How CMNIX Has Battled Volatility Over Its 31 Years

This is an extraordinarily challenging year in the markets, with equities near bear-market levels and bonds flirting with double-digit declines. As of Friday, the S&P 500 is off to its fourth worst start to a year in the history of the index.

Calamos Market Neutral Income Fund (CMNIX), valued by investment professionals over the last three decades as a fixed income alternative in clients’ portfolios, is battling the volatility with more favorable results. It closed April with a -3.56% year-to-date return.

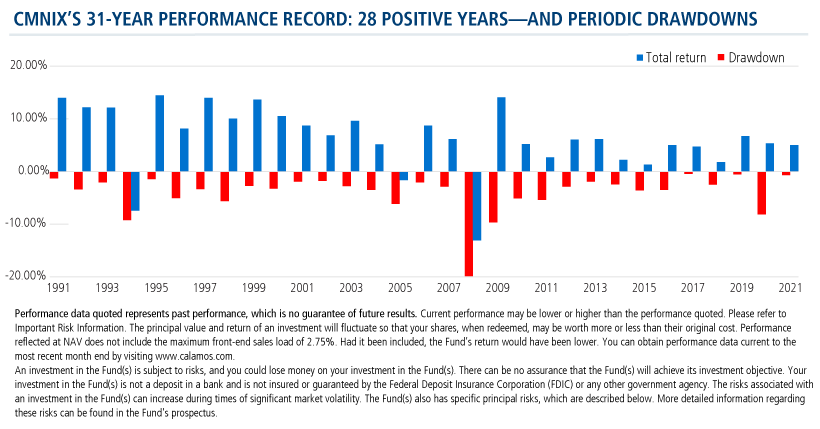

In the fund’s 31 years, all but three have ended with positive returns. Intra-year drawdowns, however, have occurred every year. In fact, there have been six years—19% of the time—when the drawdown exceeded 5% and the year finished positive. As recently as the first quarter of 2020, the fund was down 8% and finished the year ahead 5.35%.

Over three decades, CMNIX has demonstrated its consistency and resiliency across diverse markets and market conditions (see post). It’s in this volatility where the fund’s primary strategies have found opportunity.

Compared to the S&P 500 Index, CMNIX has historically offered:

- Lower sensitivity to drawdowns during heightened volatility due to the fund’s hedged equity strategy. The strategy acts as a hedge to the S&P 500 through a combination of low beta, income generated from dividends and option premiums, and gains in our put hedges.

- Smaller drawdowns, which were then followed by relatively strong performance as a result of the fund’s convertible arbitrage strategy. The strategy shorts the underlying convertible bond’s stock.

Investment professionals, for more information about CMNIX, please reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The S&P 500 Index is generally considered representative of the U.S. stock market.

810145 522

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

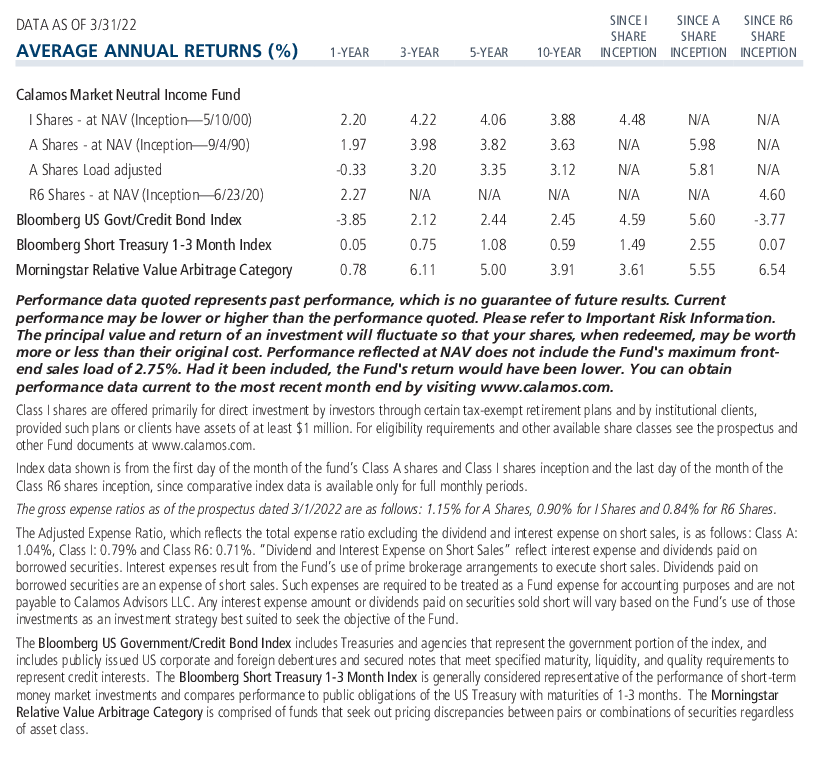

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on May 23, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.