Investment Team Voices Home Page

Investment Team Voices Home Page

Private Credit: More than Just Direct Lending

By Aksia LLC, Featured Author

Key Points

We believe:

- The private credit asset class is virtually as diverse as the global economy.

- Institutional investors typically seek to invest across a range of private credit sectors to diversify their portfolios with the aim of improving risk-adjusted returns.

- Private credit can offer opportunities for income.

- Several sectors of the private credit asset class may offer compelling potential throughout the market cycle.

- Many private credit sectors offer an inflation buffer either through floating-rate coupons or through exposure to hard assets whose values tend to rise in inflationary environments.

- Private credit’s historic performance generally has been resilient.

Private credit is a big house, and the direct lending sector is only one room inside. Direct lenders predominantly provide loans to companies purchased by private equity funds (“sponsors"), but there is a larger universe of private credit opportunities beyond private equity dealmaking. Private credit finances transportation equipment, real estate, structured debt assets, royalty streams, supply chains, receivables, intellectual property, equipment leases, fleets of trucks, airplanes, ships, helicopters, river barges, and railcars. Private credit investments can be found on six of the seven continents (and Antarctica is probably not the best place to seek investment opportunities). It is virtually as diverse as the global economy.

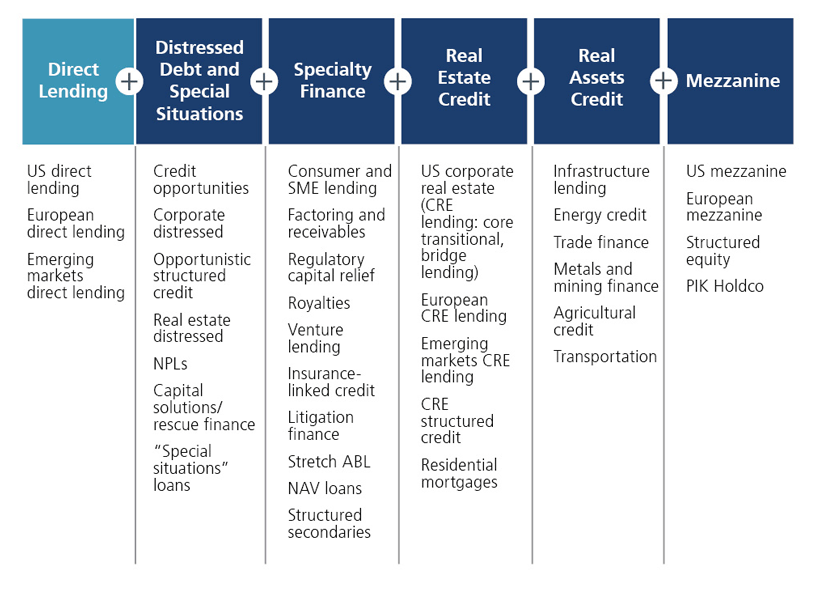

Below, we lay out Aksia’s private credit “map” or the addressable market for the asset class: a framework of six sectors each containing a number of strategies.

Private Credit is More than Direct Lending

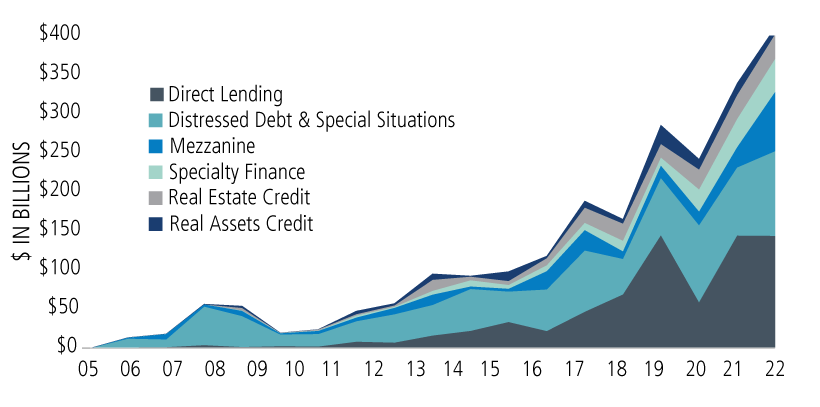

Private Credit Capital Fund Raising Trends, Gross Dollars

People are often surprised to hear that direct lending accounts for less than half of historic private credit capital raising and that US sponsor-focused direct lending accounted for less than 20% of total fundraising activity from 2018 to 2022.1 The direct lending sector itself contains a variety of strategies and investors may gain diversity from differences in borrower size (e.g., upper middle market to lower middle market), geography (e.g., Europe), industry focus, and collateral types.

Institutional investors typically seek to diversify across a range of private credit sectors to diversify their portfolios with the aim of improving their risk-adjusted returns.

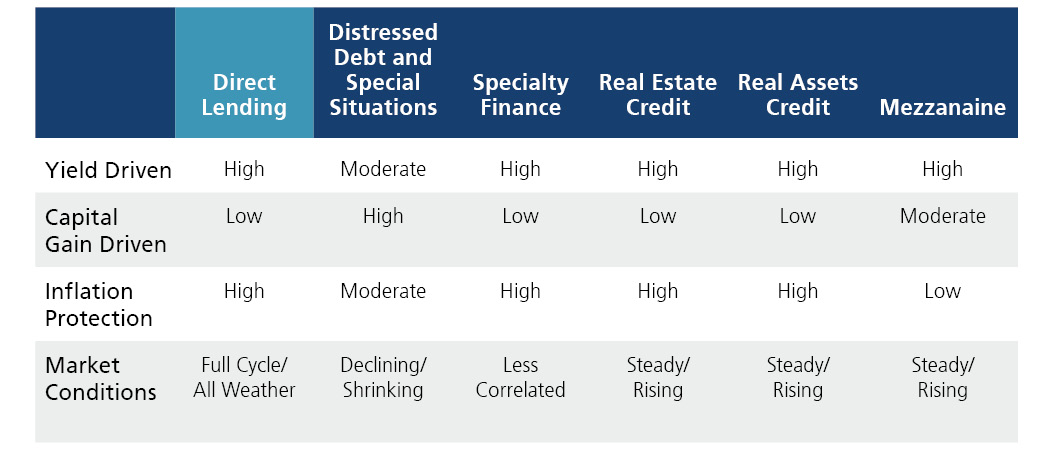

The table above illustrates what Aksia believes are the drivers of returns across different private credit sectors. Investors should not be surprised that the main driver is yield for most. However, private credit also offers the opportunity for capital gains over and above current income. For example, distressed debt investments might capture an outsized return when buying a loan trading at a discount that is later refinanced at par whereas special situations deals may include a lump sum payment at maturity, a prepayment fee or other enhancements like a revenue share or equity participation. Mezzanine investments can also generate some “equity upside” via attached equity warrants.

The table also shows what Aksia believes are the inflation environments and market conditions favorable to each. Most private credit sectors offer an inflation buffer either through floating-rate coupons or through exposure to hard assets whose values tend to rise in inflationary environments.

Most private credit investments should provide downside risk mitigation through senior lien positions and sound collateral. A well-structured direct lending transaction should feature financial covenants along with other levers to protect investors upon unforeseen challenges and to help mitigate losses. Similarly, specialty finance transactions are often collateralized loans by a variety of asset types. Reporting tracks underlying collateral performance (typically referred to as “borrowing bases”), allowing lenders the ability to respond to worsening collateral by sweeping cashflows to repay loans and de-risk. Other specialty finance strategies seek to buy less correlated assets such as royalty streams—patients’ demand for critical pharmaceuticals generally should have limited correlation to the financial markets.

Private credit’s historic performance has been resilient. Based on Aksia’s proprietary returns database, as well as data from Preqin and Pitchbook,2 the 2018 and 2019 direct lending fund vintages (direct loans mostly completed prior to the worst of the COVID-19 pandemic) reported median net IRRs of 7.6% and 8.6%, respectively as of April 2023.3 Specialty finance funds of those same vintages tend to have even higher median net IRRs of 9.6% and 11.2%, respectively, as of April 2023.4

Distressed and special situations private credit strategies offer investors the chance to capitalize on uncertainty. When banks and other traditional lenders pull back from lending, distressed and special situations managers tend to be hunting for new investments. Capital starved businesses can seek them out to provide essential financings. Based on the abovementioned data set, 2008 vintage distressed and special situations funds reported a net IRR to investors 16.1%.5 The 2009 vintage was not far behind with 13.8%.6 When the credit markets seize up, private credit managers can be well-situated to both offer financing and to extract favorable terms.

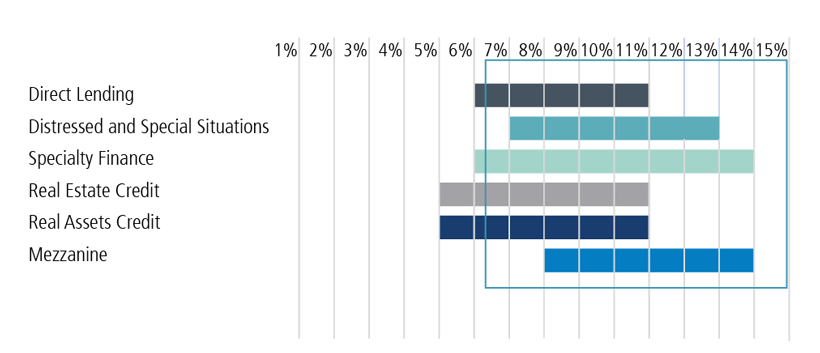

The hundreds of private credit investments covered by Aksia typically target net returns to investors ranging from 7% to 15%.7 We typically advise our institutional clients to build diversified “core and satellite” portfolios that target a variety of private credit sectors and underlying strategies. This portfolio construction approach often includes exposure to the large, scalable private credit opportunities like global direct lending and real asset/real estate debt deals, while adding a range of specialist transaction types, often targeting niche markets along with ones capitalizing on shifting market conditions.

Aksia’s Private Credit Target Returns Range

Source: Aksia

Conclusion

We believe that a diversified private credit portfolio can offer investors an opportunity for more stable returns and current yield through market cycles. Further, this approach can often complement an investor’s overall portfolio invested in equities, fixed income and other alternative investments through seeking to lower overall risk and provide income enhancement.

To learn more about the opportunity of the global private credit asset class, please reach out to your Calamos Investment Consultants at 888-571-2567 or email at investmentprofessionals@calamos.com.

1 Source: Preqin, Pitchbook and Aksia, January 2023

2 Database includes 1,156 funds reporting into Aksia, Preqin, and Pitchbook from 2005 to 2021.

3 Aksia estimates based on database of funds reporting into Aksia, Preqin, and Pitchbook from 2005 to 2021; 2008 vintage returns comprised of 57 and 37 funds reporting, respectively.

4 Aksia estimates based on database of funds reporting into Aksia, Preqin, and Pitchbook from 2005 to 2021; 2009 vintage returns comprised of 13 funds and 5 funds reporting, respectively.

5 Aksia estimates based on database of funds reporting into Aksia, Preqin, and Pitchbook from 2005 to 2021; 2008 vintage returns comprised of 14 funds reporting.

6 Aksia estimates based on database of funds reporting into Aksia, Preqin, and Pitchbook from 2005 to 2021; 2009 vintage returns comprised of 13 funds reporting.

7 Aksia estimates based on database of 1,156 funds reporting into Aksia, Preqin, and Pitchbook from 2005 to 2021.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Private Credit – Direct Lending. Through its direct lending strategies, a private credit strategy may invest directly in or indirectly in privately originated unrated senior secured term loans (typically first lien or “unitranche” loans) to predominantly middle market companies to facilitate buyouts, refinancings or recapitalizations, growth initiatives, and other corporate uses. Generally, the term “middle market” refers to companies with approximately $10 million to $100 million of earnings before interest, taxes, depreciation, and amortization (“EBITDA”).

Private Credit – Distressed Debt and Special Situations. Through its distressed debt and special situations strategies, a private credit strategy may opportunistically seek to invest in obligations across the capital structure (including secured debt, senior and subordinated unsecured debt, convertible debt obligations, preferred stock and public and private equity) associated with corporate distressed transactions, real estate distressed transactions, non-performing loan portfolio purchases (“NPLs”), as well as new debt financings to stressed borrowers (capital solutions). Returns for distressed and special situation strategies will generally be driven by the purchase discounts to par value of the acquired debt along with contractual income payments and potentially other opportunities to increase returns such as equity participations.

Private Credit – Specialty Finance. Through its specialty finance strategies, a private credit strategy may invest in privately originated senior secured “re-discount” loans (lending against pools of loans at a discount to estimated fair value), asset-backed securities and loans, and subordinated and/or hybrid transactions that may be collateralized by different, non-corporate collateral types and other types of loans. Specialty finance transactions may also include the direct purchases of small balance whole loans, as well as debt or equity investments in asset management platforms. Specialty finance investments are expected to provide collateral diversification and potentially introduce less correlated exposure to the Fund.

Private Credit – Real Estate Credit. Through its real estate credit strategies, a private credit strategy may invest in privately originated senior secured and subordinated and/or hybrid loans collateralized by real estate. Real estate loans can include, but are not limited to, transitional loans, core loans, bridge loans, non-qualified mortgage loans, single family rental (“SFR”) loans, residential NPLs, and mortgage servicing rights.

Private Credit – Direct Lending. Through its direct lending strategies, a private credit strategy may invest directly in or indirectly in privately originated unrated senior secured term loans (typically first lien or “unitranche” loans) to predominantly middle market companies to facilitate buyouts, refinancings or recapitalizations, growth initiatives, and other corporate uses. Generally, the term “middle market” refers to companies with approximately $10 million to $100 million of earnings before interest, taxes, depreciation, and amortization (“EBITDA”).

Private Credit – Real Assets Credit. Through its real assets credit strategies, a private credit strategy may invest in privately originated, typically subordinated and/or hybrid loans (i.e., holding company loans subordinated to operating company debt, mezzanine loans, leases) collateralized by, but not limited to, infrastructure, energy companies and projects, transportation and equipment assets, metals and mining companies and projects, and agriculture.

Private Credit – Mezzanine. Through its mezzanine strategies, a private credit strategy may invest in unsecured loans including unitranche last-out, second lien, mezzanine, and other subordinated debt with features of both debt and equity. Transactions will typically be secured by middle market companies looking to effectuate buyout transactions and/or recapitalizations or refinancings but may feature a variety of underlying collateral types.

Calamos Advisors LLC

2020 Calamos Court | Naperville, IL 60563-2787

800.582.6959 | www.calamos.com | caminfo@calamos.com

Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

© 2023 Aksia LLC. All Rights Reserved. Aksia® is a registered trademark of Aksia LLC.

19076 0523

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.