Building Client Portfolios With Small Cap Growth

VIEWS FROM FINANCIAL ADVISORS 2019

The small company growth stock captures the investor’s imagination: Somewhere among the country’s thousands of small public companies are the next Amazon, Starbucks or Microsoft, all accessing the capital markets to fund exploration, innovation, even transformation. There’s an undeniable romance—completewith the potential to break one’s heart—to the small cap stock.

Similarly, the growth potential of small caps appeals to portfolio-building financial advisors, most of whom prefer to gain exposure for their clients through funds. With that decision made, others remain. Where should small caps be used? How? With which clients? And to what effect?

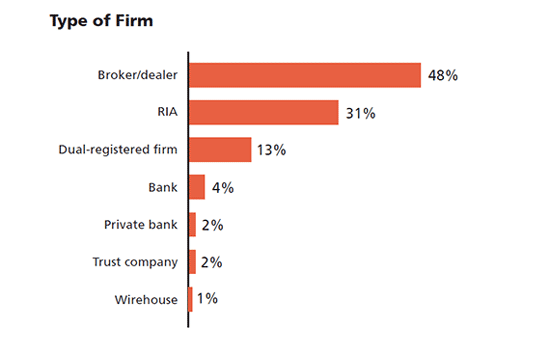

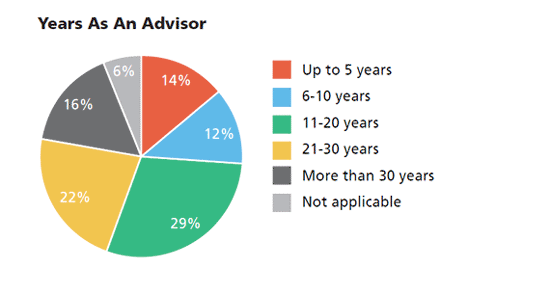

To deepen our understanding of how financial advisors view the role of the small cap fund in an investment portfolio, Calamos Investments in April 2019 sponsored a research project conducted by Advisor Perspectives with its extensive database of financial advisors. Responses from 795 advisors in a range of intermediary distribution channels (see demographics) serve as the basis for the report that follows.

In summary, the research shows:

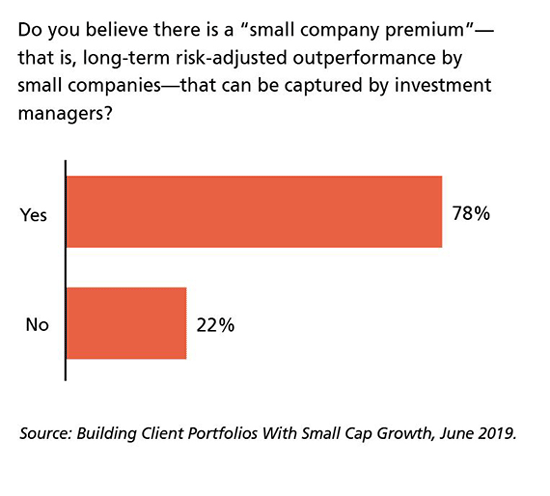

- Most advisors (78%) believe in a “small company premium” (i.e ., long-term outperformance by small companies over large companies)—and that small caps offer potential to add alpha to a portfolio.

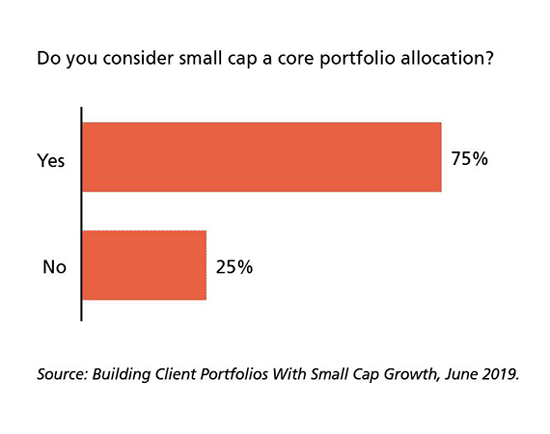

- Three out of four say small cap funds belong in a core portfolio.

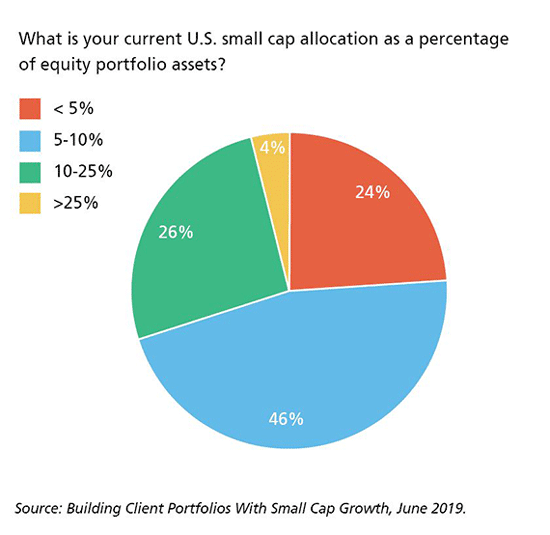

- Just 30% of advisors use small cap allocations greater than 10%, despite plenty of headroom under their firms’ investment policy guidelines.

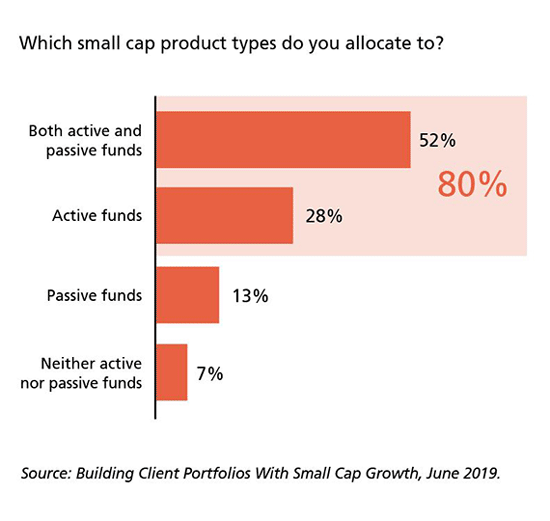

- The majority of advisors (80%) use actively managed small cap funds, valuing active management’s historical outperformance and portfolio management experience.

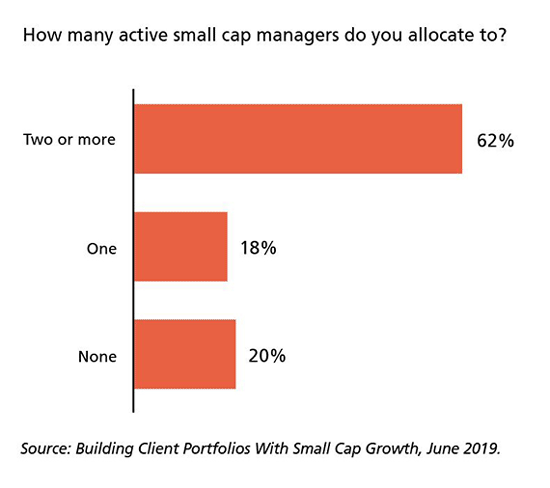

- Almost two-thirds (62%) use two or more active small cap funds.

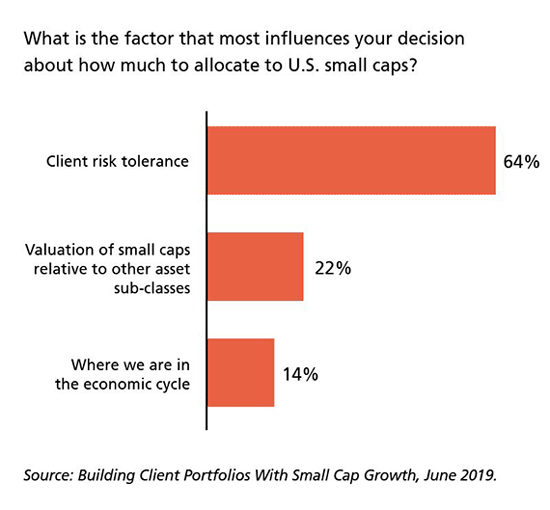

- With a nod toward small caps’ heightened volatility, advisors say client risk tolerance most guides their allocation decisions.

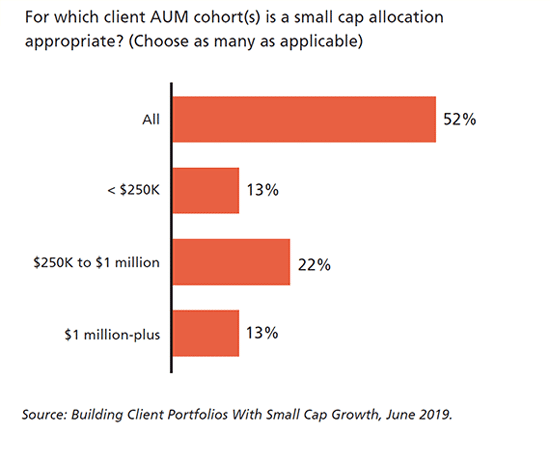

- Small cap growth funds are believed to be appropriate for investors across a range of ages and portfolio sizes.

Included for additional context are several verbatim comments from the survey respondents.

Optimizing a Small Cap Portfolio Allocation: Calamos Can Help

Financial advisors, for our thoughts on optimizing a small cap portfolio allocation, read our whitepaper or get help from the Calamos’ Portfolio Analytics team. Please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

1. 3 Out Of 4 Advisors Consider U.S. Small Cap A Core Portfolio Allocation

More than 10% of the survey respondents commented on the question of whether small cap was a core portfolio allocation, here’s a sampling.

Yes.

“Greater opportunity to add alpha. Lower bar for long-term sustainable growth. Greater long-term upside potential.” RIA, >$1 billion in AUM

“Absolutely essential for diversification but also for opportunity to really add some alpha to a portfolio.” Broker-dealer, $500 million to $1 billion, AUM

“I’d go so far as to say micro-caps are a core allocation.” RIA, <$1 billion in AUM

“Once investing in a high quality small cap fund, one needs to stay in the fund long term, through thick and thin.” Broker-dealer, $100 million to $250 million in AUM

“Actively managed small cap can exploit market opportunities as conditions change and should be a core part of the equity component—not an asset class/style to move in and out of." RIA, >$1 billion in AUM

“Small caps offer growth opportunity when the economy is in good shape but large cap is stagnant.” Broker-dealer, $100 million to $250 million in AUM

“Much greater potential alpha than large cap, and a better diversifier via opportunities for lower correlation.” RIA, $100 million to $250 million in AUM

“I think it’s appropriate to consider a slightly higher allocation to small caps than is present in a typical ‘total market’ index fund, especially for investors with longer time horizons.” RIA, <$100 million in AUM

“We include small cap with any equity allocation but in varying degrees.” RIA, $100 million to $250 million in AUM

“We use both small cap growth and value funds. The goal is to outperform. Think that this is an asset class to do this.” Broker-dealer, <$100 million in AUM

“Small cap investments are a big part of any market rally. It’s also important to note they can be a big part of a downturn as well. I feel like small cap needs to have an allocation in any portfolio.” Broker-dealer, $100 million to $250 million in AUM

“For the long haul, small cap is the way to go. I endured the market downfall during the Great Recession, but the bounce back in small cap more than made up the loss in two years.” Investment consultant

No.

“Small caps are too volatile for my clients to be considered a core allocation.” Broker-dealer, <$100 million in AUM

“We focus on individual companies with strong balance sheets and promising growth prospects. Whether they happen to be small, mid or large cap is a secondary consideration.” RIA, >$1 billion in AUM

“Small caps are not a true core holding but reasonably important in any diversified account of size.” RIA, $250 million to $500 million in AUM

“We use market cap weight to determine allocation as a percent of equity. Small cap is not an asset class.” Trust company, >$1 billion in AUM

2. 78% Of Advisors Believe In The “Small Company Premium”

“Yes, but probably small and shrinking.” RIA, $250 million to $500 million in AUM

“Just read French and Fama. They’ve proved it.” Investment consultant

“Yes but...this premium exists primarily among companies not followed by the Street (i.e., micro-caps).” Trust company, >$1 billion in AUM

“There must be some small liquidity premium built into the valuations of these companies.” Bank, >$1 billion in AUM

“To get the premium one must hold through all cycles...” Broker-dealer, $100 million to $250 million in AUM

“This is where home runs are hit...” Broker-dealer, <$100 million in AUM

“I believe it exists. But I do think that with so many investment vehicles currently trying to capitalize on it, I’m wondering if the premium is at risk of going away.” RIA, <$100 million in AUM

“Probably will increase over time because of the amount of money entering into passive management as well as the minimum amount of research coverage of small cap companies. Therefore, active management small caps will have an advantage vs. the total market.” RIA, <$100 million in AUM

3. Return potential notwithstanding, advisors are most mindful of their clients’ tolerance for the volatility that accompanies small cap equities performance.

“Small caps are like any other element in equities investing—it is one part of a diversified strategy. I believe there should be some exposure for most if not all investors, though exposure decreases (as % of portfolio) with age of investor.” Bank, <$100 million

“Start with the Russell 3000 weight and then increase/decrease based on your short-term and long-term views.” RIA, $500 million to $1 billion in AUM

“Client risk tolerance is a hub for all investment decisions but I also look at the economic cycle. When we reach our next bear market, I expect I will increase small cap holdings.” Broker-dealer, $100 million to $250 million in AUM

“Depends where we are in the liquidity and credit cycle.” RIA, >$1 billion in AUM

“Allocate more if recently out of favor, less if recently in favor.” Broker-dealer, <$100 million in AUM

“Client risk tolerance, while important, can be managed more effectively in other ways. In other words, using small cap allocation as a tool to solve for risk tolerance is sub-optimal and lazy.” RIA, $100 million to $250 million in AUM

“All based on client risk and down capture of the fund or ETF being considered.” Broker-dealer, $250 million to $500 million in AUM

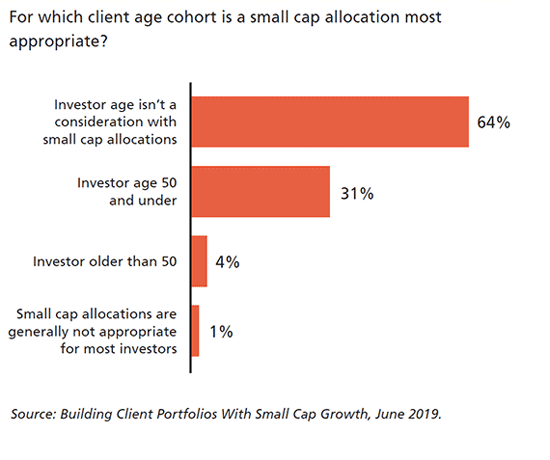

4. Half of advisors like small caps for all size portfolios, and 87% like them for all but the smallest portfolios. While two-thirds of advisors say client age isn’t a consideration, one-third prefer to use small caps for investors age 50 and younger.

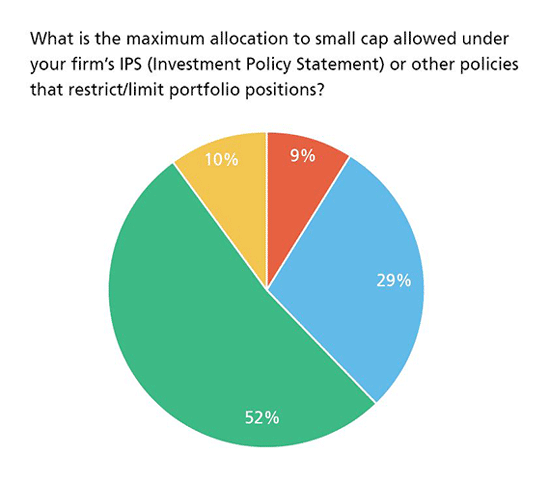

5. Current allocations are well below investment policy statement guidelines. While more than half of advisors say their allocations could represent as much as 10%-25% of client portfolios, 70% allocate less than 10% to small caps.

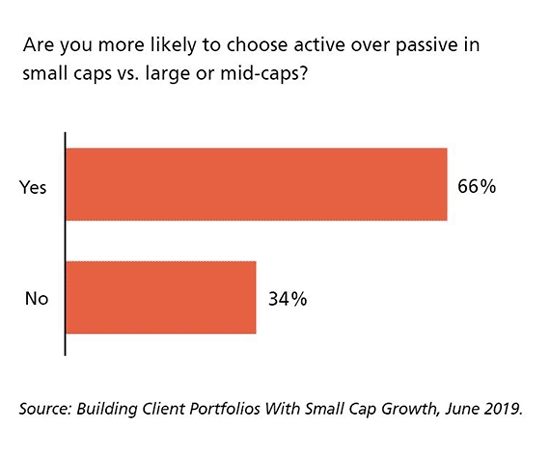

6. Two-thirds of advisors are likelier to choose an active manager for a small cap fund.

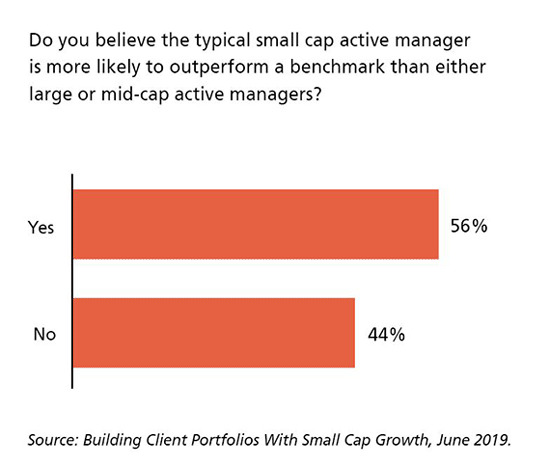

7. And, here’s why: more than half of advisors express confidence that active management can outperform in the small cap space.

“There is more research to be done on smaller, less known companies and that’s why I trust active managers for the small cap space.” Broker-dealer, $100 million to $250 million in AUM

“Usually looking for funds that consistently beat their benchmark but usually split position with passive and active managers.” RIA, <$100 million in AUM

“It is very hard to outperform the market but I feel like active managers that really dig into small companies can find value from information that is not as well known as blue chip companies.” Broker-dealer, $100 million to $250 million in AUM

“This question is not easy to answer. I often have constraints on qualified money in smaller accounts, including the number of funds/ETFs used. In these smaller accounts, I am more likely to use passive products for several reasons, including effort to reduce internal costs.” Dual-registered, <$100 million in AUM

“Research, performance and kicking the tires are all important and something you pay a premium for to be able to pick best of the best.” Broker-dealer, $500 million to $1 billion in AUM

“Small cap managers have a better history of outperforming their equivalent benchmark when compared to large cap actively managed funds.” Broker-dealer, $100 million to $250 million in AUM

“By the time most active small caps have a decent track record, they are closed.” Bank, $250 million to $500 million in AUM

“Small cap (core/value/growth) is the only U.S. allocation (besides niches/microcap) where we still regularly consider alpha managers. There are exceptions elsewhere, but alpha is persistent in small cap.” RIA, $100 million to $250 million in AUM

“Someone has to be watching.” Broker-dealer, <$100 million in AUM

“We index large cap and look to generate alpha from the active small cap allocation. Ultimately, the aggregate performance of small cap is 100% reflective of flow of funds and so (as per ‘01) we reduce the allocation to zero when flow of funds turns negative.” Wealth manager, >$1 billion in AUM

“I look at long-term performance and risk-adjusted performance. If an active manager can protect me in down markets, I will sacrifice a little bit of upside capture for the reduced risk and volatility, especially in a space that can show a lot of volatility.” RIA, <$100 million in AUM

8. For providing exposure to U.S. small cap stocks, 8 out of 10 advisors use active management.

9. Within the active allocation, almost two-thirds of advisors use two or more managers.

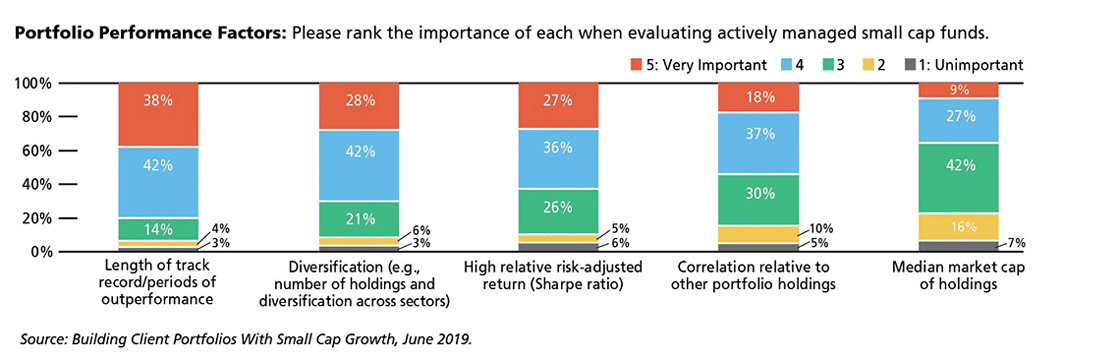

10. Length of track record, performance results and diversification are advisors’ top considerations.

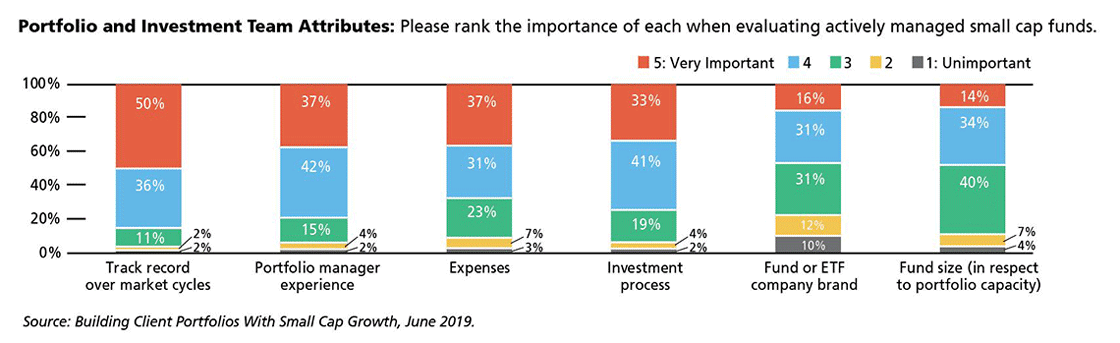

11. Advisors most value demonstrated experience—an active small cap fund’s track record over market cycles and on the portfolio management team.

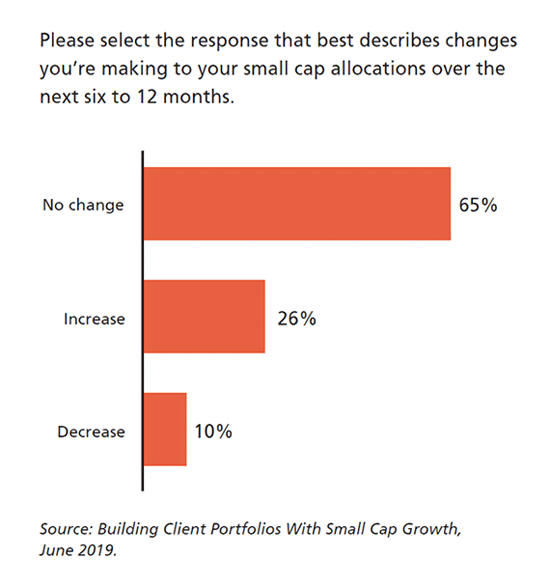

12. Two-thirds of advisors expect to be making no changes in how they allocate to small caps.

“Will increase allocation as large cap leadership wanes.” RIA, $100 million to $250 million in AUM

“We add or subtract based on drift relative to a target. Valuation is also considered.” Trust company, >$1 billion

“I would increase but can’t find ones I like.” Broker-dealer, <$100 million in AUM

“We search for small cap funds that are not extremely large that have the ability to make quick moves.” Broker-dealer, $100 million to $250 million in AUM

“Our process is active so there are times we may have zero allocated to small caps and other times when we might have a relatively high weighting. Currently, we are at zero.” Broker-dealer, $100 million to $250 million in AUM

“Slowing GDP may be a headwind for small caps, but they are more insulated from trade issues so it’s a ‘wash.’” RIA, >$1 billion in AUM

“Much would depend on how the economy shapes up. If we slide into a recession, I would likely reduce exposure to small caps until we are near a bottom before reallocating to small caps. If markets continue to plod along, I see no change in my small cap allocation.” RIA, $100 million in AUM

“If the market pulls back, we will likely increase our small cap allocation, but not at today’s prices.” Dual-registered, $250 million to $500 million in AUM

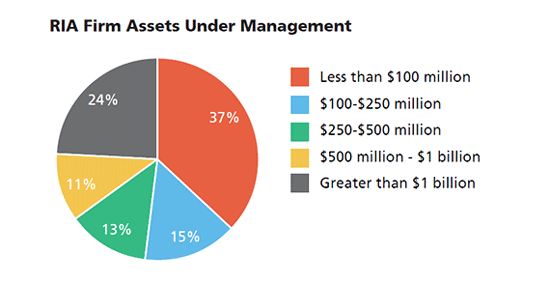

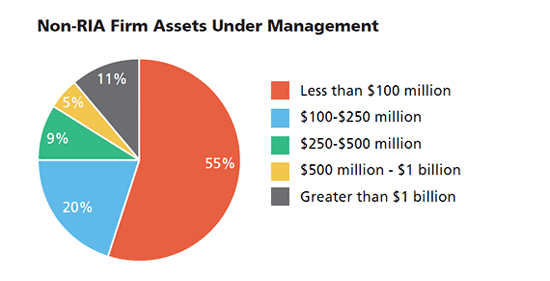

Survey Demographics

Financial advisors, for additional perspectives on optimizing a small cap allocation, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com about Calamos Timpani Small Cap Growth Fund (CTSIX).

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, foreign securities risk, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, liquidity risk, portfolio selection risk, portfolio turnover risk, sector risk, and small-sized company risk.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Active management does not guarantee investment returns or eliminate the risk of loss. It should not be assumed that any securities mentioned in this report will be profitable or experience equal performance in the future.

801580 0619O

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.