How CNWIX’s Active Management Limited the Downside in the Early Days of the Coronavirus

Calamos Evolving World Growth Fund (CNWIX)

Morningstar Overall RatingTM Among 718 Diversified Emerging Mkts funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 3 stars for 3 years, 5 stars for 5 years and 4 stars for 10 years out of 718, 646 and 423 Diversified Emerging Mkts Funds, respectively, for the period ended 6/30/2024.

Five weeks into 2020 and emerging markets have gone on quite a ride. The year started on a high note. A global recovery was underway, emerging markets valuations in particular looked especially attractive relative to developed markets, and growth prospects were poised to outperform.

News of a fast-spreading virus came as a shock, however, and specialists worldwide—health professionals, economists, market prognosticators—are furiously trying to understand the coronavirus and its potential impact.

In the Q&A that follows we check in with Nick Niziolek, CFA, Co-CIO, Head of International and Global Strategies and Senior Co-Portfolio Manager, for his insights.

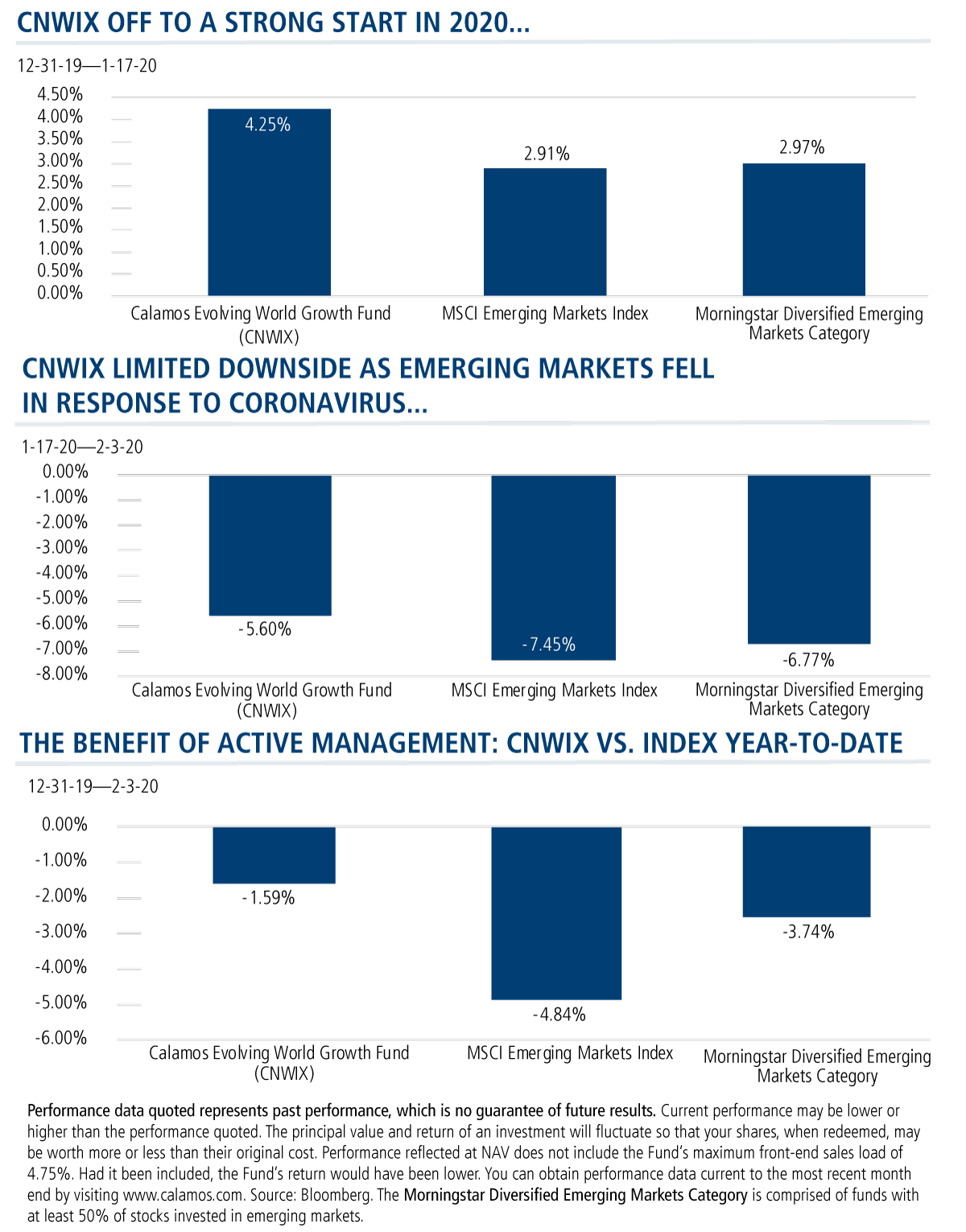

A. Right, the fund’s return through January 17 was about 1.5 times the return of the MSCI Emerging Markets Index, with the fund benefitting from positioning for a global recovery in 2020 with emerging market equities set to gain given their superior relative valuation and growth prospects. The fund also bested its peers in the Morningstar Diversified Emerging Markets Category by more than 100 basis points.

But, I’d argue that the period since the coronavirus news broke was a critical time that demonstrates our active approach in EM.

A. These are the times—they’ve happened before and they will happen again—when we can demonstrate how CNWIX is managed as an emerging market alternative.

In addition to the positive skew, we try to build into this portfolio over time via our use of convertibles, when we became concerned that initial reports of a new virus in China could have a broader economic impact, the team was quick to react. We added select health care opportunities, reduced near-term theta/gamma risk to reduce the downside participation, and trimmed travel-related exposure.

To the right you can see the result for the period ending yesterday, the day Chinese markets resumed trading: -75% downside participation.

Year to date, then, in a period when the coronavirus has shaken investors, CNWIX has participated in just 32% of the downside in the EM index.

A. There’s no way of knowing but we suspect not. But while the team expects the impact to continue and even accelerate, the policy response by China and other Central Banks has been significant.

This is an interruption in the path emerging markets were on at the start of the year. But we are optimistic that the global recovery we were seeing has been delayed, not averted. In fact, the significant stimulus we’ve seen has the potential to make the recovery even more significant than we anticipated.

A. Emerging markets are on the other end of that discussion, which is why it’s important for financial advisors to understand their options when building emerging markets exposure for their clients. A risk-managed approach capable of limiting drawdowns when they occur can keep clients invested and exposed to the potential for future growth.

Our team has begun re-risking the portfolio with exposures we believe will benefit from a 2H20 recovery. That’s something we believe the market may begin anticipating sooner rather than later.

Financial advisors, for a more detailed discussion of the Calamos Evolving World Growth Fund, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Click here to view CNWIX’s standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that represents large- and midcap companies in emerging market countries. It includes market indexes of Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, South Korea, Taiwan, Thailand and Turkey.

The Morningstar Diversified Emerging Markets Category is comprised of funds with at least 50% of stocks invested in emerging markets.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment.

Delta expresses the convertible's sensitivity to changes in the stock price. It expresses the change in the convertible price per unit of change in the underlying stock price.

Gamma is the change in delta as stock price moves.

Theta is defined as the change in an option's value given a one-day change in time.

Skew describes asymmetry from the normal distribution in a set of statistical data.

Morningstar Ratings are based on risk-adjusted returns for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%,and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2020 Morningstar, Inc. All rights reserved.

©2020 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

801891 0220 R

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on February 03, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.