Investors gravitate to growth stocks for their potential to produce substantial returns that can exceed 100%.

And yet, the first concern, according to Calamos Senior Vice President and Co-Portfolio Manager Joseph Wysocki, centers on volatility. “Investors say they can’t invest knowing they could lose one-third of their money overnight,” he says.

There’s also the price to play. Growth can be expensive, he acknowledges—“I have yet to see a truly cheap growth stock. They’re expensive for a reason.”

All of which is a prelude to how Wysocki likes to illustrate the benefit of using convertible bonds to manage the risk of investing in technology, as an example.

4 Real-Life Examples

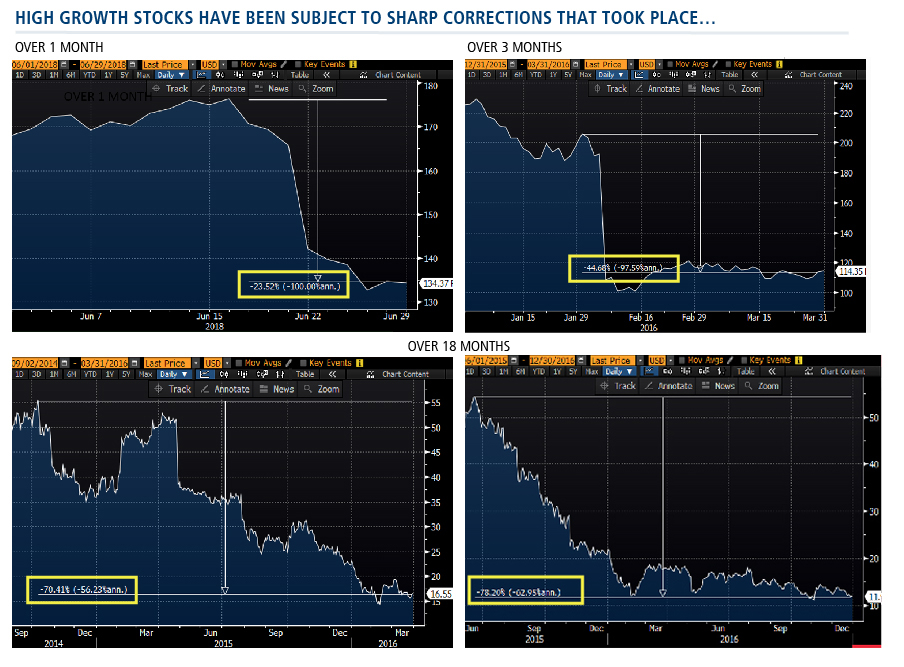

Below are snapshots showing the daily price of four technology companies. All represent exposure to what Calamos considers an attractive, fast-growing market theme. Wysocki cites these as real-life recent examples of the sharp corrections that can occur over relatively short periods of time—one month to 18 months. Miss on earnings, and a stock can “blow up.”

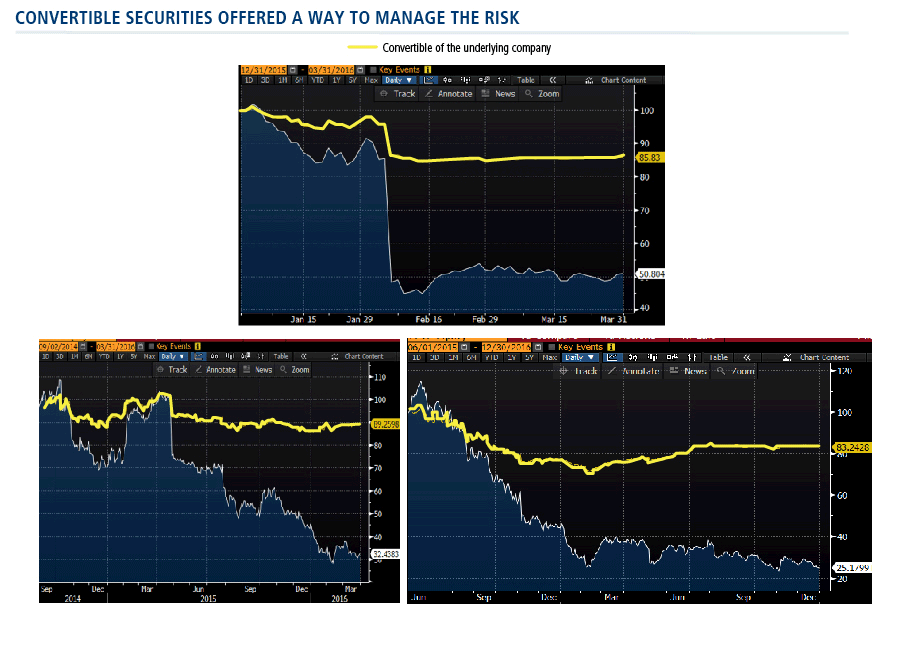

Now let’s look at the prices of the convertible bonds of three of four of these companies over the same time period. As you can see, convertibles lost about 10 cents on the dollar.

These are examples of downside protection afforded by convertibles, while still providing exposure to growth.

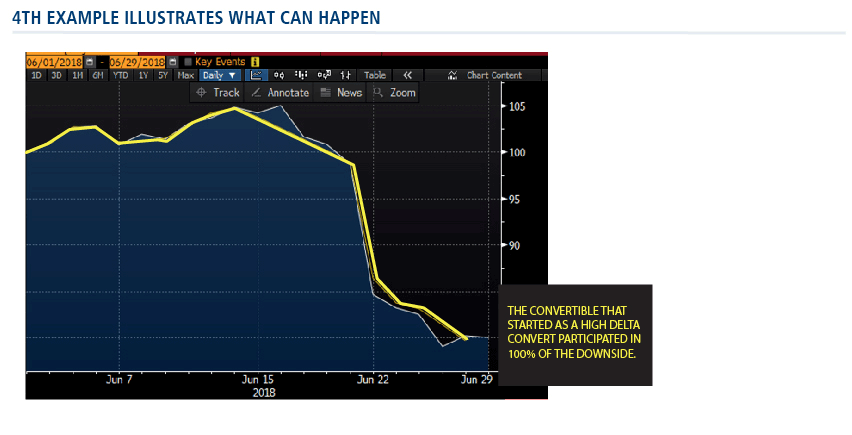

As far as the convertible on the fourth example, Wysocki offers it as an object lesson. High delta equity-sensitive converts can be expected to perform in line with the underlying equity—when the bottom falls out of the stock, the same can happen to the convert. That’s what occurred with this company earlier in the year.

More broadly, Wysocki says, this illustrates the risk investors run with “closet equity funds” masquerading as convertible funds. The investment portfolio that includes a convertible allocation needs to be able to count on convertibles limiting the downside. The Calamos team’s goal is to capture as much as possible of the equity upside while maintaining the discipline that financial advisors expect.

Investing in today’s innovators that can turn into tomorrow’s market leaders can be very rewarding. Convertibles, when managed appropriately, can be a powerful tool to provide upside participation while protecting against what is also understood to be a very real downside risk.

Advisors, for more information about Calamos’ pioneering 40 years of experience investing in convertibles and our convertible-using funds, talk to a Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.