Broadband Funding: A Meaningful Opportunity for Small Caps

Kyle Kolberg

Senior Research Analyst

Within smaller capitalization equities, we have the good fortune of researching companies that see substantial impact from large change agents (i.e., federal funding, secular change, capital investment cycles) while larger capitalization companies may see more marginal impact. The incrementality and leverage to these change agents is significantly greater the further down the capitalization spectrum one ventures—and that can create meaningful opportunity.

Multi-year broadband funding is one such example. Internet access is oft times considered ubiquitous as we stream the latest House of the Dragon or Marty and Wendy Byrde drama, ask Alexa “what’s the weather like today?” or order the seventh package of the week to be delivered to our doorstep. This is a luxury that most, myself included, take for granted.

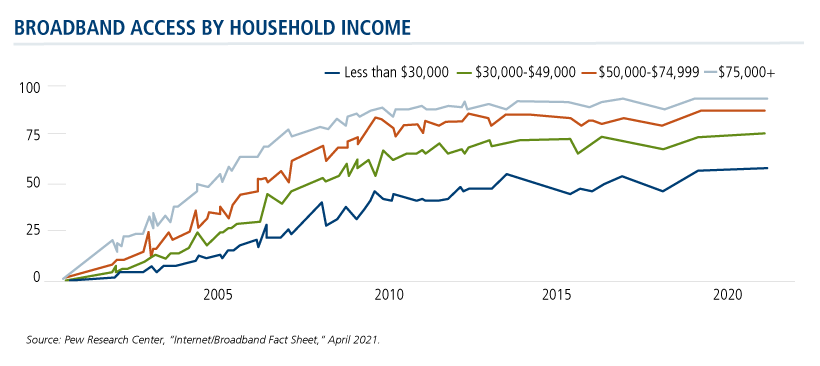

Unfortunately, internet access is not available to all. There is a linear relationship with broadband internet access and annual household income, an inequity the federal government is working to address.

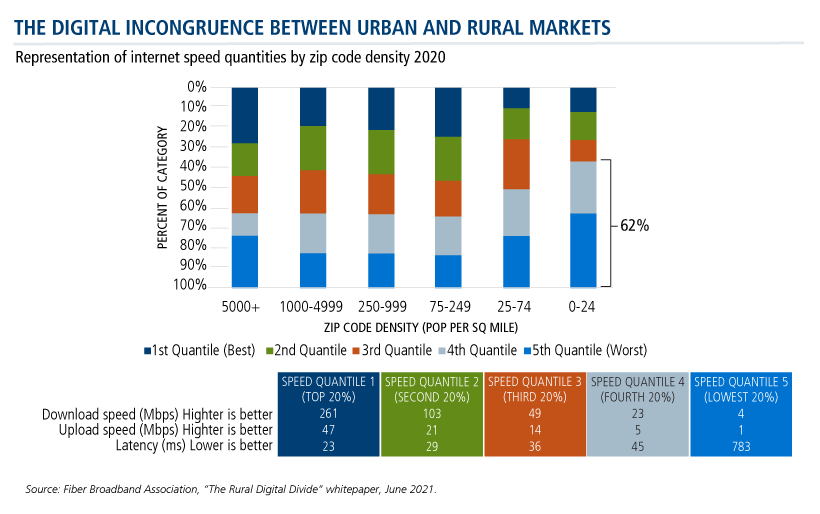

Legislation related to broadband infrastructure was being drafted even before the pandemic. The Rural Digital Opportunity Fund (RDOF), initiated in 2019, allocated $20.4 billion to narrow the digital incongruence between urban and rural markets, inclusive of both commercial and residential subsegments.

As we moved through the unfortunate events of the pandemic, it became clear that the inequities associated with availability and quality of internet access were harming students outside the traditional classroom. Alongside education, healthcare (telehealth) and labor (job postings, training) imbalances surfaced. Enter the American Rescue Plan Act (ARPA), which includes more than $25 billion focused on delivering affordable high-speed broadband infrastructure.

In addition to those two significant funding sources, the Infrastructure Investment and Jobs Act (IIJA) provided $65 billion earmarked primarily for the Broadband Equity Access and Deployment Program (BEAD) and Affordable Connectivity Program.

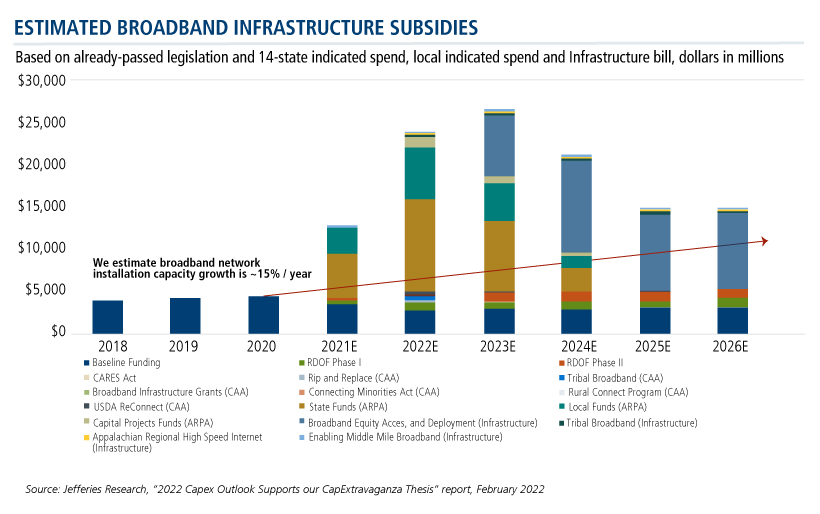

In aggregate, RDOF, ARPA, and the IIJA provide north of $100 billion in funding, perceptibly larger than historical baseline industry funding.

Traditionally, capital investment by large carriers and cable operators has been very lumpy, with numerous stops and starts. While we can debate capital allocation strategy, what’s not up for debate is the federal funding entering the market.

A Tier 1 criteria within our investment process is growth sustainability. Unfortunately, capricious capital allocation habits are inconsistent with growth sustainability for companies levered to that capital spend. With RDOF, ARPA, and the IIJA, we believe the sustainability is markedly more visible than in recent history.

As shown below by Jefferies, the funding is taking off in real time. However, due to persistent labor constraints and the expected government bureaucracy, the actual flow through to exposed operators and vendors is likely pushed to the right. We expect a more gradual, elongated, flow through to companies levered to the subsidies—thus, improved sustainability.

An industry that has historically been more cyclical will become acyclical over the next several years as we’re just in the early innings of the RDOF, ARPA, and IIJA deployment.

Here’s how the President and CEO of Clearfield, Inc. (CLFD), a telecom equipment vendor, characterized the nascency in federal funding contribution on their fiscal third quarter 2022 conference call. When asked about contribution from subsidies related to either ARPA or RDOF, Cheryl Beranek responded, “They’re less than 5% of our revenues. Very, very, very early.”

Within the Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX), we have been incrementally adding to the thematic broadband basket that we believe to be in the early stages of a multi-year growth tailwind.

Names within the current portfolio that stand to benefit from this tailwind are Calix, Inc. (CALX), Clearfield, Inc. (CLFD), Dycom Industries, Inc. (DY), and Harmonic, Inc. (HLIT). These companies participate anywhere from the actual installation of the infrastructure to the more annuitized subscriber service stream that follows the installation.

“Picks and shovels” is a term that is arguably overused when describing equities. (As Mark Twain said, “When everyone is looking for gold, it’s a good time to be in the pick and shovel business.”). Nevertheless, “picks and shovels” is an apt analogy for our investment theme here. When you are selling “picks and shovels,” you are agnostic as to who finds the gold.

As it relates to the broadband spending ramp, we are generally indifferent as to which service providers ultimately gain the most subscribers, yet the federal funding will encourage the service providers to spend to gain those subscribers. We want to own the stocks of the companies on the receiving end of that spend.

Investment professionals, for more about how the CTSIX team is pursuing the broadband opportunity or the fund’s investment process in general, please reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

| Company | Industry | % |

|---|---|---|

| Celsius Holdings, Inc. | Soft Drinks | 4.3% |

| Lpl Financial Holdings, Inc. | Investment Banking & Brokerage | 3.5% |

| Shockwave Medical, Inc. | Health Care Equipment | 3.0% |

| International Money Express, Inc. | Data Processing & Outsourced Services | 2.9% |

| Treace Medical Concepts, Inc. | Health Care Equipment | 2.7% |

| Calix, Inc. | Communications Equipment | 2.6% |

| Axonics, Inc. | Health Care Equipment | 2.3% |

| Evolent Health, Inc. - Class A | Health Care Technology | 2.2% |

| Harmonic, Inc. | Communications Equipment | 2.1% |

| Clearfield, Inc. | Communications Equipment | 2.1% |

| Total | 27.7% |

Dycom Industries, Inc. represented 1.20% of the portfolio as of 8/31/22.

| Company | Industry | % |

|---|---|---|

| Lpl Financial Holdings, Inc. | Investment Banking & Brokerage | 4.1% |

| Celsius Holdings, Inc. | Soft Drinks | 3.9% |

| Carlisle Companies, Inc. | Building Products | 2.6% |

| Axon Enterprise, Inc. | Aerospace & Defense | 2.6% |

| Deckers Outdoor Corp. | Footwear | 2.5% |

| Calix, Inc. | Communications Equipment | 2.5% |

| Shockwave Medical, Inc. | Health Care Equipment | 2.2% |

| Enphase Energy, Inc. | Semiconductor Equipment | 2.2% |

| Range Resources Corp. | Oil & Gas Exploration & Production | 2.1% |

| Evolent Health, Inc. - Class A | Health Care Technology | 2.1% |

| Total | 26.8% |

Dycom Industries, Inc. represented 1.06% and Harmonic, Inc. represented 0.54% of the portfolio as of 8/31/22.

820299 1022

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on October 21, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.