Investment Team Voices Home Page

Investment Team Voices Home Page

Investing in Technology Innovators: The Benefits of a Global Approach

Global Team Perspectives by Alex Wolf, CFA

As global growth investors, we see many compelling investment prospects across the technology industry. Currently, we believe the opportunity set may even be more favorable in non-US companies. For example, 5G is an important global theme that many investors are focused on, but the U.S. might not be the best place to access it. China is investing heavily domestically in 5G, and there are also many other non-U.S. companies that have solidified themselves within key parts of the value chain.

China is projected to spend $145 billion on 5G over the next five years,1 which could be double the 5G spend of the U.S. The first 5G networks have already been turned on in China with the big 3 telecom providers announcing available 5G plans across 50 cities. Expectations are that 28% of China’s mobile connections will run on 5G networks by 2025, and the government has announced it expects more than 100,000 base stations will be activated by the end of 2019.

5G is an important next step in the advancement of wireless technology, featuring high bandwidth, low delay, and increased capacity to enable the next steps of digital transformation. It will touch many areas, not just improved connectivity for cell phones. Peak download speeds can be as much as 60x faster than 4G. The increased capability will improve industrial automation, Internet of Things devices, sensors, mobile robots, machine vision and other automated technologies while also enhancing supply chain and inventory management. 5G will also touch connected automobiles, smart retail, remote surgeries, and virtual reality/artificial reality. The reach of 5G is staggering: In 2035, global 5G enabled economic output will be $13.2 trillion dollars, according to projections from IHS Markit.2

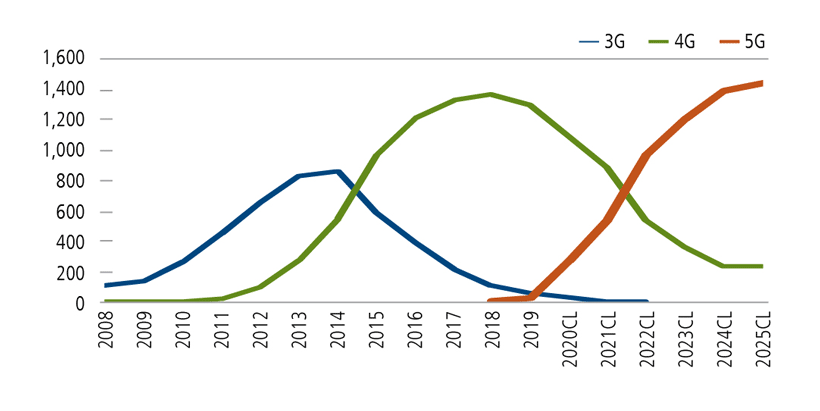

Source: CLSA, “Global technology, Sector outlook,” July 19, 2019, using CLSA and CLST.

The buildout of 5G will be a long process before reaching full adoption of the highest frequencies, with earlier stages seeing 5G and 4G acting congruently. We view China as a great setting for the initial adoption of 5G, supported by a political willingness to spend and a digitally savvy population that can adopt tech very quickly.

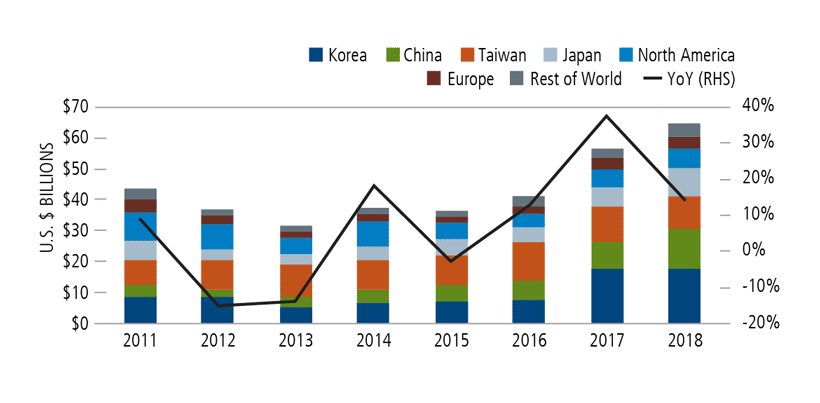

The economic opportunity spans across consumption of new phones, increased demand of leading-edge semiconductors, and manufacturing equipment and robotics. 5G needs signal towers, base stations, distributed services, and mega-scale centers to house data. The companies that cater to this include many Chinese domestic entities. Many companies outside of China are also participating, although the trends are certainly moving away from U.S. companies as China works to insource its supply chains. Technology players throughout Asia and Europe will benefit, including Japanese automation companies and Taiwanese semiconductor companies.

Source: CLSA, “Tech in colour: Macro, bottom-up themes forecast blue skies for 2020, January 2020, using SEMI and CLSA.

Around the world, the trade war and globalization tensions have created opportunities for domestically focused companies across many industries and technologies. There are strong desires to build up national industries amidst a growing political frustration with expanding U.S. big tech, creating opportunities for those that can seize them. Examples of this include Germany launching a European Cloud, called Gaia-X, with the sole purpose of giving European firms a non-American or Chinese option to retain sovereignty over their data. This is on top of a vastly changing landscape in Europe, where we’ve seen the EU impose regulations to guard data privacy and improve competition, while France has threatened a tax against U.S. big tech companies.

Moving beyond these broader themes, our investment process next focuses on finding best-in-class innovators that have cemented their place on the global tech value chain. This is especially evident within the semiconductor industry, where we believe specific companies have built up sufficient moats and economies of scale to allow them to remain at the leading edge for 5G and beyond. Continued evolution and investment in these areas can further bolster the moats these companies have as they widen technological gaps and differentiate themselves versus peers.

Conclusion

The global technology ecosystem is an exciting growth theme—and it’s an area where global and international approaches are likely to have a real advantage as the ecosystem continues to evolve and grow.

1 Reported in China Daily, from an original estimate from a report by the Global System for Mobile Communications Alliance.

2 IHS Market, “The 5G Economy, November 2019”

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific companies, securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to buy or sell. Investing in non-U.S. markets entails greater investment risk, and these risks are greater for emerging markets. The above commentary for informational and educational purposes only and shouldn’t be considered investment advice.

18758 0120O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.