When Will Investors Care About Small Caps Again? Soon, Believes CTSIX’s Nelson

How is the equity asset class that we believe is poised for the strongest growth (see below) currently among the worst performing? That just comes with the small cap territory, according to Brandon Nelson, Senior Portfolio Manager of Calamos Timpani Small Cap Growth Fund (CTSIX). Nelson’s decades of experience investing in small caps have prepared him for times like these.

“Sometimes, the market just doesn’t care,” said Nelson to a group of investment professionals last week. “The market right now is obsessed with the macro.”

“Sometimes, the market just doesn’t care,” said Nelson to a group of investment professionals last week. “The market right now is obsessed with the macro.”

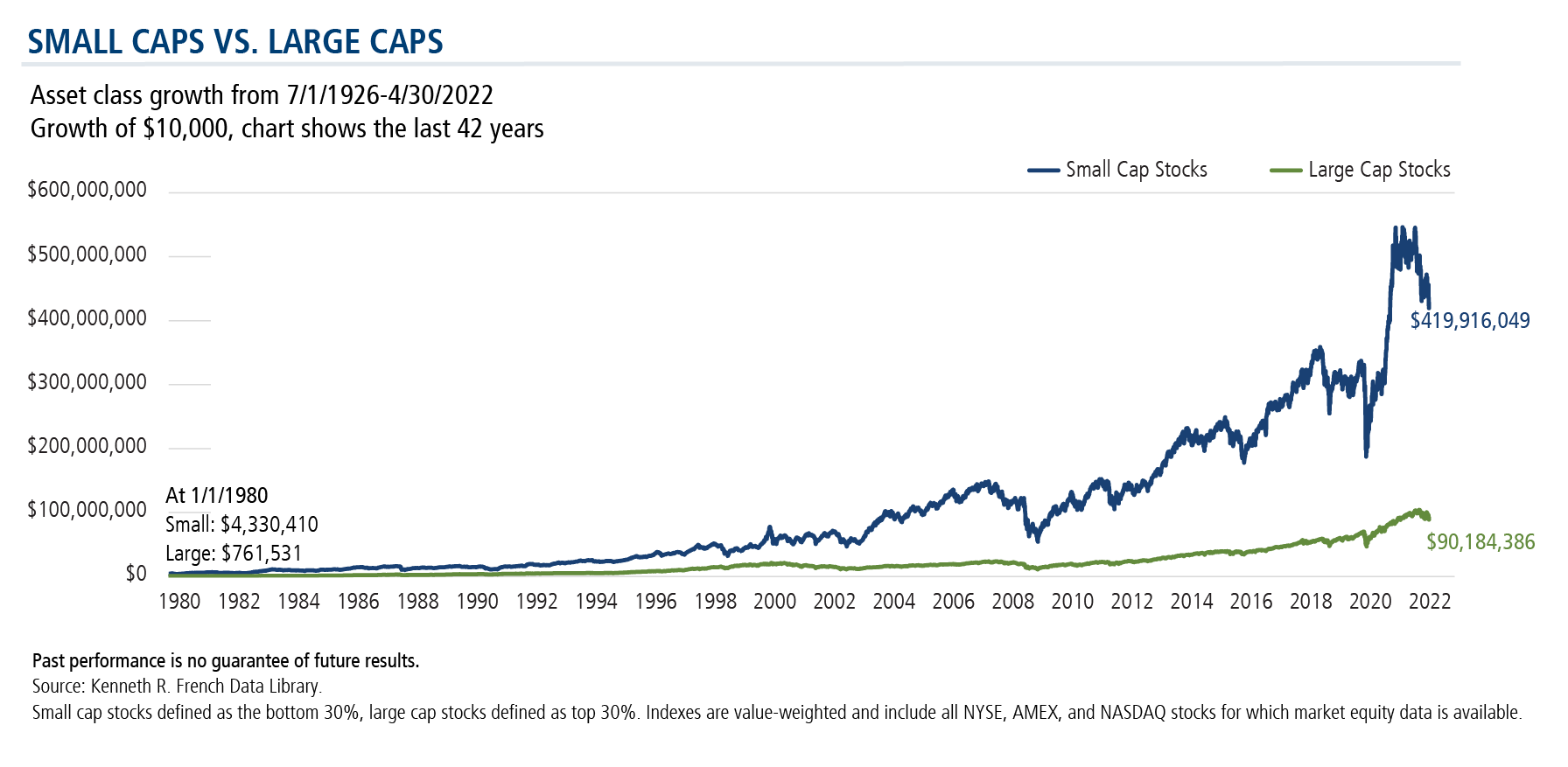

While small caps have historically provided diversification and outperformance over the long term, as illustrated by the chart below, investors appear to have temporarily lost their appetite for smaller companies.

On CTSIX in particular, Nelson commented, “We’re having a rough go. Everyone knows it. Do I think we suddenly got foolish with our stock picks? No.”

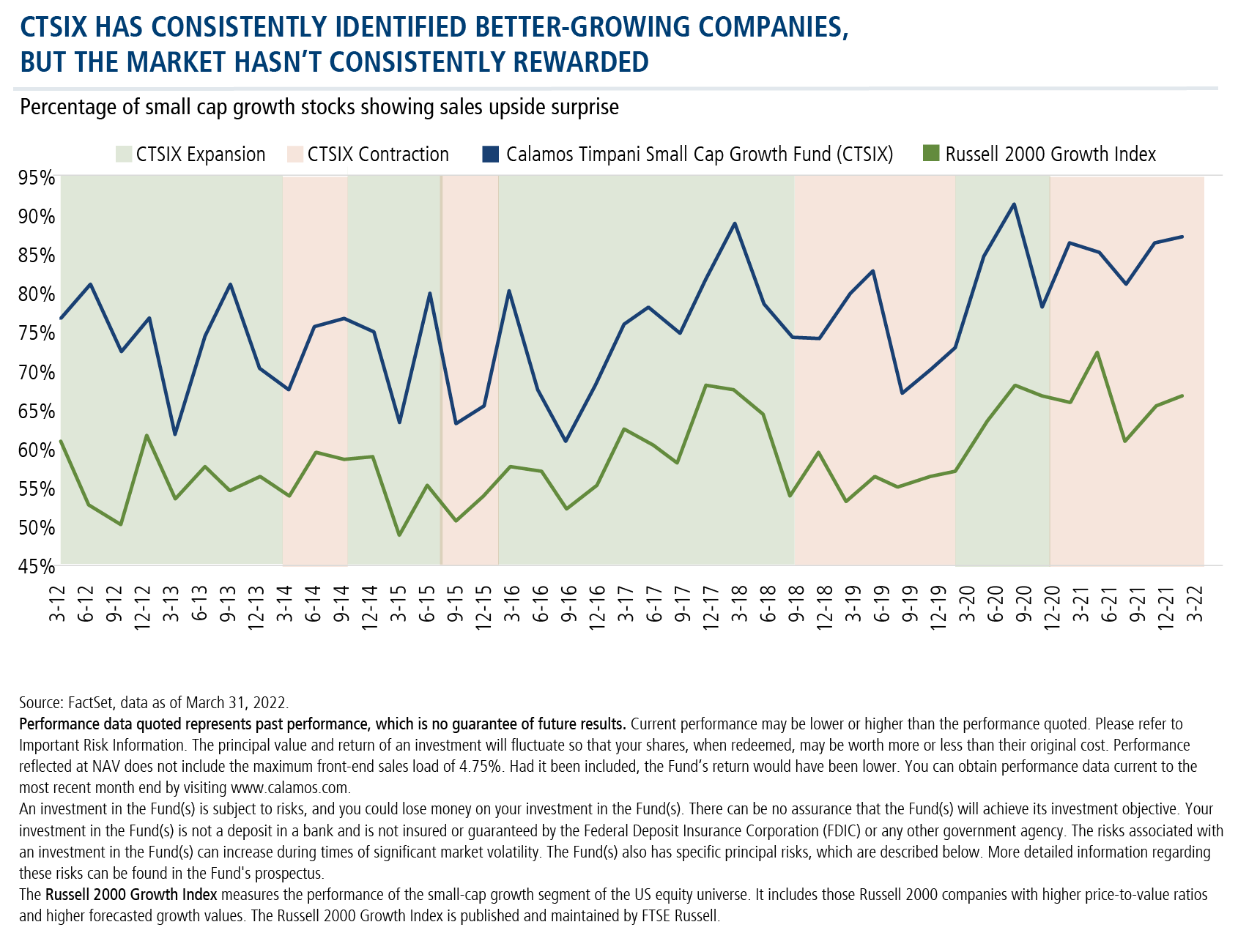

Nelson presented the following chart, which tracks the percentage of small cap growth stocks with sales upside surprise as identified by the CTSIX versus the Russell 2000 Growth Index.

Whether in periods of expansion or contraction for the fund, “you can see our consistency,” said Nelson. “Over the last couple of quarters, nothing has changed. We continue to find the companies we are looking for. Yet, the NAV of the fund is off 47% (2/6/2021 through 5/11/22). It’s not because we just stopped doing our jobs. This chart proves that we’re still finding these stocks.”

“The wildcard,” Nelson said, “is always: are you going to get paid for it? Recently, the market has said, ‘That’s great that you’re finding those companies, but we don’t care. They’re too expensive, and we’re taking valuations down.'”

“We’ve seen this happen before. Eventually, the market does care. And when it does, we will be there, and we will hopefully get credit. If history repeats itself, we think we’ll make up the damage that’s being done.”

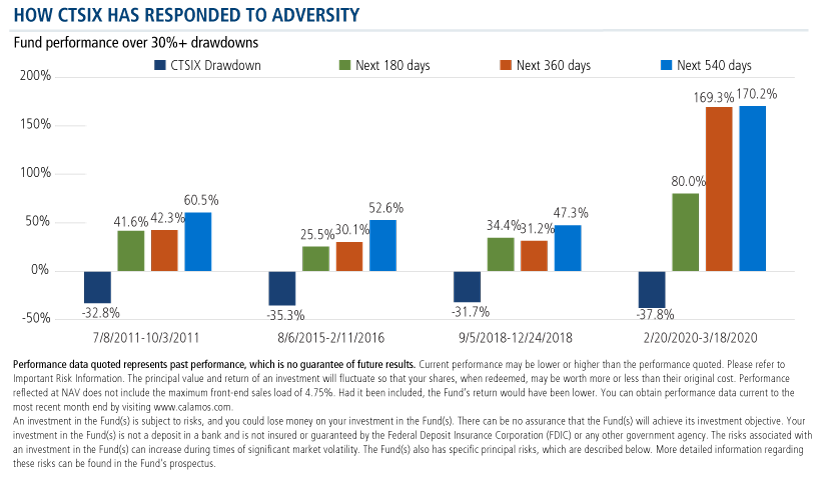

Nelson showed the chart below, which tracks CTSIX’s performance at multiple timestamps following the four 30%-plus drawdowns in the life of the fund. In each, it had rebounded no less than 25.5% in the six months that followed, and more in the next year.

When can investment professionals expect the market’s opinion of small caps to mean-revert and small caps to stage a turnaround? Nelson believes we may be “at a critical point right now.”

Compared to large caps, “small caps have been going through this for a much longer period of time. There’s been a lot more damage.” As a result, Nelson said, “they’re much more mature in the bottoming process.

“I’m very optimistic,” said Nelson, who volunteered that he recently increased his personal stake in the fund. “I think the outlook is much better than what we’ve been seeing, even though the macro is very murky and there’s a lot to worry about. The market is way ahead of all that. And, it’s priced in a ton of bad news already, it’s probably priced in a recession.”

3 CTSIX Portfolio Themes

Nelson singled out three themes he and the team are pursuing:

-

Energy is about 15% of the portfolio. “That might not sound like a lot, but the benchmark weight in the Russell 2000 Growth is only 4%. The low benchmark weight means that there’s significant potential to generate alpha. While many think of energy as a value sector, “there is real sizzle here. There is growth and acceleration of growth. I think there’s sustainability of growth for multiple quarters,” according to Nelson.

The cycle could be elongated relative to past up-cycles, which could enhance valuations beyond the valuation expansion they typically see during up-cycles. While the private, smaller energy companies are ramping spending aggressively this year, the bigger, public companies are likely to be more aggressive with their spending in 2023, he said. -

Casino equipment companies are turning the corner as casino operators are seeking to become more efficient and refresh with popular games/slot machines after being neglected for two years during the pandemic.

“They’re trading at really low valuations, 6 to 7 times forecasted cash flow, and they probably should be 10-plus. And they’re beating expectations,” said Nelson, citing these as another example of worthy companies not getting credit from investors. -

Healthcare companies appeal for three reasons: pent-up demand for elective procedures coming out of Covid, they’re less economically sensitive, and the sector tends to outperform six months prior to mid-term elections.

“We were underweight for several months, we’re slightly overweight now, and it’s probably going to trend higher from here,” said Nelson.

Investment professionals, for more information about CTSIX, please reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the US equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth

values. The Russell 2000 Growth Index is published and maintained by FTSE Russell.

810151 522

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on May 31, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.