The Case for Strategic Convertible Allocations

Throughout this guide, we’ve demonstrated that volatility is a normal part of the markets. One of the best ways to navigate volatility is by having a well-diversified asset allocation that reflects your risk tolerance and financial goals.

Of course, because every investor is different, there’s no one “right” asset allocation. Good asset allocation strategies have something in common, however: They make it easier to stay invested during periods of market turbulence.

Convertible allocations may be particularly attractive for longterm investors who recognize the dangers of market timing. The unique structural characteristics of a convertible bond can lessen the temptation to make timing decisions about the stock market or interest rates.

Because the convertible universe is very equity-sensitive at times and very bond-like at other times, an active approach is essential for controlling risk and managing upside and downside participation without making a market timing call. With active management, convertibles can fill diverse asset allocation needs—from core equity to alternatives.

Convertibles and Asset Allocation

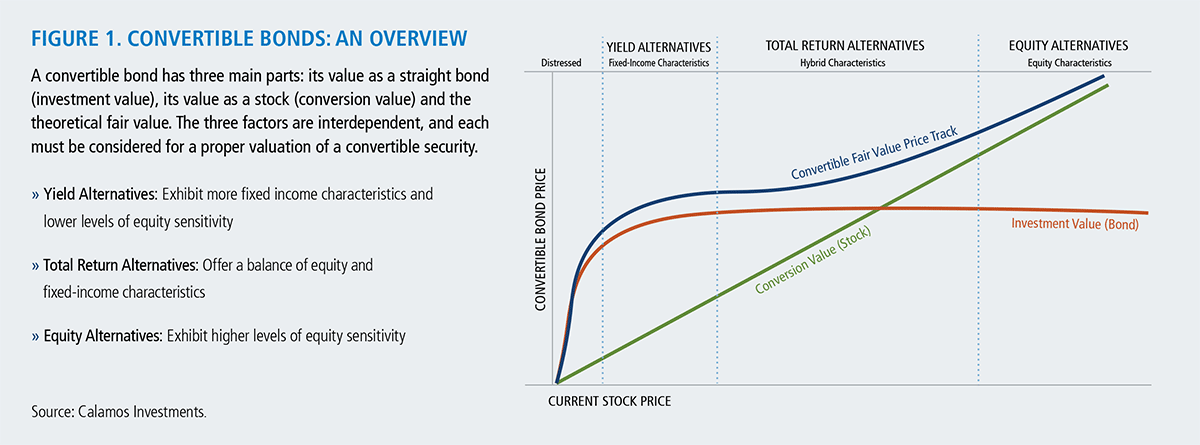

Convertible securities are equity-linked instruments that offer equity market participation with potential downside resilience when equity markets decline. In simplest terms, a convertible is a fixed-income security that includes an embedded option. Structurally, the risk/reward characteristics of convertibles allow them to support a range of asset allocation goals. However, convertible securities are complex. The attributes of convertibles may differ considerably and a specific convertible may be more equity-like at certain periods and more fixedincome- like in others. As a result of this dynamic, convertible securities demand active management.

Often, convertible securities are thought of as a single asset class; this ignores the variations within the convertible universe. Our approach is to use different convertibles within specific investment strategies. It is not simply the convertibles that make a strategy work but how convertibles are managed to achieve a particular investment objective.

Lower Volatility Equity Participation

Convertibles with higher levels of equity sensitivity may be utilized within lower-volatility equity allocations, providing an innovative solution for investors who wish to participate in equity markets but are concerned about downside equity volatility. In volatile markets, the bond value provides a floor, and through coupon income, investors are “paid to wait” for the markets to turn. Furthermore, in volatile markets, the convertible’s embedded option can also increase in value.

A Proactive Way to Address Interest Rate Increases

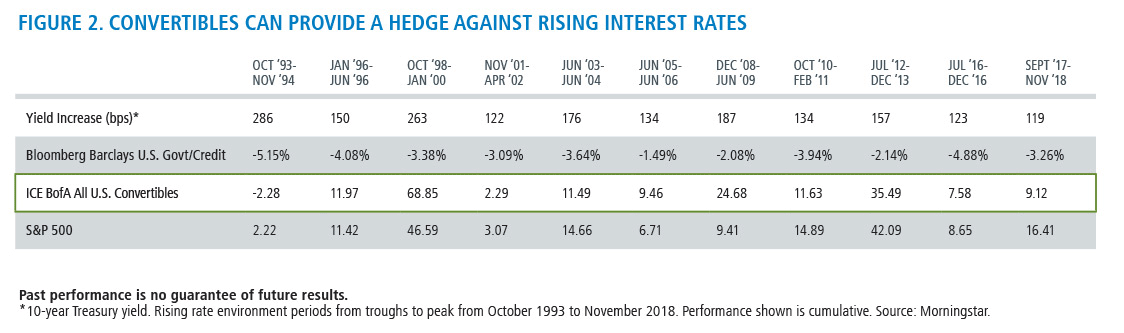

Convertibles have historically performed well during periods of rising interest rates and inflation. Convertible strategies may be used to diversify a traditional fixed-income portfolio (i.e., government bonds) as a high yield corporate bond allocation might. Bonds tend to lose value in an environment of rising interest rates. However, convertible returns have tended to more closely reflect equity returns than bond returns when the 10-year Treasury yield rose more than 100 basis points (Figure 2).

While convertibles are influenced to a degree by interest-rate fluctuations, they also are affected by the price movements of their underlying stocks, a factor that historically has helped soften the negative effect of rising interest rates. In general, the more a convertible’s price is determined by the value of its underlying equities, the greater its tendency not to be influenced by changing interest rates.

Alternatives

Convertibles with a range of characteristics can be used within alternative allocations, such as hedged strategies that employ convertible arbitrage. (For more information, please see Gamma Trading: Why Big Market Swings Can Be Good News). Including convertible-based alternative strategies can provide an added layer of diversification to an asset allocation.

Conclusion

Calamos Investments’ experience with convertible securities dates to the volatile financial markets of the 1970s. During this period, convertible strategies often provided better returns than either the stock or bond markets. Since then, our teams have used convertibles to enhance asset allocations through full and multiple market cycles, providing benefits that stock and bond allocations alone cannot. As a fixed-income security with equity attributes, a convertible may be viewed as offering the best of both worlds; and with active management, convertible securities can address many different types of asset allocation needs.

Return to the Volatility GuideOpinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Past performance is no guarantee of future results.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

John P. Calamos, Sr.

Founder, Chairman and Global CIO

Eli Pars, CFA

Co-CIO, Head of Alternative Strategies

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.