With Realized Convertible Arbitrage Profits and Poised for Hedged Equity Opportunities, CMNIX Is Having a Good Year

The convertible arbitrage strategy of the Calamos Market Neutral Income Fund (CMNIX)—at a high 60% allocation—has found a lot to like about 2020 to date. Co-Portfolio Manager David O’Donohue outlined the elements of the favorable environment at Wednesday’s CIO call for investment professionals, which also featured comments from Eli Pars, Co-CIO and Head of Alternative Strategies. (Listen to replay here.)

The Benefits of New Issuance

Convertible bond issuance is on pace for the largest year ever (see the latest data in the Calamos U.S. Convertible Market Snapshot). A strong new issue market provides many benefits, including idea generation, liquidity and returns, O’Donohue explained.

“A high percentage of deals trade well. Historically, there’s an embedded cheapness to a new convertible issue—you have to price at a discount to fair value to bring that much paper to the market at once.” By being selective, including avoiding mispriced or aggressively priced deals, the team enjoys a high “hit ratio,” with many new deals trading well on Day 1.

This year’s new issuance calendar has produced more than the typical share of opportunities involving new issues from a previous issuer.

Here’s how O’Donohue describes the “double win:” “When a serial issuer wants to come to market to raise more capital, they’ll issue a new convertible, subsequently redeem the existing bond, and potentially convert it into equity. In that case, we’ll get paid to sell our existing position at a slight premium and buy the new issue, hopefully at a discount, on Day 1.”

The Market Is Still Cheap

On CIO calls held in March (see post) and in April (see post), the CMNIX team discussed the embedded value in the convertible arbitrage book that they expected the fund to benefit from as the market normalized. That’s what has happened since the spring.

“When you have big increases of volatility and shocks to the system,” O’Donohue said Wednesday, “that volatility does flow through to valuation, not necessarily through to profits, though, immediately. Widening bid/ask spreads and widening implied credit spreads offset the increase in valuation.

“Instead of monetizing right away,” he continued, “there can be a really nice tailwind as things normalize. Over the last couple of months, we’ve been in that tailwind stage, monetizing and realizing that spike in volatility we saw in the first and second quarter.”

In addition to profiting from the realization of cheapness, the portfolio benefited from heightened awareness of and investment in the convertible asset class. “People increasing allocations, multi-asset class strategies, people starting new funds—all of that results in more assets flowing into the space, helping push up the valuations and increasing profits for us,” according to O’Donohue.

More Volatility Ahead

While the hedged equity side of the fund may find it more challenging, the most recent environment of relative stability with pockets of volatility is positive for convert arb.

“Stocks up and volatility up is fine in general,” said O’Donohue. “We don’t care what creates that increase in volatility as long as it doesn’t come from deteriorating credit…Anything that creates dislocations is generally good for positioning if it creates gamma trading opportunities, more inefficiencies inside capital structures and more opportunities for new trades. In general, this is a more target-rich environment for us.”

O’Donohue listed multiple catalysts for the rest of the year that have the potential to create short-term market shocks, including the general elections, debates over the Supreme Court justice nomination, a possible vaccine, delays to a vaccine, etc.

“All of these present a good opportunity to have increased volatility that flows through to valuations to convertibles and also to monetize some of that and turn directly into profits,” he said.

With relatively cheap valuations and a good backdrop of higher equity volatility, especially macro and event-driven as opposed to company-specific, the team expects the convertible arb allocation to stay on the high end of the fund's historic range.

Hedged Equity Sizing Up the Opportunities

In his comments on the hedged equity side of the fund, Pars repeated much of the market up/volatility up perspective from last week’s Calamos Hedged Equity Fund (CIHEX) CIO call—while noting the market's decline in the days since the call.

The team is comfortable with the strategy’s positioning at the highest end of its historic range, or at the low end of equity sensitivity. “A lot of our hedge has a lot of time left on it,” Pars said. “We have a lot of flexibility regarding whether we want to do something sooner or later, depending on how things develop for the next six weeks.”

Pars referred to noise in the market relating to the sell-off earlier in the year, COVID-19 and politics.

“All taken together, it led to sustained bid to volatility. Up until a few weeks ago we had really low realized volatility and high implied volatility in options, which is a short-term phenomenon and not sustainable,” he said.

“It can be tough to get skew,” continued Pars. “We like to build skew into our hedge or where we can have positive optionality to the upside as well as to mitigate the downside risk when the market moves. That’s been tough to do.”

As volatility pulls in, the team expects to be able to add more skew. In the meantime, the positive part about the higher level of volatility is that “we do get paid to wait, basically paid to put our hedge on,” he noted.

Recalling the opportunities around the 2016 election or the Brexit decision earlier that year—two periods CMNIX was positioned to benefit from—Pars said the team was “starting to see some interesting things around the election. We have put a few trades on and will try to put a few more on. Vol will continue to have a bid to it through the election, there will continue to be a lot of noise. We’ll see as we get further in the year how the volatility market evolves.”

Rates, Doomsday and Credit Quality

As moderated by Robert Behan, Calamos President and Head of Global Distribution, the Q&A part of the call included some questions frequently asked of the team.

Interest rate outlook: CMNIX does not have much sensitivity to the longer parts of the curve, said Pars. “The convertible book is generally two- to three-year paper. The typical convertible new issue is five years, and CMNIX owns a relatively seasoned book so the fund’s duration is shorter. A five-year convert has a duration of a three-year bond. So, when we talk about our book being two to three years to maturity, the duration is around one year.”

“With the duration component being so low, we don’t have a lot of rate sensitivity in the fund,” said Pars. “What we like to say is that we don’t have a lot of rate sensitivity and we don’t have rate opportunity. We’re not making money from the bond market if it rips and, conversely, we won’t lose much if the bond market sells off.”

The fund does have sensitivity to overnight money because the rebate earned on the short position hedging the convert book is directly linked to overnight money.

The team expects rates to stay on the short end for a while, but to avoid heading negative.

Pars commented on CMNIX as a fixed income alternative at this time. “The risk/reward on bonds is just terrible right now. I’m looking at a five-year Treasury at 27 basis points and 10-year at 68 bps. Where is it going to go on the upside? Versus where it could go on the downside?”

Doomsday: Asked for a “doomsday scenario, the worst possible environment for the strategy,” Pars replied, "The absolute worst we’ve ever seen is 2008. But, a more realistic downside scenario is what we experienced with the March drawdown when the market was straight down and harshly, almost every day.”

For a reasonable proxy of how convert arb has performed during market stress, look back to 2000, 2001 and 2002. That's when, Pars said, “the overvalued tech market rolled over—not sure if that rings a bell for anything we’re watching in today’s environment but we’ll see.”

At that time, he said, “Convert arb did well, a lot of [issuing] companies aren’t very levered, the credit side held up fairly well. It was a very bad environment for the equity market and not a bad and even a good environment for convert arb.”

Credit quality: In answer to Behan’s question, Pars said he was satisfied with the quality of the names in CMNIX’s portfolio.

“We have a high weighting in technology and people sometimes wonder about that. But a lot of our tech names have a pretty clean balance sheet, and many times are non-rated. They’re non-rated because they don’t have any other funded debt in the capital structure. If [an issuer is] not getting an investment grade rating, investors are comfortable doing their own credit work and don’t care much. A stock that has done well, is priced for a lot of growth, has a business that’s growing, a clean balance sheet or a small amount of debt, and maybe starting to generate free cash flow can hold up pretty well.”

Pars went on to strike a difference between high yield and convertibles. “We don’t get a lot of CCC new issuance, almost none, whereas that’s a big chunk of high yield. The five-year default rate on CCC paper is 30%, really high. We don’t get any of that, a lot of it is LBO [leveraged buyout] paper. Those companies don’t have public equity and can’t issue converts. Even though the convert market is 20%-25% investment grade, the credit quality is materially better than what you see in high yield.”

Investment professionals, for more information about CMNIX, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Convertible arbitrage and gamma. Convertible arbitrage is an investment strategy that generally involves a long position on a convertible security and a short position on the issuing company’s common stock. A long position is the buying and holding of a security and a short position is the selling of a security that the seller does not own. Eventually, the seller must purchase the same security (hopefully at a lower price) and return it to the owner. Convertible arbitrage seeks to take advantage of dislocations in the value of a convertible security and its underlying equity. Theoretically, as the price of the underlying stock rises, the convertible value rises, and as the stock value falls, the convertible value falls as well. How much the convertible value rises or falls for a given stock move is referred to as delta. The change in delta as stock price moves is referred to as gamma.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

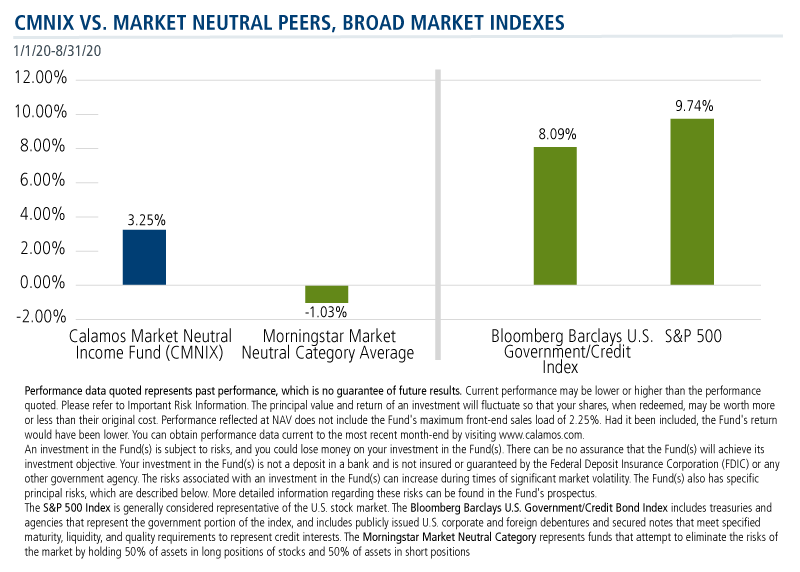

The S&P 500 Index is generally considered representative of the U.S. stock market.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Out of the money means that an option has no intrinsic value, only extrinsic value.

Skew is the difference in implied volatility between out-of-the-money options, at-the-money options, and in-the-money options.

Morningstar RatingsTM are based on Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2020 Morningstar, Inc. All rights reserved.

802165 0920

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

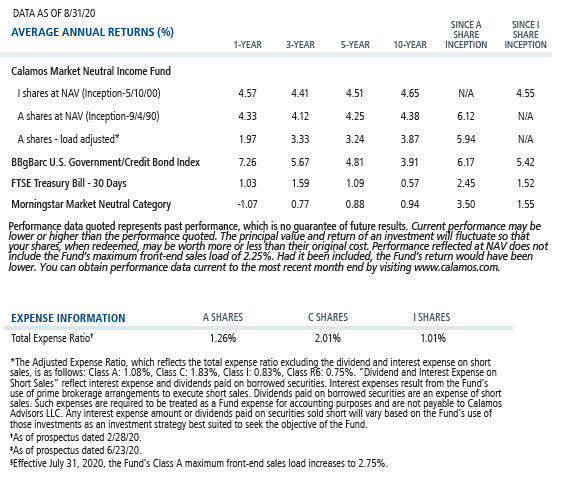

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

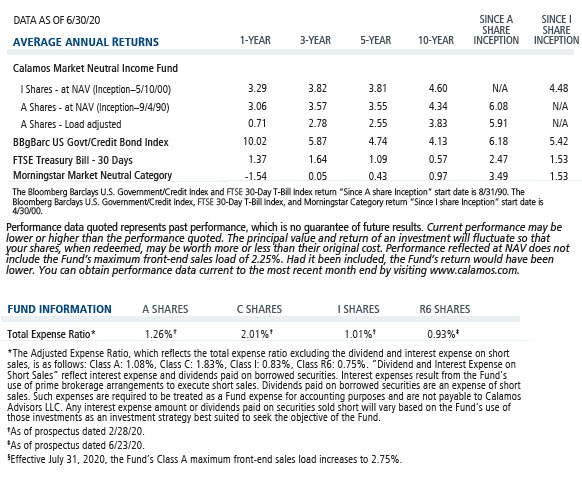

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on September 25, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.