Investment Team Voices Home Page

Investment Team Voices Home Page

5 Reasons for Small Caps and Calamos Timpani Small Cap Growth Fund (CTSIX)

We’re very excited about what we’re seeing in small caps and believe the tide is turning after a difficult 2022. Valuations are attractive, and there is growing evidence that a small cap leadership regime is in its early innings. And while we’re encouraged about small caps as an asset class, we’re even more optimistic about small cap growth stocks and the opportunities we see for Calamos Timpani Small Cap Growth Fund (CTSIX). We have a time-tested, repeatable process and believe we are just six months into what is likely a multiyear upcycle for our investment style. Here are five important takeaways:

-

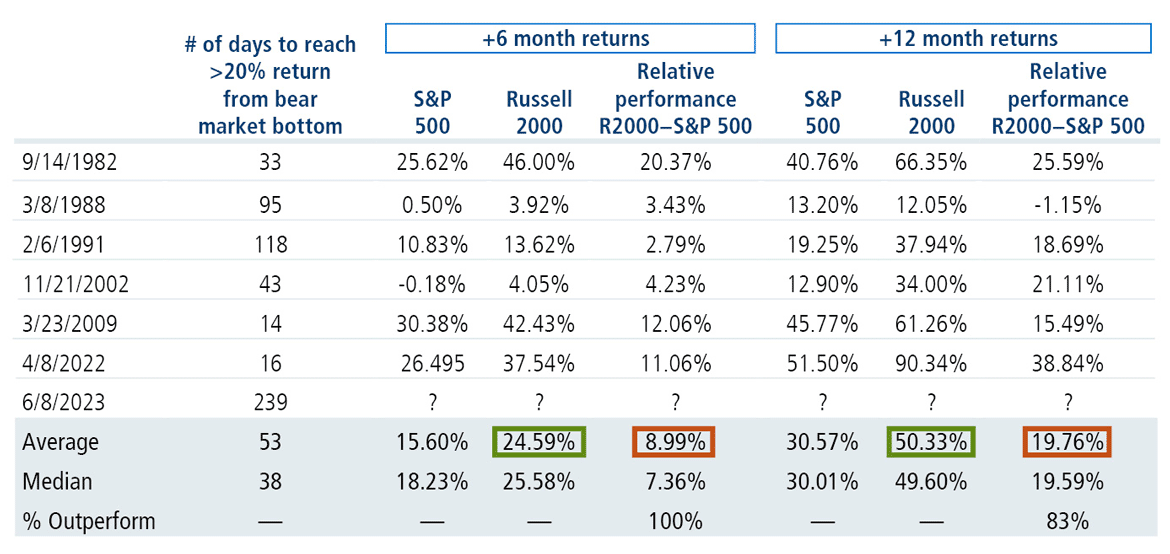

When the S&P 500 Index has rallied above bear market lows, small caps have outperformed

Historically, small caps have posted strong performance after the S&P 500 Index rallied more than 20% off bear market lows—both in absolute terms (highlighted by the green boxes in the table below) and relative to large caps (orange boxes). Just a few weeks ago in June, the S&P 500 gained 20% above its bear market low in October 2022. We believe crossing this threshold is a positive for all stocks, but especially small caps relative to large caps. In June and July, small caps outperformed large caps by a total of 467 basis points. Two months isn’t a long time, but it’s still something we believe is worth paying attention to, especially as part of the bigger picture that’s coming together.

Small cap performance after bear market bottoms and confirmations of new bull markets

Since 1980

Past performance is no guarantee of future results. Source: Piper Sandler Technical Research and Bloomberg.

-

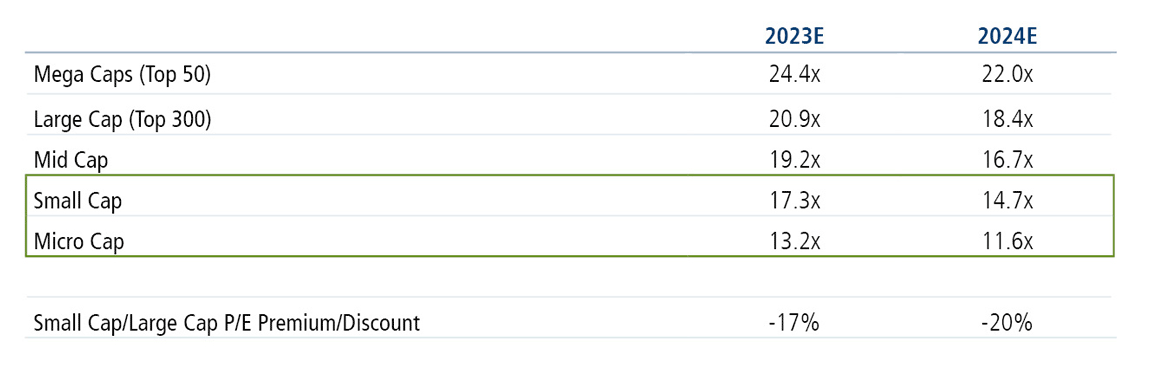

We believe small caps are cheap on both an absolute and relative basis

A lot of mega caps carry high price tags, but the chart below shows how inexpensive small caps are. The smaller you go, the more attractive the price-to-earnings ratios are for both 2023 and 2024 earnings estimates.

Small caps and micro caps: Attractive valuations

Past performance is no guarantee of future results. Source: The Leuthold Group. Data as of 7/31/23. Small Cap/Large Cap P/E Premium Discount is a measure of the degree to which the price/earnings ratios of small caps are greater or less than those of large caps. A negative value, or discount, indicates that price/earnings ratios of small caps are less than those of large caps. Price/earnings ratios measure the price of a stock relative to its earnings per share.

-

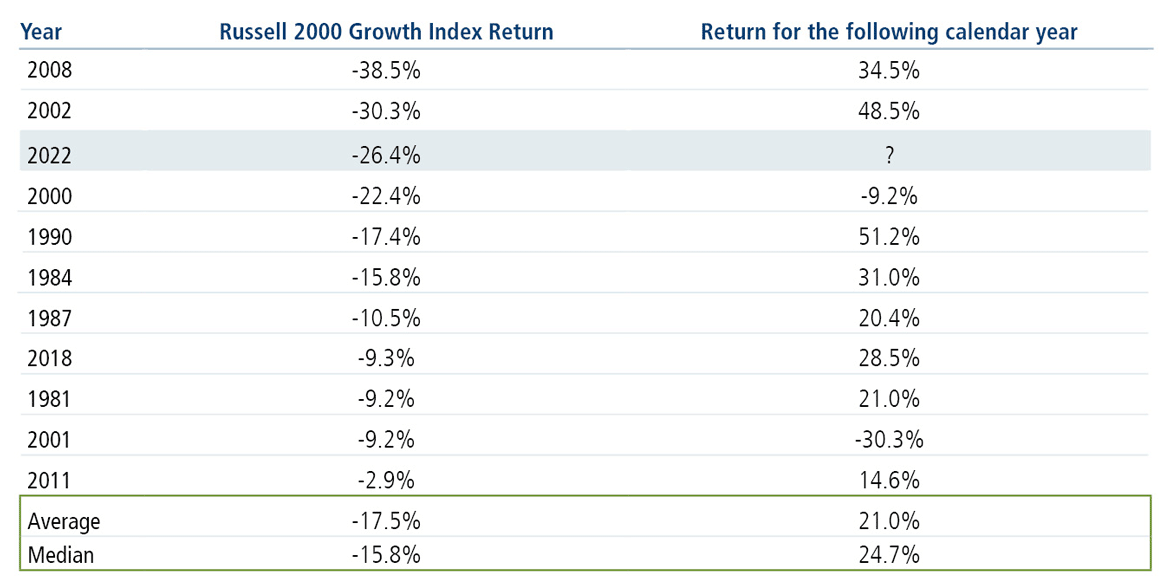

Historically, bad years for small cap growth stocks have been followed by good ones

Past performance doesn’t guarantee future results, but it can provide meaningful context. More often than not, small cap growth stocks have rebounded strongly after down years.

Small cap growth stocks: A history of bounce backs

Past performance is no guarantee of future results. Source: Factset, FTSE Russell, Jefferies.

-

The current environment is a good backdrop for our bottom-up approach

We follow a time-tested, repeatable, fundamentally driven process to identify fast-growing companies poised to exceed earnings expectations for the next several quarters. For the past 20 months, markets have been driven by macro factors that favored large caps relative to small caps, and small cap stocks with strong growth fundamentals have often been overlooked and underappreciated. This created headwinds for our approach, but we are starting to see a shift back to a market where company-specific fundamental momentum matters more.

Below, we show correlations since December 2001. As the graph shows, correlations in recent months are falling among small caps. Falling correlations are a sign that the market is willing to embrace company specifics—in other words, it’s more of a stock picker’s market. We expect that companies with good earnings and growth characteristics will be rewarded, and the bad will be punished. That’s an environment we believe sets up well for our approach because we believe history has shown that we’re good at identifying companies with strong fundamental profiles.

Company specifics matter more when correlations are lower

Russell 2000 Index, pair-wise correlations in small caps, based on quarterly rolling periods

Past performance is no guarantee of future results. Source: FactSet, Lipper Analytical Services, FTSE Russell, Jefferies. Pair-wise correlations indicate the historical degree to which a pair of variables (such as two stocks) have been linearly related or moved in relation to each other. Higher pair-wise correlations indicate that the variables have shown a closer linear relationship in their moves than if pair-wise correlations were lower. The data in this graph shows that the most recent pair-wise correlations of stocks in the Russell 2000 Index were lower than average.

-

AI growth opportunities in the small cap and mid cap world

If we’re in a stock picker’s market, the next logical question is “where are these opportunities?” In our view, the answer is all over the market—health care, industrials, consumer plays and of course, technology, including AI. Although the mega cap AI names in the headlines are out of bounds for us, there are a lot of other ways to play AI in the small and mid cap world. By and large, our participation at this point is through periphery plays related to AI-enabled data center buildouts and reconfigurations. The semiconductors made by certain large cap companies need to go into high-performance computing servers. These servers are placed within server racks and need to be connected to other equipment. These AI-enabled servers require substantially more power. More power means more heat is generated, which means more cooling tools are required. Small cap and mid cap companies are playing an important role in all of these areas. The table below shows some examples of companies that meet our criteria.

Small cap and mid cap companies: Key to the AI data center buildout

Industries Examples in CTSIX Servers Super Micro Computer (SMCI) Power and Thermal Management

(data centers run hot!)Vertiv (VRT) Semiconductors/Connectivity Credo Technology (CRDO), Smart Global (SGH), Arteris (AIP) Data Networking Extreme Networks (EXTR) Data Engineering Innodata (INOD) Data Center Operations Applied Digital (APLD) Data Center Construction Sterling Infrastructure (STRL) The fund is actively managed and holdings are subject to change daily and without notice The holdings listed above are included in the portfolio of Calamos Timpani Small Cap Fund as of 6/30/23. Please see the disclosures for additional information.

A final note: Calamos Timpani Small Cap Growth Fund has substantial tax loss carryforwards of $146.2 million (as of the semiannual report dated April 30, 2023), representing nearly 50% of fund assets. These tax loss carryforwards could be used in the future to offset realized gains, and although the tax tail shouldn’t wag the asset allocation dog, we believe this is a compelling point for many investors.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The S&P 500 Index is considered generally representative of the large-cap US stock market. The Russell 2000 Index is considered generally representative of the US small cap market. The Russell 2000 Growth Index is considered generally representative of the US small cap growth stock market. Indexes are unmanaged, do not include fees or expenses and are not available for direct investment.

Important Risk Information. An investment in the Fund is subject to risks, and you could lose money on your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The Fund also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

Calamos and its representatives do not provide tax or legal advice. Each individual’s tax and financial situation is unique. Individuals should consult their tax and/or legal advisor for advice and information concerning their particular situation.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Additional holdings information: As of June 30, 2023, the 10 largest positions in Calamos Timpani Small Cap Growth Fund are as follows, as a percent of net assets: Celsius Holdings, Inc., 4.6%; Tecnoglass, Inc., 3.7%; Super Micro Computer, Inc., 3.4%; Alphatec Holdings, Inc., 3.1%; Inspire Medical Systems, Inc., 2.8%; TransMedics Group, Inc., 2.7%; On Holding, AG - Class A, 2.7%; Sterling Infrastructure, Inc., 2.6%; Bel Fuse, Inc. - Class B, 2.5%; RxSight, Inc., 2.5%. As of June 30, 2023, the Fund held, as a percent of investment, 2.04%in Vertiv (VRT), 1.34% in Credo Technology (CRDO), 1.99% in Smart Global (SGH), 0.53% in Arteris (AIP), 1.46% in Extreme Networks (EXTR); 0.61% in Innodata (INOD); and 0.88% in Applied Digital (APLD).

822140 0832

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.