4. China’s exports continue to outperform world exports

Source: Gavekal Dragonomics/Macrobond, “For Exports, It’s Stronger For Longer,” January 14, 2021.

-

China can benefit from a less acrimonious trade relationship with the Biden administration. Although a change in administration will not change the trajectory of separation we expect to occur between the U.S. and Chinese economies over the long term, U.S. policy toward China will be less volatile and more traditional and transparent over the near term. A reduction in headline risk can provide investors with more comfort when making decisions to allocate capital to China.

-

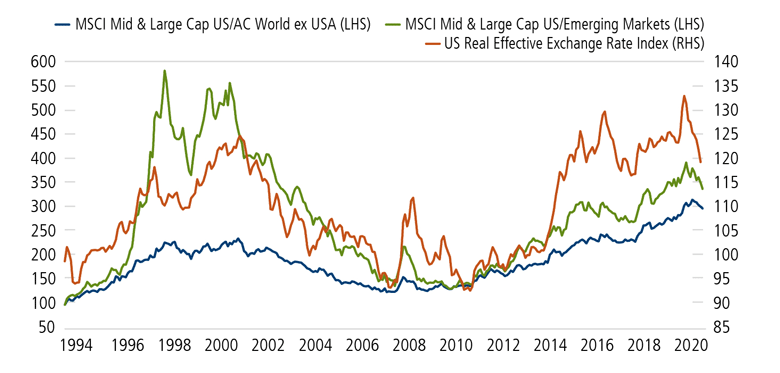

A weak dollar regime benefits China as part of a broader tailwind to emerging markets. When the U.S. dollar is strengthening, it puts pressure on emerging markets to fund growth. When the dollar is weakening, the opposite typically holds true. (See our post, “Cyclical Themes: Outlook for the U.S. Dollar.”). As a result, emerging market stocks have tended to outperform during weaker U.S. dollar environments.

Figure 5. In weak USD environments, ex-U.S. equities have tended to outperform

Source: Macrobond. Indexes are total return, USD terms.

Conclusion

Economic fundamentals, strategic policies, a weak dollar and a range of cyclical and secular tailwinds support the bullish case for Chinese equities. A growing number of Chinese companies have joined the ranks of global innovators and top performers, and we only expect this trend to continue. We believe our team’s understanding of the top-down forces and bottom-up fundamentals shaping the Chinese economy and its equity market will serve the Calamos global and international portfolios in good stead in this current phase of the economic cycle—and well beyond.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The MSCI ACWI measures the performance of equity markets in developed and emerging economies. The MSCI ACWI ex US measures the performance of equity markets in developed and emerging economies, excluding the United States. The MSCI Emerging Market Index measures the performance of emerging market equities. The MSCI US Index measures US equity market performance for large and mid cap stocks.

18869 0220O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.