Pursuing an Expanded Efficient Frontier with Private Credit

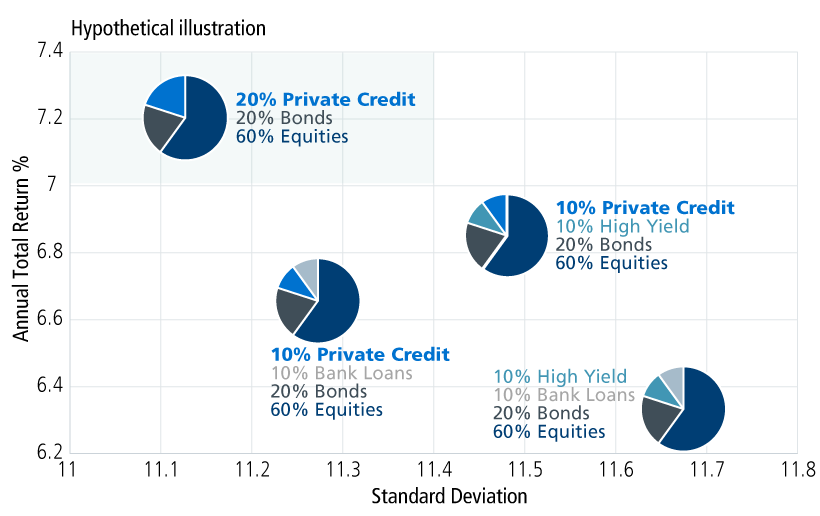

- Including a diversified basket of private credit assets in a fixed income allocation may help generate enhanced returns and lower standard deviation than public market fixed income alone, based on a proforma analysis performed by Calamos Investments.

- Private credit’s complementary risk profile to public market credit asset classes may help drive diversification benefits.

Enhanced Risk/Return

Investors often think of fixed income in terms of “core” and “plus” sectors. We believe that using private credit as a “plus” sector in a fixed income allocation has historically meant both higher returns and lower standard deviation versus a 60% stock/40% bond portfolio.

Private Credit as a “Plus” Sector: Adding the potential for improved risk/reward

Source: Aksia, Morningstar Direct and Preqin Ltd, 1/1/2004-9/30/22. Past performance is no guarantee of future results. Equities represented by the MSCI World Index. Bonds represented by the Bloomberg US Aggregate Bond Index. Bank loans represented by the Credit Suisse Leveraged Loan Index. High yield represented by the Bloomberg US High Yield 2% Issuer Cap Index. Private credit asset class return data is comprised of time weighted returns of deals within the Aksia research database. A minimum of six data points for each period and segment is required. The total number of accounts in the Aksia research database is greater than 650.

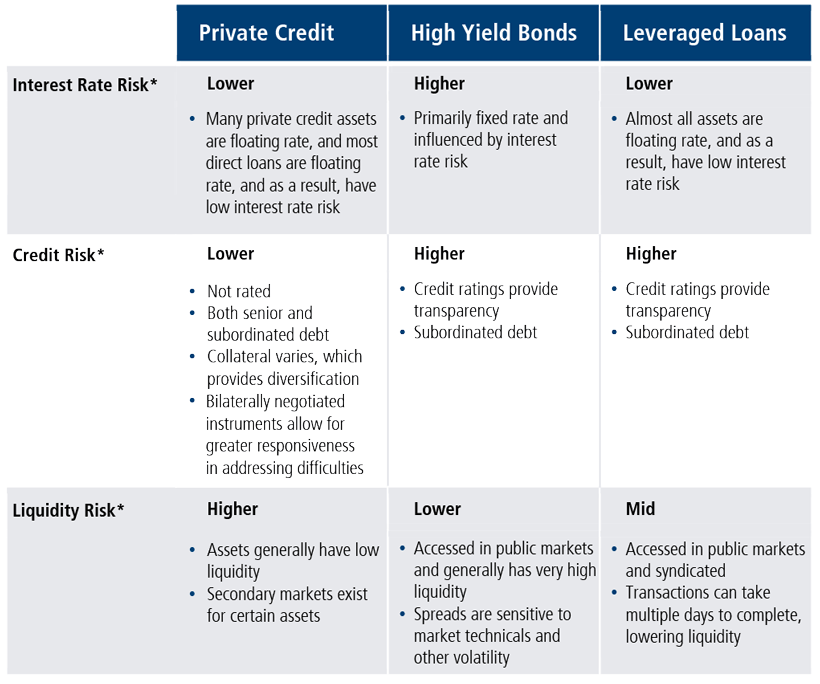

A Closer Look at How Private Credit May Enhance a Fixed Income Allocation

Investors often worry about interest rate risk, credit risk and liquidity. We believe private credit can provide another set of tools to navigate these challenges.

- Typically, private credit holdings are issued with floating rate terms. Because the coupons adjust over time in response to changes in a benchmark rate, floating rate characteristics can be advantageous in rising rate environments.

- For investors concerned about credit risk, private credit is often senior in the capital structure to high yield bonds. More importantly, private credit assets tend to be negotiated directly between the lender/investor and the borrower/seller, rather than intermediaries like investment banks paid by the borrower to find the cheapest cost of capital and most borrower-friendly terms. Furthermore, private credit assets are typically held by a few lenders/investors, including the negotiating lender/purchaser, rather than by many bond holders. We believe that fewer lenders mean closer scrutiny of borrower performance and easier concerted effort to respond to problems. Trading out of a deteriorating asset is often very difficult, meaning that private credit funds require staff to work out problem loans. Timely action by skilled professionals can help private credit investors solve problems before they get too big and credit risk becomes unmanageable.

- In exchange for lower liquidity than public market debt, private credit may offer compelling opportunities for investors seeking higher yield. A qualified investment professional can help you determine what level of liquidity risk aligns with your long-term yield objectives.

At-a-Glance Comparison: Risk Attributes of Private Credit, High Yield and Leveraged Loans

*Lower, mid and higher risk assessments are a historical comparison of these broad asset classes relative to one another, reflecting the beliefs of Aksia. Individual holdings vary in terms of their risk levels and may differ from the information shown above.

The Bottom Line

We believe that private credit can provide diversification benefits through unique investments, as the asset class has historically exhibited lower correlations with stocks and bonds.

As we continue to see volatility in both equity markets and fixed income markets, using a private credit sleeve as a strategic allocation can provide a ballast against challenges faced by public market products.

To learn more about the opportunity of the global private credit asset class and how you can access it, please reach out to your Calamos Investment Consultants at 888-571-2567 or email at investmentprofessionals@calamos.com.

Learn more about our capabilities here.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Indexes are unmanaged, do not include fees and expenses and are not available for direct investment.

Correlation data: For the period from October 1, 2021, to September 30, 2022, private credit correlation data versus the S&P 500 Index and the Bloomberg US Aggregate Bond Index were 0.70 and -0.15. The S&P 500 Index is a measure of the US equity market, the Bloomberg US Aggregate Bond Index measures the performance of investment grade bonds. Private credit asset class return data is comprised of time weighted returns of deals within the Aksia research database. The database includes both discretionary and non-discretionary investments. A minimum of six data points for each period and segment is required. The total number of accounts in the Aksia research database is greater than 650. Source: Aksia, Morningstar Direct and Prequin

Private Credit – Direct Lending. Through its direct lending strategies, a private credit strategy may invest directly in or indirectly in privately originated unrated senior secured term loans (typically first lien or “unitranche” loans) to predominantly middle market companies to facilitate buyouts, refinancings or recapitalizations, growth initiatives, and other corporate uses. Generally, the term “middle market” refers to companies with approximately $10 million to $100 million of earnings before interest, taxes, depreciation, and amortization (“EBITDA”).

Private Credit – Distressed Debt and Special Situations. Through its distressed debt and special situations strategies, a private credit strategy may opportunistically seek to invest in obligations across the capital structure (including secured debt, senior and subordinated unsecured debt, convertible debt obligations, preferred stock and public and private equity) associated with corporate distressed transactions, real estate distressed transactions, non-performing loan portfolio purchases (“NPLs”), as well as new debt financings to stressed borrowers (capital solutions). Returns for distressed and special situation strategies will generally be driven by the purchase discounts to par value of the acquired debt along with contractual income payments and potentially other opportunities to increase returns such as equity participations.

Private Credit–Specialty Finance. Through its specialty finance strategies, a private credit strategy may invest in privately originated senior secured “re-discount” loans (lending against pools of loans at a discount to estimated fair value), asset-backed securities and loans, and subordinated and/or hybrid transactions that may be collateralized by different, non-corporate collateral types and other types of loans. Specialty finance transactions may also include the direct purchases of small balance whole loans, as well as debt or equity investments in asset management platforms. Specialty finance investments are expected to provide collateral diversification and potentially introduce less correlated exposure to the Fund.

Private Credit – Real Estate Credit. Through its real estate credit strategies, a private credit strategy may invest in privately originated senior secured and subordinated and/or hybrid loans collateralized by real estate. Real estate loans can include, but are not limited to, transitional loans, core loans, bridge loans, non-qualified mortgage loans, single family rental (“SFR”) loans, residential NPLs, and mortgage servicing rights.

Private Credit – Direct Lending. Through its direct lending strategies, a private credit strategy may invest directly in or indirectly in privately originated unrated senior secured term loans (typically first lien or “unitranche” loans) to predominantly middle market companies to facilitate buyouts, refinancings or recapitalizations, growth initiatives, and other corporate uses. Generally, the term “middle market” refers to companies with approximately $10 million to $100 million of earnings before interest, taxes, depreciation, and amortization (“EBITDA”).

Private Credit – Real Assets Credit. Through its real assets credit strategies, a private credit strategy may invest in privately originated, typically subordinated and/or hybrid loans (i.e., holding company loans subordinated to operating company debt, mezzanine loans, leases) collateralized by, but not limited to, infrastructure, energy companies and projects, transportation and equipment assets, metals and mining companies and projects, and agriculture.

Private Credit – Mezzanine. Through its mezzanine strategies, a private credit strategy may invest in unsecured loans including unitranche last-out, second lien, mezzanine, and other subordinated debt with features of both debt and equity. Transactions will typically be secured by middle market companies looking to effectuate buyout transactions and/or recapitalizations or refinancings but may feature a variety of underlying collateral types.

19104 0523

Calamos Advisors LLC.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on June 21, 2024Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.