Convertibles Are Off To Another Chart-Topping Year

October 27, 2017

First published: June 13, 2017

It’s a function of market cycles that interest in any one fixed income asset class ebbs and flows. This year, convertible securities have enjoyed a resurgence in popularity among both issuers and investors. (Advisors, subscribe to our Calamos Alternatives Snapshot for insights on alternative fund flows.)

But while fixed income asset classes may trade places year after year, there has been no asset class that can rival convertible bonds in terms of performance consistency.

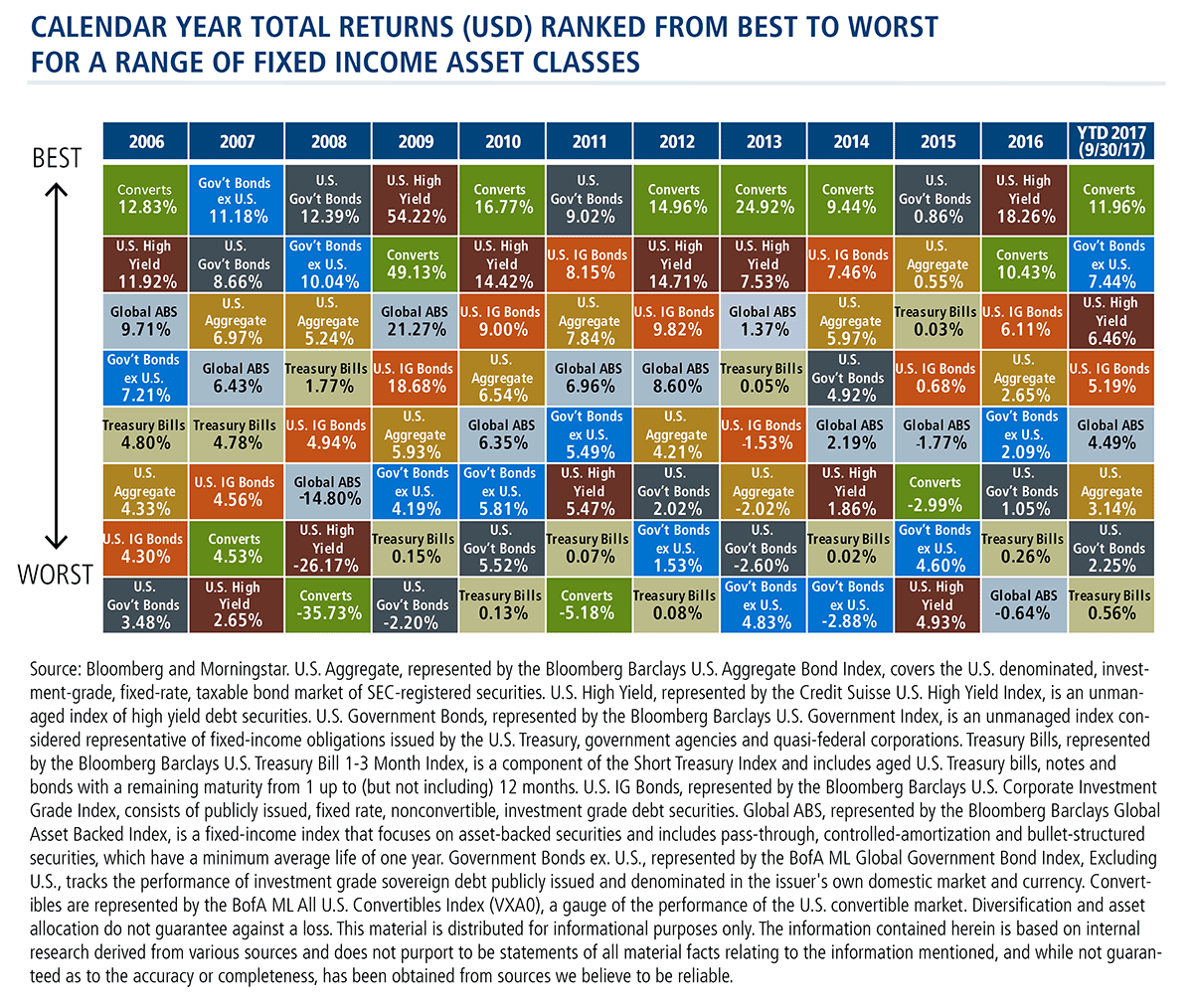

Convertible bonds have been the top performing asset class for five of the last 10 years and second to the top for two years. The quilt below shows the calendar year total returns (USD) ranked from best to worst from 2006-2016. And, convertibles sit on top for the year-to-date 2017.

(click image to enlarge)

Here’s why we believe convertibles make sense now:

- Their structural characteristics (the opportunity for upside equity participation with a degree of downside resilience) can appeal to investors concerned about high equity valuations.

- They’ve proven to be less vulnerable to interest rate increases than non-convertible debt (see post). It’s a timely consideration if you’re expecting another rate increase this year.

- Convertibles have a wide range of characteristics that can be deployed within alternative allocations, such as hedge strategies that employ convertible arbitrage.

For further analysis by Calamos Founder, Chairman and Global Chief Information Officer John P. Calamos, Sr., a pioneer in investing in the asset class, see his recent blogs posts:

Financial advisors, for more information on any of the Calamos funds that use convertible securities, please see the Related Funds section or talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Additional Resources

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Past performance is no guarantee of future returns.

The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned, and while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Convertible securities entail interest rate risk and default risk.

Convertible Arbitrage involves buying convertible bonds and short selling their underlying equities to attempt to hedge against equity risk, while still providing the potential for upside returns.

Total return assumes reinvestment of dividends and capital gains distributions and reflects the deduction of any sales charges, where applicable. Performance may reflect the waiver of a portion of the Fund's advisory or administrative fees for certain periods since the inception date. If fees had not been waived, performance would have been less favorable.

Indexes are unmanaged, do not entail fees or expenses and are not available for direct investment. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index.

Active management does not guarantee investment returns and does no eliminate the risk of loss.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

800228 1017 R